The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

It feels appropriate to break this post into two since your starting point matters so much when it comes to the conversation of “building credit.”

For today, we’ll focus on those of you who have normal-to-decent credit already (in other words, you’ve never had any super negative events hit your credit report, like missed payments or defaults). We can revisit credit repair, which is essentially crawling your way back to “good” after something causes your score to drop, and use today to discuss credit principles and best practices.

Why your credit score can impact your financial health long-term

The book “I Will Teach You to be Rich” taught me a lot about this topic, and it opened my eyes to an aspect of the credit score’s impact that I hadn’t considered before.

Your credit score determines what kind of interest rate you can get on big ticket loans, like your car and home. People with poor credit scores end up paying thousands (if not hundreds of thousands) more over the lifetimes of their loans, which means your credit score can directly impact your ability to build wealth.

For example, let’s say you have a stellar credit score, a score that would make Dave Ramsey feel hot and bothered. You take out a $250,000 mortgage on a $310,000 house (read: you’re borrowing $250,000 and putting $60,000 down).

You get an interest rate of 2%. Great! Over your 30-year fixed rate mortgage, you’ll pay $82,000 in interest, meaning your $250,000 loan will cost you $330,000. Woof.

But now let’s pretend you have a slightly less stellar credit score, and instead of a 2% interest rate, you get a 3% rate. Yep, just 1 percentage point higher.

Now, over the course of that same loan, you’ll pay $129,000 in interest.

What if you got a 4% rate? Now you pay $180,000 in interest.

By simply jumping from a 2% interest rate to a 4% interest rate, you pay $100,000 more over the lifetime of your loan.

This is why Ramit Sethi, the author of the book, really hammers home the long-term financial importance of having a kick-ass credit score—it’s not just a number to halfway understand, it’s your ticket to good loans.

How your credit score is determined

Hopefully you’ve spent enough time on this site by now to know why your credit score matters (read: it’s your ticket to free travel via premium credit cards, if nothing else), but let’s dive into the ways your credit score is measured.

If you’re like, Which entity is out there grading me on my financial behavior? Who has THE NERVE to do such a thing?, the answer is a variety of credit reporting agencies like Equifax, Experian and Transunion. Usually, you’ll hear people talk about the “FICO” credit score, which is determined by a mix of financial data points about you. Kinda big brother-y, huh?

There are five primary categories that you’re being judged in, and unfortunately, the standards are more on the Simon Cowell side of the spectrum than the Paula Abdul side.

Your “payment history” accounts for 35% of the score.

This means 35% of the outcome of your credit score is determined by if you’ve made correct, on-time payments in the past. Since your credit score is used by lenders to decide whether or not you’re likely to pay them back, your payment history is a huge factor.

Missing payments (even just out of forgetfulness, not lack of financial ability) is probably the worst thing you can do to your credit score, which is why I’m a big fan of setting up auto-pay everywhere that you can.

The next most-important thing? How much you owe accounts for 30%.

Also known as “credit utilization,” the amount you owe to different lenders plays a big role in determining your score. In other words, lenders interpret owing a bunch of money as a sign that you might be overextended, if it’s a high percentage of the credit available to you.

Think about it like this: If you have one card with a $3,000 limit and you’re consistently using $2,500 of it, you’re sending the message that you need nearly all the credit that’s available to you—you’re living close to the edge, at least in the bank’s eyes. If you were to open two more cards, both with $3,000 limits, and you still only continued to use $2,000, lenders would see that you’re now only leveraging $2,000 of your available $9,000, and look more favorably on that.

It feels backwards when you treat it reasonably: “I only need $2,000 a month on my credit card, so why should I keep getting more credit?” I get it—but this is how the system works, and we’re all pawns in its game—and you can’t win if you don’t play!

This is why opening more credit cards is considered a good thing—it makes your total line of credit larger. And if you remember anything from middle school, you’ll know that when you increase the denominator, your percentage gets smaller.

