Should You Take the “$200 Flight Credit” Card Offer During Checkout?

August 5, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

August 2020

Man, I might lose my job for this one – but it is my duty as a credit card points enthusiast to cover my bases, and usually I’d say that I cannot in good faith support you applying for an airline credit card via the $200 instant credit offer.

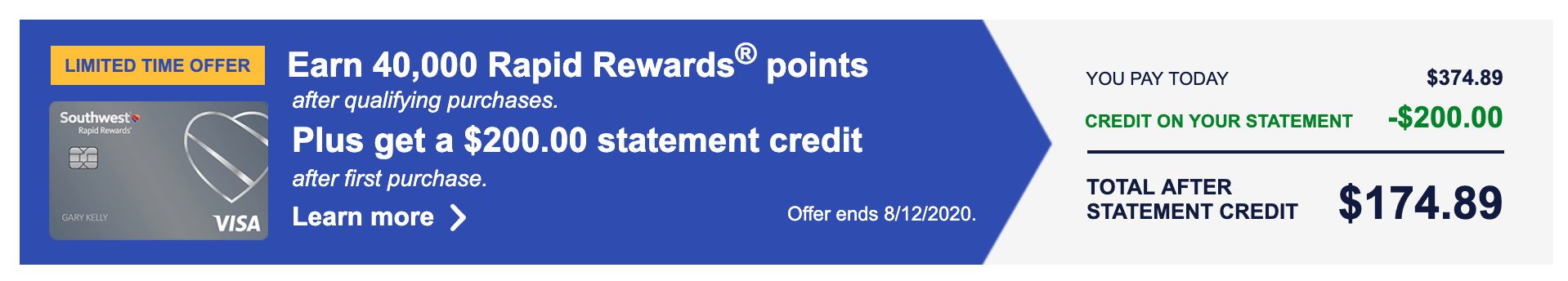

If you’re like, That’s great, but I don’t even know what that is, allow me to refresh your memory. Think back to the last time you bought a flight. Do you remember something like this?

Delta’s instant credit offer, grabbed on 8/3 – $200 credit and 20,000 SkyMiles.

Southwest’s instant credit offer, grabbed on 8/3 – $200 credit and 40,000 Rapid Rewards points.

American’s instant credit offer, grabbed on 8/3 – $250 credit and 40,000 miles.

Look familiar?

I can’t tell you how often I get sent screenshots of these offers (regardless of the airline) accompanied by the question, “Is this a good deal?” while someone is in the process of buying flights and tempted by the easy-peasy, immediate gratification of knocking $200 off their total right then and there.

The answer is usually unequivocal: No.

EXCEPT.

Except for right now. Right now, it’s a little trickier (and a lot closer).

As airlines try to stimulate demand for both their air product and their credit card offering (the two biggest money makers for most airlines), they’re doubling down on their in-path (i.e., in the process of booking) offers to help customers afford air travel and sign up for the card. A true coup for the airline, and a pretty good deal for the consumer, too.

Normally, these offers are simple and lackluster: about $200 off the cost of your purchase in the moment, with no points to speak of. I usually discourage this approach because (almost always) the points bonus option in the regular card application is worth (sometimes substantially) more.

Note: By “the regular card application,” I mean the credit card offer that’s totally separate from the one you’re offered while you’re actually purchasing a flight. It’s the one that would come up if you Googled “American Airlines credit card.”

