How Rich People Legally Avoid Taxes, and You Can, Too [2025]

March 8, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

If you can’t beat ‘em, evade taxes like ‘em.

Just kidding – there will be no tax evasion here (you hear that, little FBI man that resides in my MacBook Air? No need to call Jim at the IRS, because everything in this post has its origins in tax code loopholes, laws, and cultural differences between the wealthy and the middle class).

I think it’s very much worth calling out: I am middle class. I was raised middle class, I make a middle class income, and I don’t consider myself “wealthy” in the sense that I’m talking about “the rich” here. However: I’d rather model my financial behavior after people with two commas in their net worths instead of one.

Isn’t avoiding taxes illegal?

Good question! Here’s the thing to understand right off the bat about taxes:

Your earned income and your property are the two things that are taxed the most aggressively.

Read that again.

Your earned income and your property are the two things that are taxed the most aggressively.

What do middle class people have in common?

Well, usually, they have good, middle class jobs (that pay earned income) and a primary residence (that faces unforgiving property taxes every year).

(Property taxes are the thing that everyone likes to ignore when making the argument that home ownership is an unquestionably good idea. At a national average of 1% of the value of your property every single year, your $350,000 home has an additional (average) $3,500 expense tacked on to its mortgage, interest, and insurance annually that goes toward nothing but Uncle Sam. Puke! The more expensive your home, the more you owe to the government. It’s one of the most effective ways to actually tax the wealthy, because you can’t move your home to an offshore bank account.)

Now, there’s nothing wrong with owning a home (see the “Cars & homes” category on this site for more articles about the math of home ownership), but the hard thing about the middle class is that 80% of middle class Americans have the majority of their net worth (60%) tied up in their home, which means most of their net worth is taxed over and over and over again on an ongoing, never-ending basis.

Conversely, the upper-middle class and “wealthy” in America (the demographic we’re attempting to model our financial habits after) own homes that account for only between 10 and 30% of their total net worth.

So what’s taxed un-aggressively?

Is un-aggressively a word? It keeps generating that ugly red line underneath it, but I’m plowing forward for the sake of the narrative.

You know what’s taxed at an almost laughably low rate?

Your long-term capital gains and your dividends – that is to say, any money that your money makes for you (in an investment account) is taxed so little it’s almost a joke. Let’s dive deeper.

Why the wealthy hide most of their net worth in investments

Historically, the middle class in America has put most of their net worth into their homes. And you know what? It’s not their fault: We’ve all been sold a lie that home ownership is the way you get rich (it’s not). To understand why, check out this post about when the math actually supports buying instead of renting.

But what happens if my entire net worth (or close to it) is “invested” in my primary residence?

Let’s say my primary residence is worth $500,000 and I have about $25,000 in cash. My total net worth is $525,000, assuming I own the home outright and no longer owe any payments on it.

Let’s also pretend that my income is $125,000 per year. Because I like nice things, I don’t really invest any of the money – I just take it all as cold, hard cash, spend most of it, and shuffle whatever’s left over into that $25,000 cash sitting in my savings account on the side.

If you’re looking at this scenario thinking, “Hey, that’s not so bad! Half-a-million-dollar home, $25,000 in cash, and a six-figure salary? I’d take it.”

My friends, this person is a tax NIGHTMARE!

Let’s explore why:

-

Assuming they pay the national average in taxes on their $500,000 home, they’re looking at a $5,000 property tax bill annually.

-

Their earned income, $125,000, is their only source of income – in other words, they’re only living on earned income – no capital gains or dividends to speak of. This person would be taxed on the full $125,000, paying $29,101 in federal income taxes and FICA (want to calculate your own? I’m using this calculator).

Our hypothetical middle classer is paying nearly $29,000 in taxes this year – more than the amount they’ve got in their savings account liquid. They’re technically “worth” over half a million dollars, but they can’t use their home to pay their income taxes.

How would investing have helped this individual?

Investing is beneficial for your tax liability (in other words, it can help shield you from taxes) in two ways:

-

When you invest in a pre-tax account, you shield that money from Uncle Sam’s bill collectors because you’re “deferring” the taxes for a later date (but if you’re a loyal Money with Katie reader, you know you can also collect it later tax-free too if you perform the Roth IRA conversion ladder and keep your conversions under the standard deduction).