The length (or “age”) of your credit history accounts for 15% of your score.

Think about it like this: If you were going to lend someone $1,000, and you had the option between someone who had a really positive history of paying people back for 15 years or someone whose history of paying people back only extended about 6 months, which one would you feel more confident spotting for $1G?

Yup, the average age of your credit history plays a role. This is why it’s a good idea to get a credit card (or some other form of credit) early in life so you can establish that credit footprint early (so go back in time and take care of that! I know, so helpful).

My first card dated back to 2014. It was a Shell gas card that my dad gave me after I came home from college freshman year complaining about how much I had spent driving home from Alabama… I miss being a dependent on their tax forms more than just about anything. I stopped using it after I graduated and my mom punted me out of the family checking account.

After two years, the credit line was closed due to inactivity, and my credit score took a hit because my oldest account and form of credit (from 2014) was no más. My next-oldest account was my Discover card opened in 2016.

The average age of my credit dropped precipitously, especially thanks to all the new premium cards I’ve acquired (#NoRagretz, though), but over the last few months it’s risen again.

Relevant Pro Tip: If you don’t have credit yet (or you have a low credit score), use this “Shell gas card” approach (assuming you have a willing parental participant). By opening a joint account with someone who has a good credit score, their score will help you get approved, and that’s your “in” to show off your best financial behavior and improve your own score. Of course, if YOU miss payments, it’ll hurt their score, so this arrangement requires a great deal of trust and discipline. That’s why I suggest going in on it with a parent or spouse.

Ready to mix it up? Having different types of credit counts for 10%.

There are two major types of credit accounts: revolving credit and installment accounts.

When you think revolving, think flexibility: your credit cards, a Target Red card, a Shell card… they’re usually associated with stores, gas stations, or your run-of-the-mill credit card.

When you think installment, think loans that require a set minimum payment every month with no flexibility—in other words, you’ve been given a payment schedule to pay a lender back. Auto loans, mortgages, and student loans fall into this category.

It helps to have diverse types of credit because it makes you look ~ well-seasoned ~, but notice that it only accounts for 10% of your total score. You probably don’t want to rush out and buy a car to increase your credit mix.

When my Acura RDX lease fell off my credit report (in other words, it ended), my credit score went down because the installment loan disappeared. Luckily, the addition of my Audi A3 auto loan helped, but it took a couple months for that to be reflected in the score. Patience is a virtue.

Lastly, new credit makes up 10% of your total score.

In other words, having a bunch of “new” credit on your score (especially that which is acquired rapidly) is a bad sign to lenders, because it makes you look like you’re financially squeezed (of course, you may just be a new reader of Money with Katie whose eyes have been opened to the wonders of the Ultimate Rewards portal, but they don’t know that).

When you apply for a new credit card, a “hard inquiry” is placed on your credit report—simply put, the lender “inquires” as to the details of your report when making the decision whether or not to lend you the line of credit, and that “inquiry” stays on your report for two years. The FICO score is supposed to only account for inquires from the last 12 months.

A hard inquiry usually causes your score to go down by a few points. If you’re like, “Why?!” I say, “Same.”

A lot of hard inquiries on your report makes it look like you’ve got a lot of action happening in your financial world, and that’s perceived as a bad thing. This is one of the reasons I tell people to wait 90 days between card applications, so as not to rock the metaphoric boat too much.

Keep in mind, though, that new credit only makes up 10% of your score, so it’s not a factor I’d worry too much about.

Building your credit over time

While there’s no voodoo magic you can work on your score to make it jump 100 points overnight, there are a few little hacks (hackettes, if you will) that might speed up the process for you.

If you only have one credit card, get another one.

The idea here is that you’re expanding your line of credit. Spread your spending across them both. If your score is already good enough for a premium card (usually 720 or above), may I suggest you peruse my favorite part of this site to learn about which card may be best for you?

Request a higher credit limit on your existing cards.

If you’ve had your credit card(s) for awhile, you can request a higher line of credit. Again, the idea here is that you’re growing your available credit to make your total credit utilization go down.

