The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

I started thinking the other day about my borderline-concerning insatiable longing to be work-optional. After about three years of investing aggressively, I was roughly 25% of the way there.

On one hand, that’s pretty impressive—25% of the way to early retirement after just three years? Dope. That means (#math) only (3 * 3) 9 more years before the job is finished, right?

Ugh.

I’ve written in the past about how the journey to FI begins as a very motivated, practically amphetamine-riddled obsession.

Cutting luxuries out left and right, layering side hustles… it’s all very exciting.

Then, somewhere around the 25% mark (guilty), you’re like, Damnit, it’s still so far away.

I realized—in one of my wee-hours-of-Sunday-morning reflection sessions—that I didn’t necessarily want to retire, I just wanted the freedom to be an entrepreneur without any financial risk. So I did what any good money blogger would do—calculated a new “baby FI” figure, and posted about it. (If you, too, are interested in becoming a work-optional, self-employed person with Stickittothemaneosis, I highly recommend reading it.)

But where does the math of FI help us out along the way?

As we’re all hopefully well aware by now, compounding returns are the wind beneath our work-optional wings.

At the risk of oversimplifying, that means that:

The more you invest, the faster it goes.

I always like to relate it to a snowball rolling down a hill. At the top when you’re just starting to add snow, your tiny fledgling snowball won’t pick up much speed. But before you know it, it’ll have enough snow packed on that the weight of its own snowball body will be driving most of the accumulation and speed, regardless of how much snow you’re managing to pack on as you go.

I haven’t quite worked out the physics of how you’d add snow as it rolls, but the metaphor stands.

Time for an example

Obviously, I’m claiming that half FI is actually more like 75% FI, when you look at it through the lens of time to FI.

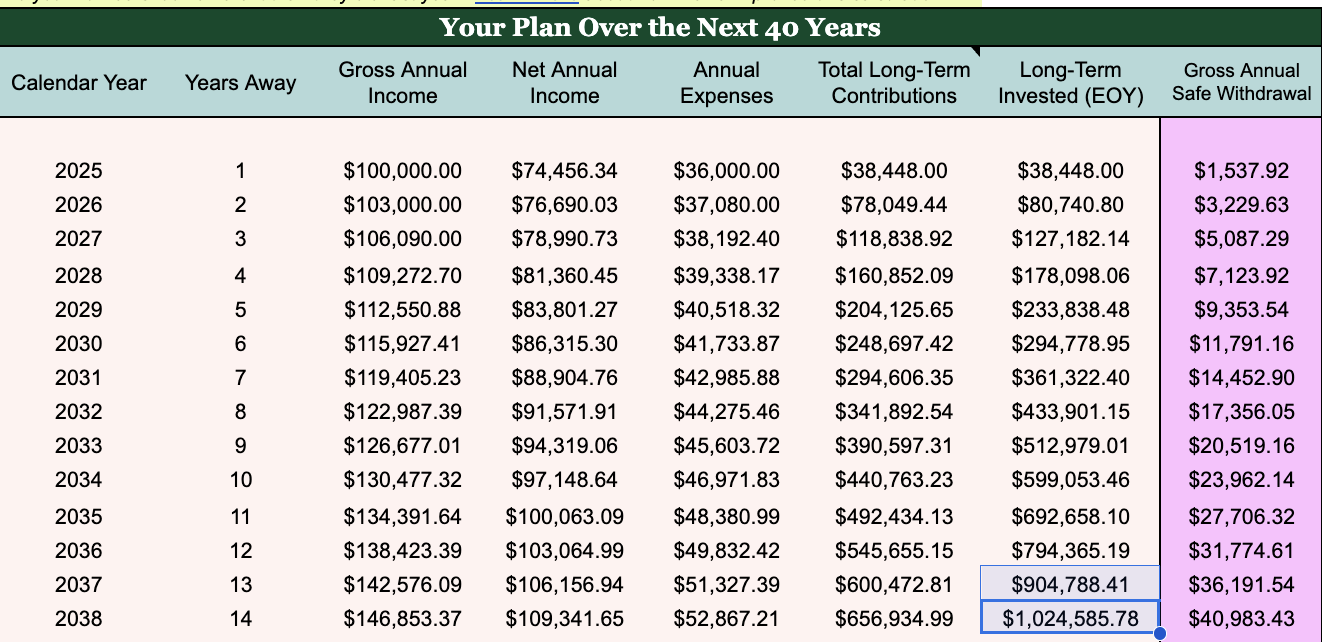

To help me prove this, I’m going to enlist the help of my trusty Financial Independence tab that’s built into the Wealth Planner.

For the sake of the example, our parameters involve a #RichGirl who…

-

Makes $100,000 per year

-

Has $0 invested today (i.e., starting fresh, baby)

-

Gets a 3% raise every year to keep up with inflation

-

Spends $3,000 per month

-

Is expecting a 7% average return (why 7%?)

Knowing that she spends $3,000 per month, or $36,000 per year, we can calculate that her “FI” number (25x your annual expenses invested) is roughly $900,000. We’ll round up to an even $1M to give her a buffer, in case Cardi B ever decides to headline Coachella last-minute.

Here’s the resulting timeline:

Remember, she’s starting in Year 1 with $0. So after the first year, she saves $38,500. By year two, she’s got a little over $80,000. By year three, $127,000. We can see she’s making steady progress (the result of living well below her means), but it still feels like a slow-ish road. By year 2037, she becomes technically work-optional. She literally went 0-100 in about 13 years. Where did she technically hit “half FI”? That said, we can define half FI as—ready for this?—the FI number halved. In her case, $500,000. She didn’t hit $500,000 until sometime between year 8 and year 9! Yet by Year 13-14, she was FI. If she weren’t watching her progress, she’d probably clock in during year 8/9 “halfway there” and be like, Ugh, shit, I’m only halfway there? 8 more years to go? No, ma’am—because those returns are compounding . The snowball has taken on a life of its own. Just shy of four years later, she’s FI. Reaching half your FI number means you’re about 75% of the way through your FI investing timeline. Thanks to your compounding returns, around the halfway mark, they start to do most of the heavy-lifting for you—that’s encouraging news, no? You don’t have to reach the mountain peak on your own. Just strive for halfway, and watch the rest of your timeline melt away. (Maybe melting is an inappropriate and troubling metaphor for an example wherein our financial wellbeing hinges on the success of a snowball. We’ll workshop it.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time