Personal Capital Review: My Favorite Way to Track Net Worth

August 19, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

August 2020

Looking at all my accounts growing in aggregate like…

You know what they say: If you can’t measure it, you can’t grow it (or something cliché like that).

Today, I want to spend some time reviewing the pros and cons of a tool I like to use called Personal Capital. It’s handy, dandy, and most importantly, free (frandy?).

But first, let’s talk about why tracking your net worth is important.

Human beings & progress

I was a Psych minor at a giant SEC state school, which means I’m 110% qualified to pontificate about human psychology on the Internet. I don’t make the rules.

Humans love progress. Humans in an individualist, capitalist society like the United States really love progress. There’s something about seeing growth (and your hard work paying off) that re-energizes and re-incentivizes. It tells our subconscious, Hey, this is working – keep doing this.

At the risk of using another cliché, think about a physical health journey. If you’re trying to lose weight, what’s the most motivating thing that can happen? Seeing the number on the scale go down after you eat well and exercise for a few days.

Tracking your net worth is like weighing your assets, except in this scenario, you want to see the number go up.

What’s the fun in saving, investing, budgeting, and robbing American Express’s FH&R collection if you don’t get to actually see the forward momentum your good choices are creating?

Whether you use Personal Capital or not, you should still track your net worth.

Because I’m a lunatic, I use Personal Capital to aggregate all my accounts and then manually transcribe the totals into a separate spreadsheet on the first of every month. I began this process in May of 2018, so I can see – MoM – exactly how much my net worth has grown, expanded, and, in some cases, contracted over time.

It’s like you’re managing your personal financial life like a business and doing a little monthly accounting. I am the CEO, CFO, and COO of KG, and we have aggressive revenue goals.

I don’t think it’s any coincidence that my net worth has now quintupled since I began tracking it. Every month when I’d input the new number, I’d either be fueled or frustrated.

If the increase was smaller than I anticipated, I’d curse the markets and pick up a few extra classes. If it was bigger… I’d still feel motivated to make it even larger the next month. Maybe I’m just competitive with myself, but knowing exactly where I stood financially helped me to continue charting my path forward intentionally.

Tracking your net worth might reveal a disturbing truth to you – that you’re overspending. If, month over month, you see that your net worth is going down, it likely means you’re living beyond your means. A net worth that trends downward over time is something to watch for as an indicator of poor or unsustainable financial health.