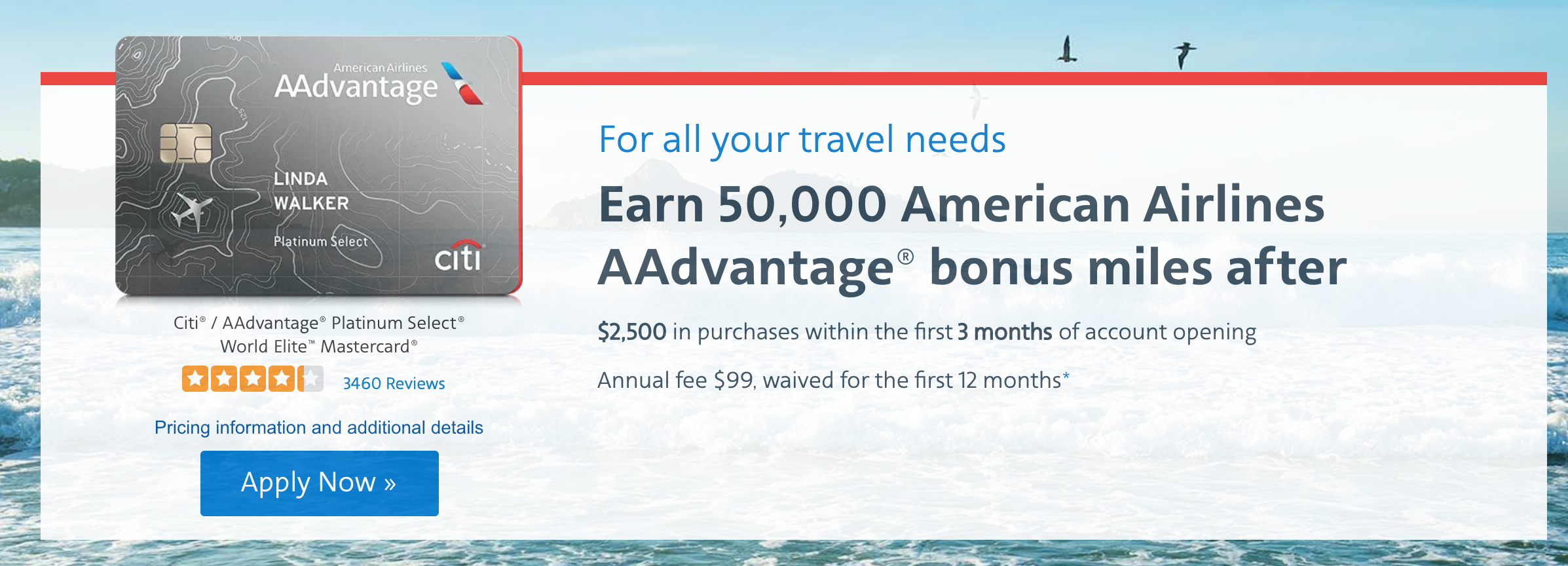

For example, here’s the current American Airlines offer: 50,000 miles. Keep in mind that point valuations vary depending on the source, but if you look at The Points Guy’s July 2020 assessment, he values one American Airlines mile at 1.4 cents (I think this is generous, but I digress).

This means 50,000 American Airlines miles are worth about $700.

Remember the American Airlines instant credit offer during checkout? $250 off your purchase and 40,000 points?

40,000 points = $560 + $250 (knocked off your purchase of the flight) = $810.

OPE. This is rare, my friends. I can’t remember the last time (if ever) that the credit card offer during checkout was more lucrative than the real thing. And why would it be? The hope is that you take a less valuable offer for instant gratification in the moment, versus slaving away for three months begging your friends to let you pay their rent on your credit card to hit a spend threshold.

You can apply this same value comparison to every instant credit offer.

Which offer is more valuable, instant credit or the regular points bonus?

9 times out of 10 in a pre-pandemic world, the regular sign-up bonus is going to kick the pants off the instant credit offer. As we just saw above, 2020 is the year where nothing is sacred. Kobe Bryant is gone. A pandemic has turned our world upside down. The instant credit offer is more valuable than the regular points bonus. Life as we know it has shifted on its axis.

We’ve already looked at American Airlines and its 1.4 cents/mile valuation to determine if 50,000 miles was greater than or less than 40,000 miles + $250 off. But I believe in #examples, so let’s do Delta and Southwest for the hell of it, too.

