No, We’re Not in a Recession—But Somehow, This Economy *Feels* Worse

July 25, 2022

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

I need to get something off my chest, as we all wait with bated breath for the June 2022 GDP growth numbers on July 29 to learn whether or not we’re officially in “recession” territory. No? Just me?

But regardless of what the growth numbers say, I think our economy right now is a little…different from recessions of yesteryear.

Why? Well, because it feels like we’re conflating the idea of a recession (true GDP contraction, high unemployment, etc.) with our experience of relatively high (but not historically high) inflation and relative slowing after a ton of money printing and the last decade’s abnormally low interest rates.

Unemployment is lower than it was pre-pandemic; 372,000 jobs were added in June alone. And GDP growth is being slowed intentionally because things were getting too hot: “The economy has downshifted from its torrid pace of 2021 as federal stimulus programs ended and rampant inflation cut into consumer spending and corporate profits. The Federal Reserve is aggressively raising interest rates to slow demand at a time when the economy remains constrained by ongoing supply chain issues,” writes US News.

Finally, as Michael Grant highlights in this episode of Animal Spirits, every recession in history has been preceded by stress in the credit markets. We aren’t seeing that right now. As one Bloomberg analyst wrote, we aren’t “anywhere close” to a point that would be considered troubling.

The data don’t seem to match the ongoing narrative that the world is coming to an end, and if we can reset supply and demand to a reasonable equilibrium (as opposed to the whiplash of 2020’s screeching to a halt and 2021’s manic money printer), I think our economic outlook will improve rapidly.

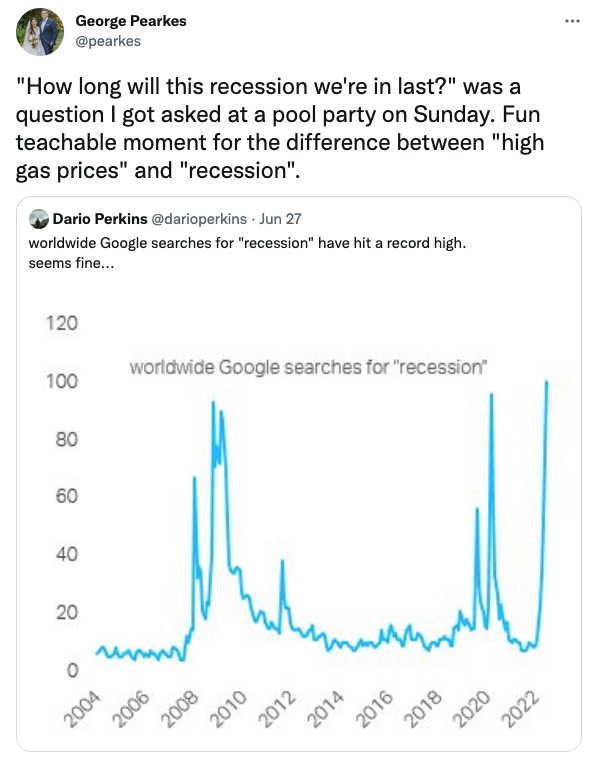

This Twitter user (whom I don’t know, but their tweet was suggested to me) makes a good point: We’re throwing around the word “recession” a lot for an economic reality that doesn’t seem to mirror typical recessionary conditions.

And to quote one exchange in the replies: “What’s the difference? If things are more expensive for households, why shouldn’t people consider this a recession?”

The answer? “The members of the households in question haven’t lost their jobs.”

In all our concern about our dollar not going as far, we forget: The Federal Reserve has created this environment by design. They want you to buy less. Their hope is that you, the consumer, will be able to afford less—and therefore buy less—to lessen demand and give supply a chance to catch up. (Which will, yes, lower inflation.)

Of course, it doesn’t feel good, in the same way that committing to a New Year’s resolution to “eat better” after three straight weeks of chugging spiked eggnog and devouring Christmas cookies by the tubful doesn’t feel good. The party’s gotta end at some point, right? And if the aforementioned “party” was mostly just due to printing trillions of dollars and—now—things are slowing down because we’ve stopped printing? That’s (probably) a good thing.

Oh yeah, and about all that printing…

In a way, the stock prices we saw last year were fake—much like the “growth” was kind of fake. Maybe that’s why now it feels like we’re reverting to a less fun “normal,” to price-to-earnings ratios that exist in a realm of reality that’s sustainable.

Why do price-to-earnings (P/E) ratios matter? Well, they’re not the only thing that matters, to be sure, but they’re a decent way to determine how undervalued, fairly valued, or overvalued the stock market is at any given moment—the P/E ratio answers the question, “How much do I need to spend in order to earn a certain amount?”

Since the prevailing theory (that I’ve come across, at least) is that modern monetary theory and its subsequent quantitative easing got us into this mess, then it stands to reason that looking at the price-to-earnings ratios pre-money printing would represent “normal”—the undistorted price signal. Once we get back to those P/E ratios, then we’d be back to “normal.”

So what would that look like? Quantitative easing kicked off in March 2009. As soon as the banks started writing off the bad mortgage-backed securities debt in 2009, the P/E ratio skyrocketed (because earnings were low or negative), jumping from a median of around 15 to a staggering 123 in May 2009. But to figure out what was “normal,” we can probably use the P/E of around 15—the average before the Great Financial Crisis and the subsequent Fed triage.

