Tax-Optimized Investing Strategies for Full-Time Workers with Side Hustles

May 23, 2022

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Hint: You may not need that Backdoor Roth IRA after all.

Blasphemous, I know—and while I’m sure this article will apply to a pretty niche segment of my audience, I had an important realization the other day that I feel I must share:

Most full-timers with side hustles (hello, millennials) aren’t taking advantage of the amazing tax benefits available to them.

Why does this matter, you ask?

“Katie, your fancy alphabet soup accounts do not interest me. I have a Robinhood account and I’m not afraid to use it.”

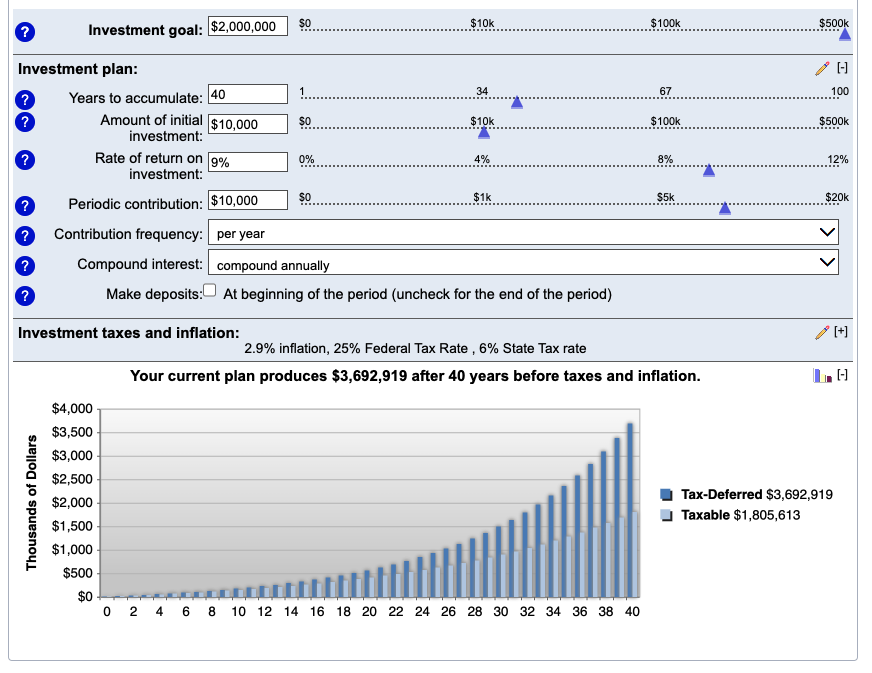

But don’t you want tax benefits?! Let’s qualify just how much money we’re talking here. Assuming you’re investing $10,000/year for 40 years (illustrative purposes only) and get a 7% average real rate of return, the difference between investing in tax-deferred/tax-sheltered accounts or outside tax-deferred/tax-sheltered accounts is *clears throat* $1.8mm and $3.6mm.

It doesn’t look like much in the first few years, but tax drag is not your friend. If having an extra $2mm in 40 years is interesting to you, it’s worth it to minimize tax drag wherever possible. Take a look:

Assumes 2.9% inflation, a 25% federal tax rate, and a 6% state tax. Assuming inflation is consistently higher over time (let’s say, 8%), the difference is nominally the same, but your purchasing power of both amounts is lessened.

Today, we’re going to break down the two most optimal account mixes for people who have both W-2 income and self-employment income from a side hustle (commonly referred to as 1099 income here forward, because I’m fancy like that, and so are you). One additional heads-up: This post will not address HSAs for simplicity’s sake, but I like those, too.

Got it?

W-2 = wages from beneficent Corporate Overlord from which taxes are already deducted

1099 = income from side gigs from which taxes are not already deducted

Having both types of income opens you to myriad possibilities with respect to fancy tax footwork—so let’s dig into the best two combinations.

Combination #1: Employer-sponsored 401(k) or equivalent account + Solo 401(k) + Roth IRA/Backdoor Roth IRA

This is technically the most optimal from a tax standpoint, but a little more complicated, and potentially unnecessary.

At first, this path seemed like the only universally viable one. Here’s why:

-

The 401(k) is flexible AF. It gives you the ability to make Traditional or Roth contributions, regardless of how much money you make (the IRA, on the other hand, has income limits associated). I’m personally a proponent of leveraging a Traditional 401(k) to cash in on those juicy tax deferrals.

-

The Solo 401(k) is basically a duplicate of the W-2 401(k). Same flexibility applies here. You can contribute up to 20% of your net business income to your Solo 401(k) even if you’re already contributing the maximum to your employer 401(k) and the same “no rules!” free-for-all applies with respect to income limits. I.e., there aren’t any. One thing to note: If you’re contributing the maximum to your W-2 401(k), make sure your contributions to your Solo 401(k) are characterized as “employer” contributions (you’re your own boss, Queen!).