Delta

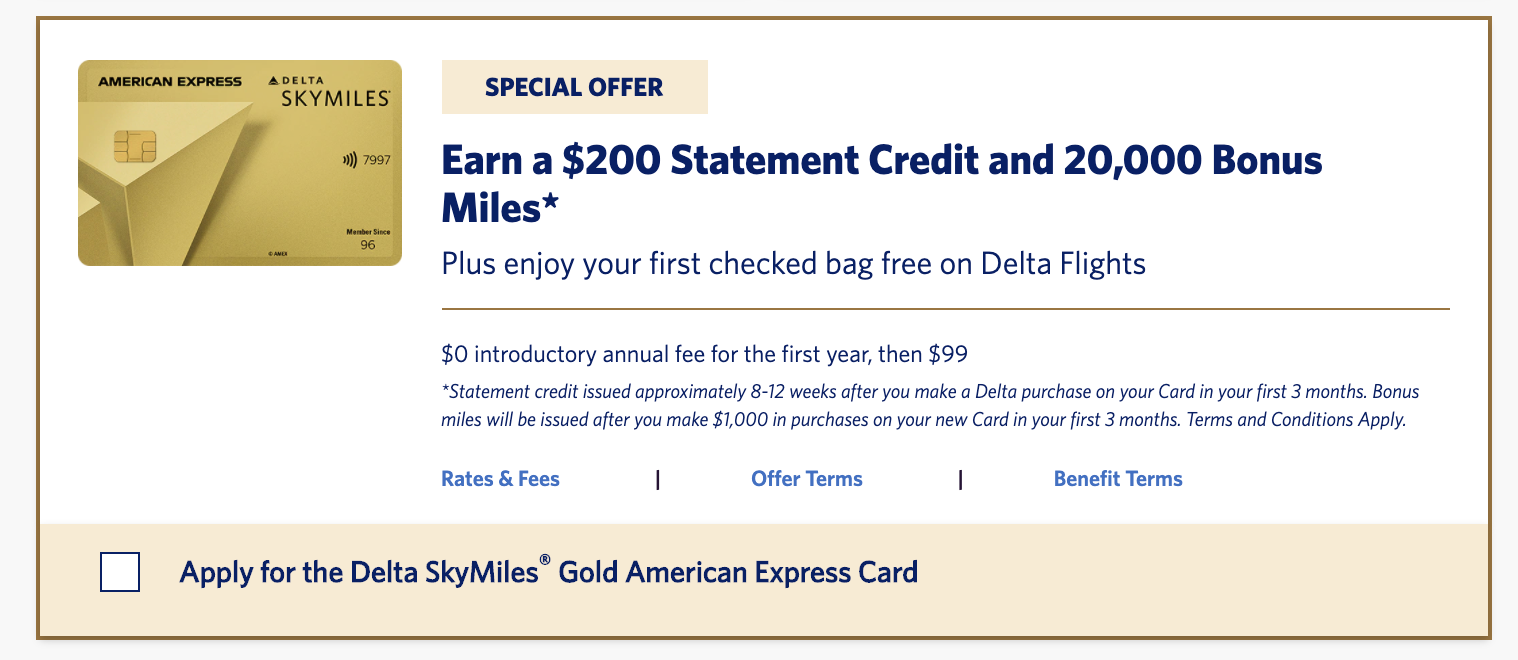

Delta’s current instant credit offer is $200 off and 20,000 points – slightly stingier than American’s, but I’d argue Delta’s product is a little nicer – so *shrugs.*

