A Tale of Two Budgets: An Honest Look at My Lifestyle Creep

September 19, 2022

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

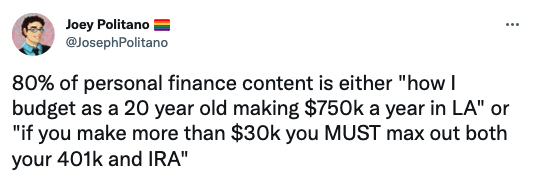

Why I think this post was overdue

This blog post felt important for a few reasons. We so often hear from staunch FI/RE advocates about their spartan monthly budgets, Costco trips, and 10-day meal prep schedules, which allow them to spend less than $20,000 per year—but we rarely hear from a staunch FI/RE advocate-turned-aspiring-high-roller (hello, it’s me).

I haven’t done a full budget breakdown in awhile but my 2022 budget (better known as a Frankenstein amalgamation of lifestyle creep and marital bliss) has more or less skated by, unexamined by the masses aside from a monthly spending review or two rife with explanations and excuses (“It wasn’t that bad if you exclude wedding costs!”).

I’m acutely aware of my old, fiery takes floating around out there, most famously in bossy pieces like “You Need to Sell Your Car” and “Being a Hot Girl is Expensive,” wherein I saddle up my high horse to run average car payments and manicure costs through compound interest calculators and point to each with a big, fat, “SEE WHAT THIS COULD HAVE TURNED INTO?!”

And while I mostly stand by a lot of it and know it was coming from a good place (“This is not my opinion. This is math. You can have your Cayenne and eat compound interest, too. Just give it a minute.”), it’s important to remember that—when I wrote those articles—I made less than $60,000 per year before taxes and desperately wanted to escape Corporate America, and assumed most of my readers did, too. No expense was safe from my Excel spreadsheet and “delete” key, and I was weed-whacking through excess like a landscaper on speed.

It wasn’t until I started earning a relatively high income (but still agonized over $100 purchases) that I realized it’s possible to indulge sometimes without being a morally corrupt cupcake of a millennial. I remember scoffing at friends who would pay $12 for avocado toast and silently judging their financial indiscretion, calculating how many minutes of retirement they had just sacrificed. Now, I join them (and occasionally foot the bill). It’s called growth, people!

It’s not lost on me that I’ve basically been using this line as a jump rope…

I know I’m in a very privileged position, especially for a 27-year-old. Things have worked out well for me, and I’m under no delusions that it’s entirely because of any effort or unique brilliance on my part. I’ve gotten very lucky on my income journey (more on that here).

Income

When I started Money with Katie, my salary was $60,000/year (putting me in the middle 40% of earners) and I made an additional $400–$500/mo. from teaching group fitness classes. My take-home pay (after 10% 401(k) contributions and taxes) was around $3,900/mo.

The pandemic was already underway by this point, and over the next several months, I began layering in freelance and contract work. This pushed my monthly income to roughly $10,000 after taxes. (In February 2021, according to my Wealth Planner, I earned $8,759 from my full-time job and contract work, and another $2,672 from the fledgling Money with Katie.)

Today, our reliable (joint) net income after taxes and 401(k) contributions is around $25,000/mo.—quite a far cry from $3,900/mo.

I share this to be transparent about the fact that it’s not difficult to budget once you’re earning more. As Gaby Dunn noted in this episode, the best budgeters are usually low-income people who have to maintain a powerful command of every dollar coming in. As a middle-income earner, my budgeting prowess was far more impressive at $3,900 per month, because at that rate, each $100 expenditure really made a dent. Discipline was important. Now as a high-income earner, I’m not a beacon of self-control and Excel savvy anymore, because generally speaking, anyone earning $25,000/mo. will have no problem staying under budget.

While I love my fellow personal finance content creators who all have multiple streams of income and 80% save rates, an 80% save rate shouldn’t impress anyone if the “income” side of the equation is a multiple 5-figure number. It’s far more impressive for someone earning, say, $5,000/month to save 25% of their income.

