My Life-Changing Money Morning Routine

December 14, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Every morning in my apartment starts the same way: Perform the elaborate pet swap (wherein the cat gets locked into the bathroom and the dog comes out of the kennel for a walk; they’ve never met), press the holy “brew” button on the Nespresso machine, and sit down with my laptop to open a series of financial tabs.

Romantic, huh? Meditative, even. Definitely less inspirational than your ideal Tony Robbins cold plunge and breath work start to the day, but I’m convinced my money morning routine has played a powerful psychological role in my rapid growth.

The idea of “set it and forget it”

When I read I Will Teach You to be Rich (by Ramit Sethi), I was pretty enamored with the idea that you could set your budget once per year, create auto-transfers to your investment accounts, and call it a day – the idea that everything would happen in the background of my life and I wouldn’t have to do anything was alluring. It had a, “I’m so rich I don’t even care!” laissez-faire vibe, and I was into it.

But I found, rather quickly, that it didn’t actually reflect my actual relationship with my #accounts.

I wasn’t checking in once a month to supervise my algorithmic automation – I was checking in every morning to see how my accounts were growing, how much I had spent that month, and to keep tabs on any “surprise” income. (You know the kind: an unexpected refund check, a gift from grandma, the profits from finally selling that marble coffee table you bought when you were trying to make your living room trendier – the income that you didn’t plan for.)

And I wasn’t checking because I was stressed or nervous: I was checking because I liked it.

I became addicted to watching my net worth crawl ever-so-slowly north. I loved trying to “beat” my previous month’s spending. The relationship I had with my money was an intimate one, and as a result, I was close to the action – when I had a slim month (like when the studio closed), I knew I had to cut my discretionary spending categories. When I had a five-figure month thanks to exploding freelance work, I knew I needed to quintuple (yes, quintuple) my contributions to my taxable brokerage account.

In fact, I credit this BFF-level relationship with my money as the primary impetus for how I saved $100,000 by age 25 (and am on track to hit $150,000 just five months later).

My money morning routine

The free financial planning software Mint is infamous in the personal finance world for either being your holy grail planning tool or something you’ve attempted to use 14 times and never succeeded.

It took me a few attempts, but now I consider Mint another family member. My second boyfriend.

The following is the order in which I cruise through my Mint account every morning to keep an eye on things and adjust as necessary.

