Does a 15-Year Mortgage Shift the “Rent vs. Buy” Equation?

March 1, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

In case you missed my previous scorching hot housing posts that almost certainly had an agenda (“Hot Takes on Home Ownership: Keep Renting” and “When the Math Supports Buying Your Primary Residence”) as I grew increasingly more cynical about the home ownership equation, I’d recommend reading at least the second one before launching into this one.

However, you can rest assured that today, we embark on this journey together out of sheer curiosity.

I had seen the numbers before for 30-year mortgages and witnessed firsthand as friends got themselves in over their heads with their housing decisions, finding themselves stretched increasingly thin as unexpected costs piled higher than their emergency funds.

But when someone brought up 15-year mortgages to me, I was intrigued. The obvious initial caveat about a 15-year mortgage is that your monthly payments are going to be higher (since you’ll be paying off the loan in half the time), which means you can probably “afford” less house than you initially thought – but I wanted to see if the interest saved would help offset the expense of buying a home, because as we saw in “When the Math Supports…” linked above, even in a market where your home literally doubles in value over the 13 years you live in it (national average), the “invest and rent” gets you further ahead financially.

Our example today

For consistency’s sake, we’re going to borrow the numbers from the “When the Math Supports…” post (see why it’s so crucial you read that first? I’m name-dropping it everywhere!) and use the following:

-

A $500,000 home

-

20% down payment at $100,000

-

Mortgaging the remaining $400,000 over 15 years (and 30 years, for context and comparison)

-

Interest rate of 3% (lower than the national average of 3.99% as of January 2021, since we’re exploring a 15-year today and usually that means a lower rate)

-

Hypothetically based in Dallas, TX, where average appreciation rate is 5.71% (this is a top-10 national figure – most cities don’t come close, as most housing markets just keep up with inflation, which defies a common misconception about how all real estate appreciates quickly. That’s some 2008 shit)

-

Maintenance costs of 1% of the property value per year (on the low end of the national average)

-

Insurance costs of 0.6% of the property value per year (national average)

-

Property tax true to Dallas, TX at 1.9% of the property value per year (this is higher than the national average of 1%, but since we’re using a home that’s in Dallas and gets Dallas appreciation, we should also use Dallas property tax to be accurate – this is a departure from the original housing post wherein I used the national average for property tax to give the #MortgageLovers in my DMs a li’l leg up)

The 30-year mortgage has a few flaws

It’s a fan favorite because it allows you to pay back a massive sum of money over three decades (making it a little easier to take a fat loan), but the problem with a fat loan is that even a small interest rate has really big implications over time.

Beyond that, when you pay back a mortgage, you’re primarily paying back the interest first – in other words, the bank front-loads your interest payments in the first several years of home ownership, and you don’t start paying back the principal (the actual amount you got loaned) until later in the mortgage. Since most families don’t live in their homes for a full 30 years, that can mean the bulk of the payments they’re making in the first 5-10 years aren’t doing much to pay down the principal loan balance – just paying back the interest.

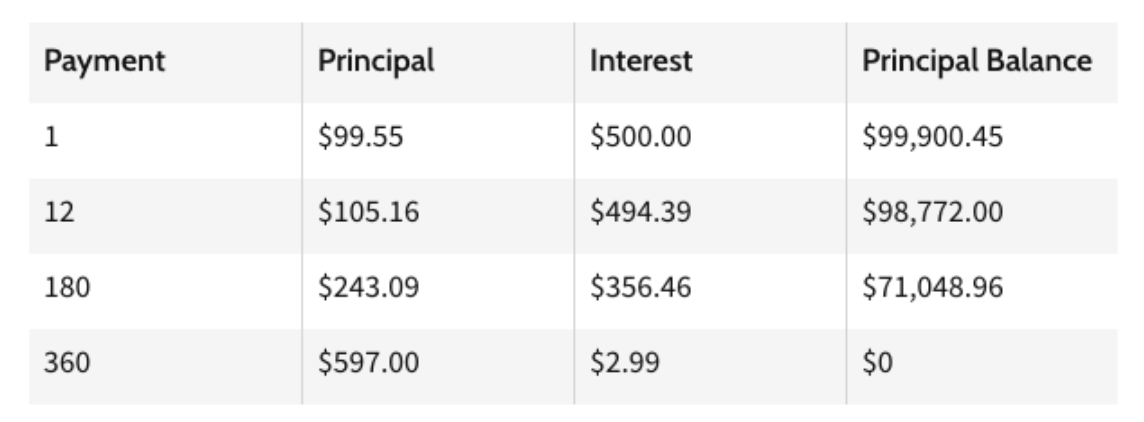

Take a look at this example from the other post, where you can see that the majority of your payments for the first 15 years (month 180) are majority interest.

