My Rule for Avoiding Lifestyle Creep: Don’t Live Beyond Your Assets

July 24, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

A piece of personal finance advice that always seemed too obvious to be helpful is to “live beneath your means.”

“Means” feels like a word from a Little House on the Prairie reboot, and besides, “if you have $5, don’t spend $10” isn’t exactly an earth-shattering insight. I’ve always found it to be a frustratingly inadequate benchmark for financially sound decision-making.

Whether the original intent behind the word “means” was “liquid net worth” or not, my interpretation (and how I often heard the phrase doled out) was that you shouldn’t spend more than you earn.

And if you’ve been working for a long time at steadily increasing your income, not spending more than you earn might actually be a relatively low bar to clear.

If you make $150,000 as a single person with no children anywhere aside from NYC or the Bay Area, I’d argue it should be relatively painless for you to get by with expenses lower than $150,000 per year.

But does that mean you’re tracking toward your goals? Not necessarily!

Someone who spends 95% of their take-home pay will have a much longer road to financial independence than someone who spends 65% of their take-home pay, even though both people are technically following the black-and-white advice to live beneath their means. Their long-term outcomes couldn’t be more different.

>

“A more helpful version of this rule emerged for me: Don’t live beyond your assets.”

It wasn’t until I found myself in a peculiar economic position that a more helpful version of this rule emerged for me: Don’t live beyond your assets.

Once I found myself graduating from a median income to a higher one, I straddled the line between two worlds: Do I maintain my exact same lifestyle and invest everything extra, or do I recognize that I can afford a little lifestyle creep?

The hard part? There’s no rule of thumb for how to handle such a situation. I felt silly skimping on brand name orange juice, but I was also terrified of backsliding into the old, spend-y habits that used to drain my checking account every month.

Just because I was making more money didn’t mean I was wealthy, and I struggled to find balance.

When I made $50,000/year, these decisions were paradoxically easier: I didn’t have a ton of extra cash every month. I spent what I spent, saved what I saved, and the whole ordeal involved less than $3,100 per month of total inflows and outflows.

But what if you suddenly find yourself making 3x that? 5x? 10x? (Hey, dream big!)

Some suggest keeping your savings rate the same as you earn more (increasing the amount you’re saving proportionally with your income), but that introduces a new quandary: Your target is technically getting further away, and your financial independence date doesn’t actually get any closer despite your income rising.

If only there were a reliable metric we could add to the equation to help guide our decision…

Fortunately, there is: Your net worth.

Your income might look as though it justifies your spending—but would your net worth?

The big question mark for me was this: Sure, I have more disposable income now that could feasibly fund a more lavish lifestyle. But if you looked in my investment accounts—my larger financial picture—would my spending behavior still seem reasonable and justified?

An example

Let’s pretend I’m a beautiful 23-year-old TikTok star who suddenly found myself earning $400,000 per year thanks to lucrative brand deals and a sparkly personality. I’m making great money, no?! I’ve had my eye on the Mercedes-Benz G-Wagon for a while, a $140,000 car. Could I make the case for affording that vehicle, given my income? Well, I suppose so—it’s roughly ⅓ of what I earn in a year, right? That’s not too outrageous.

But wait—my liquid net worth is only $50,000. Now does it make sense for me to buy a car that’s worth nearly 3x my entire life savings? Almost certainly not.

By marrying these two metrics—our liquid net worth and our income—we can strike a better balance around the type of lifestyle that’s reasonable to live, as opposed to just looking at one number or the other. While income is the number most people use to determine what they can spend, it only tells half the story.

Here’s where I landed (and I’ll share how I formulated this below): Your reasonable annual spend is the average of 4% of your current invested assets—inspired by the 4% Rule—and your income.

For example, someone who has a net worth of $250,000 and an income of $250,000 (let’s pretend that’s after tax, for simplicity’s sake) would net the following annual spending that’s beneath both their income means and net worth means:

>

“By marrying these two metrics—our liquid net worth and our income—we can strike a better balance.”

4% of your net worth: $250,000 * 4% = $10,000

Post-tax income: $250,000

$10,000 + $250,000 = $260,000

$260,000 / 2 = $130,000

In this example, someone who makes $250,000 per year and is worth $250,000 would find a reasonable “below their means” annual spend of $130,000 maximum. This allows them to enjoy their higher income without meaningfully disrupting their progress toward financial independence.

