The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

People who are already retired or almost retired can still use the Wealth Planner.

This page covers:

-

How to adjust the tax table if you’re primarily drawing down capital gains or tax-free income

-

How to think about your Financial Independence timeline’s drawdown

-

Monthly use

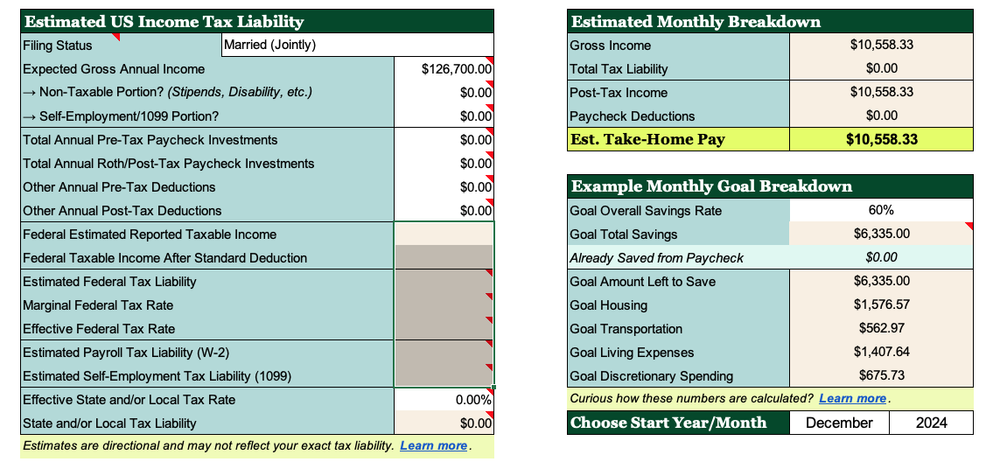

Updating the Tax Table

Since this table is designed to estimate tax liability for people who are still working and earning primarily ordinary income, this table will not accurately estimate tax liability for income that comes primarily from investment accounts and Social Security.

For example, any tax due on long-term capital gains would most likely be overestimated by this table.

If all of your investment income is coming from pre-tax accounts, the estimate will be much closer, but you can ignore (or delete) the Payroll Tax Liability in cell I16.

If you’d still like to input all of your income so that you can use the Monthly Breakdown features on the right:

-

Enter your Expected Gross Annual Income in cell I4.

-

Zero out the formulas in the tan cells (I11 through I19).

-

Manually enter an estimate for your total tax liability (the total amount of your income you pay in taxes) in cell I13.

This will manually override the W-2/1099 income tax calculations and produce Monthly Breakdowns that are accurate to your take-home pay.

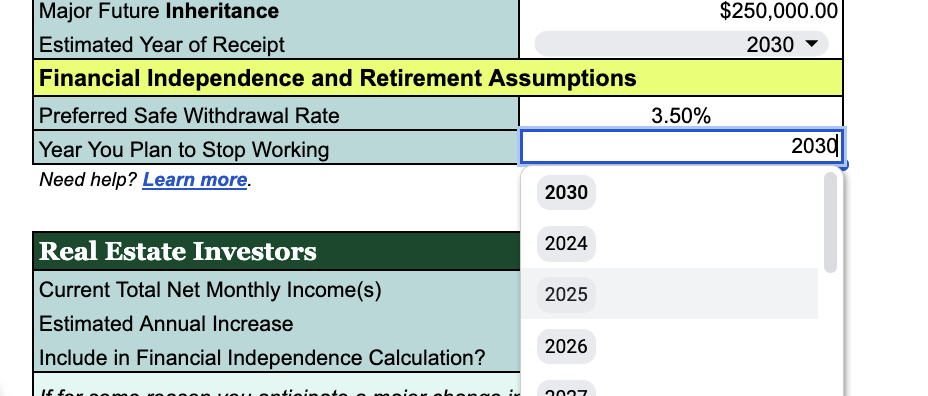

Using your financial independence timeline

If you’re already retired, your financial independence timeline should let you know that you’ve reached FI!

Make sure you:

-

Enter all the information in your Dashboard tab, including your accounts and their balances.

-

Fill out accurate information about any pension or Social Security income in the Financial Independence tab.

From there, if you’re already retired, you can select “2025” as your retirement year (assuming your Planner is set to begin in 2025) and choose your safe withdrawal rate.

The Planner will automatically assume you are living off pension and Social Security income first, then drawing the rest from your investments, and demonstrate how your timeline will play out with your assumptions about returns, inflation, etc.

On a monthly basis…

While the “Saving & Investing” section may be less relevant to you on a monthly basis, you can still use the monthly tabs to track your take-home pay and spending.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time