Why Are We Obsessed with Rich People Who Drive Old Cars?

April 3, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

As a personal finance pundit, I spend (read: waste) a lot of time trolling the online watering holes where financial topics are debated, and I’ve noticed a bizarre phenomenon ramp up over the last 12 months. (I’m already fearful this piece is going to be dubbed the result of being “chronically online,” but alas, if the shoe fits…)

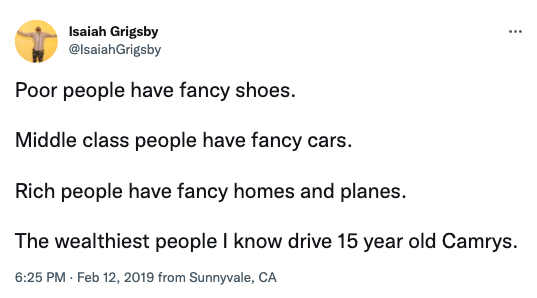

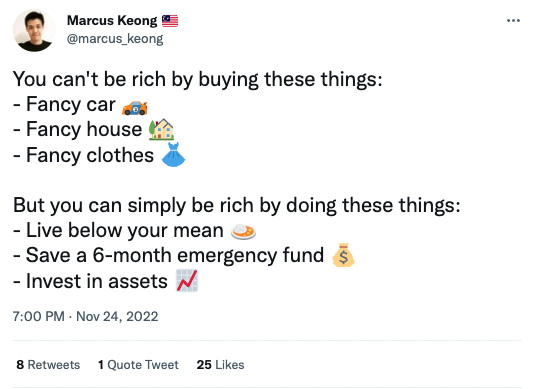

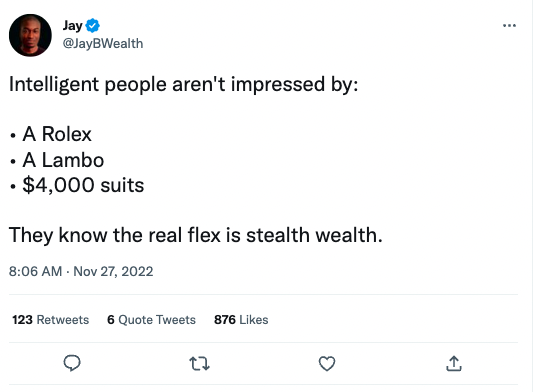

It’s the way people in business, entrepreneurship, and finance circles fantasize about—and project those fantasies upon—what “the rich and successful” do with their money, and the way it often culminates in a logical fallacy that “rich people” don’t have nice things (or, conversely, that only people who lack financial responsibility have nice things).

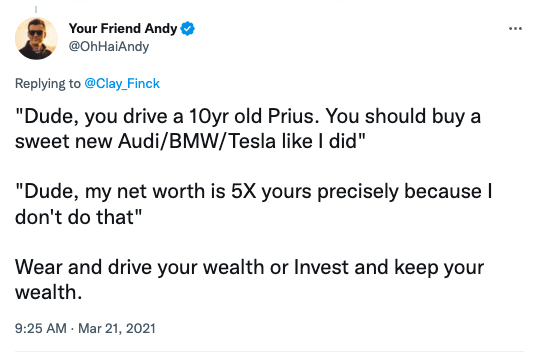

It’s easier to show than tell:

The tropes abound, and they’re strangely specific.

Rich people drive Camrys! They make coffee at home! They wear secondhand clothes! They don’t enjoy their money, they simply hoard it for ~generational wealth~.

The most quintessential depiction of this phenomenon is the way people love pointing out that Warren Buffett still eats at McDonald’s and owns the same home in Omaha he bought in 1958. Quirky fun facts, sure, but it would be a mistake to suggest these have literally any causal relationship with his financial status.

The sometimes implicit (but often explicit) suggestion is that this intense frugality and self-denial is what made someone rich in the first place. Much of this myth-making is almost certainly derived from the book The Millionaire Next Door, which minted this persistent generality.

And hey, to be fair, I think there’s something beautiful about a simple life—I’m not trying to suggest frugality is a bad thing, or that it should be avoided. Just that it usually has very little to do with how people amass vast fortunes.