Where Personal Capital comes in

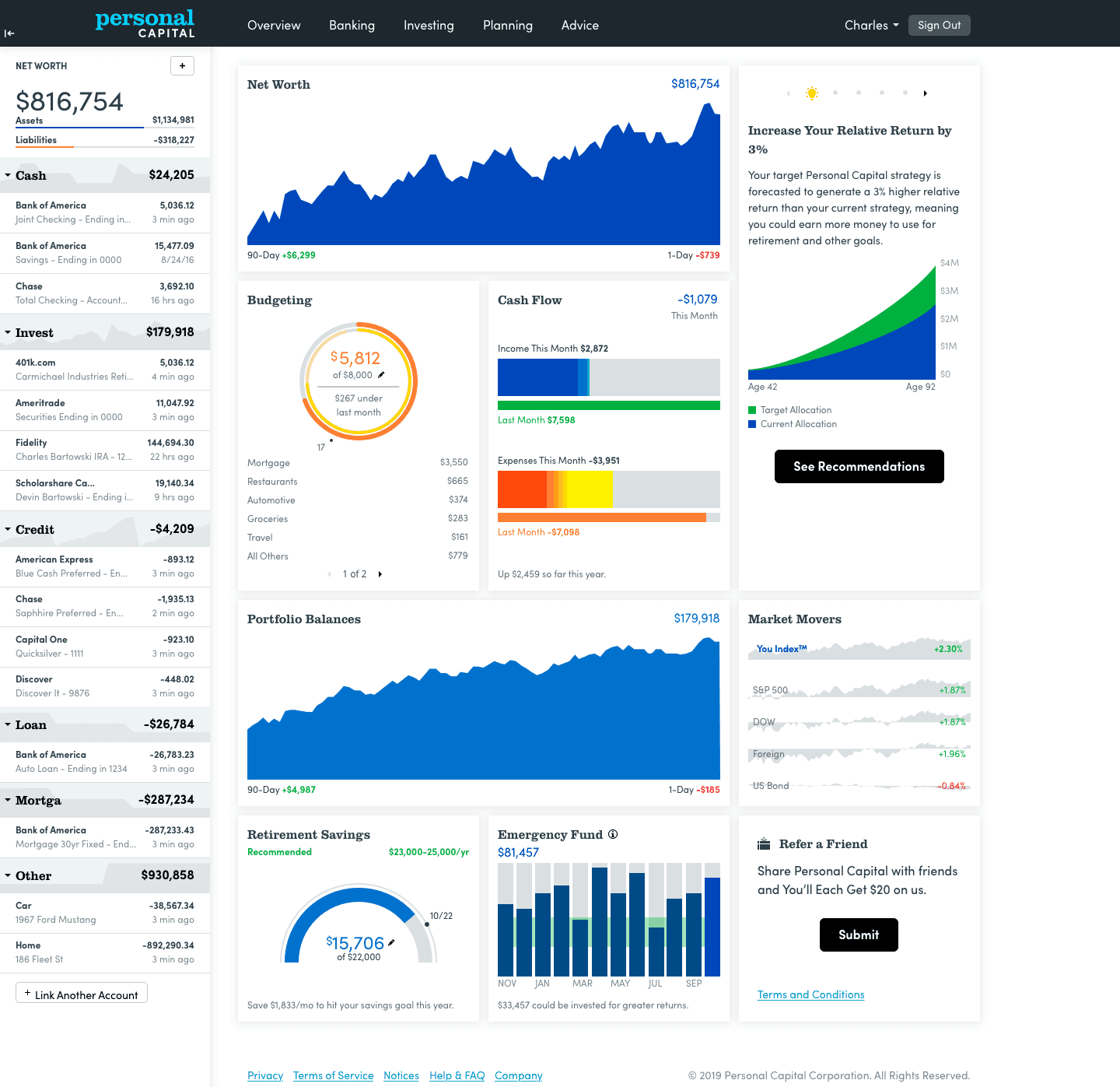

Personal Capital is a tool I found via the FI (financial independence) blogs a couple years ago. It’s pretty simple: You link all your bank accounts, investment accounts, credit cards, and loans, and then Personal Capital offers a handy dashboard to see your entire financial life at a glance.

It breaks up your accounts into different categories: Cash, Investments, and Credit. You’ll quickly be able to determine if you’re allocated a little disproportionately.

Here’s a screen grab that I wish were from my account (peep the $800,000 total net worth; casual).

We’re going to throw a party on Money with Katie when my Assets line item crosses the seven-figure mark. Free flights for all of you!

The pros

It makes a process that would otherwise be entirely manual and time-consuming a one-click effort.

It’s also pretty slick that – when you click into any of the accounts listed – it’ll show you all the transactions and movement within it. This way, if you have eight different credit cards and you want to do a quick check for any fraudulent purchases, you can click through the list quickly and efficiently.

The same goes for keeping tabs on your investment accounts. I like to look at Personal Capital to see what’s being traded by the algorithm in my Betterment accounts – I call him Robart, coincidentally the same name I gave my robot vacuum. I talk a big game about creativity, but I’m truly a one-trick pony.