(Of course, this is if you pay back the loan the way it’s intended – I saw a wild personal finance Tik Tok the other day where someone demonstrated you can put 3% down and then put the remaining 17% toward the principal as an extra payment in your first month and absolutely SLASH your interest paid, instead of just putting 20% down upfront, which was a super interesting strategy that I’m intrigued by. I love that I’m learning about mortgage hacks on an app called Tik Tok. Welcome to 2021.)

Enter: The 15-year mortgage

In order to figure out how a 15-year mortgage impacts this situation, we’ll simply run (a) the numbers for the 15-year as well as (b) the opportunity cost of paying down your mortgage early.

Opportunity cost, you say? Katie, what is this sorcery?

Well, my friend, when you select a 15-year mortgage, you’re saddling yourself to higher monthly payments, right?

That “extra money,” so to speak, is now no longer free to do #werk for you in the stock market, as it would’ve been if you had taken the 30-year mortgage.

The advantage, of course, is that you’re spending less in interest — but is it enough to offset the potential gains that extra money could’ve made if you had been investing it in the stock market instead?

Let’s take a moment now to align on one thing: The stock market is the most relentless wealth-building machine in the world. There’s truly no other asset class that can compete, including real estate. Leveraged real estate investing, or buying a home with leverage with the intent of using it to create passive income through renting it to some other schmuck, often outperforms the stock market – but (a) owning a home as your primary residence or (b) unleveraged real estate investing have not historically outperformed the good ol’, easy-to-access S&P 500.

Let’s begin.

30-year vs. 15-year

30-year (fixed rate) mortgage at 3%

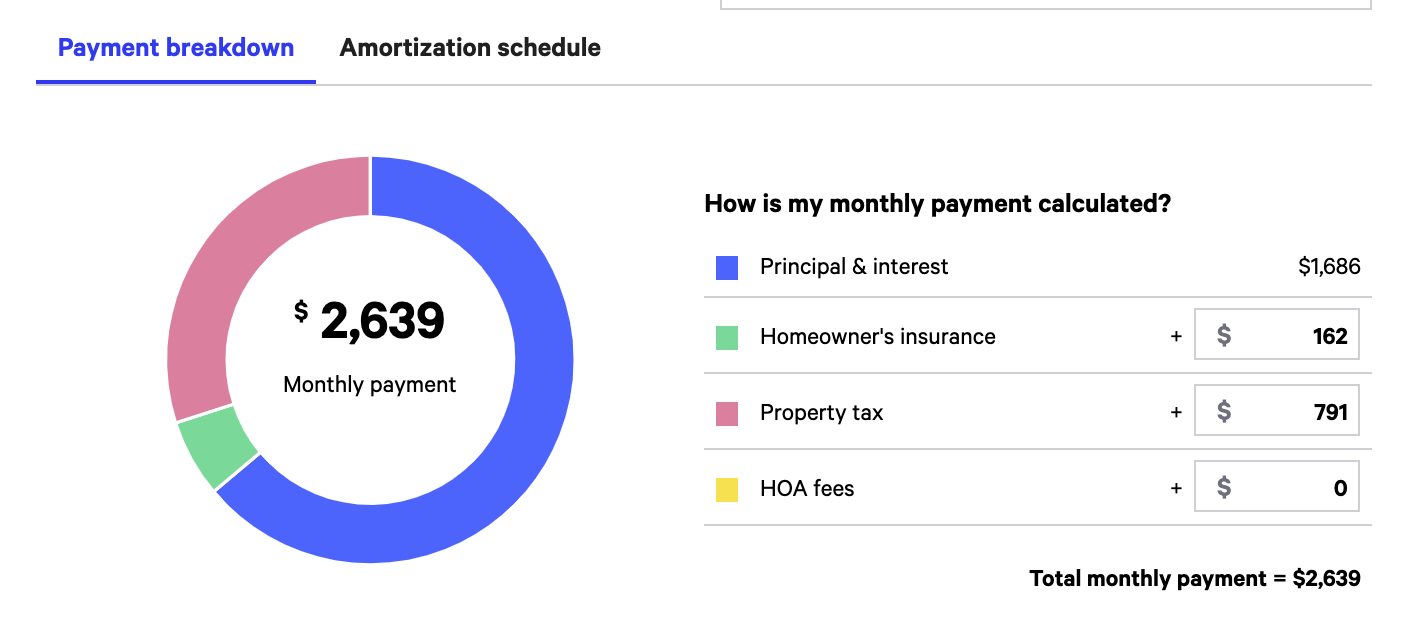

With a 30-year mortgage, our equation for the home described above looks like this:

Of course, this example ignores maintenance, but we know we can conservatively assume maintenance will cost approx. 1% of the property value per year, or $5,000 in our case (that comes out to $416 per month).

