The Best Way to Set Up Your 2021 Wealth Planner

Obviously, my intent in creating the Wealth Planner was to provide a tool that was so intuitive and easy to understand that it wouldn’t require someone sitting down with you and explaining it – but I realize that, sometimes, opening an Excel file with six tabs makes an overwhelming situation (setting up your financial life for the first time) even more overwhelming.

Today, we’re going to go through the Planner – sheet by sheet – so I can show you how I’d set it up if I were you.

If you don’t have a Wealth Planner yet, you can buy one here (or you can be frugal and resourceful and try to recreate your own based on the walk-through below – knock yourself out!). If you don’t have Microsoft Excel, the next best alternative for opening the Wealth Planner is Google Sheets – upload the file to Google Drive and then choose Open with > Google Sheets.

While the Planner represented below is the one for #solos, there’s a new Partner Planner version if you have joint expenses with your significant other and want to capture all your money in one spot.

Let’s get started: Net Worth

The first thing you’ll see when you open your Wealth Planner is a tab that says Net Worth. The intent of starting with your net worth is establishing a roadmap of where you are right now – it’s important to understand where your different accounts live and how much is in them, at a high level.

If you don’t need every row on the planner (for example, maybe you only have one investment account right now), you can right-click/“Hide” rows you’re not using (hiding them is preferable to deleting them, because deleting them can mess up the logic). Here’s a screen grab of mine filled out appropriately.

Notice all the green lines on the left where the numbers skip in the rows – that’s where I’ve hidden rows I wasn’t using. The Liabilities section in the Planner is much beefier than it looks here, with rows for credit card debt, student loans, and more – but since my only debt obligation is my car payment, I “hid” the other rows.

While I’ve got $175,000 in total assets, the $14,000 left on my car note knocks me down to a net worth (at the top) of $161,000. If you’ve got a lot of debt, this can be demoralizing – nothing feels like a kick in the nuts quite like seeing you’ve got a negative net worth. But remember, the important part here is that you’re understanding your current lay of the land. Even if you don’t love what you see, this is the best place to start.

Take the time to fill out what types of accounts you have (traditional 401(k), Roth IRA, checking account, etc.) and where those accounts live – e.g., Chase, Betterment, Vanguard. This may reveal other holes in your financial strategy, like the fact that you may not know how to log into some of them. That’s by design! You want to uncover gaps.

On the first of every month, go back into all your accounts (or sign up for Personal Capital, where they’ll be aggregated and you can see them all in one place) and record the new totals. This way, you can see if your net worth is going up or down over time.

Next, we move on to Income

Out of respect for my employer(s) who would almost definitely prefer I don’t share some of these details publicly, I’m going to use the default version of the Planner (unfilled) to demonstrate this part.

The Income sheet has two functions: The left side is for inputting averages. You can use the drop-downs to select what type of income you receive from a particular source (part-time, full-time, commission, etc.). The caption below explains how the left side of the Income tab works.

Choose what type of income you’re receiving, who the earner is (whether it’s you or your partner, in dual income situations), and then type the employer name in the [INPUT] field. Then, you’ll type in your gross monthly income, any pre-tax 401(k) contributions, any Roth 401(k) contributions, and the money that comes out of your monthly income for taxes and benefits. (The Partner Planner has room for eight sources of income and 16 paychecks per month, or double what you see here.)

Now, I’d recommend downloading a paystub (or paystubs, if you have more than one job or you’re inputting numbers for you and your partner) and calculating these numbers exactly. Usually, there are multiple line items for both taxes and benefits; rather than breaking them out separately, add them together and input them as one number.

It’s also crucial to include 401(k) contributions, as those come out of your paycheck before you see it. Finally, your “Net” pay that populates should accurately represent what you see on your paychecks every month.