As Nick Maggiulli points out, savings rates rising with incomes is one of the strongest correlations in personal finance literature.

(This is also why it cracks me up when anonymous accounts make snarky comments on my content along the lines of, “Ha, so your money advice is just to work more?” Well…yes. That is typically how one earns more, but I digress. Welcome to Late Stage Capitalism—I’ll be your host!)

Big expenditures: Then and now

I should disclaim off the bat that, in some ways, we’ll be comparing apples and oranges today—my “old” budget (from February 2021) is representative of my spending as a legally single woman with no husband or joint checking account to speak of.

In an attempt to equalize the playing field a little, I decided to chop our “joint” budget in half, pulled from February 2022 numbers for a neat, 12-month cycle. That’s being awfully generous, though, considering more than half of our monthly spending is directly attributable to me. Moreover, we’ve experienced a sweeping increase in the price of just about everything in the last year, and I think inflation itself is reflected in some of these figures (see? It’s not all my fault!).

So, the numbers may not be perfectly aligned but this is my corner of the internet, so I make the rules, #RichGirls!

February 2021: Housing for Just Me

-

Rent: $870.50

-

Gas: $74.00

-

Internet: $31.00

-

Water: $25.15

-

Trash: $12.50

-

Insurance: $7.00

Total: $1,020.15

My total housing expenses were just barely over $1,000. I shared a two-bedroom apartment with a roommate, so I suppose our true housing costs were $2,040.30—but fortunately for me, I was only on the hook for my half. Living with a roommate undoubtedly enabled me to save a lot of money in the first few years of my career.

Let’s fast-forward to 2022, shall we?

February 2022: Housing for Two People

-

Rent: $3,000.00

-

Electric: $87.28

-

Gas: $122.00

-

Cleaning: $240.00

-

Internet: $50.00

-

Water: $87.28

-

Trash: $52.00

-

Security: $25.00

Total: $3,663.56

If you divide it in half to equalize the playing field to 2021, it’s $1,831.78 per person—an 80% increase in costs. The elephant in the overpriced room is likely the rent; we moved into a 3BR home. I wrote about the decision to hemorrhage money on rent here, and for the record, I don’t regret it.

We also added certain luxuries, like a cleaning service (also #NoRagretz), but I’ll emphasize one thing about the move from an apartment to a home: Prepare for everything to cost more, even if you’re not the owner. Between lawn care (hello, water bills), HVAC, and security systems, you’re likely going to spend a lot more each month than an apartment dweller, assuming you’re footing the bill for these things.

February 2021: Car for Just Me

-

Car Payment: $316.00

-

Car Insurance: $112.00

-

Gas: $15.00

Total: $443.00

Ah, one of the rare areas where I’ve now cut back (I took my own advice and sold my car).

February 2022: Car for Two People

-

Car Payment: $0.00

-

Car Insurance: $145.00

-

Gas: $476.00

-

Uber/Lyft: $10.00

Total: $631.00

…So how did I end up spending more? My husband owns his car outright (a 2008 SUV), but his daily commute buttchugs gas. Dividing the new total by two to equalize, it’s akin to $315 per person.

It’s worth noting that—in a twist of sweet, sweet irony—I’m considering buying a car in the next year or two (and not just any car, but a Macan, the smaller, younger sibling of the Cayenne I jeeringly referenced in my “sell your car” blog post). We make plans and God laughs. This was partially the result of a bribe I made with myself regarding reaching a certain level of success with Money with Katie. Will it happen? Stay tuned.

Perhaps my tendency toward lifestyle creep is no clearer than in this desire. To go from swearing off car ownership altogether to contemplating the purchase of a notoriously expensive and finicky vehicle breaches a comedic level of absurdity.

