Side Hustle Taxes: The (Free) Way I’m Keeping Track of my 1099 and W2 Income Tax

October 29, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

In life, every upside has a downside.

When it comes to earning more money from side hustles, the downside is that you’re now on the hook to figure out how to pay the taxes on that income. I’m still not sure why the federal government, who 100% knows how much you owe, can’t just tell you – but I guess we’ll keep playing their little demented guessing game until the TurboTax lobbyists get thrown out.

Why determining your side hustle tax rate can be difficult

Of course, owing more in taxes means that you’re making more money – so who’s complaining? Hopefully nobody.

But when you’re a full-time self-employed person, it’s a little bit easier to calculate how much you’ll owe – because all of your income is 1099, so you’re calculating tax on one big pot of un-taxed money.

When you have a full-time job and side hustle(s), things get a little hairier.

I’ll never forget the regret I felt for rushing through my W4 form for my fitness instructor gig when tax season rolled around.

I didn’t tell the W4 that I had any other income, so they were withholding taxes on my cycle instructor paycheck as if I only made $12,000 per year (my income from teaching).

What a fun surprise it was to learn – on April 14, 2020 – that, “Oh, it turns out the other $80,000 you earned this year is going to make you owe way more on that cycle income!” Bada bing, bada boom – $3,000 tax bill.

Fortunately, I had the money available to pay it, but I know not everyone would’ve been in a position to pay a multi-thousand dollar tax bill on short notice. It’s probably smart to have a system in place for figuring out, with some degree of accuracy, how much you’re going to owe.

The other method, of course, is setting aside a flat figure – like 30% – but I’ve found people usually set aside too much and then suffer the opportunity cost of not investing that income (or doing something else with it) all year long as it sits there collecting dust for the IRS.

(This is your friendly reminder to fill out W4s accurately for jobs that do withhold taxes to avoid unwelcome surprises.)

Now, my tax situation is wonky as hell. I have two W2 incomes (meaning paychecks from an employer who withholds taxes) and one source of 1099 income (in other words, income that isn’t taxed – it’s on me to pay the taxes).

The 1099 income is also under my LLC, which means it’s self-employment income and subject to an additional 15.3% self-employment tax.

How your self-employment income tax is determined

The amount of tax you pay is determined by your total taxable income, not each source individually

Let’s make that real with an example:

Let’s say I make…

$20,000 from one W2 employer (given to me post-tax)

$100,000 from another W2 employer (given to me post-tax)

$50,000 in 1099 income (untaxed)

That’s a total income of $170,000, which – after the standard deduction – is a taxable income of $157,450.

But if I just looked at each chunk independently (and filled out W4s as such), I’d be underpaying taxes all year and surprised at the end of the year with a big tax bill when the government realized, “Wait a second, we’ve been taxing this girl’s $20,000 income as if it were her only income,” and added my $50,000 of self-employment income to the totals.

TL;DR: You have to self-withhold taxes from your side hustle income by taking into account the rest of your income, too – not treating it as its own individual chunk of money.

That $50,000 in self-employment income isn’t taxed like a $50,000 salary with no other income – it’s taxed as part of a $170,000 income.

This can be really, really difficult to calculate manually throughout the year (of course, the tax software will do it for you when you go to file, but by then, it’s too late – you want to know throughout the year what percentage of that side hustle income needs to be set aside for taxes, not a week before it’s due).

