How I Used My HSA Last-Minute to Save $900 in Taxes

March 22, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

I’m running out of stock photos of calculators and tax forms. Send help.

I’ve never really thought much about my HSA. FI experts always talked about it like it was this secret, secondary IRA, and to an extent I understood why, but I didn’t feel convinced enough to prioritize it as part of my ongoing financial plan. Here’s why:

Your HSA is designed for medical expenses. If you’re going to use the money for a qualified medical expense, you can put the money in tax-free, invest it and grow it tax-free, and withdraw it tax-free (yep, no taxes start to finish) – and that’s pretty sweet. But I wasn’t sure if I wanted to lock up $4,300 per year (the contribution limit for singles in 2025) for medical expenses since I had such a stellar FI plan that relied on things like the 401(k), the Roth IRA, and my taxable investing accounts.

(It’s worth noting that after age 65, the HSA essentially morphs into a Traditional IRA. You can take money out similarly to the way you’d withdraw it from a Traditional IRA in retirement and use it for anything you want, not just health expenses, but you may pay taxes on it depending on how you go about using it.)

Although the HSA “becomes” an IRA in traditional retirement (or rather, functions like one), I didn’t have a sketchy, backdoor blueprint for using the money tax-free like I do with Traditional IRAs (the Roth conversion process). For that reason, I always prioritized my taxable investing above the HSA – but today, things changed.

Whether my initial approach to HSAs was right or wrong, when it came time to file my taxes, I was reminded (in a 6 a.m. text exchange with my dad) that I could fund my HSA (that I had barely used) with post-tax money in order to claim it as a deduction in my tax return.

Why was I so excited to defer some income, you ask?

Because I found out that I owed money to the IRS.

(I basically had more taxable income than I expected this year, and didn’t pay taxes on it throughout the year as it came in. Such is life.)

Desperate to lower my taxable income by paying myself first and with no other alternatives, I funded my HSA:

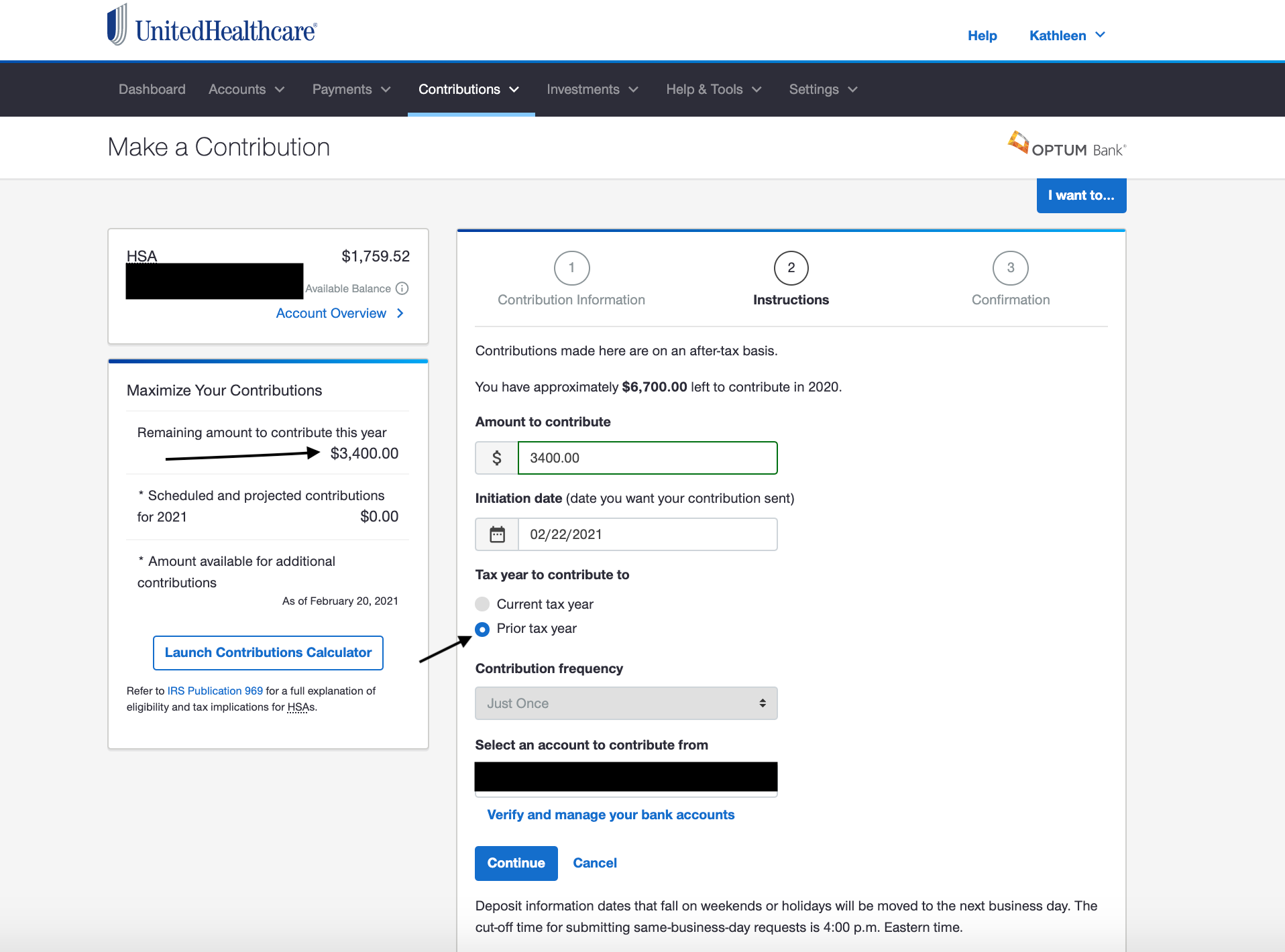

I ran to my HSA portal with Optum Bank and contributed the $3,400 it told me I still could, and clicked “Prior tax year” (2020) as the “contribute to” timeline.

Because yes, you have until the filing deadline for the current tax year (in April) to contribute to your HSA for the previous year. Holla!

As soon as I contributed the money, I pivoted back to my tax return that I was halfway through and clicked into the “HSA Contributions” section: “$3,400,” I wrote, surprised that I didn’t have to upload any forms or proof – they were just taking my word for it.

Immediately, I received an alert that I had overfunded it; apparently, my employer made a $400 contribution I was unaware of, so I had $250 of “excess contributions” for which I had to select an option that hilariously said, “Kathleen will withdraw $250 from her HSA before April 15, 2021.” Okay, baby. You got it.

But when I clicked back to “Tax Home,” my taxes owed dropped by almost $900—just like that.

If you’re like, “But wait, how?!”

Welcome to tax deferral investment vehicles, my friend!

My taxable income was in the 24% tax bracket, so my contribution of $3,400 would defer (24% * $3,400) taxes: approximately $816.

Who can open an HSA?

Anyone with a high-deductible healthcare plan (also known as an HDHP), as defined by good ol’ Healthcare.gov as “a health insurance policy with a minimum deductible of $1,650 for singles and $3,300 for families.”

Whether or not an HDHP makes sense for you probably varies a lot based on your health conditions, but for young, healthy people without pre-existing health conditions that require a lot of care, the HDHP + HSA combination will probably work well. Here’s a breakdown that will illuminate that decision.

(My friend Kylie’s Uncle Phil is an orthopedic surgeon in Dallas and we were living with him when we got our first full-time jobs and were setting up our health insurance preferences. Right away, he guided us toward the HDHP option that had a low monthly cost and HSA associated.)

You can allegedly open an HSA with a lot of different brokerage firms or banks, but I was surprised to hear this because mine came directly from my employer as part of my healthcare plan.

Unfortunately, I can’t make any solid, first-hand recommendations on where to open your HSA because I’ve never had the choice, but I can tell you that I use Optum Bank – there’s a monthly $3 fee once you invest your HSA, and that pisses me off, so I suppose it’s safe to say I wouldn’t recommend them.

Investing inside your HSA so the cash doesn’t just sit there

Once you have more than (typically) $2,000 cash in your HSA, you’re able to invest the funds.

This is crucial, because if this money were just in cash, I don’t think I’d be down to hide away virtually untouchable cash just to save $900 in taxes.