Entertainment & living expenses: Then and now

February 2021: Just Me

-

Gym/Exercise: $0.00

-

Streaming: $14.00

-

Spotify: $7.00

-

Phone: $44.0

-

Personal Care: $59.00

-

Shopping/Clothes: $0.00

-

Entertainment: $22.00

-

Pets: $0.00

Total: $146

…As I type this, I’m “white guy blinking meme.” Maybe once you see 2022’s numbers, you’ll understand why…

February 2022: Two People

-

Gym/Exercise: $18.00

-

Streaming: $25.00

-

Spotify: $14.00

-

Phone: $0.00 (I switched to Mint Mobile and pay $360 once annually now)

-

Personal Care: $404.00

-

Shopping/Clothes: $97.50

-

Entertainment: $81.68

-

Pets: $315.00

Total: $954.18

…So there’s that. “I can explain!” she shouts, covering the bleeding, naked budget with her hands. I won’t even attempt to split this one in half, because…it’s mostly just me.

In scanning the list, things haven’t gone too off the rails—until you hit Personal Care, Shopping, and Pets. “Personal Care” now encompasses monthly facials and a skincare regimen that would make Hailey Bieber blush.

This is, admittedly, an inclusion of something that reluctantly got the ax when I decided I wanted to retire at age 35 a few years ago. As I gleefully wrote in an earlier blog post, “The $8 jojoba oil works just as well as the fancy products,” which was something I earnestly believed until my facialist took one look at my skin under a microscope and gasped. “So wait,” she began, “You’re not using any real moisturizer…?” I could practically hear the Rocky Mountains (and surrounding dry air) laughing at my folly.

The sharp increase in “Pets” spending can be explained by co-parenting Georgia, my husband’s dog, as my own—and ushering her needs into my checking account with all the joy and exuberance of Willy Wonka welcoming the Golden Ticket winners into his factory. Georgia has been granted the veritable chocolate river of upgrades, as we pay $50/day to pet sitters to come stay with her at home when we travel, and have introduced her to a daily Prozac regimen. (When I die, I want to be reincarnated as Georgia so someone will feed me antidepressants covered in whipped cream.)

Shopping isn’t horrendous, but I’ve definitely made a few questionable purchases in the last year (read: shoes). In an earlier blog post wherein I declared myself a “reformed materialist,” I wrote: “I still pause and admire the rainbow of Hermès Birkin bags on Keeping Up with the Kardashians reruns, and if I see a pair of red-bottomed shoes in the wild, I definitely stop and reconsider my entire FI plan: ‘I could retire early… or I could bag that shit and start rapidly accumulating flashy stilettos!’” Turns out most of us are reformed materialists until we find ourselves in the position to afford said materials.

Food: Then and now

Honestly, just shield your eyes.

February 2021: Just Me

-

Groceries: $270.00

-

Restaurants: $7.00

Total: $277.00

Oh, how the mighty have fallen. I can hardly believe those numbers. Why? Well, let me show you!

February 2022: Two People

-

Groceries: $566.00

-

Restaurants: $357.00

-

Chef Service: $678.00

-

Date Night: $126.00

Total: $1,727.00

And when I tell you this was a lean food month in 2022, trust I’m being honest. Per person, that’s $863—a 212% increase from just a year prior.

A big part of this stems from my marriage. While a lot of people suggest getting married makes your life cheaper, it’s been the opposite for me. My husband inexplicably tries to consume 3,000 calories per day, whereas I am perfectly happy subsisting on snacks and frozen Trader Joe’s dumplings (I am the picture of health and am working on it, okay!?).

Since I work from home and my husband works from an office 45 minutes away, dinner had become my de facto responsibility—and it only took a couple months of married life for me to realize that working full-time and simultaneously playing Holly Housewife was not for me. (I explore this in more detail in a podcast episode about the economics of outsourcing domestic tasks; how two adults working full-time today aren’t splitting two full-time jobs, they’re splitting three, and how the third job—cooking, cleaning, and running a home—disproportionately falls on women.)