For our 30-year mortgage, our monthly payment is $3,055:

-

Our mortgage’s principal + interest = $1,686

-

Insurance = $162

-

Property tax = $791

-

Maintenance = $416

While it’s unlikely that your maintenance will be perfectly predictable and broken into flawless $416 chunks every month (it’s more likely that you’ll go six months without having to pay a dime and then realize your foundation under your house is f***ed and it’s going to cost $10,000 to fix it), for the sake of this exercise, it’s easier to bake it in as an average and spread it out across the payments.

So there you have it. 30 years to pay it off = $3,055 per month on a $500,000 home, with everything else included. Happy Meal, baby.

Easy math says that there are 156 months in 13 years (when our family will sell), and 156 monthly payments of $3,055 is $476,580. Add our down payment, and you get $576,580, our total spent over 13 years.

15-year (fixed rate) mortgage

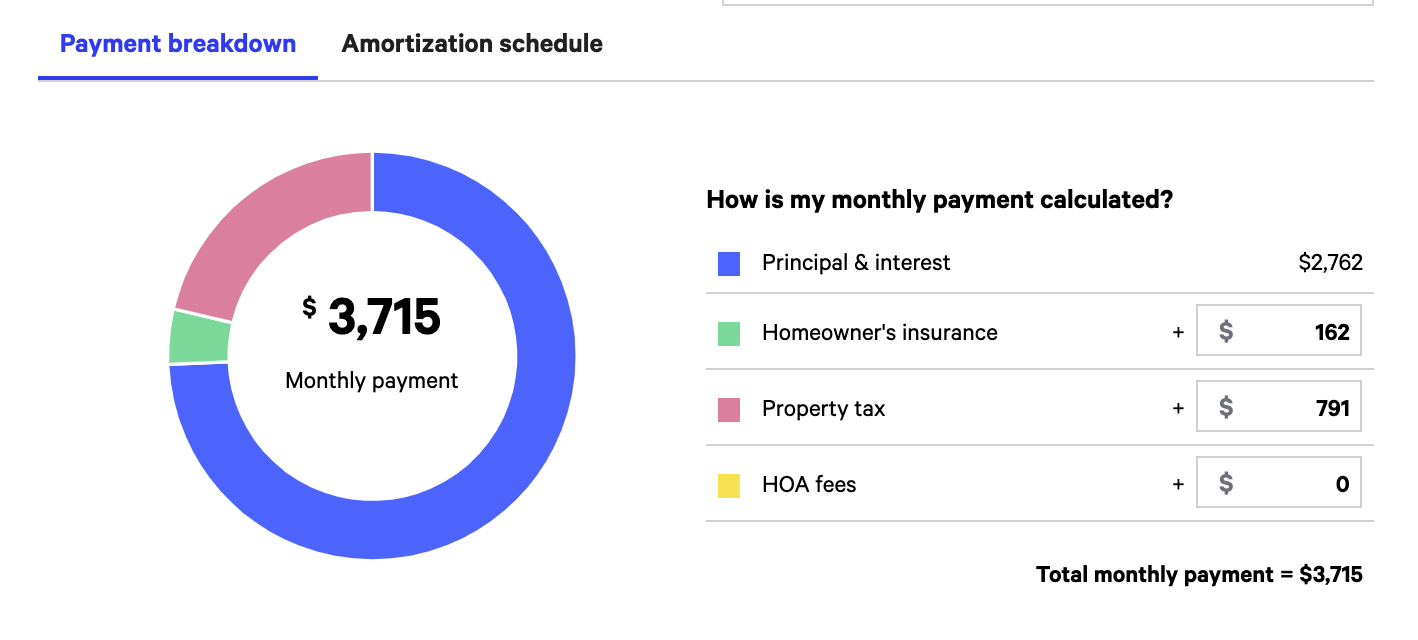

The interesting thing about the 15-year mortgage and all the other costs associated with home ownership is that your other costs don’t change despite the fact your mortgage is going up. In other words, the entire amount you’ll owe monthly for everything (insurance, taxes, etc.) doesn’t double proportionally in the same way that your actual mortgage’s principal and interest (the blue section below) will increase.

