Are Houses More Expensive Today, or…Way Bigger?

September 26, 2022

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

One of my favorite pastimes is arguing with people on the internet about the unaffordability of housing and how the home ownership calculus has changed over the last 15–20 years—that sure, buying a home in the 1980s was a great proposition. Today? Not as much. (This week’s podcast episode is a deep dive into the rent vs. buy decision in 2022’s ~interest rate environment~; don’t miss it!)

I used to enjoy going to bat for Team Rent with the fury of a thousand exploding suns, wielding not-so-fun realities, like the fact that if the median home price had increased at the same pace as median income since the 1970s, the median home value today would be $133,786—a far cry from its current $433,100.

Recently, I started to consider another aspect of how housing has changed: It’s a hell of a lot bougier than it used to be. (Yes, “bougier.” Just go with it.)

Traditionally, a “starter home” is a house that’s (a) under 1,800 square feet and (b) has three or fewer bedrooms.

Perhaps it will surprise those of you who remember growing up in the suburbia-style mega mansions boasting 3,000–5,000 square feet that the average home size (no, not starter home, but overall home) in the 1950s was only 983 square feet.

The average home in the 1950s was half the size of the modern “starter home.”

In 2020, the average home was 2,484 square feet—158% larger than its “equivalent” from 70 years ago.

So what got bigger, the house or the price tag?

So maybe—just maybe!—the price of homes isn’t inherently rising so much as it’s scaling up proportionally to our Super Size Me houses.

To fact-check my thesis, I wanted to explore not the overall cost of a home, but the price per square foot:

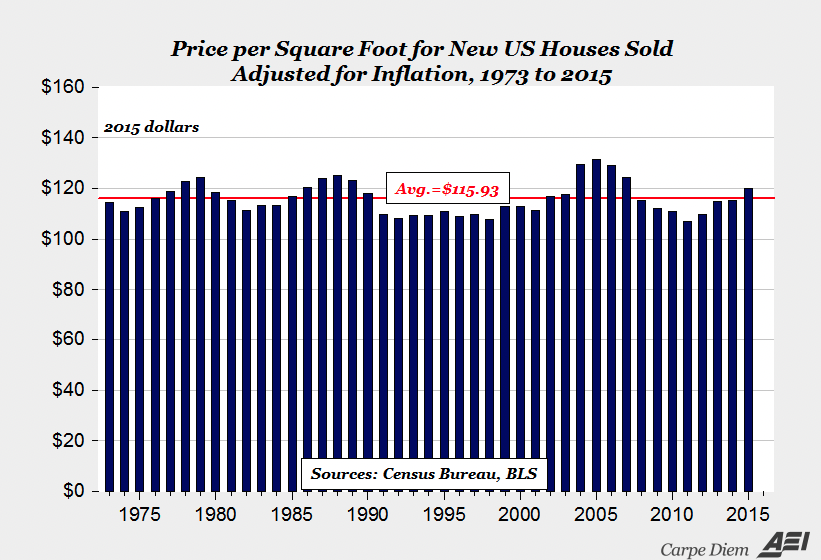

From AEI, the center-right public policy think tank: “The inflation-adjusted price per square foot for new houses (in 2015 dollars) has been relatively stable since 1973 in a range between about $107 and $128 per square foot at an average of about $116.”

That’s a lot of numbers, so to help summarize: This picture is worth a thousand words…

Granted, this data stops in 2015—and anyone who’s been paying attention for the 2021 and 2022 open Zillow hunting seasons knows that ~things have escalated~. The price per square foot has gone up a little bit, when adjusted for inflation, but it hasn’t quadrupled in price the way the median home value would suggest.

But if smaller houses aren’t as readily available, does it really…matter?

Perhaps it’s an irrelevant distinction; if there are fewer starter homes available (and the data would suggest that’s true, if the median home size is now three times as large as the Cleavers’), first-time homebuyers don’t really have as much of a choice to simply purchase fewer square feet.

It’s not all high-maintenance consumer demand-based, either—building larger properties is more profitable for developers. Surprise, surprise.

37% of homebuyers in 2021 were millennials, and the median age of a first-time home owner is 33—up from 29 in 1981. Those damned millennials are too busy traversing Thailand and paying off their student loans to plunk down the cash for a mortgage!

But this data might contribute to the situation: Millennials are waiting longer to buy their first home, and likely have more income with which to do so because they’re further along in their careers. It’s not unlikely that millennials are skipping the starter house altogether and waiting longer to afford the home they actually want.

Of course, we’re in the Instagram era of folks posing in their front yard with the sold sign and the caption, “We did a thing!”, which means it’s also possible that we feel like we should buy more “house” than we need.