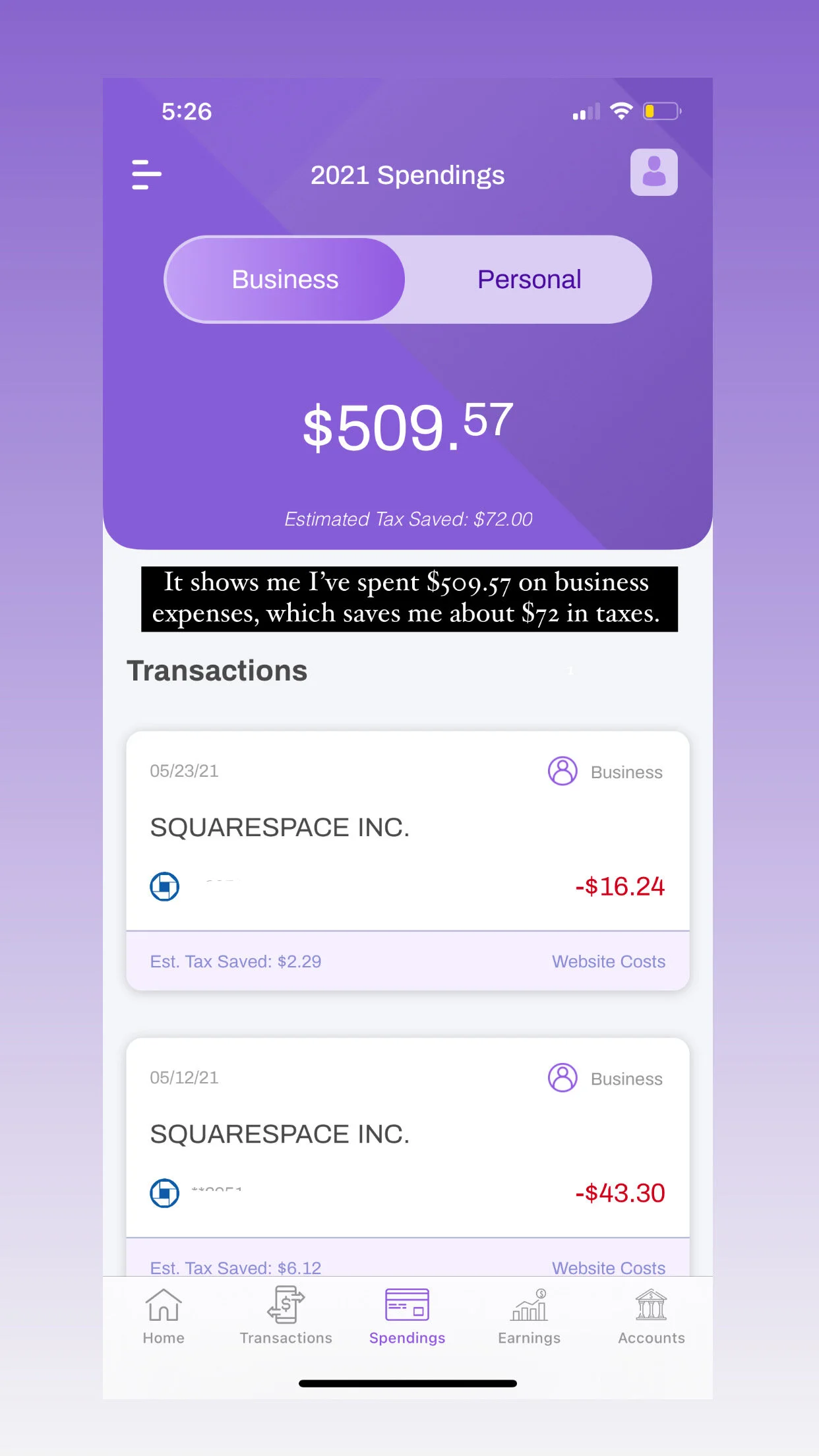

Things get even more complicated when you start adding in deductible business expenses – because as a business owner with 1099 income, you can deduct your expenses if they’re for your business (e.g., I deducted my LLC filing, my website hosting, and more, which means my taxable income is reduced by that amount).

Instead of trying to build a tool to do it, I went looking for a (free) tool that would automatically sync to my accounts and help perform some of these calculations as I go.