If you’re a freelancer, make a lot of commission, or have otherwise irregular income

The intent of this left side is just to get averages. If you have irregular income, do your best to calculate the average and input it – this information is used later to populate recommendations, not for actual tracking purposes. Speaking of tracking purposes…

The big-ass table on the right is for tracking. If you fill out your Income Sources correctly on the left, you’ll be able to choose from a dropdown in 8 allotted paycheck spots per month which employer the money is coming from, the income type, how much, and when you received it.

This is a great way to track month over month what you’re actually taking in compared to what you expected to take in (as defined on the left). Because there are 8 spots available, that should be enough for one person who receives biweekly paychecks from four different sources of income, or two people who receive biweekly paychecks from two sources of income each.

The Monthly Totals that you record will be carried forward throughout the Planner to calculate your spend and save rates each month. The exciting part is up next…

Recommendations

One of my favorite features of the Wealth Planner is the fact that it’ll use your actual numbers and make recommendations for you about some big-ticket items around which I think a lot of people need some baseline guidance.

Consider this example above: monthly recommended maximums are calculated for spend in the big, structural expenses and discretionary areas: Housing, cars, and fun money. Then, a minimum amount is suggested for saving and investing. These calculations are created based on your income.

More than anything, this page is intended to be a sanity check. If you get to this sheet and you see that the recommended housing spend for someone with your income is $800 less than what you’re spending today, that might be a sign that you want to reconsider how you go about signing your next lease – or vice versa, if you’re scrimping by frugally and denying yourself every pleasure in the world but you see you can afford to spend $500 guilt-free every month on fun stuff, you may loosen up a little.

This tab also recommends an Emergency Fund goal for you, based on your income. Your actual goal may vary based on your situation, but consider this a good ballpark estimate.

While you’ll see some of these recommendations carried forward in your Spending and Saving tabs, this page is mostly for you to get a sense for what financial responsibility for your specific income looks like.

