How Your Example Monthly Goal Breakdown Works

January 1, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

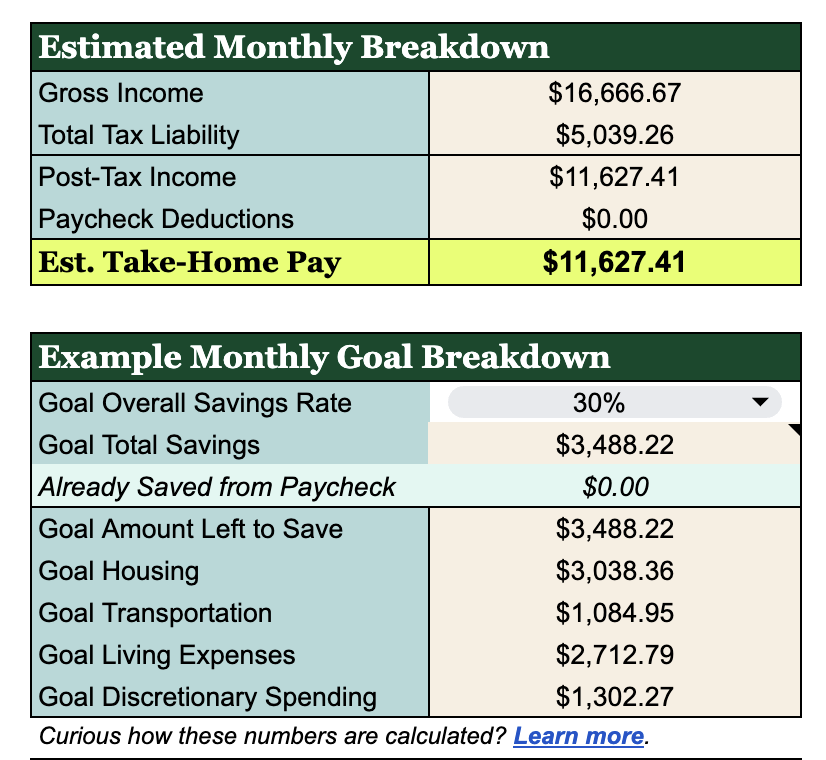

This feature is intended to help you determine the scaffolding of your budget, based on your desired savings rate.

Its calculations are based on your Post-Tax Income in your Estimated Monthly Breakdown table, and it takes into account what you’ve already saved via paycheck contributions to employer-sponsored accounts.

-

Select your Goal Overall Savings Rate—what percentage of your post-tax income do you want to aim to save? The table will calculate the savings goal for you.

-

Next, it’ll subtract anything you’ve already saved, and tell you how much of your take-home pay you should aim to save each month to hit your goal.

-

The guideline figures provided for Housing, Transportation, Living Expenses, and Discretionary Spending are generated based on a dynamic version of personal finance best practices that proportionally reallocates money away from these categories as you save more.

“How is this table used in the rest of the Planner?”

It’s not! This table is solely intended to help you determine the big picture of your budget based on your ideal savings rate, but it’s not connected to your Spending or Saving Plans below, so you’re still free to enter whatever you’d like.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time