Wealth Planner Support

There are two major changes that Wealth Planner users who live outside the United States will make: Adjusting the US tax table Updating the currency to your currency of choice We strongly recommend users outside the US use the Excel version of the Wealth Planner, as it’s much easier to make updates to currency in […]

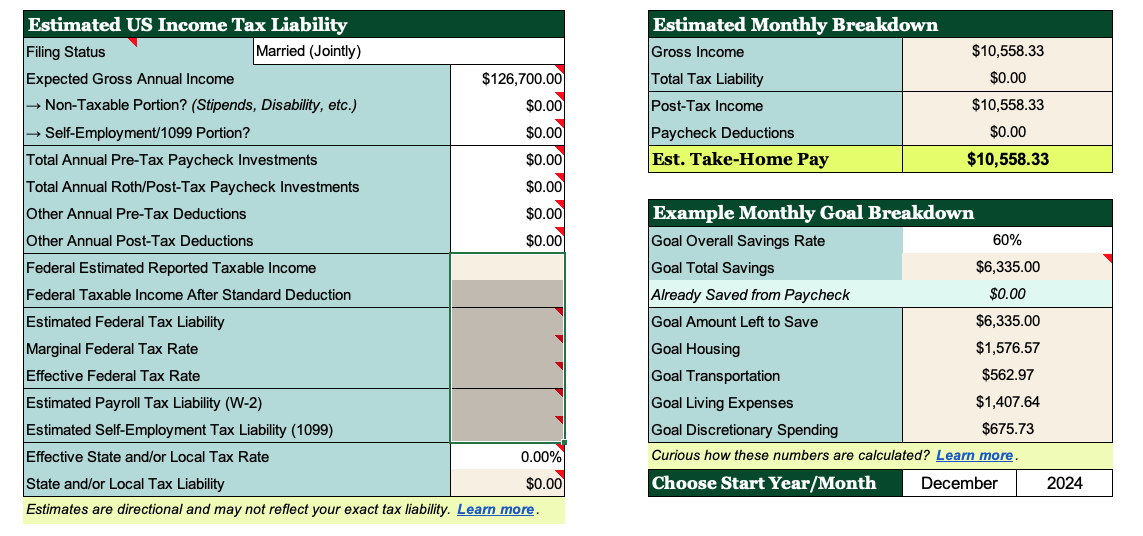

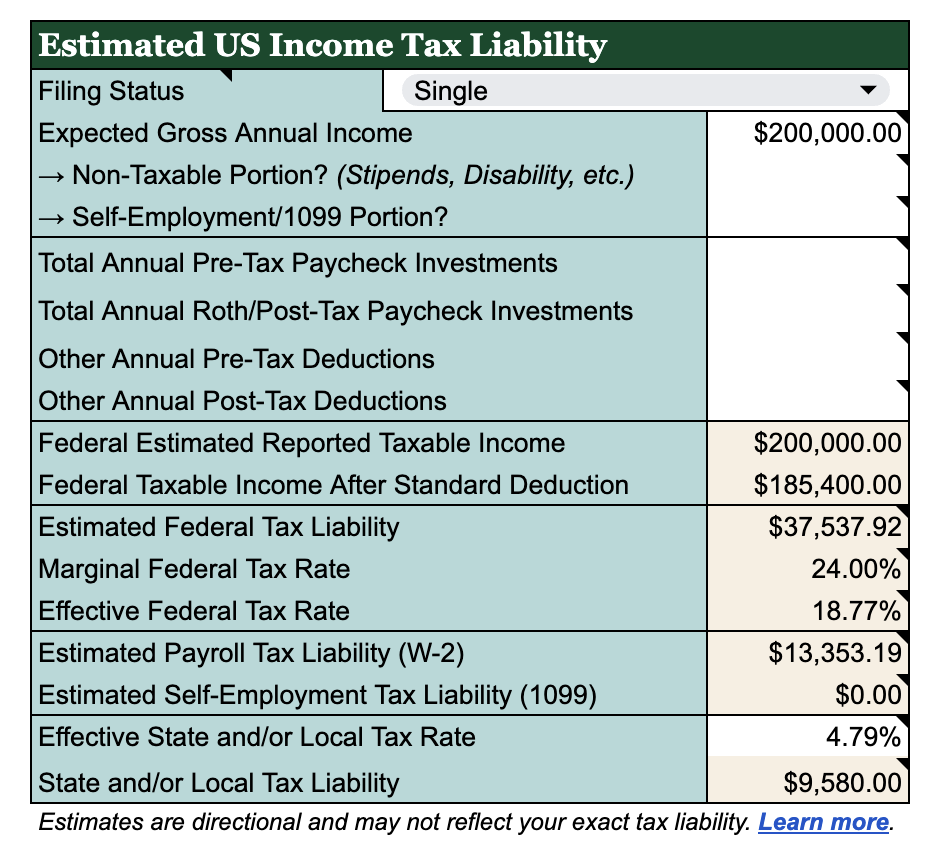

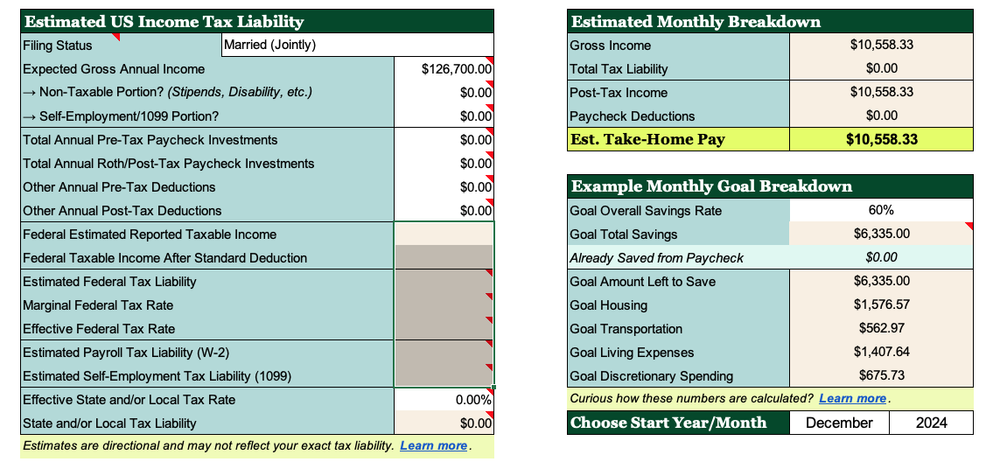

This section is designed for US users to understand a high-level estimate of their tax liability based on… Their chosen filing status. Single, married filing jointly, married filing separately, and head of household options are available. Their non-taxable or self-employment income. While non-taxable income, like stipends or disability, won’t be taxed at all, some types […]