Free app that connects to your accounts and calculates your taxes owed for you: Lunafi

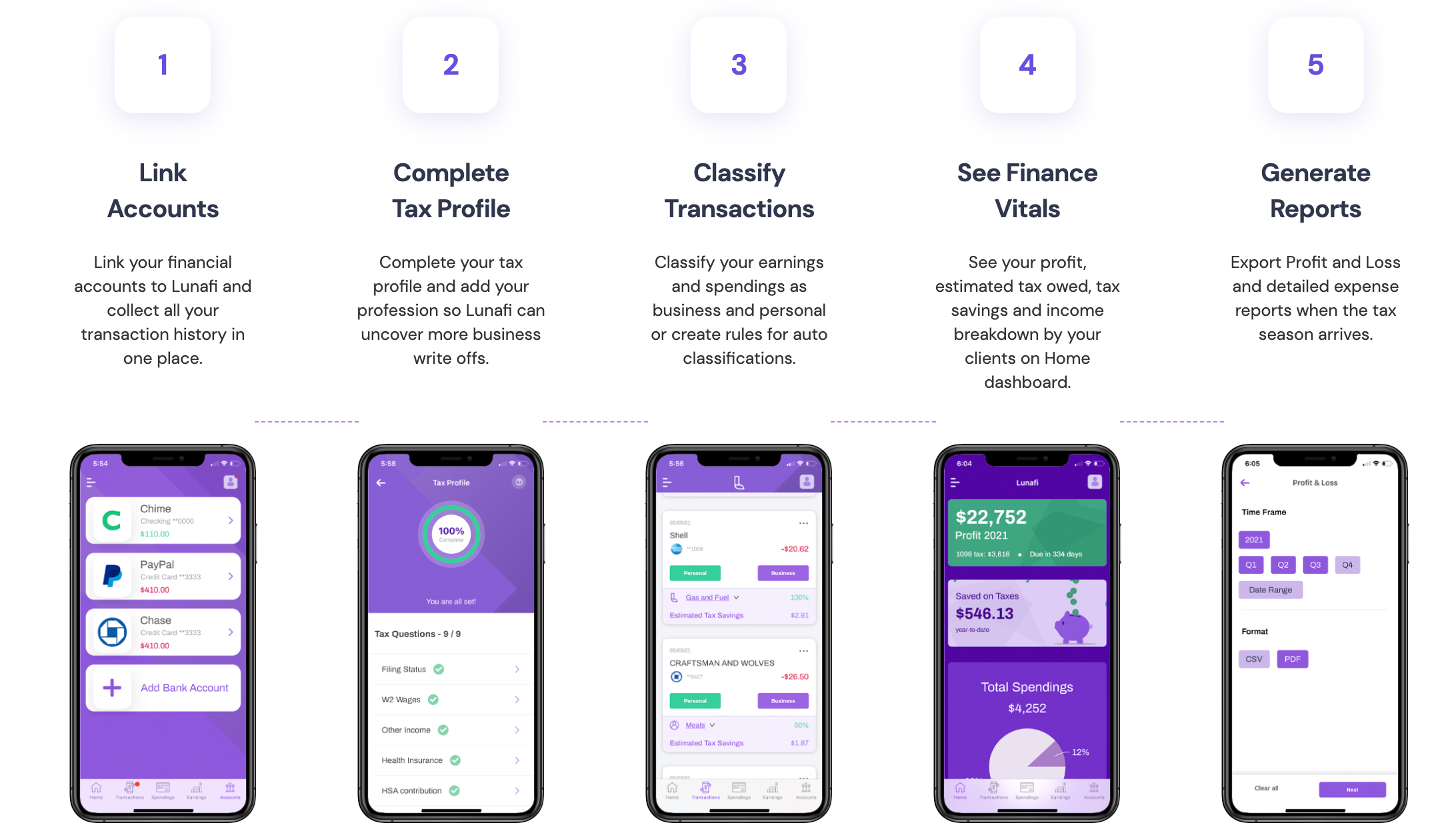

The app that I’ve been trying is called Lunafi, and it was pretty simple to set up.

First, I linked my checking account. I figured that would be enough (as I only have one central depository for all my income, W2 or 1099), but realized I needed to link my credit cards as well since that’s where I put my business expenses (if you don’t have any business expenses, I think you could just link your checking account).