-

When you get to the point where you can live off investment income (i.e., invest aggressively enough for long enough), you can “pay” yourself a ridiculously high amount before the money is actually taxed.

Let’s break this down.

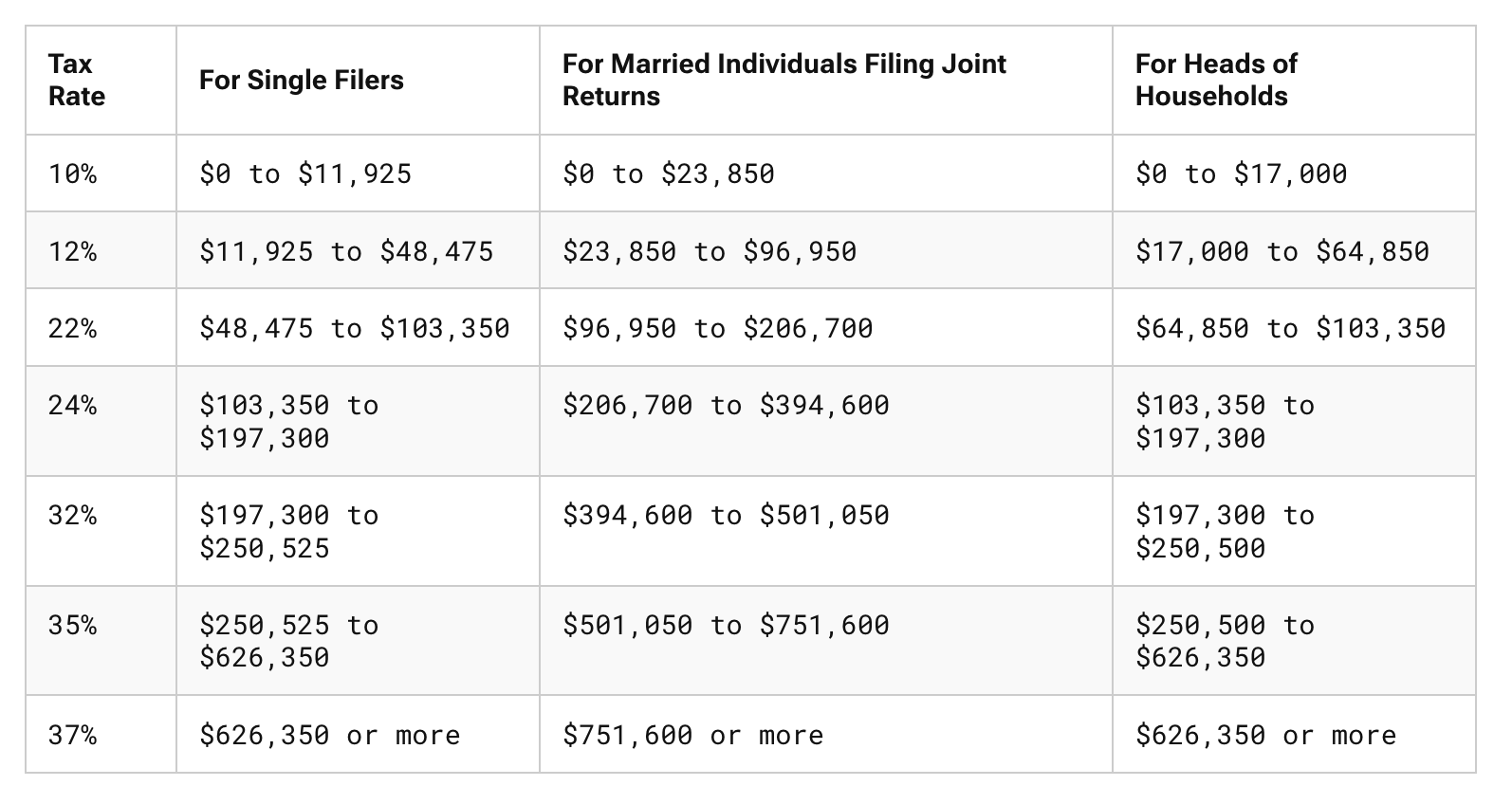

First, it’s helpful to look at the tax brackets on earned income:

As we can see here, our friend is being taxed in the 24% tax bracket on the last $20,000 he or she makes. Of course, the standard deduction will eat up some of that – but the point stands that they aren’t doing much to help themselves lower their tax liability.

