Updated Review: The Platinum Card from American Express is Still Worth the Annual Fee ($895)

August 16, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

The fine print, since we’re talking about a credit card and I’m using an affiliate link: This content is not sponsored or endorsed by any of the card brands described here and is accurate as of the posting date, but some of the offers mentioned may have expired. Money with Katie is part of an affiliate sales network and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

#

As if I didn’t elicit enough raised eyebrows when I’d reassure people that The Platinum Card® from American Express was worth the annual fee before, they’ve gone and raised the stakes for me:

American Express announced last month that the annual fee was going up from $695 to a whopping $895 (Rates & Fees).

Damn, I thought, there better be some #SweetBennies to make up for this one.

Of course, if you’ve read my previous review of the Platinum card, you’re aware that I got a few thousand dollars in value the first year I had it (which would, by default, still justify a fee that’s just $200 higher).

But we Americans don’t like when our fees get raised (and understandably so), so I wanted to revisit the topic and review the new perks.

This value assessment was a little bit simpler than you might think, only because I already believed that $695 was a bargain for all the stuff you get.

Of course, it’s worth stating explicitly now:

If you don’t travel often (or intend to travel often), it’ll be harder (okay, maybe impossible) to justify this one. But if you travel multiple times per year, I think it’s a no-brainer.

A reminder about the previous review

If you haven’t read my original AmEx Platinum review, check it out here – you’ll see that the original value for me came from a few benefits with enrollment required…

