The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

There are two major changes that Wealth Planner users who live outside the United States will make:

-

Adjusting the US tax table

-

Updating the currency to your currency of choice

We strongly recommend users outside the US use the Excel version of the Wealth Planner, as it’s much easier to make updates to currency in Excel!

Updating the Tax Table

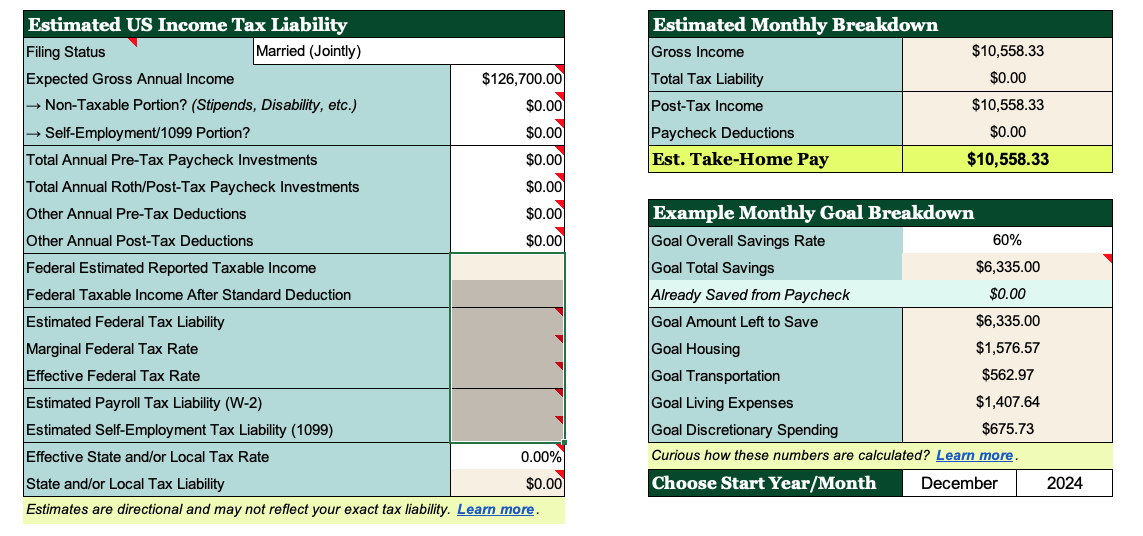

Since the US Tax Liability table feeds the tables to the right (your Estimated Monthly Breakdown and your Example Monthly Goal Breakdown), you’ll just need to clear out a few cells.

Users outside of the US:

-

Enter your Expected Gross Annual Income in cell I4.

-

Zero out the formulas in the tan cells (I11 through I19), shown to the right.

-

Manually enter your total tax liability (the total amount of your income you pay in taxes in your country) in cell I13.

This will manually override the US tax calculations and produce Monthly Breakdowns that are accurate to your situation.

Updating the Currency

This should take no more than five minutes, and involves selecting all cells in the worksheet and updating the currency at the spreadsheet level, then correcting the percentages that were changed.

Check out the video for full instructions.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

-

Looking for the full FAQ list? Check it out here.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time