And now? Our current P/E ratio is about 19. This isn’t a huge difference compared to historical highs (hello, low-40s in the peak of the dotcom bubble), but it’s still far off enough that I’m prepared to make…

My unhinged thought experiment about the bottom that shouldn’t be taken seriously

In order to reach the “equilibrium” of the pre-QE world (assuming that really was equilibrium), S&P 500 would have to come down from 3,825 points to about 3,200 points, assuming earnings per share stay consistent at the current 12-month average of $207. If earnings go down, it would have to drop below 3,200 points. But—and here’s the bull case—if earnings per share go up, the drop back towards “normal” may not have to be as precipitous.

How much would earnings per share have to go up in order for prices to remain at 3,800 points and hit a P/E ratio of 15? From $207 per share to about $250 per share, or an increase of about 21%.

Earnings have never been anywhere close to that high—in fact, somewhere around $207 is the highest they’ve ever been—but if the S&P 500 increases profits (perhaps by finding new customers in other countries, identifying efficiencies, or simply doing more with less), a further drop could be mitigated.

But the wealth destruction is already underway, and if your theory is that “QE broke the markets,” we have a decent guess of how much further we have to fall to un-break it (the S&P 500 at roughly 3,200 points). We could always start by eliminating excess like this, documented in a “day in the life at LinkedIn!” TikTok that got absolutely incinerated on Twitter.

To put it in perspective, a fall to 3,200 points would be an approximate 16% drop from where we are now. At the time of this writing, we’re already down 20% from the start of the year; all in all, it’d be a 33% drop from where we started the year; coincidentally more or less in line with the average drawdown of 33.5%. Once we reach a P/E ratio of 15, we’d be back at the “equilibrium state” of the pre-QE world (or rather, what we could consider “undervalued” to “fair value”—but these terms are starting to feel like the same thing).

The actual issue? Wage stagnation

“Oh, great, Katie’s fetishized socialism and liberal woke politics have entered the chat!” Not so, my friends. These circumstances are connected, and it’s all in the name of (a) improving quality of life for workers and (b) boosting profits and growth. Stick with me!

Here’s the thing: The recession label bugs me because it distracts from the actual reason people are struggling: wage stagnation and worsening wealth inequality.

If the price of your gas increasing by 53% from the start of the year is enough to force you into living paycheck-to-paycheck (or worse, into debt), you were already way too close to the edge and probably underpaid. For many, this is not an issue of irresponsible spending or poor money management—the “bottom 50%” of Americans have an average annual pre-tax salary of $19,000. Yeah.

Roughly half the country being unable to afford living (and working) in it much longer simply isn’t sustainable, and we have to find a way to balance shareholder interest with the broader employable workforce’s interests. Sure, we want corporate profits to increase in the name of the almighty shareholder—but if the price is great at the expense of a fair wage for the employees? We’re robbing Peter to pay Paul.

The solution to both of these problems is the same thing

How do we do it? Hear me out: We treat employees better, not just hope that those same underpaid employees hold stock. Need an example of what happens when you put employees first, compensate them fairly, and provide job security?

Look no further than Southwest Airlines. Southwest Airlines is one of the only domestic airlines that’s never gone bankrupt and—up until the global Pamela Anderson—had 47 years of consecutive profitability, a feat that’s unheard of in the airline industry. They’re the quintessential MBA business case study.

How does Southwest do it? Well, for starters, they committed early to a disruptive, scrappy business model, and their late founder, Herb Kelleher, was creative. One of his main beliefs in business was that your employees need to come first. They’ve never furloughed employees. The pay is fair. They treat people well. They have a 9.3% dollar-for-dollar 401(k) match and other excellent benefits, including great health insurance, free flights, and profit-sharing. Maybe that’s why they were ranked in Glassdoor’s “Top 10 Best Places to Work” for 10 years in a row. (Can confirm these things; I worked there for five years.)

Southwest is in a league of its own when it comes to impressive, sustained growth and profitability and being known for treating employees excellently, if not a little irritating during Group C boarding (IYKYK). Their employees are known for consistently going above and beyond, flying in the face (pun intended) of the stereotypical “rude and overworked airline employee” trope (though, not without the occasional disappointing mess, to be fair).

A workforce that’s paid well and happy must not be very productive, right? All those benefits must come at significant expense to the company, huh? Well, it’s a long-term game, and Southwest is winning. LUV (Southwest’s ticker symbol) has been one of the best-performing stocks in the S&P 500 over its 40+ year history.

When you treat employees well and pay them fairly, they’re loyal to you. They work hard for you—kinda like the four employees responsible for ingeniously hedging fuel prices to save the company $1.2 billion this year alone.

Contrast this with Amazon’s current hiring dilemma: They’re running out of people to hire because their turnover rates are so high. It’s projected that—if they continue business as usual—they’ll run out of new employees by 2024.

Amazon is a hot growth stock, but it’s not sustainable. White-hot growth doesn’t last forever when you treat your employees like garbage.

The economic growth we need will not come from a workforce that’s overworked, underpaid, and considered expendable. For our classic American innovation and ingenuity to get us out of this one, we must do as Kelleher said, and make an “audacious commitment” to “put employees first, customers second, and shareholders third.” Turns out it’s pretty good for sustained profitability.

The good news? While the stock market and supply chains will likely continue correcting, the job market is still strong—and by fixing the way we treat (and compensate) workers, we’ll likely see these other economic growth factors improve, too. A win-win. Maybe things have to get worse before they can get better; the metaphoric Amazon has to run out of workers (or rather, realize that’s where they’re headed) before their labor practices will turn the corner.

Either way, there’s reason to believe we’re in the worst of it now—and avoiding a true recession is entirely possible, if not probable.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time