-

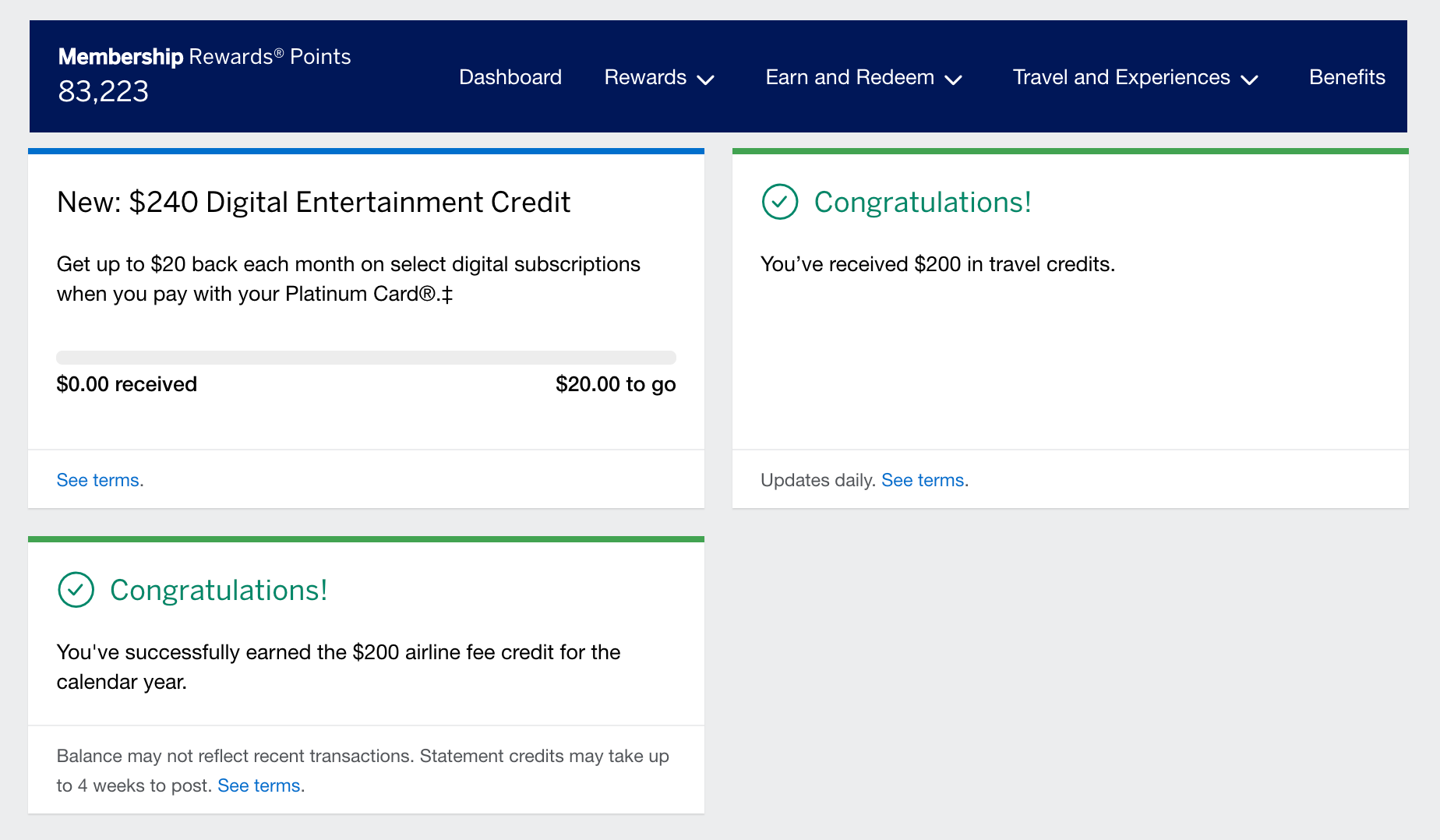

Up to $200 per year in airline incidental credit (checked bags, inflight purchases, taxes on points purchases, etc.); even if you only fly a handful of times per year, this may be worthwhile

-

Up to $200 per year in Uber Cash (distributed $15/mo. at a time, except for in December, when you get $35). To receive this benefit you must have downloaded the latest version of the Uber App and your eligible Platinum card must be a method of payment on your Uber account. The Amex Benefit may only be used in the United States.

-

Up to $100 per year at Saks ($50 biannually) – I always use mine for makeup or skincare because it feels like free money

-

Up to $100 TSAPreCheck® or Global Entry credit – you obviously don’t need this one every year, but it’s still helpful to have

-

Up to $209 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $209 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. I’m going to combine this with TSA Precheck for the ultimate security EXPERIENCE!

- Up to $300 Digital Entertainment Credit: Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners. Enrollment required.

And who could forget?

-

- Priority Pass (enrollment required) and Centurion Lounge access (though notably, free access for guests has been removed). I feel like this is the one thing that has always made this card a non-negotiable for me ever since I discovered the utter affluence and comfort of airport lounges. I’ll never go back. I haven’t paid for food in an airport in years, and I always get full meals and coffee in the lounge for free. It’s my favorite part of flying now.

Here’s an example of the regular benefits I’ve already used this year:

The new perks build on some momentum (and an existing underrated perk)

In my original review, I explained how the Fine Hotels & Resorts collection is basically a steal in and of itself.

When you book those properties in the AmEx portal (5-star properties), you get a slew of benefits when you arrive:

-

$100 resort credit

-

$75 daily breakfast credit

-

Early check-in and late checkout

The value of the new additions – keep in mind you’ll also have to enroll for some of these

(Anything with “Enrollment Required” just means you need to remember to go into your Account and click a button for each to enroll.)

The revamped Platinum card retains all of the above, as well as adds:

- Up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings. Minimum two-night stay required. (So… that alone justifies an increase and is a net positive, especially when you consider that the credit’s value multiplies when you apply it to the aforementioned Fine Hotels & Resorts)

- Up to $400 Resy Credit on eligible purchases through Resy. Enrollment required.

- Up to $120 in statement credits each calendar year for Uber One.

- Up to $300 lululemon Credit (up to $75 in statement credits each quarter). Align fam, rise up!

So there you have it. I think the hotel reimbursement alone justifies the increase (if you would’ve spent $200 at hotels anyway over the course of one year, which is probably pretty easy for most).

But assuming you intend to use the lululemon credits (guilty), the Resy credit, or the hotel credits, you’ve got an additional $300–$600 in value each year.

It’s also worth mentioning…

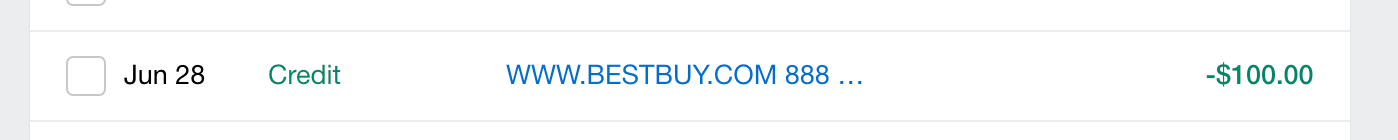

AmEx often has really good offers that are rolling – they aren’t part of the annual benefits, but are often valuable nonetheless. For example, I got $100 off at Best Buy when I bought a $330 iPad for Thomas.

Just a random offer added at the bottom of My Account that I “added” to the card before checking out. There are usually lots of them. Last year, for example, there was $100 off at Dell, and I used it to buy a monitor. I know – sexy.

The welcome bonus right now is at 100,000 points

Sitting right at 100,000 points, valued between $1,000 and $1,500.

If you found this article helpful and are interested in joining the PlatFam (I hate myself), you can apply below.

One quick note on my referral link below: You can learn more about the card below, and follow the prompts to get your own AmEx Platinum. It’s a nice way for me to receive a small kickback for your application. Love you. Mean it.

Check it out

#

Editorial Disclosure: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time