Transactions

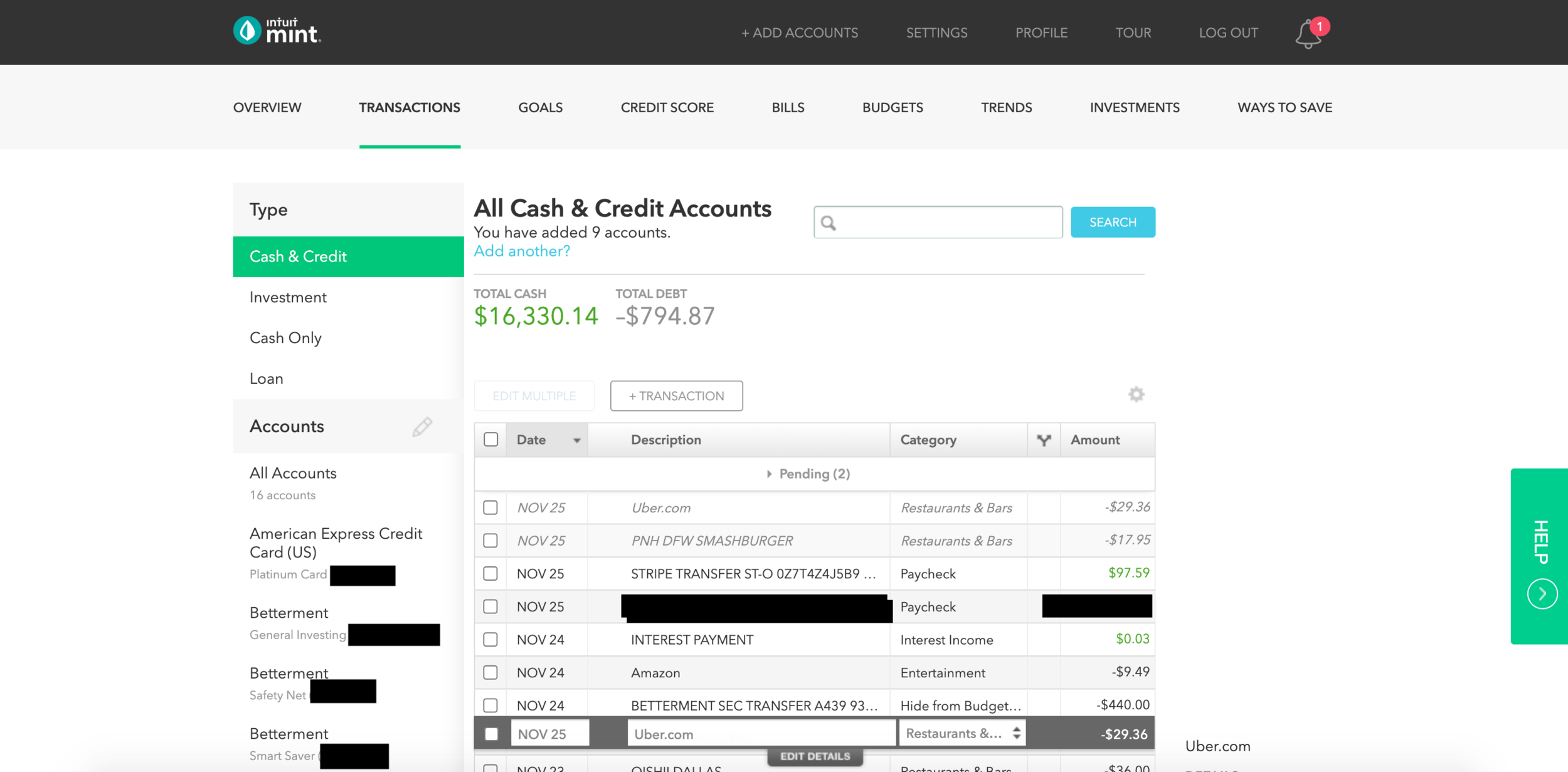

My first stop is always transactions. Because Mint syncs to all your accounts (I have six investment accounts, five credit cards, and three bank accounts connected), it’s the easiest way to make sure nothing hanky is going on in your bank accounts. As someone who had $8,000 stolen from her checking account as part of an elaborate identity theft fraud scam, this is crucial for me.

I’ll check out all the new pending transactions – expenses, income, interest payments, etc. – and make sure they’re categorized correctly.

This is where a lot of people go wrong with Mint. They wait weeks between checking their transactions, so by the time they log in, there’s a list of 45 line items that are all categorized with the sloppy imprecision of a drunk sorority girl armed with a label maker. They get overwhelmed, and they bail.

If you check and re-label on a daily basis, you’ll never have more than a handful to re-assign.

I go through this Transactions page and recategorize the pending transactions. Since I do it every morning, there are only ever a few new ones that need to be labeled appropriately.