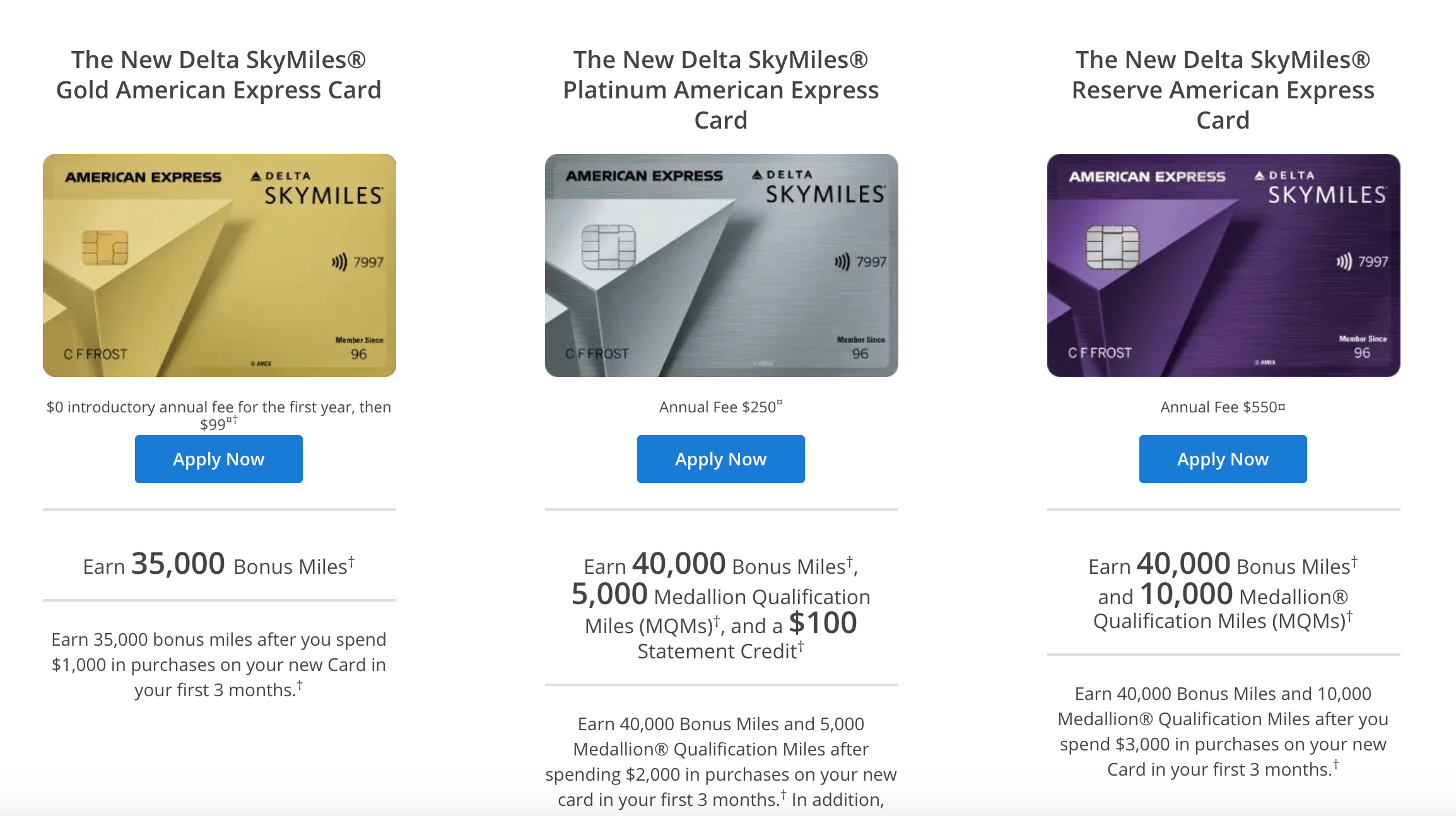

Here’s their “regular” credit card offer, which is running in parallel (e.g., I Googled, “Delta credit card”).

The card that’s offered in the checkout process is the gold one on the left, their $99/year Gold card.

The Points Guy values a Delta mile at 1.2 cents in July 2020, meaning 35,000 miles = $420.

20,000 miles = $240, + $200 off during purchase = $440.

Again, the instant credit offer beats the regular one – but just barely.

