The Mental Switch from Saving to Investing in 2025

July 29, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Welcome to adulthood! You’ve made it. Your company-issued minivan and mortgage are in the mail; BYO-orthopedic shoes.

In speaking with hundreds of women about their personal finances, a few themes emerge as big areas of opportunities. I’ve talked about some of them in the past:

-

Paying off debt the wrong way – i.e., paying down high-balance debt instead of high-interest rate debt

-

A complete lack of savings

-

Credit card overuse

Most of these themes stem from the relationship between spending and saving – between what you have coming in every month and what you have going out.

Then, on the other end of the spectrum, you have the super-saver thematic area of opportunity:

-

Saving (in the literal sense) way beyond what’s necessary and neglecting investment opportunities

See? A great problem to have.

Today, we’ll focus on the psychological side and set the foundation for the tactical in case you’re a little skeptical of diverting money away from your precious Marcus account.

What does a “fully funded” emergency fund look like?

The emergency fund of a single person with low expenses, no debt, and steady income from a W-2 job is going to look a lot different than the emergency fund of a parent with two children who does freelance work full-time and has a mortgage.

Typically, it’s around three to six months’ worth of your expenses, in cash savings (or, if you’re willing to take on a little risk, potentially one or two months in cash and the rest in an account like the Betterment Emergency Fund). For the median worker, the emergency fund target (based on income, expenses and debt) ranges most often from $15,000 to $20,000.

If you’re fully funded, it’s time to shift mental gears.

I remember the first time I invested in anything outside my company-sponsored 401(k).

Having just hit my first emergency fund goal, I felt like I was falling behind in shoveling more money into savings every month (a solid instinct, but what happened next was a little misguided).

Sitting in my cubicle one afternoon, I downloaded the Robinhood app (I know, get your “Robinhood trader” puns ready).

Ready to link a checking account? It prompted me. Hastily, I punched in the account and routing numbers, then stared at the transfer option.

How much should I transfer? How much can I afford to transfer? I wondered. Already logged into my bank portal because I used it to grab my account information, I stared at the number in checking. Once upon a time, someone had told me you should never invest money that you wouldn’t be comfortable losing (I know now that that’s probably an overly emphatic approach to risk), so I held my breath and transferred $1,500.

The green checkmark darted across the screen and I let out a deep exhale.

Cool. Now what?

I pulled up a text thread with my friend Haley with her recommendations. It looked like alphabet soup. VOO, VTI, VGT… it bears the question, WTF?

I learned later that these were ETFs, or exchange-traded funds. Upon further investigation (and I use “investigation” lightly), I had pulled the trigger on a couple shares of each. (I know. I cringe.)

I owned 6 shares of Vanguard ETFs. Nice!

Suddenly, something on the screen began to move. My money was moving! I had $1,501.87! Now $1,503.50!

“Investing is easy!” I declared to the older men on my row. “I just made $3.50!”

I have to believe they were entertained by my on-the-job day trading break.

“So, wait,” I asked, “If it goes up to $1,507, could I withdraw the $7 and use it to buy Chipotle for dinner?”

I swear, that was an actual question I asked. You have to start somewhere. They said, technically, yes.

But I didn’t. I closed the app and went back to work. The next day I was dismayed to see that my balance was $1,498.02. Maybe investing wasn’t easy. I was stressed.

Do as I say, not as I do – this experiment in trial and error luckily didn’t net any losses, but the strategies we’re going to talk about are more scientific (and a lot safer) than the Robinhood Roulette I was playing.

You’re shifting your mindset now: You’re no longer building an emergency wall of protection around you in defense, you’re playing offense. The goal is no longer preservation – the goal is growth.

Investing will feel different from saving.

I remember being nervous to transfer that $1,500, unsure whether or not it was going to disappear into the cyberspace of the fintech world forever. Now, after several years of prioritizing (smart, not sporadic) investing and watching my net worth quintuple in a few years’ time, I’m trying to find ways to move even more money out of savings and into investment accounts.

The first transfers will feel foreign, but you have to remind yourself that if you’re investing in low-cost index funds and properly diversifying your portfolio, the risk is fairly minimal. Sure, you might lose money sometimes, but if you leave your money in a savings account at the mercy of 3% to inflation every year, you will certainly lose money.

How do you start investing in low-cost, diversified index funds?

Unlike my lowly origin story, I wouldn’t recommend transferring your life savings into Robinhood and betting it all on TSLA (although, to Haley’s credit, her suggestions were actually rock solid – I was just lucky that my first financial peer influence actually knew what she was doing).

Instead, I recommend turning to a robo-advisor platform like Betterment or Wealthfront.

At the risk of oversimplifying, a robo-advisor investment platform uses algorithms to invest your money for you. You divulge your age and risk tolerance and transfer the money as if it’s a savings account, and the computer invests the money and rebalances your portfolio if your allocations get out of whack.