The problem with advice like this, I’ve found, is that people read it, think, “Sounds good!” then immediately realize they don’t know how. While it’s different for every bank, I would recommend calling the number on the back of your card and saying something to the effect of, “I’ve been paying my card off in full every month for X years now, and my income has gone up since I got this card. I would like to request an increase in my credit line.” (Assuming all those things are true!) If the person says no, politely hang up and call back the next day. Someone else will answer, and maybe they’ll be in a more generous mood.

Set up autopay.

This is a no-brainer and I almost feel bad including it as a “hack,” but this is a preventative measure – since a missed payment will really hurt you, this is an easy way to ensure it doesn’t happen.

Whenever I tell people to do this, I often hear some variation of, “But I like to make sure I have enough money in my checking account first,” to which I say, setting up autopay may actually help you keep your spending in line. You’re unlikely to go buckwild on a card and throw caution to the wind if you know it’s getting paid off in full, checking account ready or not.

Pay off your card(s) more frequently.

Remember how we talked about lenders loving that glassy, serene lake? You can think about your repayment history a little like that. If you rack up thousands on a card then pay it off in one fell swoop once a month, it can look tumultuous. If you periodically pop in and pay off your card while it has smaller amounts, it makes things look a little less volatile.

Using Credit Karma

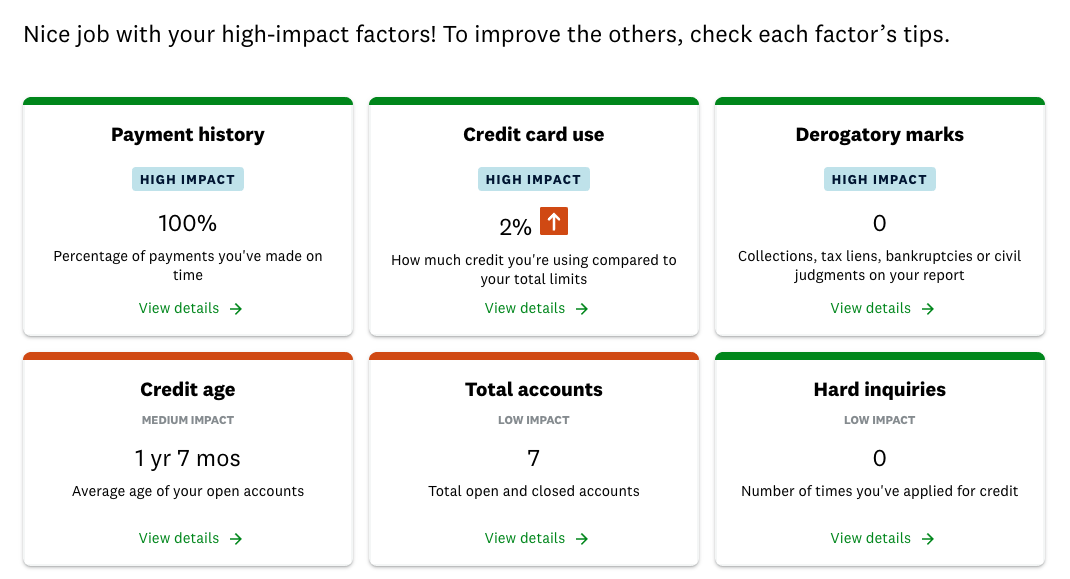

I’m personally a big fan of Credit Karma for keeping tabs on things. Here’s the screengrab from my account’s dashboard that gives me a great overview of why my score is what it is:

I’ve never missed a payment and my credit utilization is super low because I have five credit cards, but my average age of credit is low and I only have 7 total open accounts.

It’s supposed to be all behind-the-scenes science, but I’ve found that your credit score sometimes reacts erratically to things. Credit Karma has been helpful for me to understand exactly what’s happening, so I suggest using it if you’re interested in learning more (it’s free).

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time