How do I fill out the Income Tax Liability section?

January 1, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

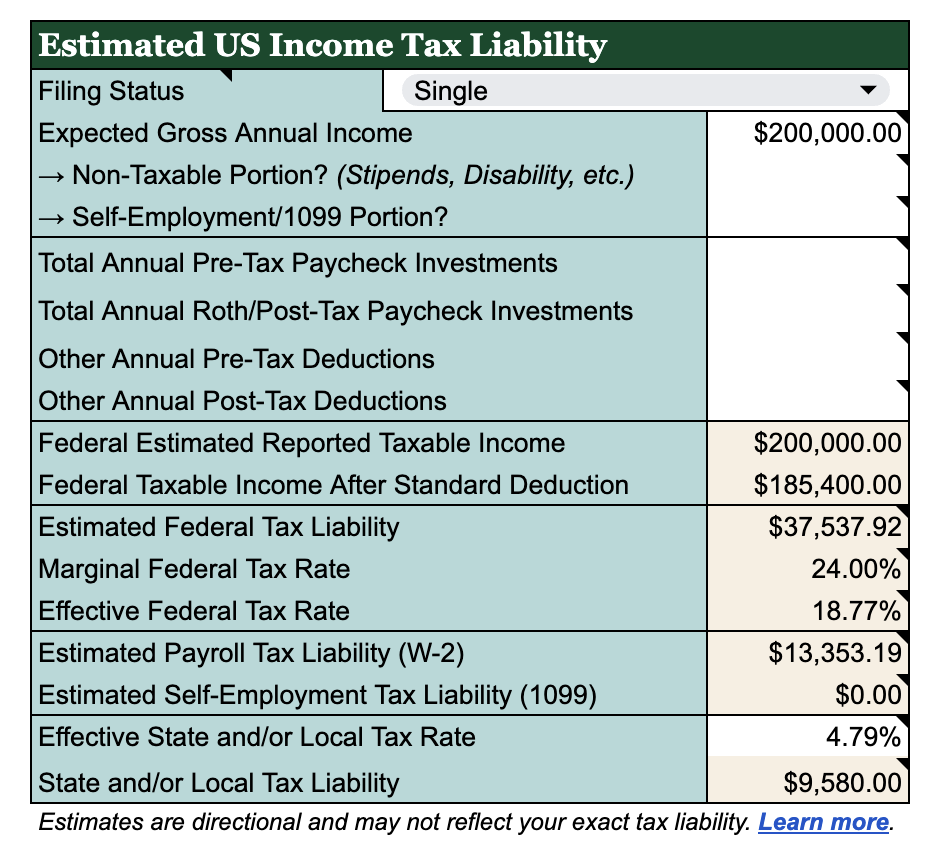

This section is designed for US users to understand a high-level estimate of their tax liability based on…

-

Their chosen filing status. Single, married filing jointly, married filing separately, and head of household options are available.

-

Their non-taxable or self-employment income. While non-taxable income, like stipends or disability, won’t be taxed at all, some types of income (like 1099) will be taxed slightly more, for the self-employment tax.

-

Their deductions. If you make pre-tax contributions to employer-sponsored plans at work or use post-tax dollars to pay for other benefits, you can include those here.

This table will feed the tables to the right, your Estimated Monthly Breakdown and your Example Monthly Goal Breakdown.

Users outside of the US:

-

Enter your Expected Gross Annual Income in cell I4.

-

Zero out the formulas in the tan cells (I11 through I19).

-

Manually enter your total tax liability (the total amount of your income you pay in taxes in your country) in cell I13.

This will manually override the US tax calculations and produce Monthly Breakdowns that are accurate to your situation.

If you don’t know your gross income and tax liability but you do know your take-home pay, feel free to just input your annual net income and zero out formulas in the tan cells!

“I have an S Corp! How do I enter the self-employment/1099 portion of my income?”

For S Corp designations and other complex forms of business accounting, we recommend working with an accountant, as this table will overestimate your Estimated Payroll Tax Liability (W-2) if you enter all of your business’s revenue as your Expected Gross Annual Income.