Standing in the hallway in front of a condo door doesn’t lavish quite the same je ne sais quoi on the feed as a palatial, golf course-adjacent monstrosity—but maybe the 1,200-square-foot condo is both in-budget and big enough.

Houses are bigger, but families are smaller

Why? Well, families in the age of smaller homes had—on average—more children. In 2012, The Wall Street Journal published a fascinating piece about the vast swaths of modern American homes that go largely unused by the (smaller) families that inhabit them. (Highlighting the hilarity of statistics, the average household in 1960 had 3.33 people in it, compared to 2.51 in 2021.)

Another image that’ll speak louder than my rambling shows the movement of “Family 11” every 10 minutes over two weekdays and evenings:

The Journal found that “Family 11” spent 68% of its time in just two primary areas: the kitchen and the family room. Sound familiar?

The transition to work-from-home likely shifts this calculus a little bit; our homes now double as our workspaces and—as any millennial living in a studio apartment will be glad to tell you—perching yourself on the same bed you sleep in for eight hours a day, laptop-clad, is not exactly the picture of work-life balance.

(I remember desperately dragging my desk out of my bedroom and into the living room of my two-bedroom apartment after weeks of rarely leaving the same 100 square feet of living space, save for the obligatory afternoon mental health walk.)

Now that I work from home with my husband, my time spent in our house (apart from sleeping) is mostly spent sitting at my kitchen counter, sitting on my couch, or sitting upstairs in my office (damn, I do a lot of sitting). The entire two middle rooms of our home (the den and the dining room) could disappear altogether and it would probably take me a few days to even notice they were gone.

Starter…condos?

So what’s a millennial to do? Should you consider moving into a condo instead of a single-family home if condos are our more readily available, affordable, smaller option?

It’s tough—condos face a bit of a chicken-or-egg financial appreciation issue and are usually saddled with absurdly high HOA fees that can actually end up making your monthly payments as high or higher than a comparable single family home of the same size (if you can find one, that is).

And the appreciation issue? The reason condos are a bit of a raw deal compared to the single family home is because the building itself (whether home or condo) is not appreciating. The land your home sits on is appreciating, and when you own a single family home, the most valuable component you own is the land. When you own a condo, you own a collection of rooms in a building.

(This is why the IRS lets real estate investors write off property depreciation—because technically, all structures depreciate over time and require an outflow of cash to maintain.)

I’m not really looking to buy property just for the sake of buying property, condo or not—and it seems as though many other millennials have no choice but to feel the same way, given the rise in average first-time homeowner age we referenced earlier.

After all, the suburbs might be making us miserable

From Business Insider: “The trouble with the suburbs is that big houses with big yards, set behind wide streets and long driveways, make socializing much harder. And since everyone is driving from A to B, unlike in large cities where residents walk or take public transportation everywhere, people who live in the suburbs have to make a much more active effort to socialize.”

In our rush to get into that megamansion out by the airport and outside the city, we tend to skip the part where we’d ask ourselves: Are we actually ready for that lifestyle? Do we want that lifestyle, or does it just feel like the next obligatory step in the march toward middle age and weekend youth soccer tournaments?

For some of us, the answer is yes. The Home Depot Goers and Neighborhood Walk Fiends are ready for it.

For others, we underestimate the amount of social cohesion and togetherness we derive from walking down the street to our coffee shops, bumping into casual neighbor-friends in the hall, and feeling collectively ~in the mix~ that’s often easier in a city or more urban area.

Some even joke that Americans romanticize college because it was the last time we lived in communally organized, walkable areas together.

I find that we unquestionably assume the move to the suburbs is a logical life upgrade worth shelling out hundreds of thousands of dollars for.

When we moved from our Dallas apartment to a Colorado suburb, I was surprised at how isolated I felt. I figured I’d be glad to be rid of my upstairs neighbor whose inexplicable 3am home improvement projects woke me up on a weekly basis, or the girl next door who often threw loud parties on weeknights.

We’re only a mile-long bike ride from the town’s city center, a privilege we pay $3,000/month for—but after visiting the cookie cutter, treeless expanses of new developments surrounded by…well, nothing, I knew I’d absolutely lose my mind working, eating, sleeping, and living at home surrounded by 1,000 other homes that looked exactly like mine with nothing much else around.

I’m glad to have the space, but I miss living in a city.

My point? Having “the suburban house” is a fit for some, but not for everyone, and Jerome Powell is practically forcing us to wait a little bit longer to make the change. After all, if the homes you want are totally unaffordable until your mid-thirties, you don’t really have much of a choice.

We could mourn the loss of the starter home, or we could embrace walking half a block to our neighborhood coffee shop/bodega/bar and meeting our neighbors on the roof for sunset cocktails.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time