Wealth Planner Support

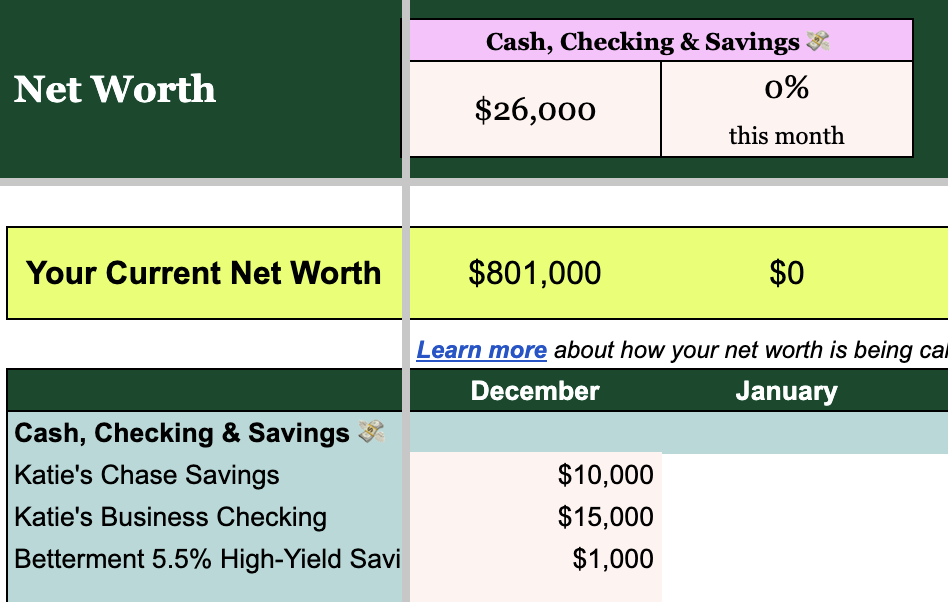

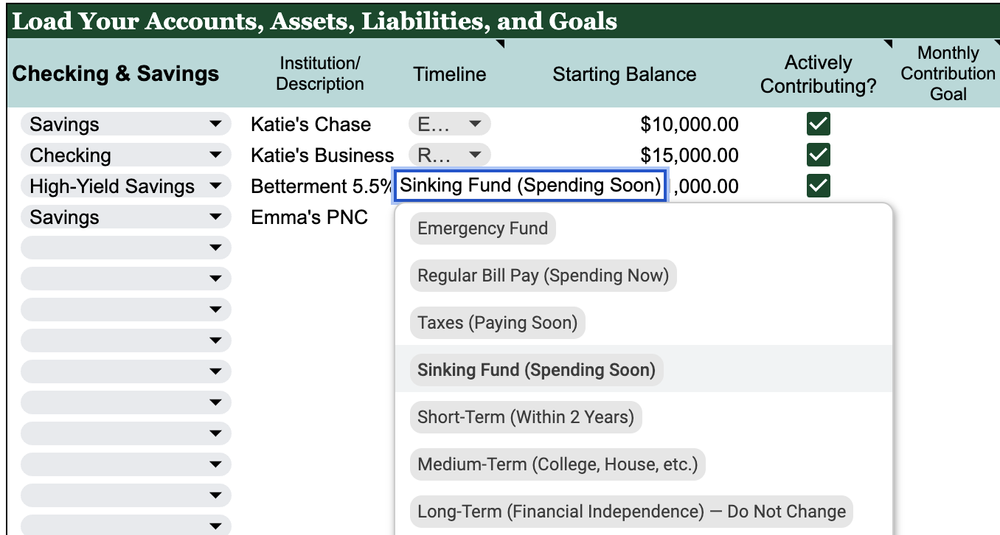

Your net worth is your assets minus your liabilities. Your assets include what you own, like: Checking, savings, and other cash accounts Investments, like 401(k)s or brokerage accounts Equity in businesses, homes, or other physical goods with meaningful value 529 plans and pensions Your liabilities include what you owe, like: Debts, like a mortgage on […]

First, we recommend watching the tutorial before diving in so you generally understand the flow of the product! Throughout the file, you’ll find helper notes in two ways: For examples and other quick tips, cells with a little black triangle in the upper righthand corner indicate a “helper note” that will appear if you hover […]

If you’d like to save a little each month to plan for a large expense that happens once or twice a year, try this method. Planning for the Expense Determine the overall amount that you’d like to save each month for the expense. For example, if it’s a $1,000 car insurance bill every six months, […]

Watch the tutorial General Watch-Outs for Successful Use These Planners were developed for Google Sheets & Excel… …which means the Google Sheets version won’t work in Excel properly, and the Excel version won’t work in Google Sheets properly (for whatever reason, many of the charts don’t “transfer” between the two programs). Functionality may also vary […]