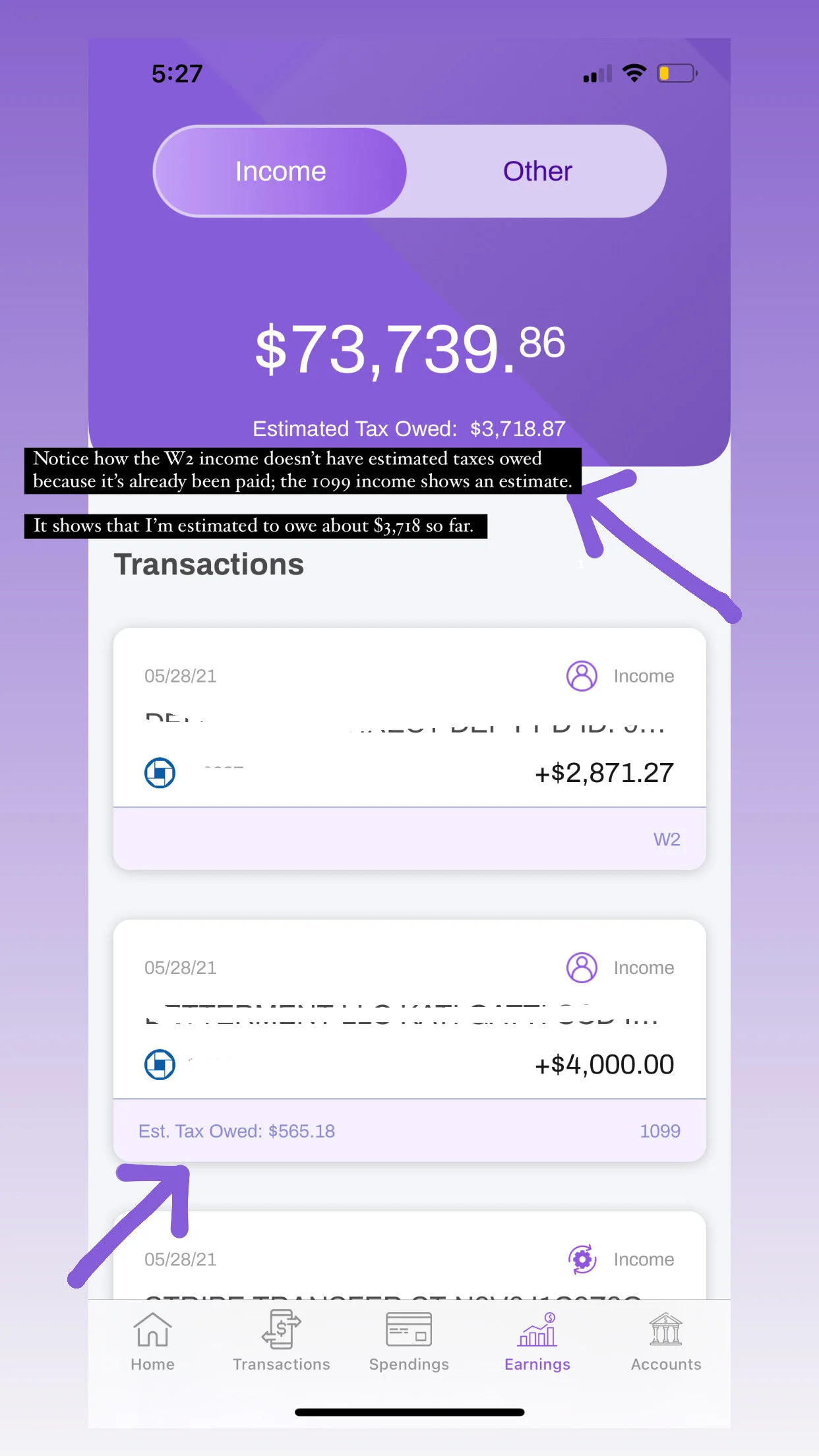

I linked my checking account so it can populate incoming funds – which you classify as either W2 or 1099. If W2, it assumes the taxes have already been taken out, and if 1099, it estimates the taxes owed based on the total amount of income and total taxes already paid.

