How Your Savings Rates are Calculated

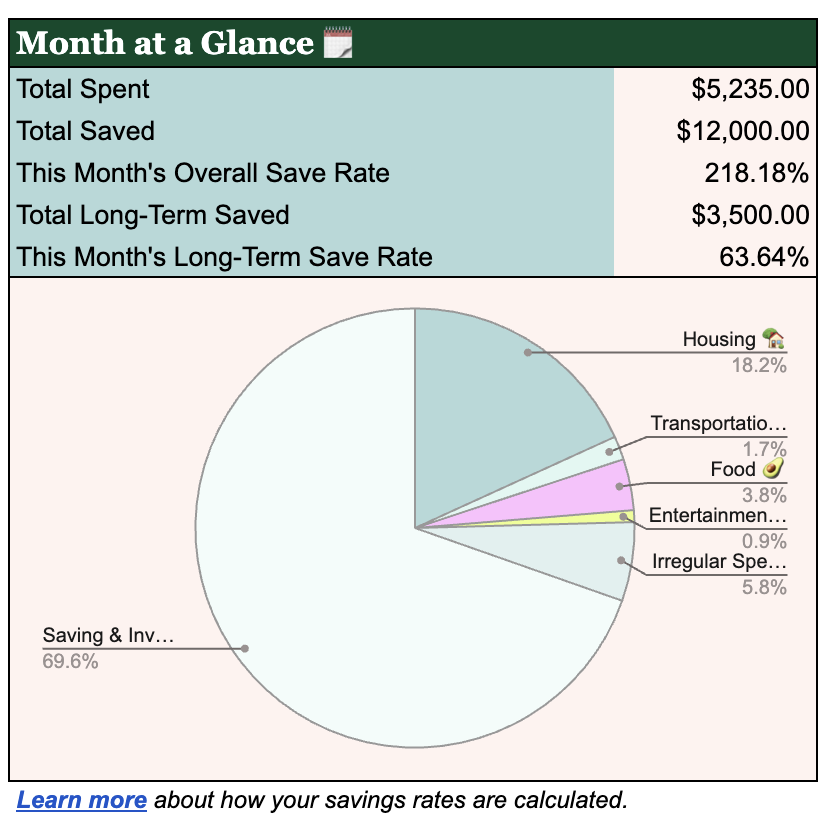

We calculate two savings rates:

“Overall,” which tells you what overall percentage of your post-tax income you saved

“Long-Term,” which is specific to that which counts toward Financial Independence

❌ Last year, we calculated savings rates in a more rudimentary way: By looking at how much take-home pay wasn’t spent.

✅ This year, the calculation is more sophisticated, as it looks at actual contributions as a percentage of total income, including your paycheck contributions. This makes it more accurate.

How we calculate your Overall Save Rate

We look at:

Your reported take-home pay for the month

Your reported paycheck contributions

Your reported contributions to any Saving & Investing accounts for the month

…and divide your contributions by your total post-tax income (inclusive of what would’ve been take-home pay, had you not contributed it to your employer-sponsored accounts).

How we calculate your Long-Term Save Rate

We look at:

Your reported take-home pay for the month

Your reported paycheck contributions

Your reported contributions to Saving & Investing accounts with the “Long-Term (Financial Independence)” tag for the month

…and divide your Long-Term contributions by your total post-tax income (inclusive of what would’ve been take-home pay, had you not contributed it to your employer-sponsored accounts).

“My save rates aren’t calculating! What gives?”

If you haven’t entered any of these variables (income, contributions to savings and investments, etc.), it won’t have the data it needs to generate your save rates.

Other Useful Reminders

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)