-

The Roth IRA or Backdoor Roth IRA add tax diversification. If you’re under the limit of what the IRS deems “high earner,” you’re in the clear to contribute normally to a Roth IRA. If you’re above that limit ($165,000 single earner or $246,000 filing jointly in 2025), you may be able to do a Backdoor Roth IRA. I say “may” because it’s contingent upon not having any other Traditional or Rollover IRAs laying around thanks to this buzzkill tax oddity called the pro rate rule—so if you fear you’re ~too rich~ to contribute, more Backdoor Roth IRA hot takes live here.

If you’re one of the few lucky Americans with income so high that you’re able to contribute the maximum to all of these accounts, you could potentially score:

-

$23,500 tax-deferred or Roth dollars in the W-2 401(k)

-

$70,000 tax-deferred or Roth dollars in the Solo 401(k)

-

$7,000 Roth in the Roth IRA

*infomercial voice* But wait, there’s more!

If your employer and plan provider allow for after-tax contributions to your W-2 401(k) (what’s known as the Mega Backdoor Roth IRA), you can fill your W-2 401(k) up to $70,000, too. Keep in mind that includes your employer’s matching contributions, so the realistic mix is likely $23,500 of your contributions, $5,000-$10,000ish in employer match, and the remaining $30,000ish in “after-tax” contributions that can be converted to Roth.

The reality? If you’ve got enough money coming in that you can sock away $70,000 in two different 401(k)s, the chances that you should be opting for Roth in either of those accounts are slim—your tax rate is likely extremely high.

Other considerations for Combination #1

Since you can opt for any mix of Traditional or Roth in both 401(k)s, especially if you can’t fill either of them all the way up, it’s likely much simpler to just get your desired amount of Roth exposure in the 401(k)s instead of jockeying around with the Backdoor Roth IRA.

If you can fill both 401(k)s and prefer to keep all of it tax-deferred, then I think the Backdoor Roth IRA makes sense—but there’s no need to overcomplicate it. (“There’s no need to overcomplicate it,” she says, in an article that’s blatantly overcomplicated.)

Fantastic. That brings me to my next point about simplicity in Combination #2.

Combination #2: Employer-sponsored 401(k) or equivalent account + SEP IRA + Roth IRA, maybe

This path might be a hair less optimized, but potentially far simpler.

-

The 401(k) is still the bedrock here. As a refresher, it gives you the ability to make Traditional or Roth contributions, regardless of how much money you make.

-

The SEP IRA works a little differently than the Solo 401(k). The major selling point? It’s way easier to open. You don’t need an EIN number (i.e., an incorporated business) and there’s less paperwork. Most robo-advisors offer SEP IRAs, while only major incumbent brokerage firms offer Solo 401(k)s. There’s no such thing as a Roth SEP IRA, so you only have the ability to make pre-tax contributions. If you’re rolling in the dough, though, that shouldn’t be an issue; most high earners wouldn’t be opting for Roth over Traditional anyway, in my opinion. Here’s more about the differences and how to open both types of accounts, if you’re torn. (Technically speaking, you contribute post-tax money to a SEP IRA that you then claim as a tax deduction in April when you’re gettin’ freaky with TaxAct and a bottle of red.)

-

The Roth IRA, but probably not. Remember our rules about the Roth IRA? Can’t contribute if your taxable income exceeds $165,000 single or $246,000 filing jointly? Well, that might make the Roth IRA obsolete for someone in this position, as someone who can afford to invest $50,000+/year is likely already above the income limit. “What about the Backdoor Roth IRA?” you say? If you’ve got a SEP IRA, that makes the Backdoor Roth IRA a tax quagmire. TL;DR: The likely outcome for Combination #2 is that you’ll only have your W-2 401(k) and a SEP IRA unless you’re under the Roth IRA income limit that allows you to go through the “front” door.

The same logic applies here: If you have enough money to contribute to multiple accounts but not enough to fill them all up, it’s likely simplest to get your Roth exposure in your 401(k) and not even mess with the Backdoor Roth IRA (assuming you’re over the income limit).

Other considerations if you’re hard up for that Backdoor Roth IRA

Frustrated because you have a SEP IRA or Rollover IRA sitting around, but in your heart of hearts all you want to do is perform a Backdoor Roth IRA? (Once again, sexual innuendos abound.)

Good news! We may have a valid workaround for you.

You know how you can roll old IRAs and 401(k) into a new 401(k)? The Solo 401(k) works the same way. You can open a Solo 401(k) and roll your pre-tax IRA funds into that Solo 401(k). This means you won’t have any funds sitting around in Traditional/Rollover/SEP IRAs, and you’ll be in the clear for the pro rata rule!

If you’re wondering whether you even need Roth, I do think some Roth funds are nice in retirement so you have diversity in tax planning (even if you’re in a high tax bracket while working). After all, the tax treatment on money contributed to a Roth IRA or money contributed to a taxable brokerage account is no different: You’re paying taxes upfront. The only difference? Dividend income in that taxable brokerage account is taxed every year moving forward and your capital gains are taxed when you sell, whereas the money in your Roth IRA is never taxed again.

One more thing…

If you’re reading an article about how to invest optimally when you have two sources of income and made it to this line, you’ve already won. Keep going.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time