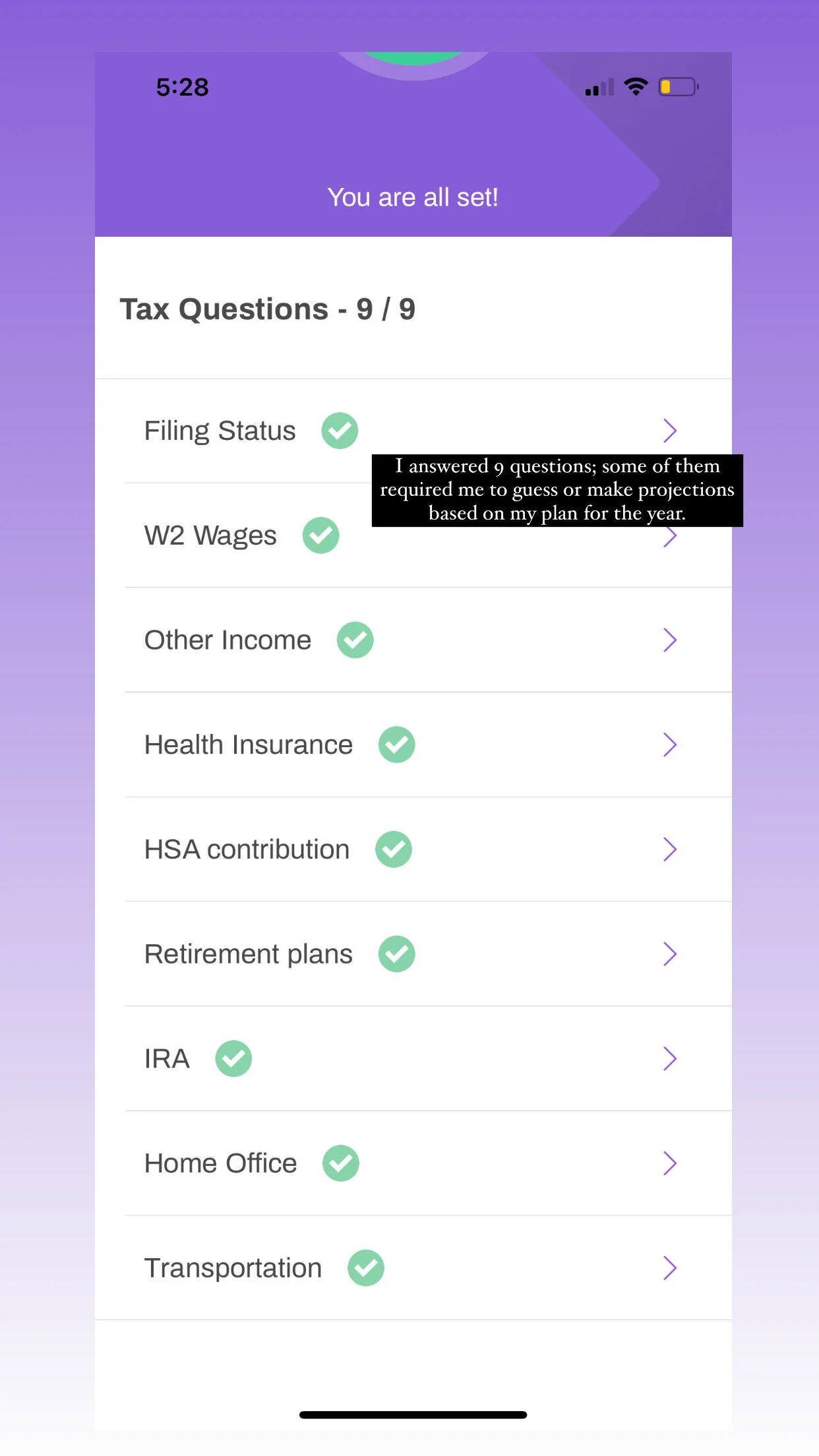

Some of the questions required me projecting or guessing, but it was mostly easy to determine.