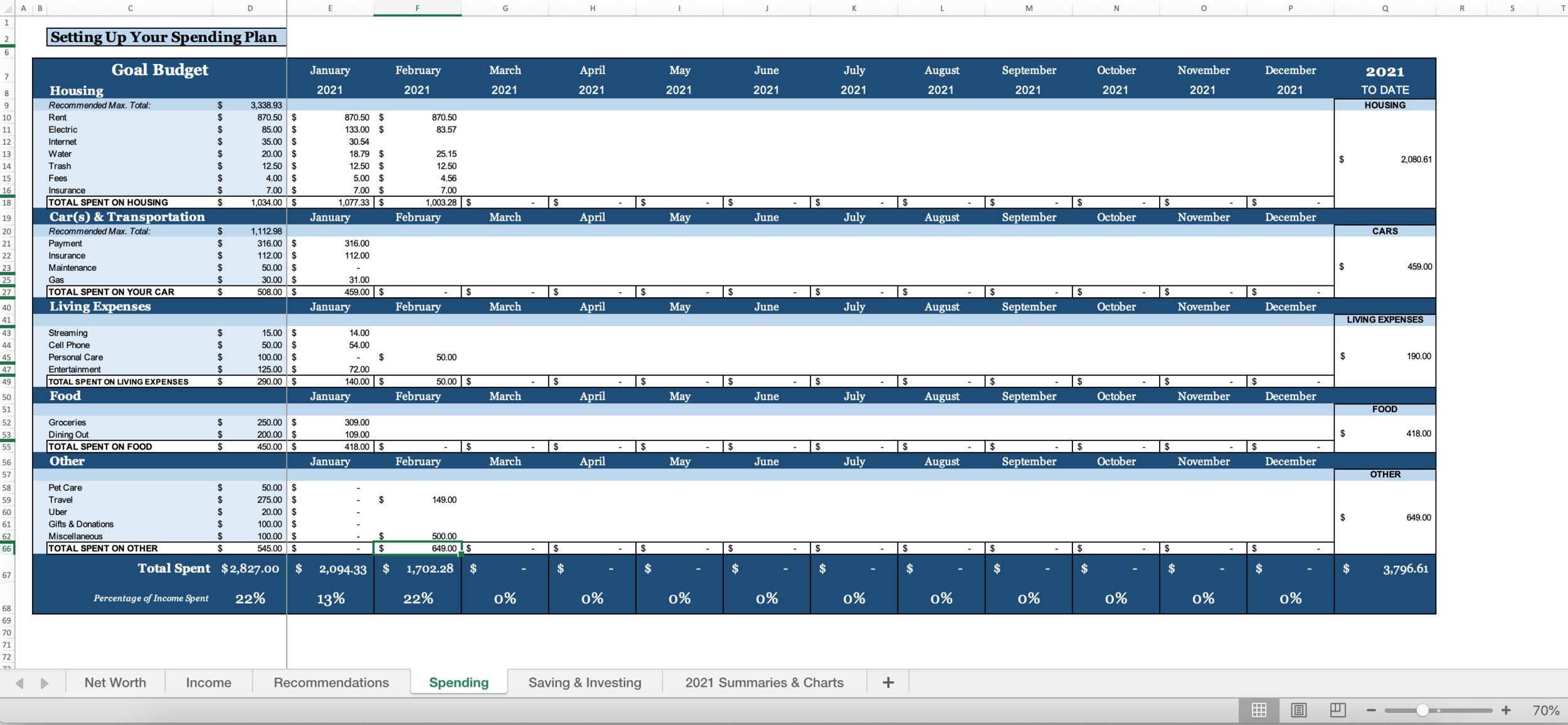

Everyone’s favorite: Spending

Otherwise known as, the part where you have to sack up and actually set up your budget.

One major thing worth noting at this point is that the categories I built in for you are just guesses. If you need to edit any, please feel free to do so – you can write right over them. The only thing I’d caution you about is adding new rows without using the ones you’ve already got – that’ll throw off some of the summaries and charts later in the workbook, so I’d suggest trying to stick with the rows you’ve got if at all possible. Usually, simpler is better anyway.

(Everyone has different preferences about how granular to make their budget; I find there’s a bit of a sweet spot. E.g., you could break out different line items for Spotify, Netflix, Hulu, iCloud, and HBO Max, but I like to lump them together in one category called Streaming. This has a two-fold benefit: One, it’s less tedious to track month over month, since these values don’t change; and two, it helps you see if you’re spending a lot of money on basically the same thing – I may not feel like $10 for Spotify and $15 for Netflix and $10 for Hulu and $3 for iCloud and $10 for HBO is that big of a deal, but if I see that my streaming budget is pushing $50 per month, I might be like, Shit, I need to rein that in; that’s almost the same as the price of cable!)

I had to zoom out a lot so you could see the entire sheet, but you’ll notice the same phenomenon down the left side – hidden rows where I didn’t need the space. Feel free to right-click / “Hide” anything you’re not using, but try to avoid deleting it outright.

One thing I’ve noticed in 1:1s when people bring their Wealth Planners is that they’re not using the actual, light blue budget down the left side. The intent isn’t JUST that you track what you spend in the white portion; the intent is that you’re setting up a spending plan in the light blue column next to the category names. You need something to measure your spending against, and if you don’t set up an actual budget, you won’t know how you’re doing.

Notice how each line item has a pre-defined spending goal in the light blue section, totaling $2,827 budgeted spend. In January, I did great – I was about $800 under budget. We’re six days into February already, and I’m already pushing $2,000. Such is life.

One of the cool things I built into the 2021 edition of the Planner is category totals. You can see on the far right the “annual total” for category spend, which can help contextualize what the f*** you’re doing with your life if you notice you’re spending more on food than rent.

The spend rate is in the last row, letting you know what percentage of your income you’re planning to spend.

At the end of every month (I like to do it on the last day), go in and record what you spent in each category. To track throughout the month automatically, I like to use Mint and set up my Mint categories to match the Wealth Planner categories exactly. That way, I can go in and recategorize transactions as they happen throughout the month so they funnel into the right categories, then record the category totals at the end of the month in the Planner.

