The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

September 2020

$2,718. That’s how much my life costs every month.

In the last six months of 2020, I’ve been within a few percentage points of this number, dipping as low as only spending 82.2% of that total and as much as 102.65% of it.

Knowing how much your life costs is step #1 of taking your personal finance skills to the next level.

Step #2 is finding easy areas to trim.

The little stuff adds up, but the big stuff adds up a lot faster. Today, we’re focusing on the big stuff.

I’m less concerned about that one time you spent $400 on two pairs of leggings and more concerned about the fact that you’re paying $200/mo. for your cell phone and Wifi when you could be getting both combined for $75. See where I’m going with this?

The three major players

For people my age, there are typically two or three major items you’ll account for first. Fire up Google Sheets and let’s start here!

-

Housing – what’s your rent cost each month? What about utilities? If you’re scratching your head, log into your utility providers and rent portal and start looking back at the last few months of service to find an average. If you’re like, “Great, I know what I’m paying, but I have no idea if I can afford this or not!” Here’s a great rule of thumb to stick to: take your monthly take-home pay and divide by 3. E.g., if I make $5,000 per month, my total housing cost shouldn’t exceed $1,667.

-

Most of the time the way I find deals is literally walking into leasing offices off the street and asking for their best 2BR rate. The unit I live in now was listed for $2,300 online and I happened to stop by when they needed to fill it quickly – and boom, 4 weeks free and a discounted rate down to $1,700. The price listed online is what they think they can get for it… but if you’re willing to traipse around town in the Texas heat harassing leasing agents, you can usually get a better deal. I went to several places before my current apartment building and either wasn’t happy with the price they quoted me or wasn’t thrilled about the unit, and the extra hours of searching definitely paid off.

-

I’m not advocating for sacrificing comfort or safety in order to save money. I’m encouraging the boots-on-the-ground approach with apartment complexes that you’d still be excited to live in, rather than conceding whatever exorbitant rate you see on apartments.com and forking it over without pressing.

-

-

Car – most people have a car payment and car insurance. You probably know these since they’re fixed – so take some time to list those, too. Remember that most salespeople will tell you that you can afford a lot more than you comfortably can, because their definition of “afford” is “won’t default on the payments.” Our definition of “afford” is “won’t really miss the money every month.”

-

The general rule of thumb is spend no more than 10% of your take-home pay on your transportation-related expenses each month.

-

-

Debt & loans – Let’s tackle this in two parts:

-

Credit card/consumer debt: Definitely priority #1. I recommend using a credit card payoff calculator to project how long it’ll take to pay off the card and how much you’ll pay in interest. Using figures that are totally in line with what I see a lot with clients, consider this:

-

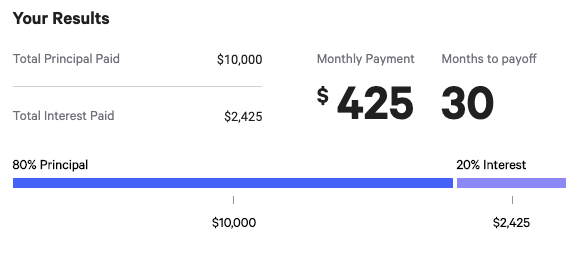

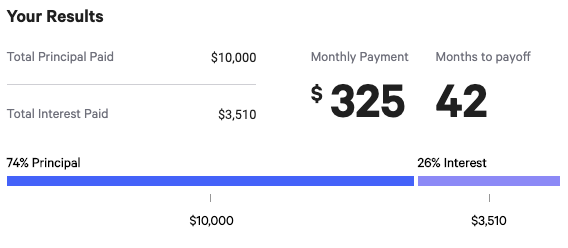

You have $10,000 in credit card debt on a card with a 17.99% interest rate and a $325/mo. minimum payment. You pay the minimum monthly payment. Here’s what that looks like:

-

-

This is a screengrab from the Bankrate calculator linked above.

It’ll take 42 months and about $3,510 in interest to pay off the $10,000, or $13,510 total. Now consider you’re willing to throw an extra $100 per month at the minimum monthly payment:

And just like that, you’ve shaved a year of payments off your life and saved more than $1,000 in interest.

So what does this have to do with how much your life costs every month?