Budgets

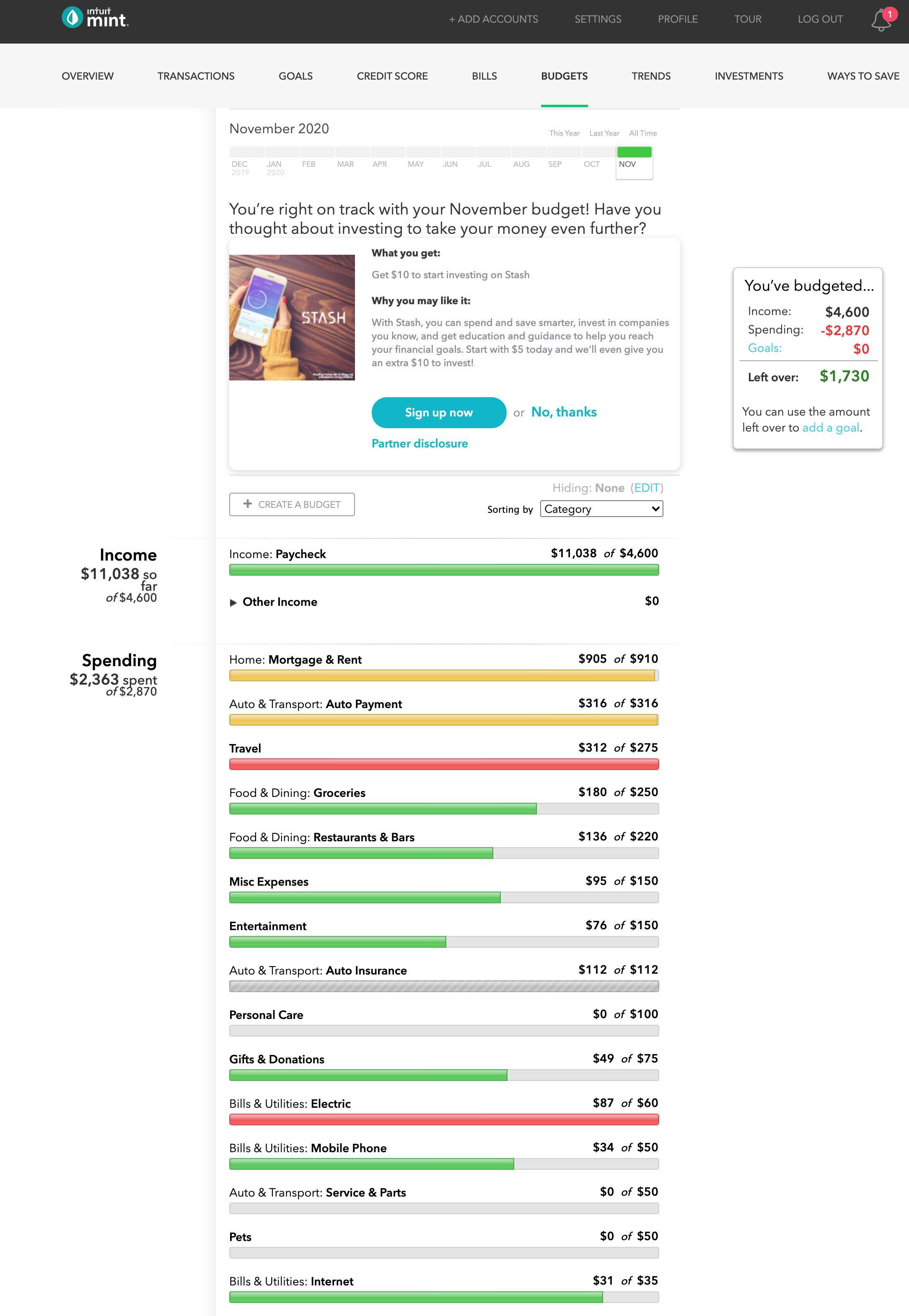

Next comes the Budgets tab, where financial self-esteem goes to be ardently reaffirmed or crushed mercilessly.

Because you set your budgets yourself, it’s like you’re measuring yourself on a monthly basis against your own expectations. In a world where we can make an excuse for just about anything, this is an excellent lesson in accountability and personal responsibility (sexy, right?!).

The primary question I hear at this point is, “But how do I know what budgets to set based on my income?” After all, you’re writing your own rulebook. If your rules suck, it doesn’t matter if you follow them perfectly – you’ll get a bad result. The Wealth Planner on my site (available for Salaried incomes and Freelance) will make recommendations based on your income and fixed expenses.

I pass through the Budgets tab to get an overall sense for how I’m doing (this is why the categorization matters – it tells the software how to classify your purchase decisions).

As you can see, this was a pretty damn good month – I’ve spent $2,363 of my budgeted $2,870.

I know what you’re thinking – “Well, shit, you’re under-budget, so obviously you’re going to enjoy this process.”

And you know what? You’re right. But keep in mind that my Mint budgets in 2017 looked very different. It was a bloodbath of red categories: It felt like shit, and that very emotion (that I’m screwing up) is part of what motivated me to kick it into gear. Even though it might not feel good at first, it’s important not to avoid stuff that makes you feel bad. Usually, that emotion is a clue that you’ve stumbled into an opportunity for serious progress.