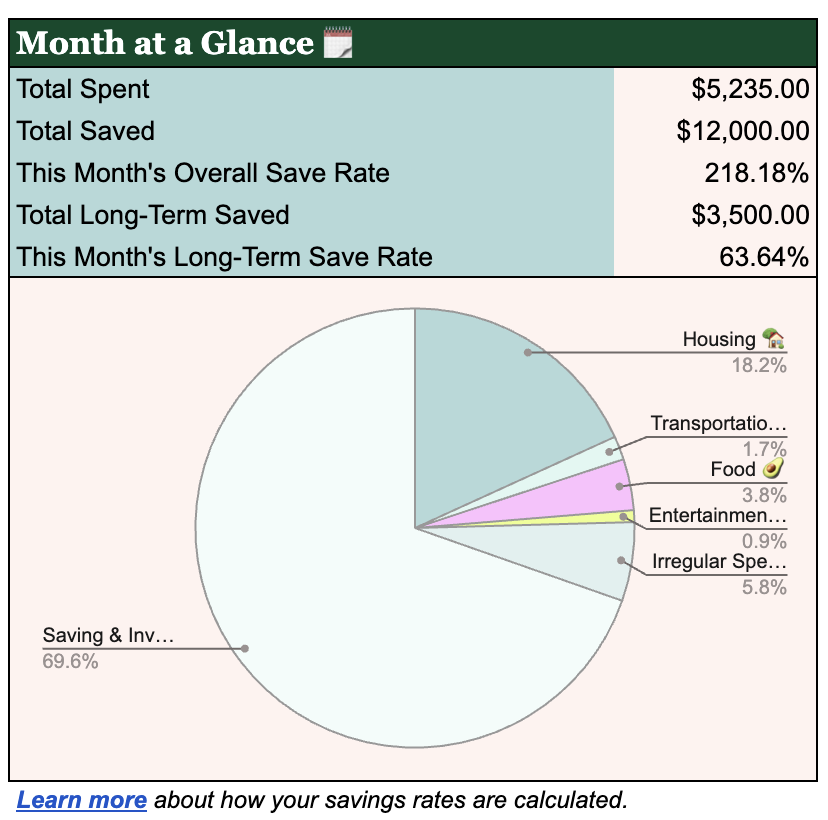

We calculate two savings rates: “Overall,” which tells you what overall percentage of your post-tax income you saved “Long-Term,” which is specific to that which counts toward Financial Independence ❌ Last year, we calculated savings rates in a more rudimentary way: By looking at how much take-home pay wasn’t spent. ✅ This year, the calculation […]

People who are already retired or almost retired can still use the Wealth Planner. This page covers: How to adjust the tax table if you’re primarily drawing down capital gains or tax-free income How to think about your Financial Independence timeline’s drawdown Monthly use Updating the Tax Table Since this table is designed to estimate […]