$325 (or $425) is a pretty high monthly expenditure – it probably rivals your car payment in size! The more quickly you can banish that payment from your life, the better, and only by contributing more to it each month can you speed up the payoff rate. You can also call the credit card company and try to negotiate your rate down. It might take 10 tries, but if it’ll drop your interest rate from 24% to 18%, it’ll be time and awkwardness well spent. (I know that suggestion makes people’s skin crawl, but I ask… are you willing to experience discomfort for 5 minutes to potentially save thousands? Probably.)

It’s in your best interest to do so as aggressively as possible, unless your debt has an interest rate of less than around 6% (give or take) or less. Student loan debt is (usually) cheap money, but a high balance. Let’s consider another common example:

-

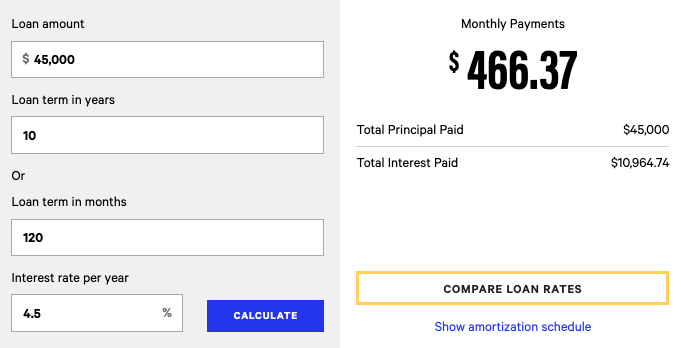

You have $45,000 in student loans with an average of a 4.5% interest rate. They’re a collection of 10-year loans and your total minimum monthly payment is about $466.

This is the Bankrate student loan calculator , also a great resource.

When it’s all said and done, that’s not great – $11,000 in interest over 10 years. But the kicker is the 4.5% interest rate – your money will (hopefully, probably) go further in the market averaging a 7-8% rate of return; that is to say the rate at which it’s growing (7-8%, on average) outpaces the rate at which your interest is accumulating (4.5%).

Other considerations

So those are the usual big suspects: housing, transportation, and debt. They’re usually (relatively) fixed, predictable costs.

Here are a few other things to factor in that are more variable, but I think you’ll find most of us hover around averages month over month. I’m naming stuff that I see most often, so some of it may seem random:

-

Gym membership (can be up to $200 in some cases)

-

Rent the Runway subscriptions (or similar)

-

Cell phone/WiFi/Cable – most people overpay for these things, please feel free to cyberbully AT&T into a better rate

-

Pro tip: Mint Mobile is super cheap. My unlimited-everything plan is $30/month.

-

-

Pet costs – I’ve seen doggy daycare creep up into the $500+ range (bless Sam’s self-sufficiency)

-

Gas, Uber, parking, and other sneaky transportation costs

-

Travel (if you’re spending thousands on travel, please, please, please consider getting into travel rewards)

-

Dining out (can vary like crazy depending on your habits)

-

Groceries (ditto)

-

Entertainment (kind of a catch-all, TBH)

-

Personal care (this includes haircuts, therapy, buying heaps of self-help books… you know the drill)

-

Donations, gifts, etc. – this is frustrating to budget for since it changes so much but I bet $100-$200/mo. is safe

If you’re certain you’re lowballing yourself, go through your credit card statements for one month and look at what you’re buying. Better yet, do a six-month look-back and use the averages.

The bottom line

It doesn’t matter if you skip appetizers and drinks when you go out to dinner if your rent payment is $700 too high. Trimming fat from the big, repetitive areas (or at the very least, identifying one key area to work on over the next 12 months when you have the opportunity to move, heckle an insurance agent for a lower premium, or throw a bonus at a credit card balance) will make a more substantial difference over time than opting for Kroger-brand Cheerios and skipping happy hours (that stuff helps, for sure, but not at scale).

I’ve seen people reclaim $1,000 per month in their budget just by moving out of an exorbitantly priced apartment and transferring their lease to something they can actually afford.

That’s one approach – the other approach is negotiating a job, promotion or side hustle that pays an extra $1,000 per month in take-home pay. Net same effect! Bonus points for combining both approaches.

Because ultimately, I’m sure we’d all much rather have that money back to spend on something better: whether that be investing, traveling more often, an expensive hobby, tastier food… the list is endless.

And figuring out your baseline is the first step toward the lifestyle that excites you.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time