(The earned income tax brackets are progressive, which means your income is taxed at different rates. Your first $10,000ish is taxed at 10%, the next $35,000ish is taxed at 12%, etc. – which means the person’s entire income isn’t taxed at 24%, only the chunk from $103,350 to $125,000.)

Pretty gnarly, huh? But what if this person had been investing in the market for the last 15 years?

Better yet, what if this person had avoided the half-a-million-dollar McMansion and instead invested heavily in low-cost, diversified index funds that were now producing dividends and capital gains this person could live on? (In other words, what if they were nearing financial independence?)

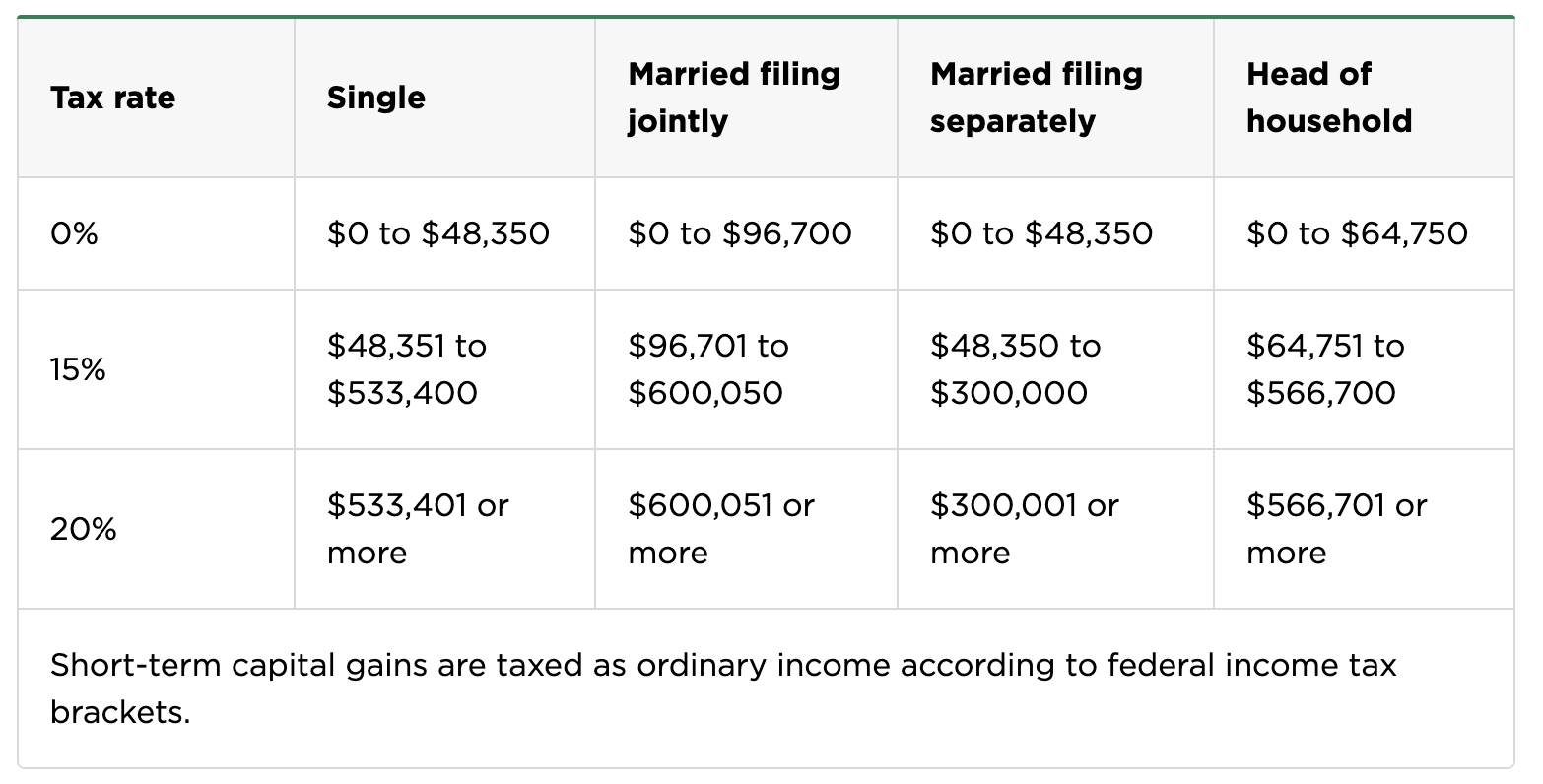

Let’s look at how your investment income is taxed (assuming no other income; in other words, you’re living off your investments instead of a salary):

Note that we’re talking long-term capital gains; in other words, gains that are older than one year. If you buy an index fund today and sell it six months from now, that gain will be taxed like regular income. Not ideal.

Yep, you read that right: A single person can withdraw up to $48,350 per year from their investment account for the low, low price of 0% in taxes paid, if it’s their only source of income.

$48,350!

And what if you want to withdraw, say, $300,000 per year? You’re living high on the hog! You’ve got six months to live! Time to finally pack your bags for Yacht Week and buy that Gucci tracksuit you’ve been eyeing.

No problem. You’ll only pay 15% in taxes on up to (I’m throwing up) $533,400.

You know what EARNED income bracket gets charged 15%? The one between $40,000 and $80,000.

The government is basically incentivizing you to invest like a crazy person to the point that you can live off your investment dividends instead of a traditional job.

When you look at it from a tax perspective, it makes almost no sense to have a real job. In fact, it makes ALL the sense in the tax world to try to invest as aggressively as possible with your earned income so you can get to the point where you can live off your capital gains, which are taxed at a much, much more forgiving rate.

And that’s why strategically wealthy people shovel all their money into investments that generate income that isn’t (or barely is) taxed.

So now you can see why it’s to your massive benefit to have enough in investments to not have to work (surprise!), but what about on the front-end? How could our friend have avoided such a high tax bill?

