The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

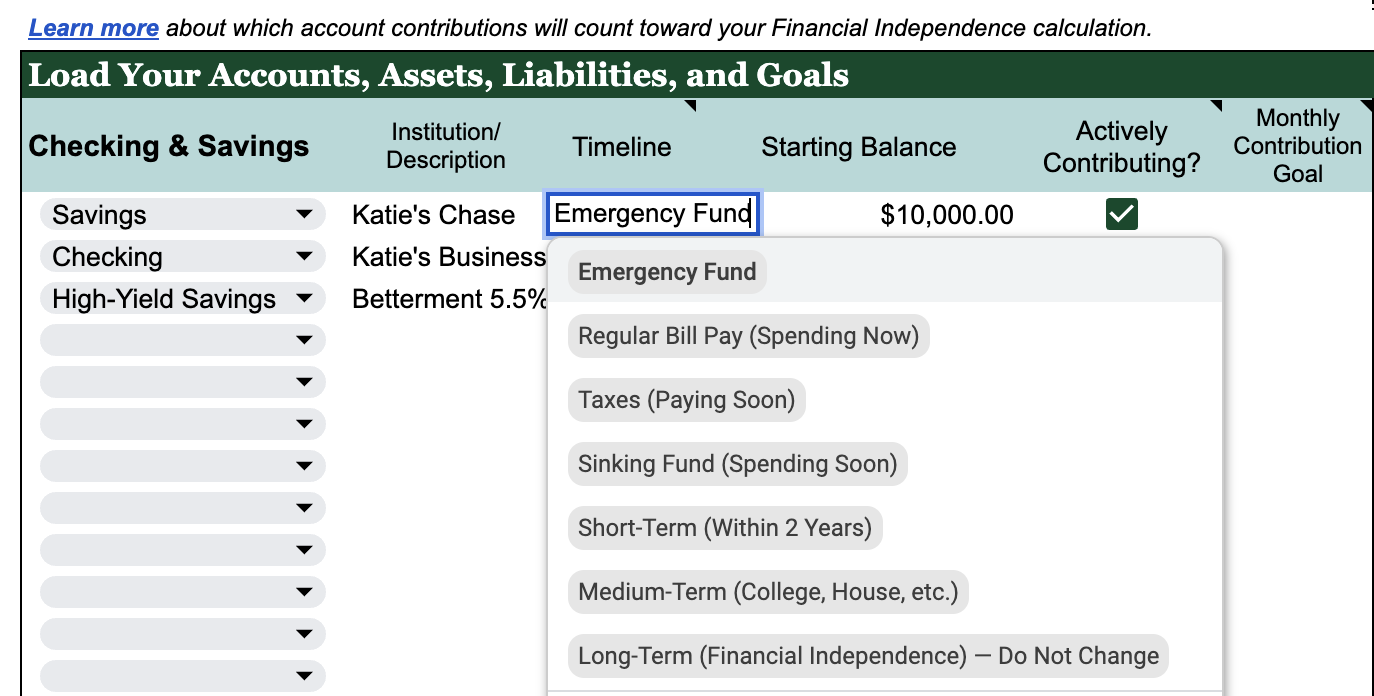

In this year’s Wealth Planner, we’re tying your savings contributions to the timeline in which you intend to use them.

-

Emergency Fund

-

Regular Bill Pay (Spending Now) — like the checking account where your paycheck is deposited.

-

Taxes (Paying Soon) — like a savings account that you contribute money to each month to pay your quarterly taxes if you’re self-employed.

-

Sinking Fund (Spending Soon) — like a savings account that you’re using to save up for a bigger purchase.

-

Short-Term (Within 2 Years)

-

Medium-Term (College, House, etc.) — think 529 plans or large brokerage accounts for a down payment.

-

Long-Term (Financial Independence) — only contributions to accounts tagged with this timeline will count toward your Financial Independence calculation.

How the Long-Term (Financial Independence) tag works

This is the only label you cannot change, since it’s used in the backend to signal to our calculation that something should be included.

In order to make the Financial Independence calculation as accurate as possible, the Long-Term (Financial Independence) tag is how you indicate to the Planner that the funds in a particular account will be used for your eventual financial freedom (as opposed to your kid’s college education, the down payment for a primary residence, or a blowout vacation).

