Personal Finance Optimization with a Lower Income

December 6, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Before we get into the meat of today’s post, there are two things that I feel like I need to address explicitly:

-

Sometimes the phrase “lower income” can carry negative connotations because it’s (sometimes) used pejoratively. Today, know that the classification of “lower income” is being driven by this Department of Housing chart, as seen in this handy-dandy interactive version on Vox.com for housing income limits, and that it’s different depending on where you live. For example, “low income” for one person in San Francisco is $73,750, while you’re considered “low income” in Dallas, TX if you make less than $41,100. #LocationMatters

-

We could devote an entire economics and ethics blog to the issue that some of society’s most valued participants for sustaining day-to-day life (teachers, grocers, caretakers, etc.) are paid way less than suit-wearing executives who send emails all day.

For the purposes of today’s post, we’re not going to lament (much) about how late-stage capitalism has thrown a monkey wrench into society’s pay scale. Instead, we’re going to talk about how those teachers, grocers, and caretakers (and also, entry-level advertising professionals) can make their money go the furthest.

This is Low Income Optimization 101.

Because maybe those music teachers, artists, and professional dog groomers don’t want to have a highly paid fake email job. I’ve written in the past about how it’s perfectly fine if your dream job isn’t lucrative, because the entire point of finding a super high-paying job (in my neck of the woods) is to save as much money as possible so you don’t have to do it anymore.

If you like what you do, you’ve already won. Liking your job is the cheat code, people!

That said, you can like what you do and still want to make sure you’re going to be able to retire someday.

Saving Money on Lower Income

Today, I’m going to focus on three major facets of optimizing for low income:

-

Leveraging Roth contributions

-

Picking your housing & transportation wisely

-

Becoming an excellent chef (ok, that last one might be a bit of a joke, but you’ll see)

The major takeaway, for me, is that it’s abundantly possible to live a beautiful (and optimized) life on a lower income, but it requires kissing the “Keeping Up with the Joneses” mentality goodbye and getting a few, big structural things right.

In my zip code, a family of two living on $49,200 would be considered low income (this is interesting, because for one person, it said $43,050 – I guess it’s assuming only discretionary expenses would go up by adding a second person?).

For the purposes of today’s exercise, I’m going to use these numbers: $49,200 for two people.

First thing’s first: Let’s talk about taxes

Generally speaking, the tax code is pretty favorable to married couples making a taxable income of less than $81,050 (2021).

For our example couple with $49,200 of income each year, they’ll take the standard deduction ($25,100) and be left with a taxable income of $24,100 – meaning they’ll only be taxed on $24,100 of income:

10% on the first $19,900

12% on the next $4,200

= $2,494 of taxes due annually, or about $208/mo.

That’s a pretty low tax bill, right? An effective tax rate of 5%.

(And yes, I just know someone out there in the wings is biting their tongue with a quip about how Bezos paid less, but remember, this isn’t a criticism of late stage capitalism… yet.)

So right off the bat, we know that 5% of our income goes to taxes. Let’s tuck that little factoid away.

The low tax liability makes a lower income person (or couple) the perfect candidate(s) for the Roth IRA.

Why the Roth IRA is especially great for lower income

The Roth IRA is effectively the most magical tax school bus available because any money that goes into it is never taxed again. It grows completely tax-free. No tax drag. If you start early, the Roth IRA can compound for many, many decades and become one of the most powerful tools out there.

Because you fund it with post-tax income, your marginal tax rate really makes a difference for how sweet the Roth IRA proposition is.

Each (earning) member of the couple can contribute up to $6,000 per year, for a total maximum contribution amongst the couple (in two different Roth IRAs, to be clear) of $12,000 per year.

To reiterate: You can only contribute to a Roth IRA if you have earned income. For example, if you make $4,000 per year, you could only contribute $4,000. You must have at least $6,000 of earned income reported to the IRS to fund your Roth IRA to the gills.

For people who pay a marginal tax rate of 24% on their contribution (married filing jointly with $172,000+ income), the Roth IRA is still nice – but it creates a larger tax bill. Twice as large, to be accurate.

Our $49,100 family will only pay their 12% marginal rate on the contribution, and that’s why the Roth IRA is a really incredible option for them.

We know 5% of our $49,100 will go to taxes. If we contribute the maximum to one Roth IRA ($6,000), that’ll account for another 12%.

You can open a Roth IRA with Betterment, fund it with cash, and answer a few questions about your goals and desired timelines – and they’ll do the rest. No investing knowledge needed.

Pause: Taxes and (the first round of) savings is done

5% has gone to pay taxes, 12% is set aside for our Roth IRA contribution (for a 12% save rate, already doing better than the national average of 9.4% in May 2021), and now, it’s time to switch gears to picking housing and transportation wisely.