The rich, they’re…just like us? Not quite.

Not to rely too heavily on anecdotal evidence, but this type of proselytizing has always struck me as discordant because the (very few) wealthy people I know (as in, “multi-8-figure net worth”) live in multimillion-dollar homes, drive luxury vehicles, and fly first class (or private) to their expensive vacations (a sentence that physically pains me to type).

I’m not sure where all these unassuming pauper zillionaires are, but they seem to exist only in the imaginations of the thinkboiz who use them as virality fodder.

A Rolex? A “Lambo”? Have these people ever seen a single movie about investment bankers?!

It all drives at this insidious implication that massive wealth should be achievable by anyone, if they’re sufficiently able to just sleep a little less and make love to a 15-year-old Toyota regularly.

To be fair, I also know a few people who became millionaires after 40 years of hard work and sacrifice. They accumulated $1 million in the same slow-and-steady way I’d walk a marathon. But it’s worth explicitly distinguishing between these types of people—who genuinely did scrimp and save for an entire lifetime—and Warren Buffett.

It doesn’t even feel appropriate to use the same word to describe them. $1 million in retirement is enough to support a $40,000/year lifestyle, assuming you ascribe to the 4% rule. Warren Buffett earns more than that in two minutes.

I don’t think anyone would logically group these two levels of wealth together if pressed, but “the rich,” “millionaires,” and someone like Warren Buffett are used surprisingly interchangeably in this type of clickbait, and it’s worth highlighting just how cosmic the gap is.

But who cares?

While it’s not inherently harmful to suggest someone should be frugal, it does expressly miss the point, if its intention is to create a how-to manual for becoming wealthy.

Although there are certainly notable exceptions (like corner store owner Leonard Gigowski, who supposedly left a $13 million endowment to his former school, assuming this story passes the fact check), most people don’t become wealthy because they’re driving an old car.

None of this is to suggest that someone can’t become independently wealthy through their own decisions—just that much of our online fantasizing about morning routines, old beater cars, and coupon clipping is a sideshow. Here are a few more, for good measure:

Trying to project middle class habits onto rich people and then extrapolate backwards (“See? Just live like this and you’ll get there, too…”) is a logical fallacy.

The people who become really wealthy do it through earning or inheriting a high income and investing it

Using your income to buy (or build) cash-producing assets over time is how people become wealthier, and yes, that’s only possible if you’re earning more than you’re spending (or ahem, inheriting money). The laser focus on frugality is ultimately a distraction from the truth, because it directs the lion’s share of the attention to the less-important side of the wealth-building equation.

Graham Stephan, who “saves 99% of his income,” comes to mind, as does Invest with Ace, who enjoys “8-figure frugality.” Both make lifestyle choices that are right for them, and are careful to suggest these preferences for frugality are not why they’re rich (they both got rich from real estate investing and content creation). Graham in particular is often heralded for his ultra-frugal habits and his $7m net worth, but again, these two plot points are mostly uncorrelated: He reportedly earns $120,000 per month from his YouTube channel, affiliate links, and real estate classes alone. His income is the reason he’s wealthy, not because he never orders takeout.

But it’s much harder to create a YouTube channel that generates as much as $3m per year in ad revenue than it is to buy generic brands at the grocery store, so we tend to focus on the latter when we talk about the “habits of the rich and successful” worth mimicking.

Much like we’ve all learned from the SBF-ad nauseam news cycle, being super frugal is merely an eccentric personality trait that—in the vast majority of cases—is not causally linked at all to impressive wealth.

This fantasy—that only people without financial security have nice things—is simply not grounded in objective reality, and it casts a shameful hue on anyone who does choose to indulge in the fruits of their labor.

It’s just a lifestyle choice that some rich people make. It’s not the reason wealthy people are wealthy.

It’d be like if LeBron James said he eats Pop-Tarts every morning for breakfast. Mimicking this choice will not improve your basketball proficiency, but that probably wouldn’t stop Wealth With Chad from writing a thread about why bagels are trash.

LeBron’s car collection is reportedly worth $3 million. He must’ve missed the memo about Camrys. And sure, Buffett still owns the home he bought in 1958, but he also has a private jet—that tidbit is typically left out of the threads about his Big Mac habit.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time