Planning for Large Expenses that Happen Irregularly

January 1, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

If you’d like to save a little each month to plan for a large expense that happens once or twice a year, try this method.

Planning for the Expense

-

Determine the overall amount that you’d like to save each month for the expense. For example, if it’s a $1,000 car insurance bill every six months, your goal would be $166/month.

-

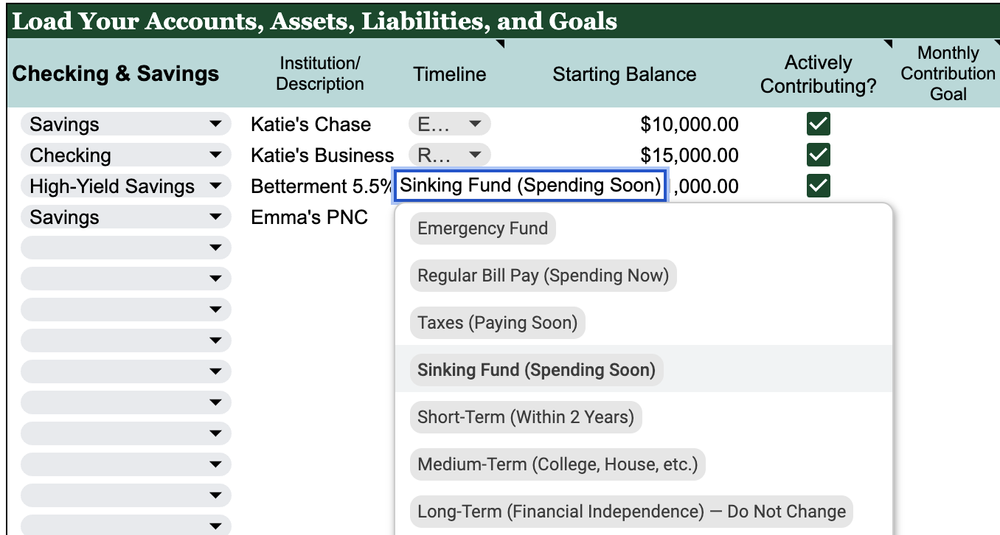

Go to the Checking & Savings section of the Load Your Accounts, Assets, Liabilities, and Goals table.

-

Select the account you’d like to use from a dropdown. For example, if you’re using a high-yield savings account, select High-Yield Savings from your dropdown.

-

Give it a name or description in the “Institution/Description” field.

-

In the Timeline column, choose “Sinking Fund (Spending Soon).” Enter the balance currently in the account.

-

Check the “Actively Contributing?” box to let the Planner know you plan to make contributions to this account.

-

For the Monthly Contribution Goal, enter the goal. In this example, it’s $166.

Using the Money When It’s Time

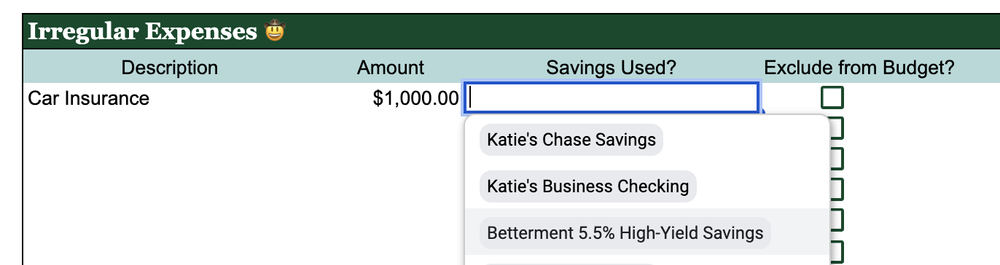

When it’s time to use the money, you’ll head to the Irregular Expenses box in your monthly tab, enter the description, amount, and select your sinking fund from the dropdown menu.

The purchase will automatically be “included” in your budget, but if you’d like to exclude the purchase from your spending total, you can check the box to exclude it.

This is only for the purposes of tracking your spending; the money will not be automatically removed from the account in the Net Worth tab. The expense will be reflected in the Net Worth tab when you do your next update and input the lower balance.

“I’m saving for multiple goals in one savings account!”

No problem—just add up the total monthly contribution goals, and enter one number in the “Monthly Contribution Goal” column.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time