Overview

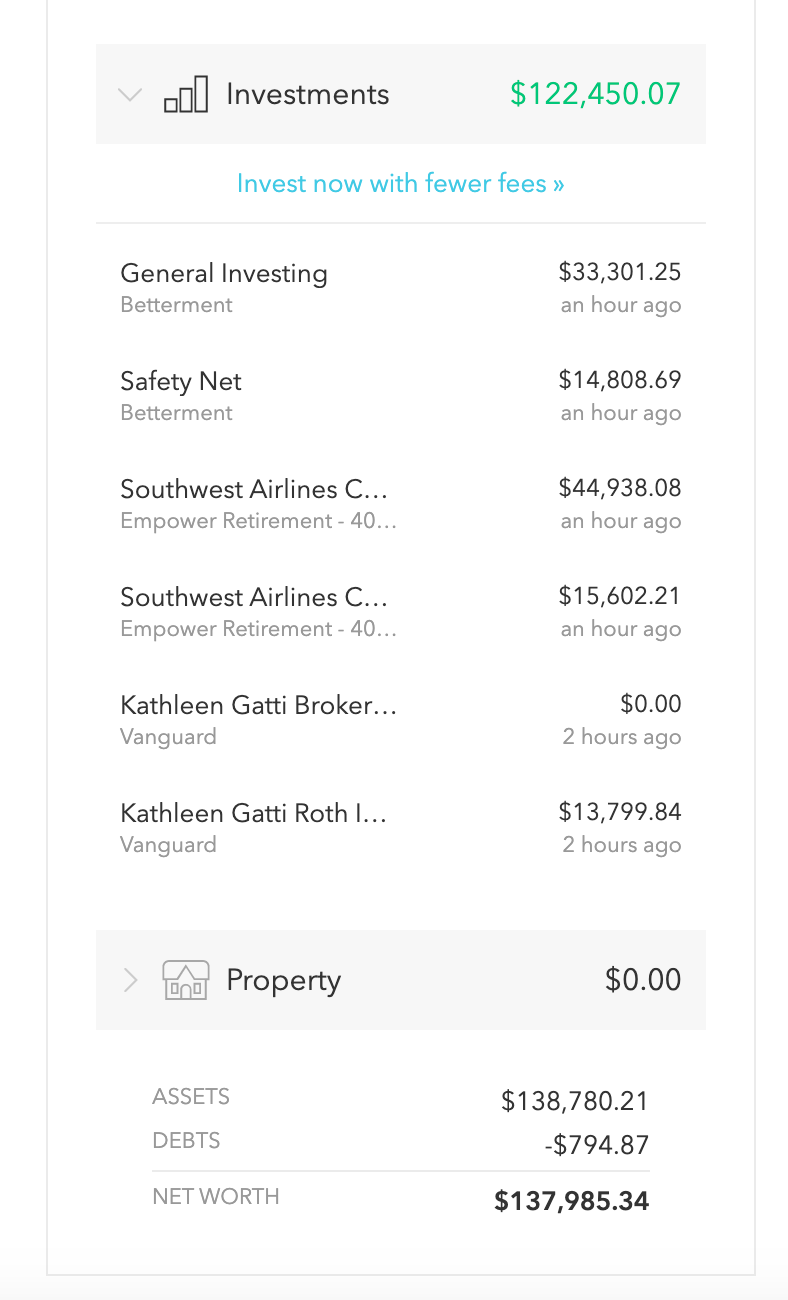

The Overview tab comes last (so in a way, I work backwards through the software).

This dashboard view is probably the most helpful aspect of my morning routine, in my opinion, because it tells you two things:

-

Overall net worth

-

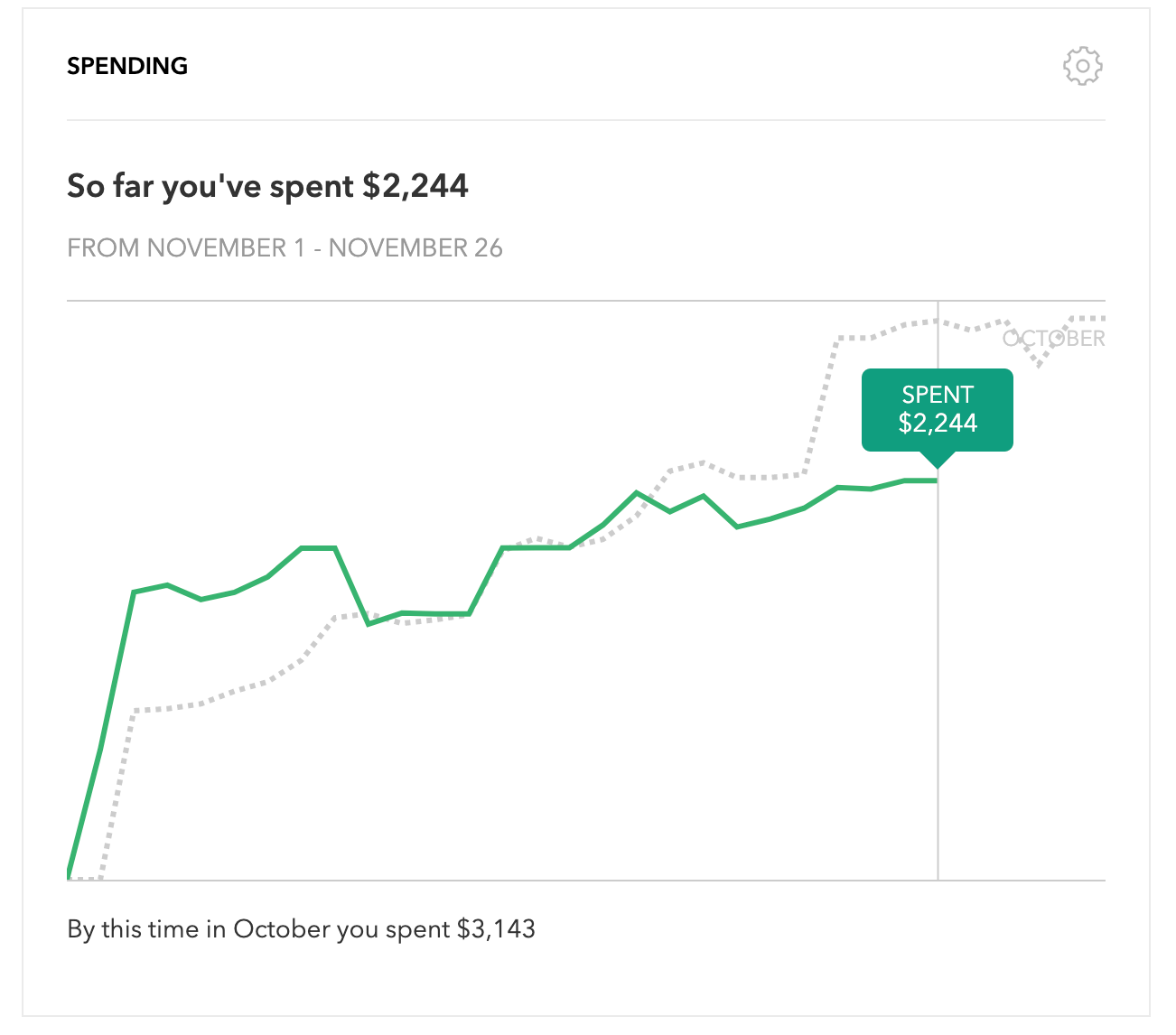

Your spending compared to this time last month

This view of your overall investments and net worth calculation is very helpful for understanding where you are, at a glance.

This view is one of my favorites, because it allows me to see just how consistent – or inconsistent! – I am, month over month. It helps you realize when you need to slow down (if you’re over) or if you’re way under and want to treat yourself to sushi for lunch, you know you can – guiltlessly.

How this culminates

This routine takes approximately 5 minutes in the morning, but it sets the tone for how I move through my day, money-wise. For example, if I see that my side hustle income took a hit, I might take a little extra time that night to scheme a new income stream. In a month like this one (one of my best ever), I might realize that I can afford to rest a little bit.

It’s the power of being relentlessly in touch with reality and allowing it to guide your pivots accordingly.