I don’t have a business credit card or checking account (though it’s probably time I get those), but if I did, I would’ve linked those instead of my personal accounts.

The point is, you have to link any account that has income or expenses related to your 1099 gig so it can properly total your income and expenses related to the business. The cool thing is that you can classify any income from any source as 1099, so even if you’re getting paid via Venmo, you can accurately report that income and pay taxes on it (assuming you want to).

Then, I had to answer some questions about my W2 income – and keep in mind, it’s on you to fill out your W4 forms correctly for your W2 income so the correct amount of tax is withheld from your paychecks, but the IRS actually has fairly helpful calculators for that. Shocking, I know.

There were 9 questions about how much you make from W2 income each year (which is, hopefully, something you can project rather easily by filling in your salary and bonuses), if you work from home (to deduct the “home office” portion of your rent), your health insurance situation, pre-tax contributions to accounts like 401(k)s and SEP IRAs, and more.

It was nothing too wild, but I did find myself guessing on some of it – basically, they want you to project your W2 income and pre-tax investment account contributions for the year to help the algorithm determine how to tax the rest of the income that comes in. I feel like it probably won’t be perfect, but it’ll be a lot closer than calculations I would’ve done on my own (or, the more likely scenario, ignoring it completely).

Plus, it’s free, so there’s really no downside.

How to use Lunafi in an ongoing way

From there, things are pretty damn simple. All of your transactions get floated into the app, and you just classify whether it was W2 income or 1099 income. You can create rules so it knows certain transaction names are tied to one or the other, which helps to automate it some.