Second: Get the structural expenses right

This is one that’s really going to vary by region of the country. Allow me to offer two schools of thought:

-

Option #1: Buy a conservative home in the ‘burbs and a conservative, reliable car to get you to and from work every day.

-

Pros: You’re going to build equity in a home over time, and if you buy conservatively, your unrecoverable costs (property taxes, insurance, maintenance, mortgage interest) hopefully won’t be too high. Eventually, the home will be another valuable asset that you can sell.

-

Cons: Buying a home opens a can of worms with potentially expensive and unpredictable repairs, and experts say 1% of the property value should be set aside every year for maintenance. Depending on how much your home costs, this could eat into your annual income significantly. Owning a car and driving a commute introduces another potentially hairy collection of costs to the picture, and should be weighed based on location.

-

-

Option #2: Rent a conservative apartment near your work and take a bike or public transportation if it’s safe and feasible where you live.

-

Pros: While your entire rent payment will be unrecoverable, it’s a known quantity that you can commit to upfront without any “surprise” expenses that need to be accounted for. Biking or using public transportation takes the expense of a car out of the equation, and if you’re close to work, you’ll cut down on commute time.

-

Cons: Depending on where you live and work, this may not be possible. Some places have effectively no public transportation (thanks, America) or the weather is too gnarly to use a bike. And as we noted, your entire rent payment will be unrecoverable, so no portion of it will build equity in another asset.

-

See why location seems to matter a lot here? Some housing markets will make this impossible – while other rental markets will make it prohibitively expensive.

If you still work in an office, hospital, school, etc. (a physical location), buying or renting conservatively near your place of employment is likely the best option.

So how much should our hypothetical couple spend?

House/apartment

We don’t want any more than roughly 28% of our gross annual income to go toward the roof over our head, lest we feel absolutely #HousePoor.

That equates to roughly $1,145 per month.

I know, I know – it doesn’t sound like a ton. But this is where living in an affordable zip code makes a difference (and the reason why San Francisco’s “low income” is up in the mid-$70,000 range).

Using national averages, a $200,000 home would generate a PITI (principal, interest, taxes, insurance) payment of roughly $955 per month after $40,000 down, getting us comfortably below our $1,063 limit.

If we assume $2,000 per year (1% of the property value) will be set aside for maintenance, that adds another $166 per month, for a total of roughly $1,121. We’re right about in line with our goal.

Now, to find a house that costs $200,000…

Just kidding, kind of – the housing market is really on some next-level bullshit right now, and that’s why I’m personally a fan of renting.

So you get the picture: Putting the legwork into finding a housing situation that enables you to live on roughly 28% of your gross income will help the first major, structural puzzle piece fall into place.

Pause: Taxes, savings, and housing is done

5% has gone to pay taxes, 12% is set aside for our Roth IRA contribution (for a 12% save rate, already doing better than the national average of 9.4% in May 2021), and 28% has gone to housing. That means we’ve used 45% of our income so far, and have about 55% left.

Third: Curating a lifestyle that your grandmother would be proud of

I always channel my Grandma Jean whenever I think about money and food – she and my Papa John (rest in peace) were so poor when they got married, they literally shot squirrels in their backyard, cooked them, and ate them for dinner.

Every time I order Uber Eats for lunch, I look to the sky and say, “Papa, please forgive me, for your granddaughter is a weenie little b**** with very few home economics skills.”

In all seriousness, I’ve taken a great deal of inspiration from the resourcefulness of my parents and grandparents – and you don’t have to be “poorer than a church mouse,” as Grandma Jean says, to curate your lifestyle resourcefully.

While my parents were better off than their parents, they still made (really delicious) homemade meals every night. We rarely ate out for dinner (and I mean rarely), going out maybe once or twice a month.

Embracing the ability to cook delicious food at home using fresh groceries is, in some ways, way more luxurious than eating out. Cooking is a lost art, and becoming good at it is one of the best money (and health) hacks out there.

So let’s say we’re not going to eat out very much – maybe $100 per month for meals out – and the rest of the time, we’re going to cook at home. We need healthy groceries for two to make delicious meals:

-

$100 per month ($1,200/year) for dining out

-

$600 per month ($7,200/year) for healthy groceries

That’s a total food cost of $8,400 per year, or 17% of our overall figure.

While suggesting restaurants are worth cutting may feel a little too Dave Ramsey-esque, hear me out: I’m not suggesting cutting them out because they’re life’s finest joy and you don’t deserve that. I’m suggesting cutting it out because I actually think dining out is quite overrated for how expensive it is.

The other week, I got groceries with my husband – $84 for 6 days of food for the two of us.

I also had one meal out, got a beer at a brewery, and an iced coffee and scone. $35.

My half of the week’s groceries was $42, but a subpar chicken sandwich, Miller Lite, and cold brew was $35? It’s hard to justify.