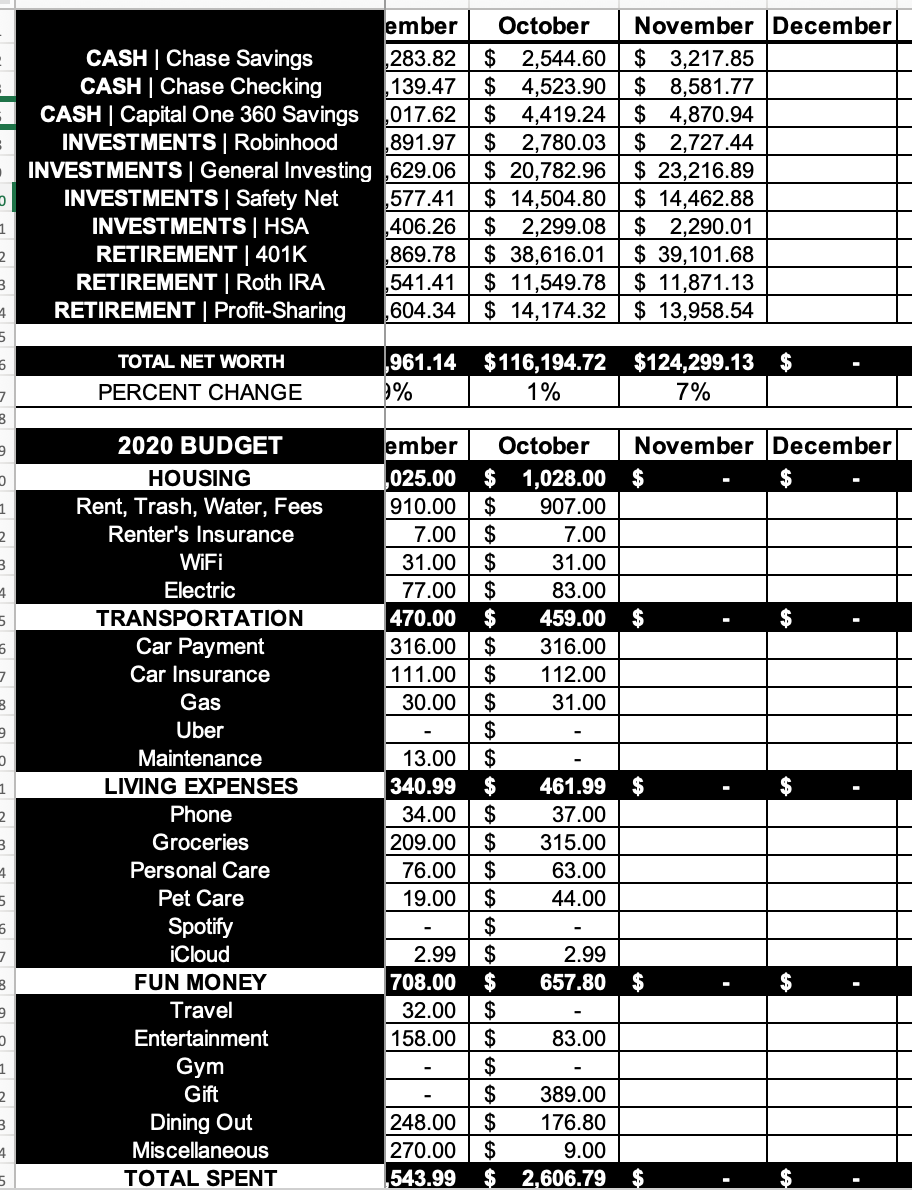

After a month of morning check-ins, I sit down on the 1st of the month with my net worth tracking spreadsheet (the manual version of Mint, if you will) and record my final numbers for the month. This adds an extra layer of accountability and comparison, and it’s actually become (unintentionally) a great way to historically confirm progress.

This spreadsheet has data all the way back to early 2018 (when I started tracking) of how I actually spent each month compared to my budgets, and the account balances.

Where to start?

If this is all new to you, you might be feeling a mix of emotions right now: excitement about a new way to relate to your money, and existential dread about the fact that you don’t necessarily know where to start. It’s easy to feel behind, but I want to reassure you: Just starting is the best thing you can do. Make your budget, open a Mint account, sync that puppy up, and start. You’ll be surprised by how quickly (a) you enjoy getting in the weeds with your money and (b) you start to learn and make adjustments accordingly.

And don’t forget the espresso. That part is crucial.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time