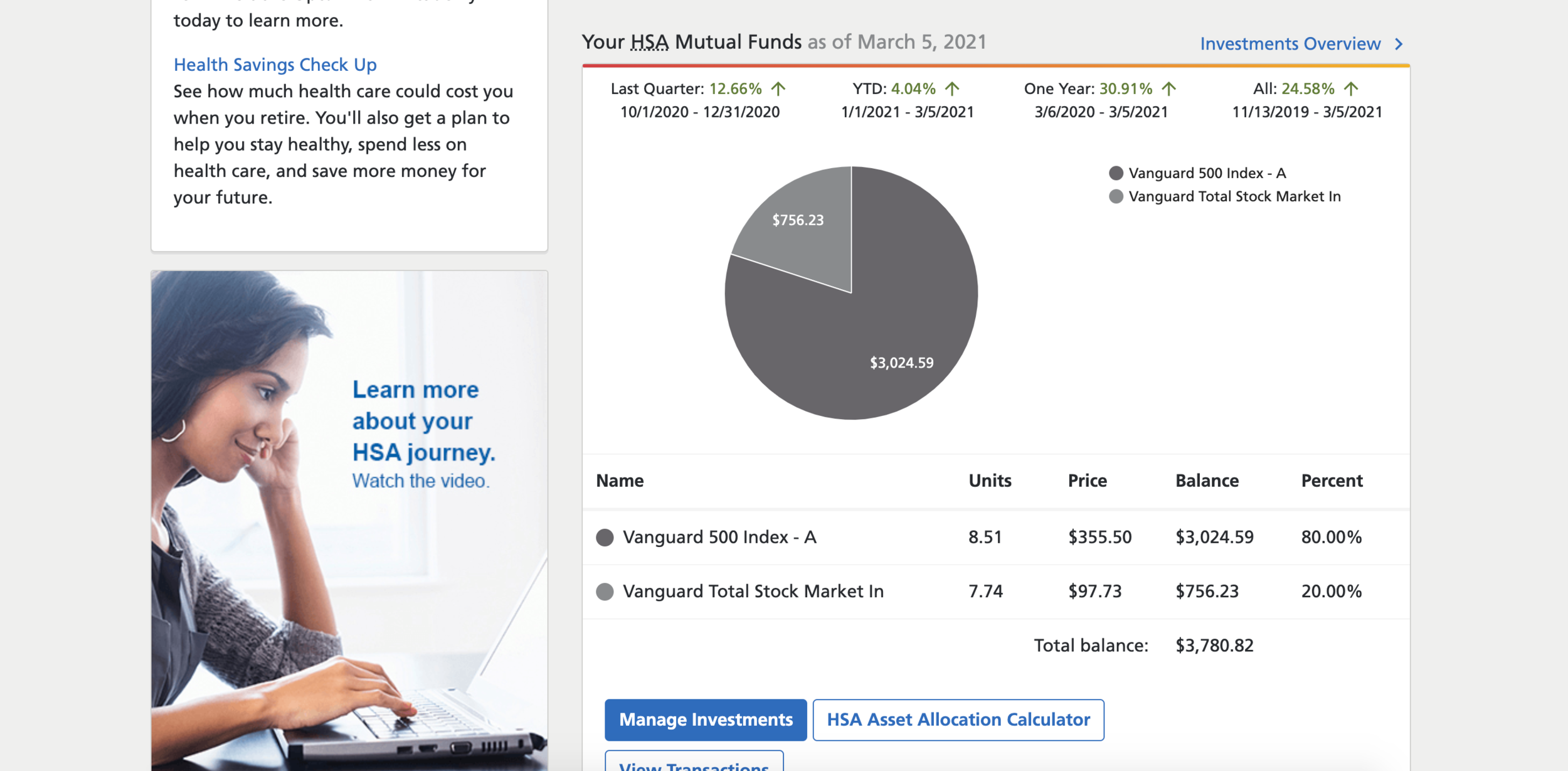

But when you let me invest it in VTSAX and VFIAX as you see below, I’m up for it.