This probably sounds like a shit ton of work, but I promise it’s actually pretty smooth once you get into the habit. The majority of people I talk to about it actually derive a great sense of control from being this up-close-and-personal with their money.

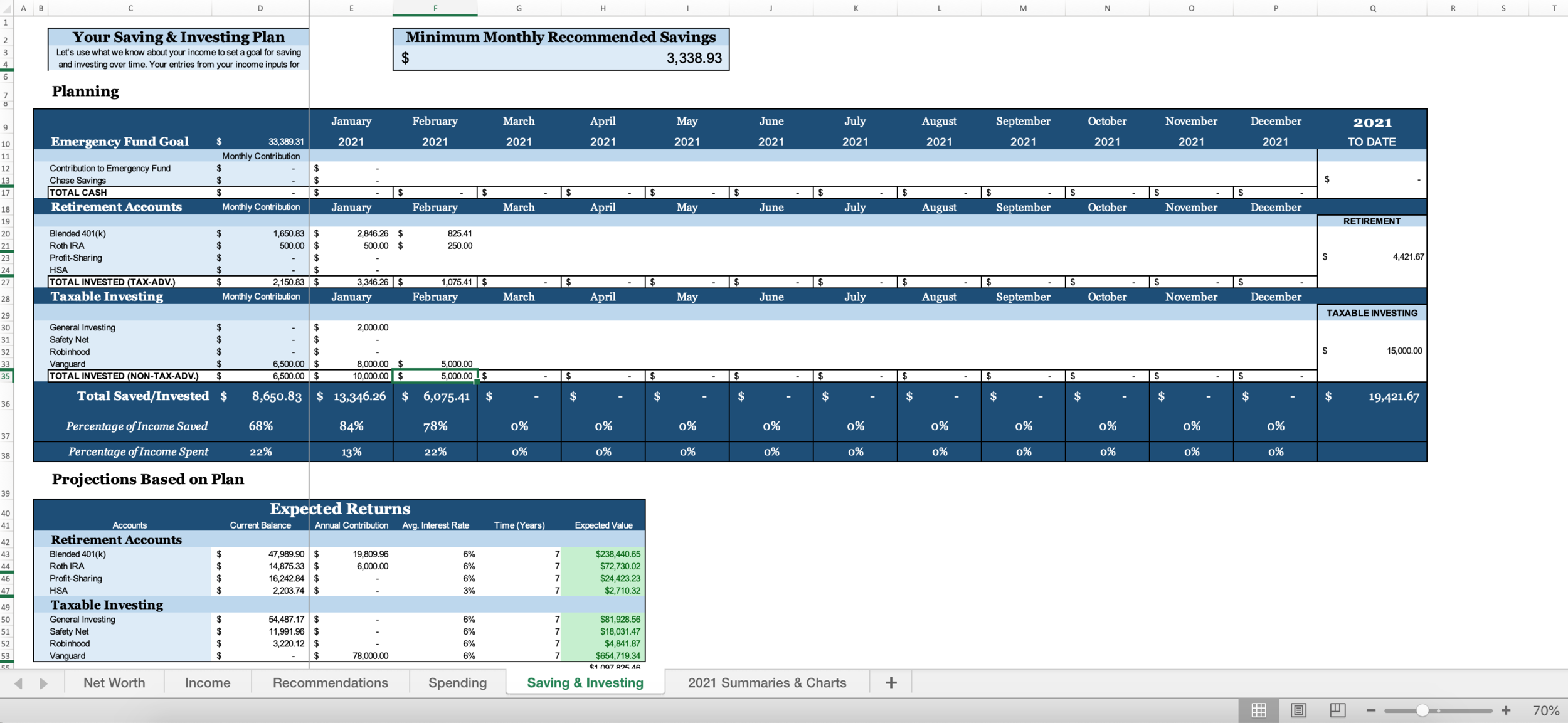

Spending’s sexier counterpart, Saving & Investing

Ah, my favorite: saving and investing. This tab is intended to help you track how much you’re actually contributing, month over month, to your various saving and investing accounts. Note that that’s different than net worth: You’re not tracking the total amount in the savings or investment account, you’re tracking how much you’ve added that month.