The cons

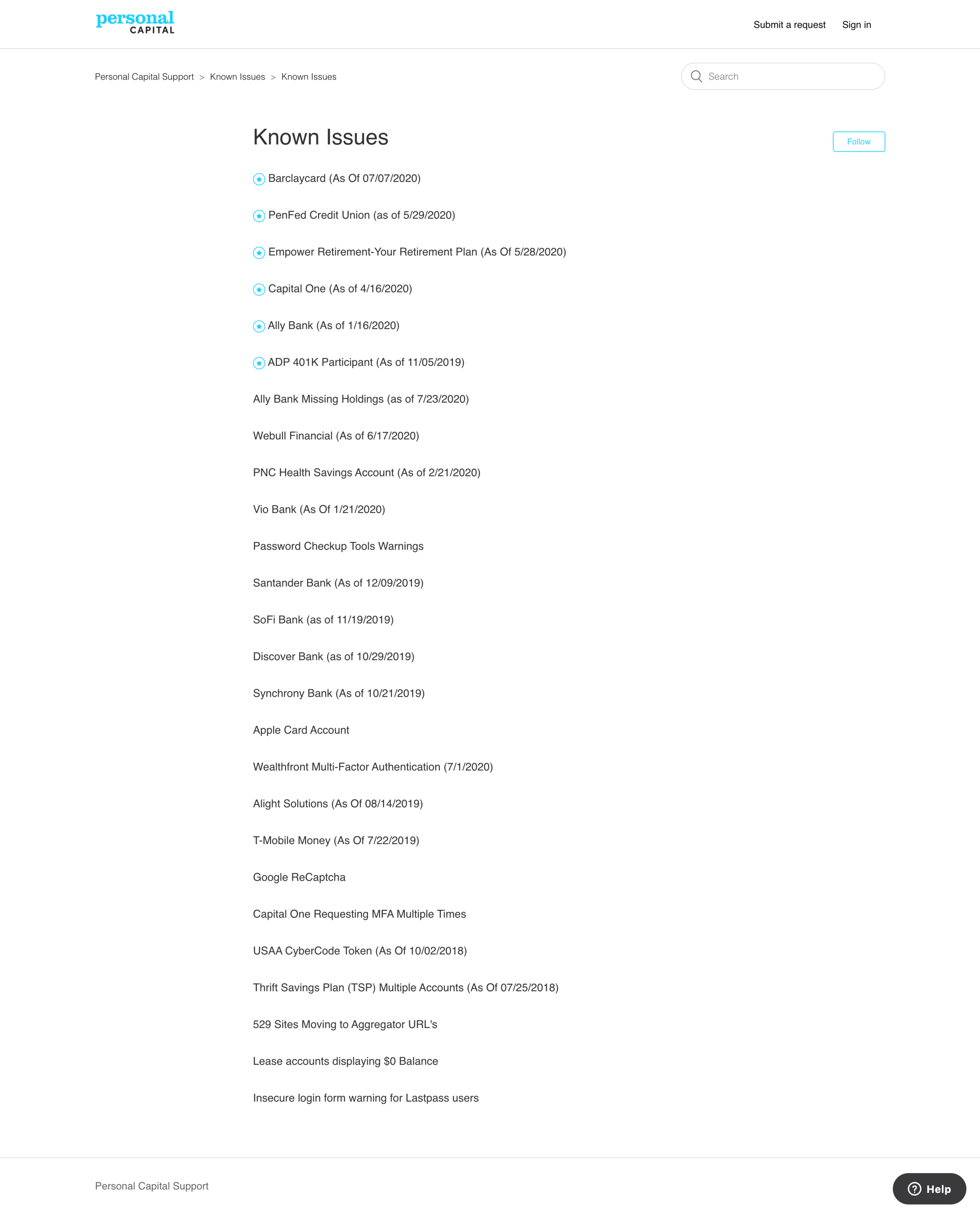

An increasingly longer list of known issues is beginning to frustrate me a little. See for yourself:

These issues are in various stages of remediation, but essentially, it just means it has trouble syncing some of these accounts. It just so happens that my retirement account is represented in this list, so mine hasn’t refreshed in a long time. It’s frustrating to have to check that one manually, but overall, I won’t stop using the product. (When I clicked on that item in the list, it said their site is having issues with aggregation and that the brokerage has temporarily disabled third party services in order to fix it, so I’m hopeful it will be back soon.) The simpler you can make this on yourself, the better A lot of the people I work with who initially report feeling lost financially benefit the most from tools like this one. Usually, the problem is a lot simpler than they even recognize: They just don’t have a good benchmark or baseline for where they stand. To beat a dead horse with the weight loss analogy, it’d be like starting without a scale. You can feel a difference and see a difference when you eat well and exercise, but tracking specifics using real metrics lends a sense of accountability and tangible progress that’s less nebulous than “I feel healthier,” or “I feel richer.” When you go to give someone directions, what’s the first thing you ask? “Where are you now?” * struck temporarily comatose with Bieber fever * Security concerns This is a huge question for people before they start using an aggregator tool like this one. I did some digging and found this quote from the CTO/CIO of Personal Capital named Fritz: Our point of view is that viewing your banking and brokerage accounts via Personal Capital is *safer* than going directly to the banking/brokerage site from your browser. Your credentials are stored in a secure data center versus always being transmitted via the user’s (generally less-secure) browser. The connection is read-only and no money can be transferred out of your banking/brokerage account via Personal Capital, and your banking/brokerage passwords are never returned to your browser from our servers. Our service gives you notification of all banking/brokerage transactions (via email or mobile push notifications) that make it easy for you to monitor you banking/brokerage accounts for fraud, all in one place! If reading about data encryption is your thing, (a) you’re in the wrong place and (b) you can learn more here . I repeat, though: Even if you don’t use Personal Capital, start tracking your net worth, yesterday. I promise that the mere awareness of the balances in your accounts will shift your behavior positively.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time