If you would like to understand what your personal income tax liability will be: Enter only the salary you pay yourself as both the “Expected Gross Annual Income” and the“Self-Employment/1099 Portion?”

“I’m already retired and living off investment income. How should I use this tax table?”

Since this table is designed to estimate tax liability for people who are still working and earning primarily ordinary income, this table will not accurately estimate tax liability for income that comes primarily from investment accounts and Social Security. For example, any tax due on long-term capital gains would most likely be overestimated by this table.

If all of your investment income is coming from pre-tax accounts, the estimate will be much closer, but you can ignore (or delete) the Payroll Tax Liability in cell I16.

That said, if you’d still like to input all of your income so that you can use the Monthly Breakdown features on the right:

-

Enter your Expected Gross Annual Income in cell I4.

-

Zero out the formulas in the tan cells (I11 through I19).

-

Manually enter an estimate for your total tax liability (the total amount of your income you pay in taxes) in cell I13.

This will manually override the W-2/1099 income tax calculations and produce Monthly Breakdowns that are accurate to your situation.

For more information about how retired users can get the most out of their Wealth Planner, check out this special guide.

How to enter each section of your Estimated US Income Tax Liability

Filing Status

Choose Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

If you file your taxes jointly but manage your money separately and only intend to input your income, spending, and saving in this Planner, we recommend choosing “Single” for a more accurate representation of your personal tax burden (though of course it won’t be totally accurate).

Expected Gross Annual Income

Put in your best estimate for your household’s annual income except for dividend income from investments. People with salaried positions will find this easiest; people who work jobs that are heavily commission-based or have many sources of income may find this more challenging. Give it your best conservative estimate!

→ If you receive income that’s non-taxable, like disability income, please enter the portion of your overall income that’s non-taxable. For example, if you make $100,000 and $50,000 of it is non-taxable, you’d enter “$100,000” for Expected Gross Annual Income and “$50,000” for Non-Taxable Portion.

→ If any of your gross income is self-employment or 1099 (and therefore subject to self-employment taxes), please enter the portion of your overall income that’s 1099. For example, if you make $75,000 and $20,000 of it is 1099, you’d enter “$75,000” for Expected Gross Annual Income and “$20,000” for Self-Employment/1099 Portion. If all of your income is self-employment income, you’d enter the same number twice.

Pre-Tax and Post-Tax Contributions and Deductions

-

Total Annual Pre-Tax Paycheck Investments. If you make any pre-tax contributions to investment accounts via paycheck deductions (e.g., 401(k), 403(b), HSA, FSA, etc.), put those here. Do not include employer matches yet.

-

Total Annual Roth/Post-Tax Paycheck Investments. If you make any Roth or post-tax contributions to investment accounts via paycheck deductions (e.g., 401(k), 403(b), ESPP, etc.), put those here. Do not include employer matches yet.

-

Other Annual Pre-Tax Deductions. Think expenses that you pay for with pre-tax paycheck deductions, like health insurance, vision, dental, etc. The purpose of entering these is to make our tax estimate more accurate, as well as to make sure our take-home pay number is close.

-

Other Annual Post-Tax Deductions. Think expenses that you pay for with post-tax paycheck deductions, like union dues, employer disability insurance, employer life insurance, etc. The purpose of entering these is to make sure our take-home pay number is close.

Effective State and/or Local Tax Rate

Because we have users in all 50 states, we don’t auto-populate state and local taxes—if you don’t know your state and local tax rates, we recommend using this resource to determine them, and then inputting the total percentage. For example, if your state tax rate is 5% and your local tax rate is 2.5%, you’d enter 7.5%.

Other Useful Reminders

-

Be careful not to cut & pasting cells. This can create #REF errors. (Copy & paste is fine.)

-

Only change data in the white cells. Colored cells have formulas in them to make the Planner work!

-

Avoid adding or deleting rows & columns. (Hiding rows and columns is fine.)

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time