In other words, you don’t have to know the perfect blend of large-, mid- and small-cap funds to choose or which bonds to select; it chooses them for you.

The pros of investing with a robo-advisor

So easy a caveman could do it. You make virtually no decisions beyond how much to transfer and when.

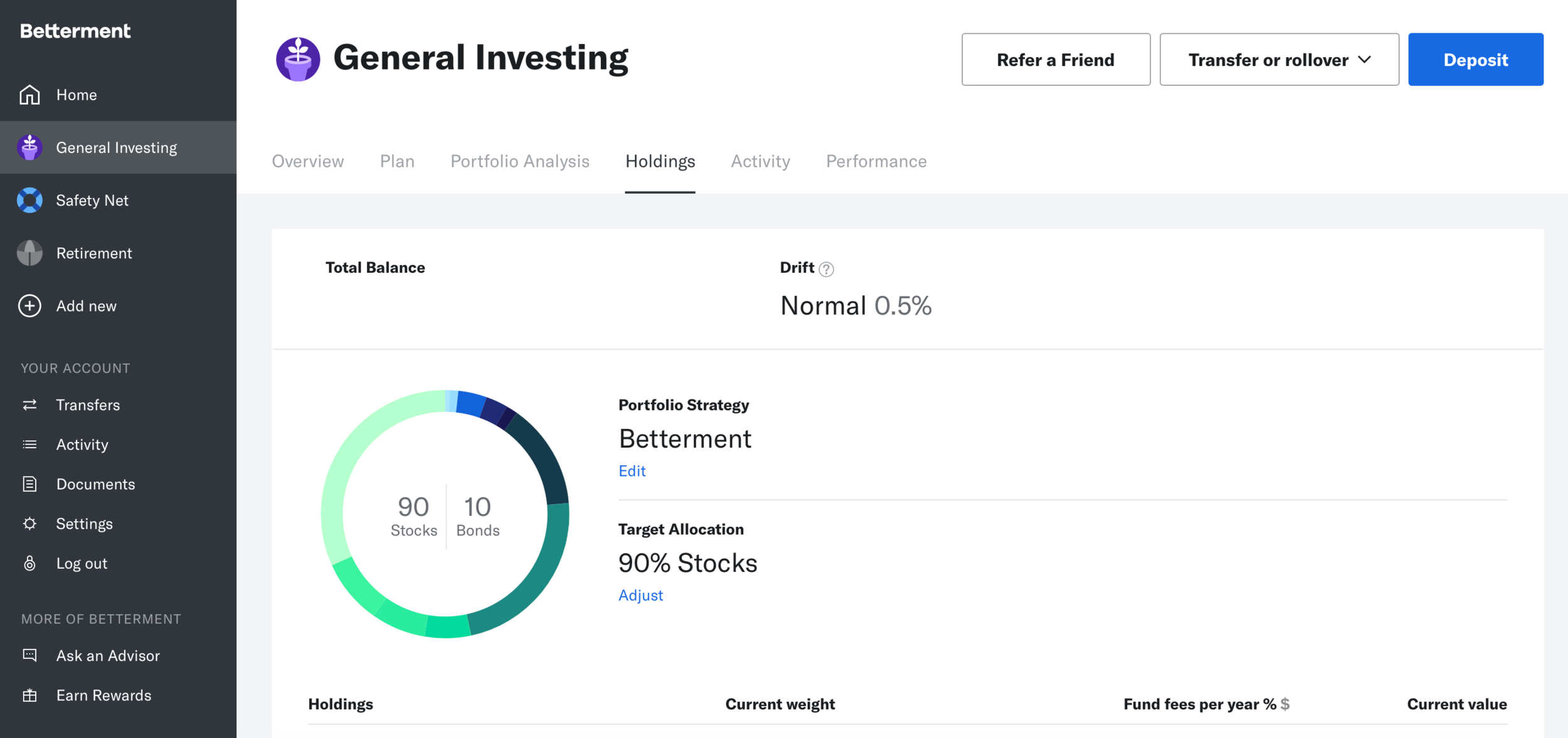

The UX/UI is really clean and easy to understand; you can see your performance, holdings, and other key pieces of information in a way that’s much easier to comprehend than your typical brokerage site.

When Betterment was being developed, Jon Stein was pitching it to venture capitalists and angel investor Chris Sacca famously complained that it looked too simple. “So let me get this straight,” Jon said in response to Chris’s distrust of the interface, “You’d like it more if it were harder to use?”

The rest is history.