Southwest

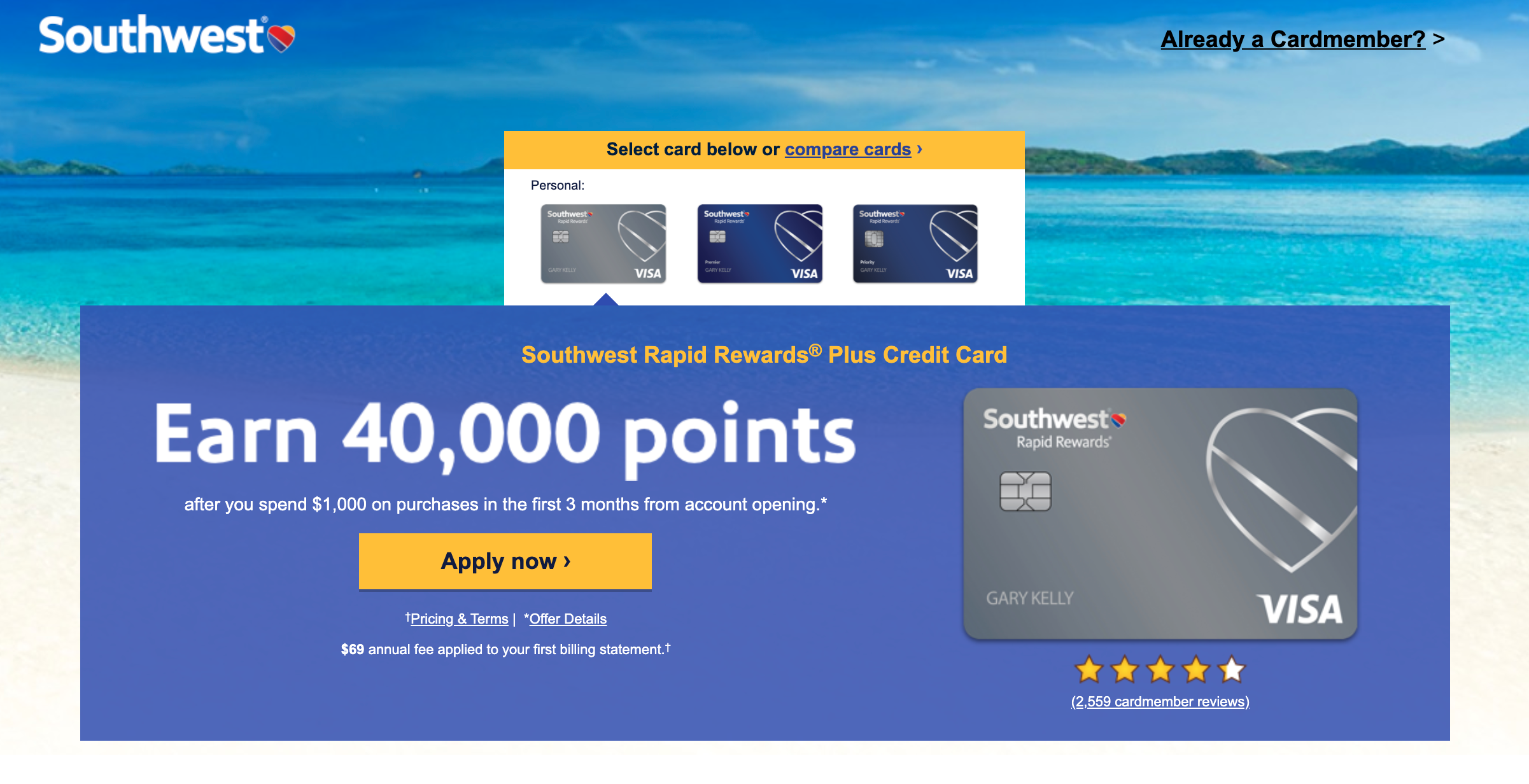

Southwest’s current card offer (as of 8/3) is 40,000 points. If you recall, the current instant credit offer is 40,000 points + $200 off.

You don’t have to be a mathematician to know immediately which option is better.

But, for the sake of consistency, let’s do the full breakdown. The Points Guy claims that a Rapid Rewards point is worth approximately 1.5 cents, so 40,000 points is worth $600.

This means your instant credit offer is worth $600 + $200 off your flight, for a total value of $800.

The caveat the rest of the time: How much of a premium am I placing on getting money off right now?

Let’s say you’re faced with this decision in six months from now and the pot is decidedly less sweet. If you’re buying flights all the time, you’re (typically, meaning: not right now) better off going about your credit card application the old-fashioned way: Applying through the “points” offer, hitting your spend threshold, and patiently waiting the 3ish months for your points to hit your account.

If you’re in a bind and need flights right now and for whatever reason can’t spend the money on them, then (I guess) the instant credit offer makes more sense – take your $200 off and be done with it. (I would typically discourage traveling if the $200 credit is make or break for your budget, but sometimes we get put in bad situations and need to fly somewhere, so I’ll leave that choice to you.)

Final assessment summary

American Airlines

The better deal: Taking the $250 off + 40,000 points while buying an American Airlines flight ($810 in value).

Delta

The better deal, barely: Taking the $200 off + 20,000 points while buying a Delta flight ($440 in value).

Southwest

The better deal, by a landslide: Taking the $200 off + 40,000 points.

Obviously, this assumes…

…that you’re buying a flight right now. If you don’t foresee yourself buying flights over the next month or so, you may be better off going the tried-and-true route and banking all the points for later.

I didn’t do this example for every airline that offers a credit card (and I’ve kind of slighted United; my apologies), but hopefully the examples were clear enough that you can apply the same logic wherever, whenever.

Curious about which airline cards are best? My top pick is the Southwest Rapid Rewards Priority card, and it’s not just because I work there.

See you soon!

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time