So what’s the 15-year look like?

For our 15-year mortgage, our monthly payment is $4,131:

-

Our mortgage’s principal + interest = $2,762

-

Insurance = $162

-

Property tax = $791

-

Maintenance = $416

There you have it: roughly $1,076 more per month.

$4,131 multiplied by 156 monthly payments is $644,436 spent, plus our $100,000 down payment for a total of $744,436 spent over 13 years.

(It’s now that I’d like to remind everyone that the house itself was “only $500,000.”) * insert smiley face *

So what do you get for your extra $1,076 per month?

Well, if you recall in our original example, our family moved out after 13 years – less than halfway into their 30-year mortgage term. This meant that – despite already paying $263,016 to their mortgage lender (i.e., just their monthly payment * 156 months) – they still owe $256,992. How is that possible? Remember, they were making majority-interest payments almost the entire time – so while they’ve already spent $263,016 on their mortgage, they still need to pay back $256,992 toward their principal.

If your head is spinning from the #QuickMath, that’s $520,008 in total for the $400,000 mortgage alone if they were to stop in year 13 and pay it off all at once with the proceeds from the home sale.

Because our family bailed after 13 years, they had made the bulk of their interest payments but few actual principal payments by comparison.

They paid $132,315.31 in interest over those 13 years.

Woof.

What’s this picture look like for a 15-year mortgage?

We already know we’re paying $1,076 more per month, and if we still bail after year 13, we’re only 2 years away from being totally paid off anyway (which means we don’t have to cut the bank a fat check after we sell the house).

After 13 years, the 15-year mortgage family would’ve paid only $95,191 in interest, compared to $132,315.31. Not only that, but rather than still owing $256,992, they’d only owe $64,268.

While the 30-year mortgage would’ve elicited $263,016 in payments over the last 13 years, the 15-year mortgage would’ve seen roughly $430,872 in total payments – meaning our 15-year mortgage ballers paid $167,856 more than our 30-year mortgage cruisers over 13 years for their mortgages.

What are their final totals spent?

I’m pulling the taxes, insurance, and maintenance out of these figures to make it just about the mortgage principal and interest payments. We’ll add back in taxes, insurance, and maintenance at the end because I like to twist the knife.

The 30-year mortgage would’ve cost:

-

$263,016 over 13 years in principal and interest

-

$256,992 at the sale of their home to pay back the bank

-

= $520,008 spent total

The 15-year mortgage would’ve cost:

-

$430,923 over 13 years in principal and interest

-

$64,268 at the sale of their home to pay back the bank

-

= $495,191 spent total

While we easily could’ve just taken the total interest paid in both scenarios after 13 years and done a little fast subtraction to see the difference, I wanted you to see – firsthand – how we arrived at these final totals.

The 30-year mortgage peeps paid only $24,817 more.

Does this feel shockingly low to you? It did to me.

“How could that be?” I asked myself, double-checking the math. “When I look at ‘total interest paid’ in every single mortgage calculator, it says the 15-year mortgage would save more than $100,000 in interest!”

If you’re asking yourself the same thing, consider this: A 15-year mortgage will save you roughly $110,000 in interest compared to a 30-year mortgage, over the entire 30-year lifetime of the loan. But if you’re bailing in year 13, that’s 17 years of interest that never has the chance to accrue. You sell the house, pay off the remaining principal, and move on.

But we’re not done yet – what about opportunity cost?

So we can clearly see that the 15-year mortgage cost more as we went, but ended up saving us about $24,817 in interest.

Remember the opportunity cost we talked about? At $1,076 extra per month, the 15-year mortgage didn’t come cheap.