Here’s an example of the Betterment interface:

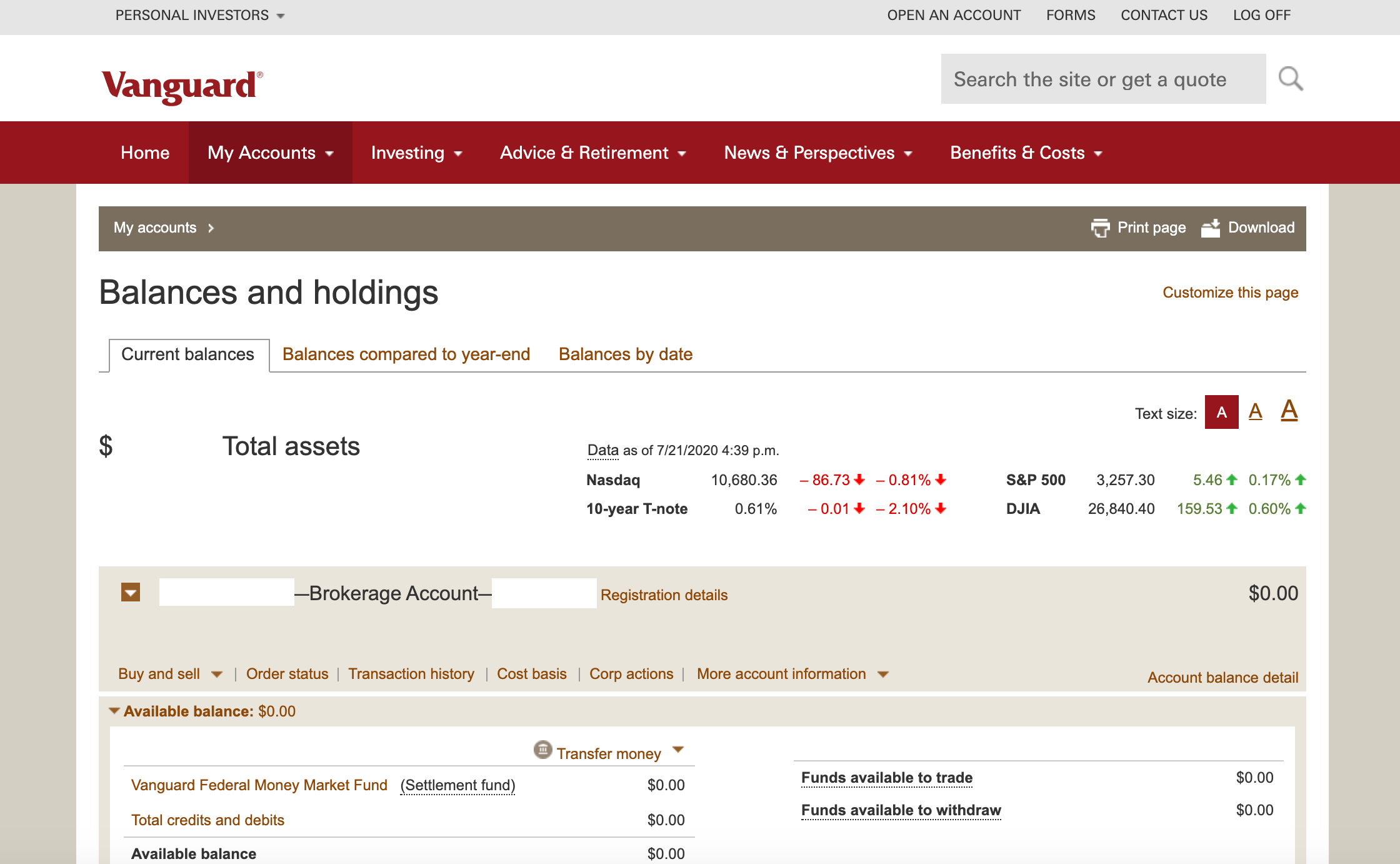

And here’s an example of a Vanguard account:

That’s not to say that Betterment is a better brokerage firm than Vanguard; Vanguard is a trusted (and trustworthy) institution with an impeccable track record. This is merely to say that, if you are unfamiliar with the financial services industry, that should not preclude you from participating – and Betterment’s platform will probably make it feel easier to start than Vanguard’s does.

The cons

In a word, fees. You’ll pay 0.25% of your invested assets annually with Betterment and Wealthfront. This means, roughly, that a $10,000 balance would elicit a $25/year fee for the service. There is no “management fee” of this kind for a self-managed brokerage account elsewhere (like the account shown with Vanguard).

This is still significantly lower than you’d pay a real person to manage your money for you, where you could expect fees more in the 1-2% range (netting $100 or $200 per year on a $10,000 balance as opposed to $25).

That said, you should always be skeptical of any fees levied on your net worth in money management. Ultimately, this is something you could learn to do yourself. But in exchange for the ease and convenience Betterment offers, I made the call for myself that 0.25% annually was acceptable.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time