The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

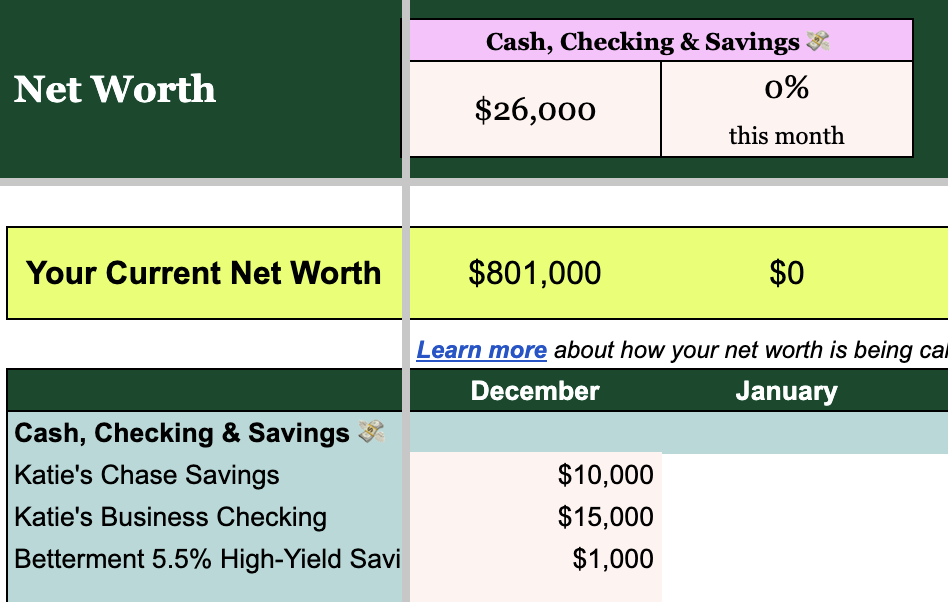

Your net worth is your assets minus your liabilities.

Your assets include what you own, like:

-

Checking, savings, and other cash accounts

-

Investments, like 401(k)s or brokerage accounts

-

Equity in businesses, homes, or other physical goods with meaningful value

-

529 plans and pensions

Your liabilities include what you owe, like:

-

Debts, like a mortgage on your home

-

Revolving lines of credit, like on credit cards or HELOCs

-

Student loans and auto loans

How to Use Your Net Worth Tab

To get started, go to the START HERE | Dashboard tab. Your Net Worth tab is powered by your Dashboard.

-

After you fill out your “Load Your Accounts, Assets, Liabilities, and Goals” in the Dashboard tab, you will see all of your assets and liabilities populate in the appropriate sections in the Net Worth tab.

-

Your first month’s column will already be filled out, since you entered your “starting balances” on the Dashboard tab. For now, you’re done!

-

At the end of every month, come back to the Net Worth tab and update your account balances for the current month only.

-

That’s it! Watch your net worth grow over time.

-

Be careful! Because the rest of the Wealth Planner is calculating your current net worth by referencing the most recent column with numbers in it, partially inputting values for future months that haven’t happened yet will throw off the net worth calculation.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time