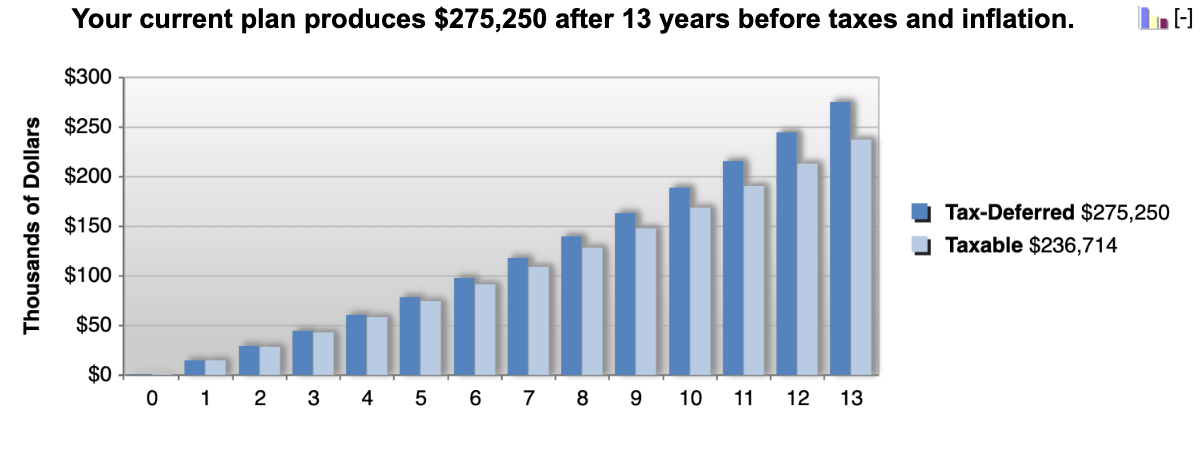

What would’ve happened if our 30-year mortgage fam had invested the extra $1,076 instead of applying it to a 15-year mortgage?

Assuming a conservative 7% average rate of return…

There you have it.

Our 15-year mortgage pals saved $24,817 in interest, but our 30-year mortgage pals are actually the ones who got ahead.

Investing the extra $1,076 per month for 13 years resulted in $236,714 in a taxable investing account.

Subtract the $24,817 extra that they’ve had to pay in interest for their net gain:

The family with the 30-year mortgage who invested the extra monthly payment in the total stock market instead of securing a 15-year mortgage would have net $211,897 more than the family with the 15-year mortgage.

That, my friends, is opportunity cost.

However, that’s still not the end of the story (gasp!)

Remember, to get your equity out of a home, you have to sell the home.

Assuming our friends sold their homes for $1M each (#twins), here’s how they really netted out:

-

They each paid $123,500 in Dallas property taxes over 13 years (1.9% of the property value every year)

-

They each paid $39,000 in insurance over 13 years (0.6% of the property value every year)

-

They each paid $65,000 in maintenance over 13 years (1% of the property value every year)

That’s $227,500 in #extras.

So we add that number onto the cost of the mortgage over the 13 years as well as the amount they still owe the bank:

-

30-year | $520,008 spent on mortgage + $227,500 in #extras = $747,508 total spent for the $500,000 home over 13 years

-

15-year | $495,191 spent on mortgage + $227,500 in #extras = $722,691 total spent for the $500,000 home over 13 years

Since both homes are selling for $1M 13 years later, that means the real estate agent’s 6% commission is $60,000. Throw it in the bag, sis.

-

30-year | $747,508 total spent + $60,000 commission = $807,508 spent

-

15-year | $722,691 total spent + $60,000 commission = $782,691 spent

And last but not least: Did you notice one sneaky cost we haven’t accounted for yet?

Our $100,000 down payment.

That’s right! The two figures above for each mortgage are just the monthly payments, taxes, insurance, and maintenance. When we add our initial $100,000 down payment, our final costs are:

-

30-year | $807,508 spent + $100,000 down payment = $907,508

-

15-year | $782,691 spent + $100,000 down payment = $882,691

So our 30-year mortgage family will have:

-

$92,492 in profit from their home sale and $236,714 in an investment account, for a total walk-away value of $329,206

And our 15-year mortgage family will have:

-

$117,309 in profit from their home sale and $0 in an investment account, for a total walk-away value of $117,309

All in all, the 30-year mortgage folks are $211,897 ahead.

Does $211,897 sound familiar? That’s because we saw that number above when we subtracted our extra interest payments from our stock market gain, and we could’ve stopped after merely subtracting – but I wanted to flesh the scenario all the way through to #completion to show the final net gains for each.

Obviously, it goes without saying that six figures in gain is great – but these families spent the same amount of money over the 13 years, and one came out $212,000 ahead. One invested in their home, one invested in the stock market – and it’s clear who came out in front.

The majority of the growth and profit over that period came from the investment account.

All that to say, don’t ignore the stock market in your pursuit of home ownership, regardless of which type of mortgage you end up choosing. While there’s a psychological benefit to paying off your home and owning it outright, there’s little financial or mathematical sense in it (as you can see here).

Ta-da! * takes bow *

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time