So what does a woman with a healthy level of resentment for wifely duties and newfound disposable income do? She pays someone else to be the houseperson. Enter: the chef service. Every week, we pay a local, woman-owned business between $180 and $250 (depending on meal selection) to prepare 4–5 entrees and sides for us, which comprises lunches and dinners for both of us. On the weekends, we usually get takeout, which the old me would have considered borderline heretical.

Travel: Then and now

This category actually hasn’t changed very much, because I still very much fancy myself Points Mami. Observe:

February 2021: Just Me

-

Airfare: $0.00

-

Hotels: $0.00

-

Credit Card Annual Fees: $149.00

-

Airport Parking: $0.00

Total: $149.00

(That was the annual fee for the Southwest Rapid Rewards Priority Card, the credit card I’ve used to get the Companion Pass and to rack up so many points that I haven’t paid for a flight in ages.)

February 2022: Two People

-

Airfare: $0.00

-

Hotels: $0.00

-

Credit Card Annual Fees: $0.00

-

Airport Parking: $0.00

Total: $0.00

Rejoice! Credit card points! Here’s my full breakdown, though it’s probably time to revamp it. Now that Thomas is active-duty military, our annual fees are waived, so we’ve acquired a few more cards since the inception of my points breakdown.

In 2021, I spent $2,770 total on travel; in 2022 so far, we’ve spent $2,062 together. Most of our spending now is airport parking and shuttles since we live two hours away from the airport.

Miscellany: Then and now

Also known as: Where all good budget intentions go to die.

February 2021: Just Me

-

Gifts & Donations: $20.00

-

Miscellaneous: $545.00

Total: $565.00

February 2022: Two People

-

Miscellaneous: $309.00

-

Gifts & Donations: $50.00

-

Katie No Questions Asked: $200.00

-

Thomas No Questions Asked: $168.00

Total: $727.00

This category varies wildly, but the important thing to note is that we added budget categories for both of us to spend whatever we wanted (ideally capped at $150 each, which…as you can see…).

We did this when we first combined finances because I was worried my Inner Only Child Demon would take over and I’d get pissy if Thomas ever spent any of “my” money on stuff I didn’t approve of, but turns out, one of the privileges of earning a lot is not caring very much about that. I’m (for the most part) pretty laissez-faire about his spending and often encourage it, since he’s still fairly frugal.

Total spent: Then and now

February 2021 for just me: $2,600

February 2022 for two people: $7,817 ($3,908 per person, a full-throated 50% increase)

Overall save rates & takeaways

When Thomas and I first got together in 2018, he was the spender and I was the saver. After I beat him over the head with enough “FINANCIAL INDEPENDENCE RETIRE EARLY!” rhetoric, he joined me in my obsession. Then, I promptly did a 180 and decided ultra-frugality wasn’t for me long-term, and he more or less retained a more centrist position.

2021 Save Rate: 76%

2022 Save Rate (so far): 72%

The irony of improving my own financial situation

Now that I’m earning more, one would think my situation would be more admirable than before—but in truth, I think my “old ways” had more to teach: $7 in restaurant spending?! Are you kidding?!

If there’s anything this should demonstrate, it’s that increasing your income is the highest-ROI activity. That’s the irony of improving your own financial situation: The more progress you make, the easier it becomes. For my husband and me, I hope our ultra-frugal days are behind us, but it’s nice to know I can do it.

There are times in life to be super frugal. There are also times in life to live a little (that is, if you’re part of the two thirds of the US who earns more than minimum wage). I did the “ultra frugal” thing for a few years, until my income reached the point where it started to feel silly. I have no doubt that—had my income remained the same—so, too, would my spending habits.

My TL;DR: It’s natural (and encouraged, even) to spend more as you make more, but your spending probably shouldn’t rise proportionately with your income. Ideally, your nominal amount saved should rise as your income rises.

Lifestyle Creep: It’s what’s for dinner.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time