Why does my Financial Independence data look different than it did last year?

January 1, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

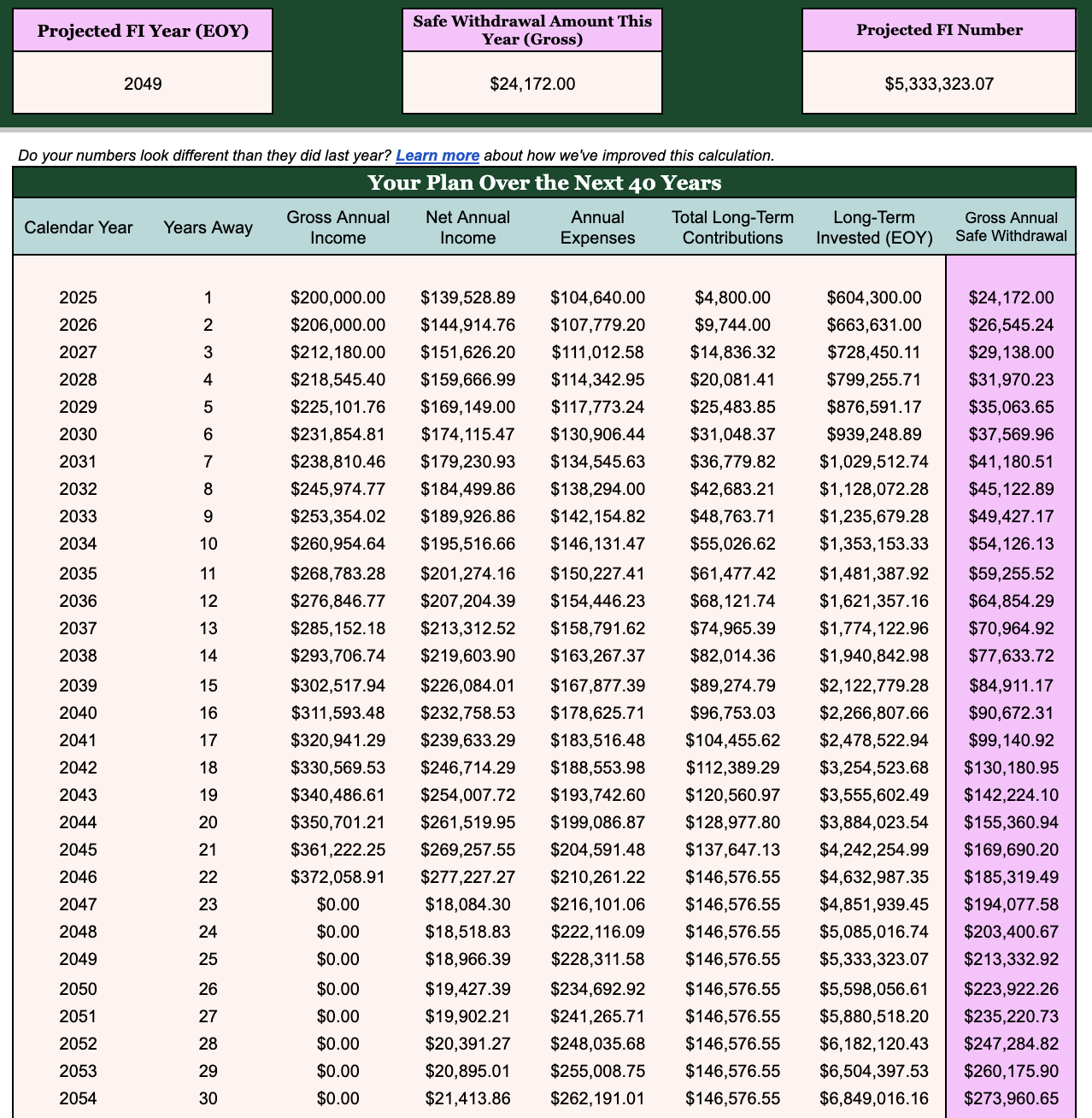

We improved the accuracy of the 2025 Financial Independence tab by fine-tuning two important variables:

In 2024, we looked at the difference between your post-tax income and your planned spending, and assumed you were saving the rest for retirement.

❌ Why this wasn’t ideal: This estimate was a good rough projection, but many users save income for other medium-term goals (like college, down payments, etc.) that aren’t going to be used for financial independence. Because of this, some users’ expected annual long-term savings were inflated.

✅ How we improved this: In the 2025 Wealth Planner, you tell us when you fill out your Dashboard tab exactly how much money you intend to contribute to your long-term savings each month by selecting “Long-Term (Financial Independence)” from the timeline dropdown. This way, only savings contributions you intend to use for long-term investments will count toward your FI goal.

In 2024, we always referenced your most recent current invested assets and added 12 months of your projected savings for the current year.

❌ Why this wasn’t ideal: Once most of the year had already passed, the estimated end-of-year invested balance was inflated by expected contributions that had already happened.

✅ How we improved this: In the 2025 Wealth Planner, only your first month’s invested assets will be used as the base—and the rest of the year’s savings contributions will be assumed based on your goals.

If things still look really different, be sure to check…

-

That your spending hasn’t changed. Even a $1,000 increase in monthly spending can dramatically affect a financial independence timeline.

-

That your invested assets are correct. Remember that only assets marked “Long-Term (Financial Independence)” will be counted toward your balance.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time