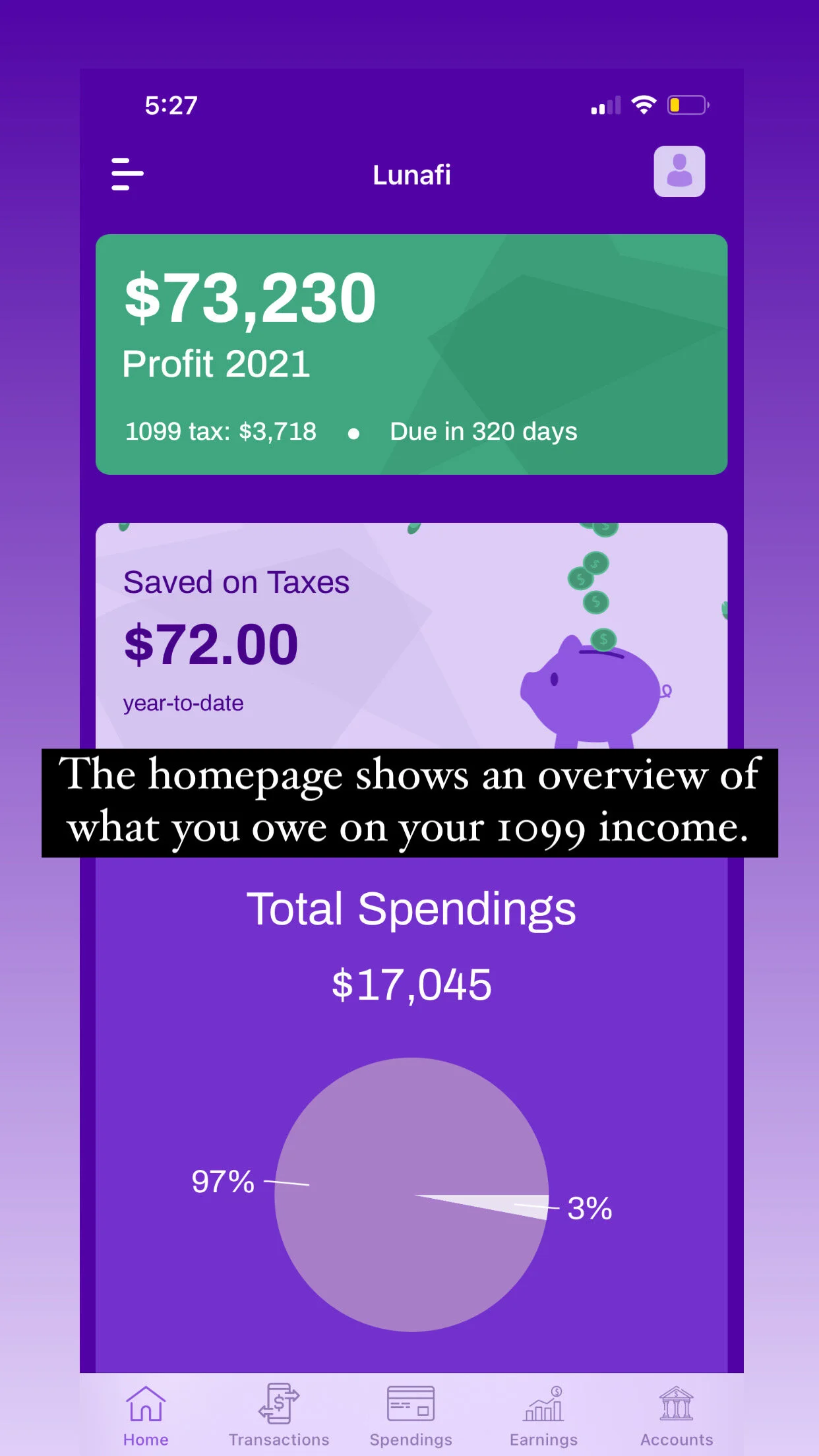

Then, it shows you – right on the home screen – your total income for the year and estimated taxes owed.

It doesn’t file quarterly taxes for you (that’s also something I’m still in the process of learning more about), but it’ll tell you how much you likely owe on the income.

I found this graphic on their site that explains the steps pretty well:

I’ve also been using the feature that allows you to assign certain income to a “client” so I can see, at a glance, how my sources of income stack up against one another. This is fascinating, especially for someone with multiple sources of income or clients.

(I can totally see a situation wherein someone starts tracking income by client in this app and then notices their one pain-in-the-ass client represents such a small amount of their income that it’s not even worth it. The visualizations are helpful.)

And as income flows in, it’ll tell you the estimated income tax on each individual payment, too. So while I may see that I owe $3,000 so far for Q1 based on my projected W2 income for the year and 1099 income earned so far, I can see one client’s payment generated about $150 in income tax. Kinda cool.

How often I’m using Lunafi to keep tabs on my 1099 tax

This isn’t something I interact with on a daily basis. I’m not going in there and closely monitoring how much I owe in taxes each afternoon. But I do check it every couple weeks, make sure the income is being classified properly, and deduct any business expenses that have come through.

This is the page I interact with most, to see how much I’m estimated to owe on an ongoing, overall basis.

This feature is cool because it tells you the estimated tax savings based on your business expenses.

I keep an eye on the total estimated tax owed just to make sure that I’ve got a good buffer in checking and savings in case I do decide to be a law-abiding citizen and start paying quarterly taxes (though I think I’m going to risk the penalty for one more year to see what happens, in the name of science – at least until I know more).

I’m just now starting to get a little more serious about creating reports for my business to understand the top sources of income, how I’m spending my time, etc., so I think the reporting feature will come in handy when I start generating monthly reports like a real business bitch.

Only time (and tax season) will tell how well it prepares me, but for a free tool that automates the calculations and takes out the guesswork for me, I’m pretty pumped.

If you have side hustle income or consider yourself a “freelancer,” give it a spin.

I asked Lunafi to provide me with a referral link to share and if they’d be willing to sponsor this post about their product, and they agreed.

You may also like these posts about taxes…

Featured

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time

![How to Contribute Thousands of Extra Roth Dollars Each Year: The Mega Backdoor Roth IRA [2025]](https://moneywithkatie.com/wp-content/uploads/2021/10/Frame37846.webp)

![In These Tax Brackets? The HSA + High-Deductible Plan Might be Cheaper for You [2025]](https://moneywithkatie.com/wp-content/uploads/2021/10/HSAHDHP.webp)