Pre-tax investment accounts. These are what we like to call tax shelters, because the federal government can’t touch it until you go to use it later, strategically at a time where you’re in a lower tax bracket. Checkmate.

What would’ve happened if our friend had maxed out their 401(k) instead of taking home all their income?

At an annual maximum contribution of $23,500, our friend could’ve lowered their taxable income like this:

Income: $125,000

2025 standard deduction for a single person: Subtract $15,000 for the standard deduction, which lowers taxable income to $110,000

401(K) maximum contribution: Subtract $23,500 for the 401(k) contribution, which would go into the 401(k) completely untaxed

New taxable income: $86,500

There are other tax-sheltered accounts this person could play with, like HSAs and IRAs, but for the sake of our example today, we’ll keep it simple.

-

An HSA, or Health Savings Account, is an account that you’re eligible for if you have a high-deductible health insurance plan – the contribution limit for a single person in 2025 is $4,300. When I found out I owed $5,000 in taxes this year because I underpaid throughout the year, I put the maximum contribution into an HSA to defer that income from taxation and ended up lowering my tax bill to $4,000. One step at a time! The cool thing about the HSA is that you can actually invest the money in it once it crosses the $1,000 mark (typically).

-

An IRA, or Individual Retirement Account, comes in two flavors – Traditional and Roth – and I’ve written about them extensively. A traditional IRA, which would’ve been a great tax deferral vehicle, wouldn’t work in this example because our friend with a six-figure income is over the income limit. #sad.

Now? Our friend owes ~$23,500 in federal taxes and FICA, roughly $6,000 less.

That’s an annual savings of $6,000 by doing nothing more than putting your earned income into a tax-sheltered account.

Theoretically, if you had no other earned income, you could “make” $96,700 as a married couple filing jointly in dividends and capital gains and live on it completely tax-free.

The trick? Invest aggressively enough, early enough to build up a massive portfolio that’s capable of throwing off $96,700 per year in capital gains. Easier said than done, but hopefully this serves as spite-motivation to stiff the Feds on the taxes you’d otherwise be paying them if that $96,700 were earned income.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time