My mission in life is to get “Treat yourself at home” poppin’. Make yourself your favorite meal for a small fraction of the cost, and enjoy it way more often.

It leads to a richer life, not an emptier one, when done right.

How did we do?

Well, we’ve got taxes, saving, housing, and food accounted for:

-

Taxes: 5%

-

Saving: 12%

-

Housing: 28%

-

Food: 17%

That leaves us with 38% left, or $18,658 per year (roughly $1,554 per month).

Now, there are likely expenses not mentioned here, like:

-

Healthcare

-

Clothes/personal care

-

Pet care

-

…and more

The key point is: On $49,100 per year, if you get those few puzzle pieces correct (the Roth IRA, the conservative housing choice, and the food), it’s much easier to slide the other puzzle pieces into place.

Let’s pretend you spent the rest – for a total of $40,645 spent per year (the rest went to your taxes and Roth IRA).

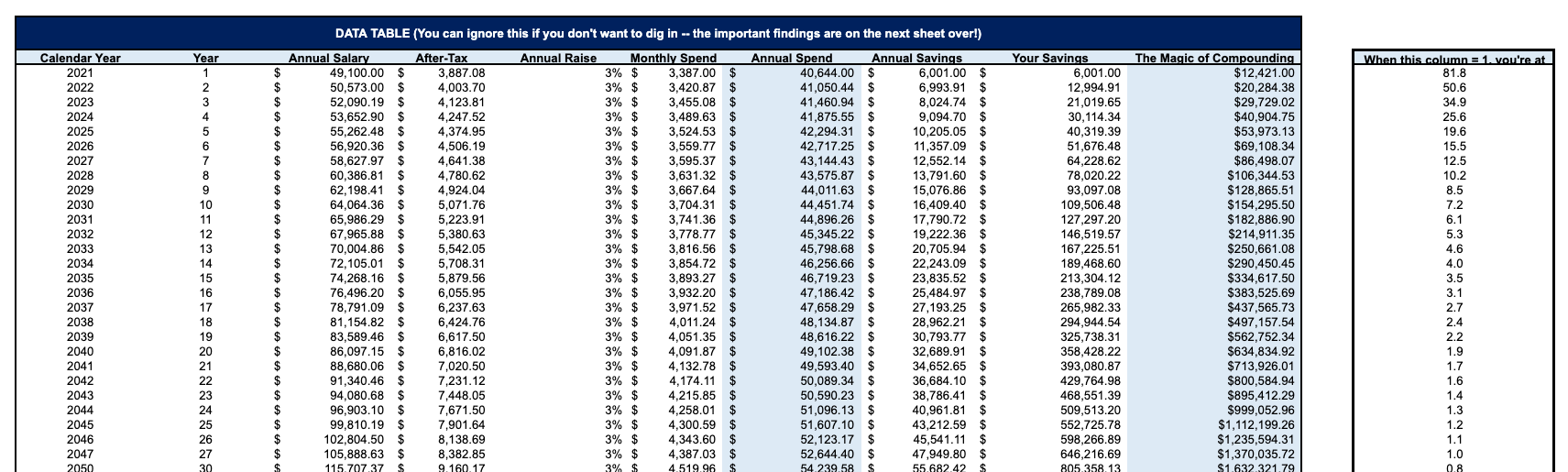

Assuming your income went up by 3% each year with inflation, your spending went up by 1% per year, and your average returns were 7% annualized…

You could be financially independent after 27 years with $1.37M.

You can see the way it plays out – the annual salary bumped up by 3% each year for inflation, the after tax monthly income growing as a result, and your annual spend increasing by roughly 1% each year. The rest gets saved (read: invested) and compounds.

If you start at 30 years old, you could be retiring as a millionaire by age 57 – assuming you continued to maintain a similar lifestyle.

Conclusion: It’s not all about the money

The obvious thing that I feel the need to state explicitly? It’s undoubtedly easier to save money when you make a lot of money. That’s hard to argue, because, Yeah, we live in a world where things cost money.

But if you’re doing something you love that doesn’t generate a crazy six-figure income, you still have a lot of options at your disposal that can help you still become a millionaire before you’re old and gray.

That’s the power of time and a little strategy, my friends!

Now, I’ll leave you with this article about a teacher from California who retired to Mexico instead and lives an amazing beachside life. The ex-pat route feels like an entirely different exploration. Maybe we’ll explore that next time….

The fine print, since we’re talking about investing

Hypothetical examples are for illustrative purposes only. All events, persons and results described herein are entirely fictitious and amounts will vary depending on your unique circumstances and factors not necessarily accounted for here, such as market volatility, inflation, advisory fees, reinvestment of dividends or earnings, etc.

Investing involves risk of loss and performance not guaranteed. Just my opinions, not advice. #sponsored.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, unless stated otherwise.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time