(Note: I’m using “post-tax” a little colloquially here; if you’re also tossing a giant chunk of money every month into something like a 401(k), HSA, 403(b), or other account sponsored by your noble corporate benefactor, don’t forget to include that in your income, too—it’s still your income, you’re just opting to save it before you see it like the wise Rich Girl you are.)

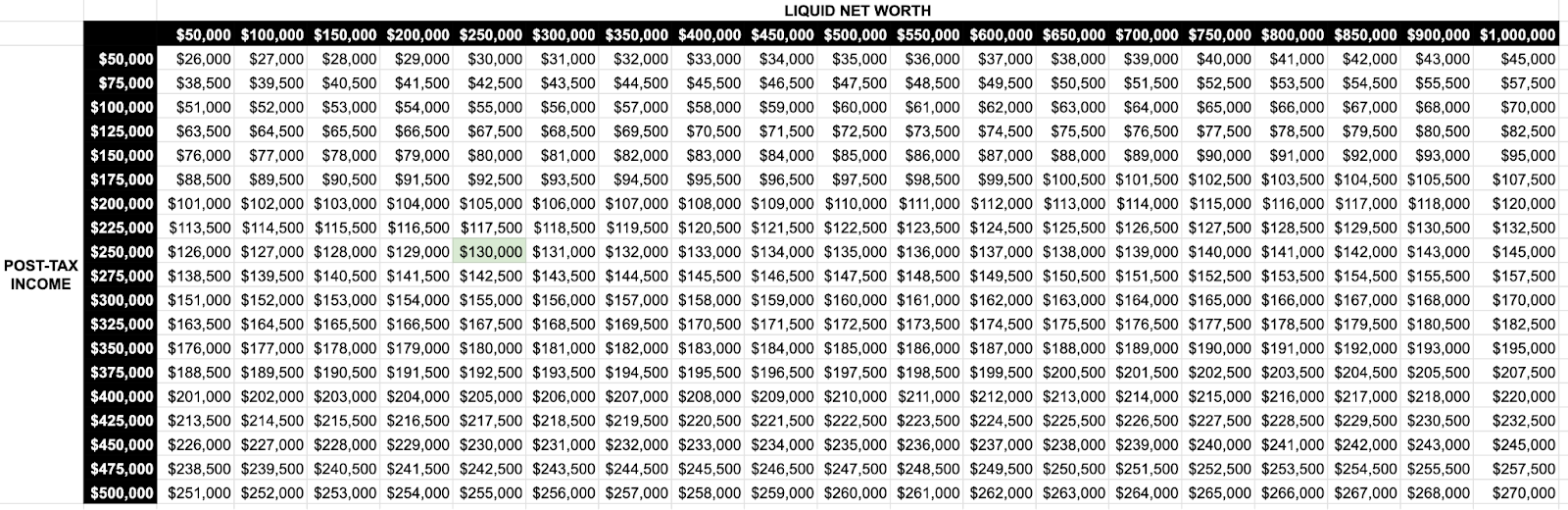

Here’s a table that takes incomes between $50,000 and $500,000 and net worths between $50,000 and $1,000,000 into account (our example is shaded in green).

How I came up with this part-art, part-science formula

The “4% of net worth” figure serves as a bit of an anchor: It reminds you of the type of spending that your current invested assets can support (thanks to the 4% rule), which can lend some perspective to how much progress you’ve already made and how far you have to go.

As you’ll see in the table, even someone who’s worth $1 million and earns $250,000 should spend no more than $145,000 per year—because while it sounds like a lot of money (in both cases, because it is!), the proportionality of financial progress means they’d need roughly $3.7 million invested to support their spending if they were to lose their income (rendering a net worth of $1 million still quite far from their goal).

>

“This formula keeps a tight leash on lifestyle inflation by grounding it in the reality of one’s net worth.”

This formula keeps a tight leash on lifestyle inflation by grounding it in the reality of one’s net worth—never allowing the runaway freight train of luxury cars and Uber Eats (guilty) to derail one’s progress completely.

On the flip side of the equation, if someone found themselves on the opposite side of the income spectrum but with similar moolah in the bank—$50,000 income and $1 million net worth—you’ll notice that the recommendation is to spend nearly everything they’re earning, because they’re so close to financial independence so as to not need to be saving much more.

Widening the aperture in this way allows you to give weight to what’s arguably the more meaningful, permanent variable in your financial life—your net worth—as opposed to basing 100% of your spending decisions on your current, subject-to-change income. This guideline should also help high earners on their way to financial independence understand just how much they can indulge with their incomes—without going overboard.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time