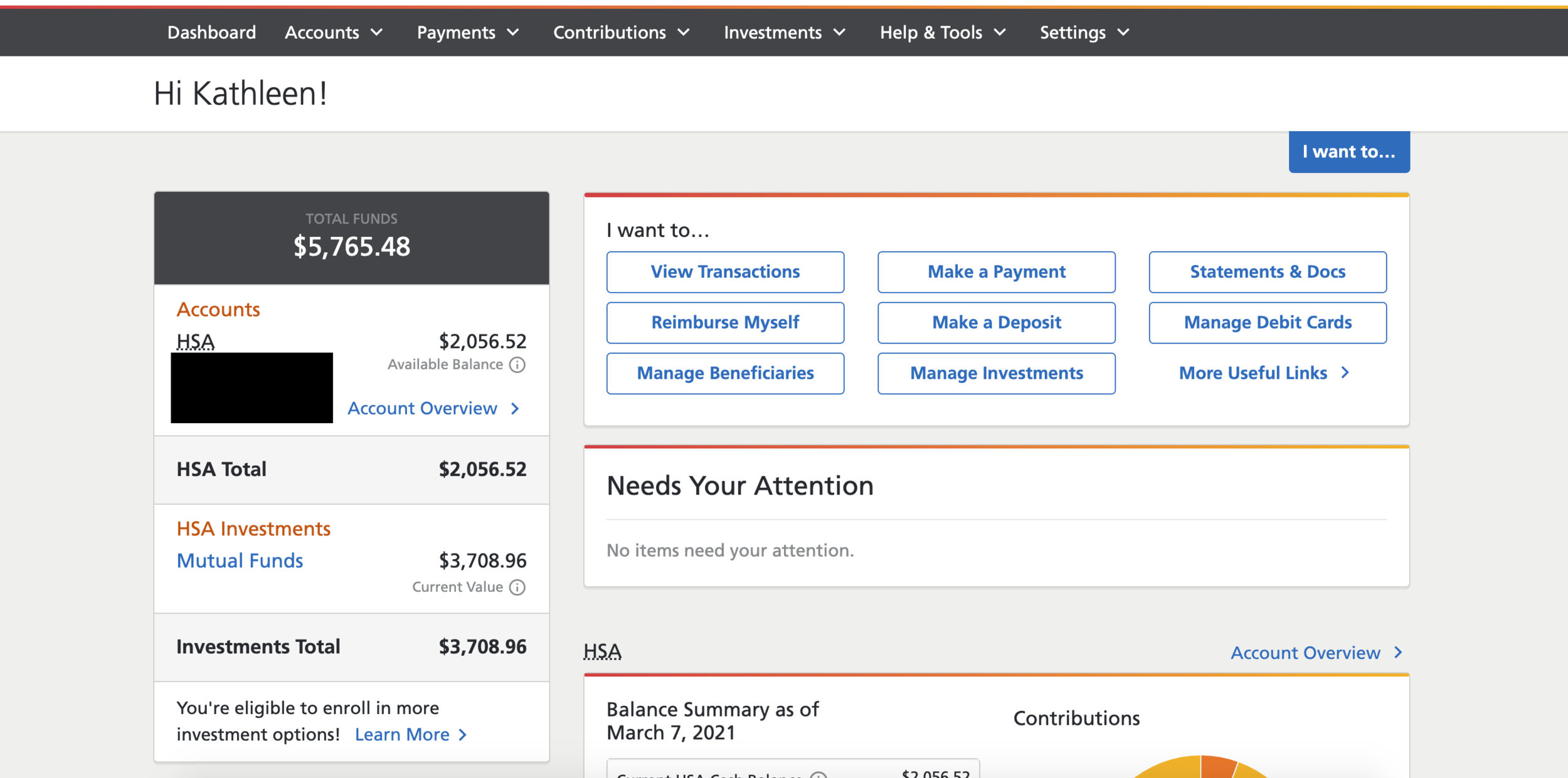

Notice above how about $2,000 of my HSA is sitting in cash, and there’s a separate portion worth about $3,700 (“Mutual Funds”) that’s invested.

You can choose which funds you want to invest in inside your HSA, and I chose the Vanguard 500 index fund and the Vanguard Total Stock Market index fund.

Conclusion

-

You can open an HSA if you have a high-deductible healthcare plan (and you may already have one from your employer); “high-deductible” is defined by the Feds as a deductible over $1,650 for singles and $3,300 for families in 2025

-

The money you contribute will go in tax-free (technically, it might go in post-tax but then give you a deduction later, as I outlined in this post), grow tax-free, and come out tax-free if used for “qualified medical expenses” (I’ve used mine for everything from Latisse prescriptions to Tums at CVS, though ideally you wouldn’t use it for anything and instead keep receipts and allow it to grow)

-

When you turn 65, it functions like an IRA and you can use it without paying the penalty that you’d ordinarily pay for using it for something other than medical expenses

-

The contribution limit for the 2025 tax season is $4,300 for self-only plans and $8,550 for family coverage

If you owe taxes this year, this is a great avenue and last-ditch effort to stiff the Feds.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time