If your emergency fund is already met, you won’t be adding any more per month – same with your savings account. You probably won’t be actively contributing month over month to either of those accounts, if your savings goal has already been hit. But your 401(k), Roth IRA, and taxable investing accounts may be seeing some action, so you want to record those here.

We’re almost done! Notice how your minimum monthly recommended savings is carried forward here, for a benchmark. The categories are split into three major buckets: Savings (cash), Retirement Accounts (tax-advantaged), and Taxable Investing (taxable). Some of these category names may carry forward from your Net Worth sheet, but be sure to double-check and make sure they match and feel free to hide any rows you don’t need.

Once again, the light blue portion is intended to be the plan. Now, whether or not things go according to plan will probably vary based on a lot of factors – but it’s important to set out some intentions for your investing behavior. There are tons of articles on this site that help you figure out where to focus first, and if you’ve got less than $25,500 to invest per year, I’d recommend checking out this quick Instagram post on how to determine where to put more energy (your 401(k) or your Roth IRA).

Think about this like your commitment to your Future Self. What are you going to commit to put into these accounts every month?

And every month that you do (or don’t), you have to record your actual contributions. Like accountability porn.

The save rate populates to tell you what percentage of your income you’re planning to save and invest.

The last piece of the pie on the Saving & Investing sheet worth noting is the Expected Returns portion. This takes your January net worth balances, your annual contribution based on your plan above, an average rate of return, and timeline (which you can change) to tell you what your account is expected to be worth in the future. It’s a speculative estimate, obviously, because we have no idea what’s going to happen, but it’ll give you a sense for what you’re on track for.

Quick note on the save and spend rates: They’re calculated based on your actual income that you record. For example, if you input one paycheck for February but haven’t gotten your second yet, then input all your monthly expenses before they happen, it’ll look wonky. The percentages won’t be accurate until the end of the month, because it’s dividing “total spent so far” by “total income so far.” (The same goes for save rate!)

Finally, the sweet, sweet page of 2021 Summaries & Charts

I freaking love this addition to the 2021 Planner. It was inspired by all the calculations I was trying to do for myself at the end of 2020, and I thought, F*** it, let’s just add this as a new thing for 2021!

Each month gets a summary box that populates for you based on what you put in the prior tabs. You won’t have to add anything to this one, it’ll just fill itself out.

I love the 2021 Overall Plan boxes down the right side because they help annualize some of the plans you’re making for yourself. You can see at the outset how much you’re on track to save, and if that’s not satisfactory, you can go back and tweak how much you’re allotting for that Rent the Runway subscription you don’t use anymore.

You can also see your progress to financial independence; i.e., the point at which your investments equal 25x your annual spend. I added a percentage here so you can see yourself creep closer, month by month.

The 2021 End of Year Breakdown will be #HellaSatisfying come December so you can see how much you spent in each major category over the year (and note that these categories/names will update on this page if you update them on your own Spending tab – this is partially why I told you to edit existing ones vs. creating new ones, so they’re captured here).

And under that, you’ll see your progress toward debt payoff, if you have any!

And there you have it. As the year carries on, these summaries will get more and more interesting, and the hope is that your own trends will inform your future decisions.

At the end of 2020, I learned my car cost me $6,000 in 2020 – I hardly felt like I got that much value out of it, and now we’re considering dropping down to a one-car situation.

You can’t improve what you don’t track. It’s never too late to start.

![Choose what type of income you’re receiving, who the earner is (whether it’s you or your partner, in dual income situations), and then type the employer name in the [INPUT] field. Then, you’ll type in your gross monthly income, any pre-tax 401(k) co…](https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1612626803543-Q4Y5Q7U1XLMSLDIO98CF/Screen+Shot+2021-02-06+at+9.53.09+AM.png)