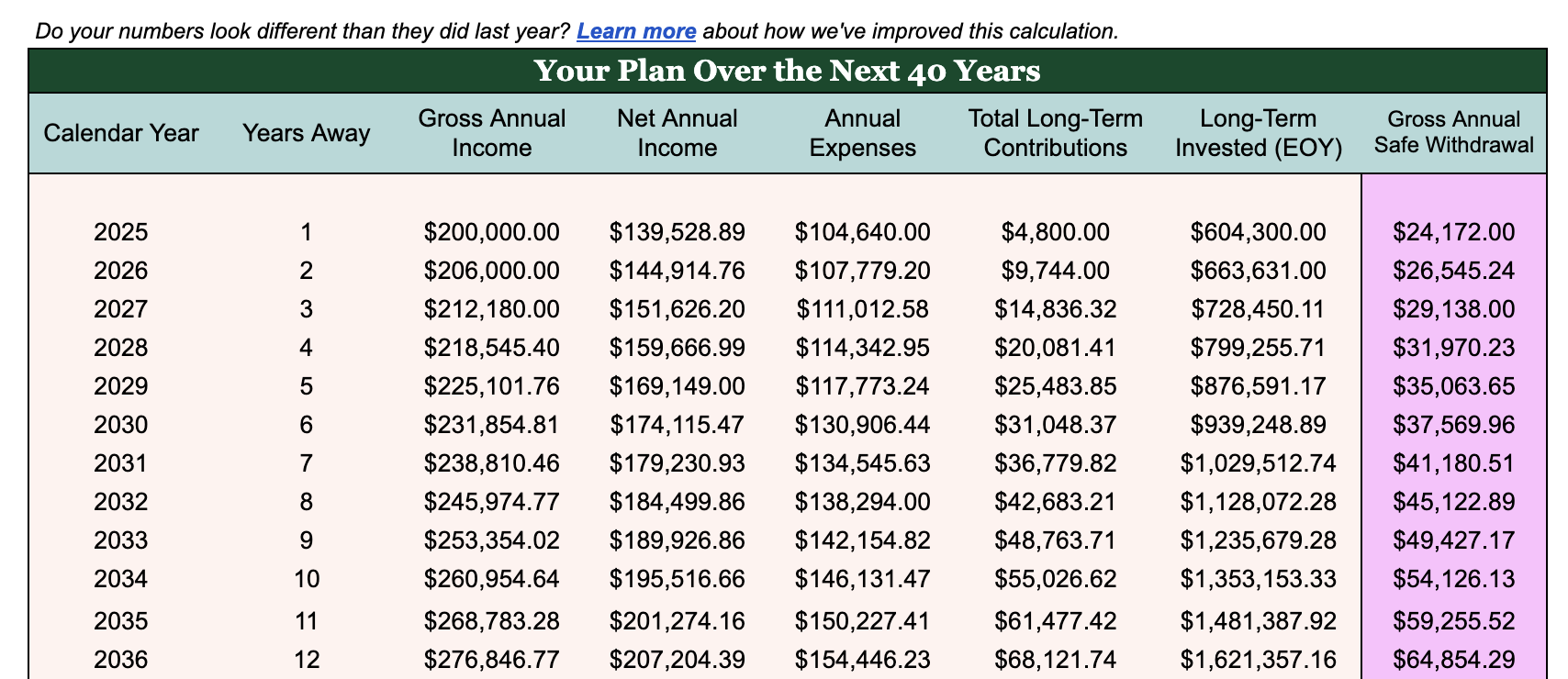

You’ll see how your planned contributions will impact your estimated balance(s) in the Financial Independence tab in the two right-most light green columns, “Total Long-Term Contributions” and “Long-Term Invested (EOY).”

How Your “Long-Term Contributions” Change Over Time

-

Your “Long-Term Contributions” will be assumed to shift up or down with the percentage you anticipate for your income. For example, if you project 3% income growth per year, the current year’s Long-Term Contributions total will be adjusted upward by 3% per year as well.

-

If you’d like to manually overwrite future assumptions about Long-Term Contributions, un-hide the FI Backend hidden tab, scroll to column AV, and write new values in to reflect what you’d expect to save in a future year if it’s different from the projection!

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time