Why You Shouldn’t Bother to Try to “Time” the Market

February 17, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

At least a few times per week, I receive a DM that sounds something like this:

“I’m thinking about starting to invest, but should I wait? The market is doing so well right now. Should I wait for a dip?”

My friends, if only. If only we knew when, if, and to what extent the market will dip.

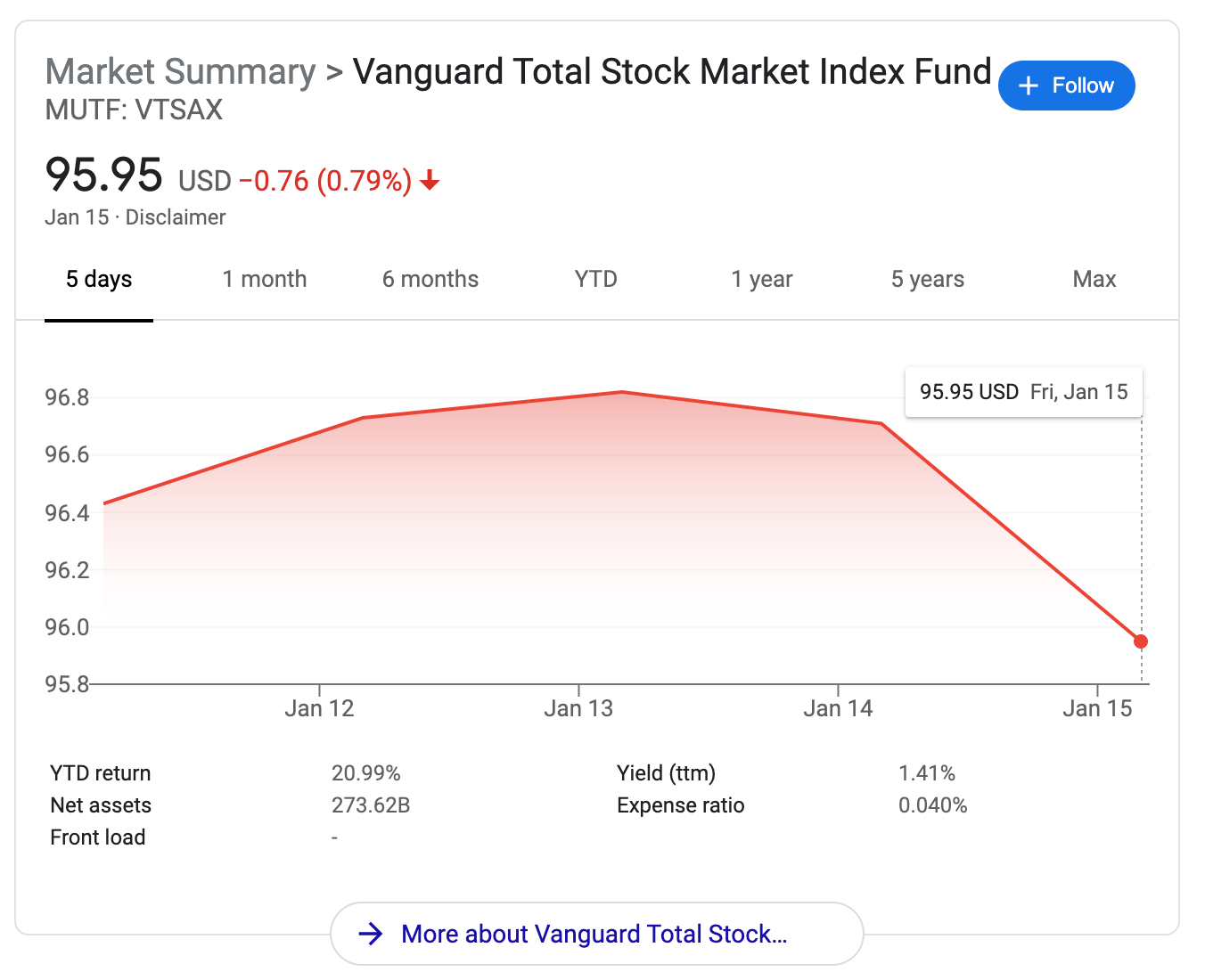

In order to visualize how futile this attempt is, let’s look at the stock market’s movement within a few days (represented by the performance of the index fund VTSAX, the Vanguard Total Stock Market fund):

Without looking at the numbers running down the Y-axis, you might assume that buying at the “height” and buying at the “dip” would make a really big difference. Of course, this represents the difference between $96.80 and $95.95, so… unless you’re wrestling with whether or not you’re going to buy the extra shot of espresso for your morning coffee, I wouldn’t wrestle with this decision, either.

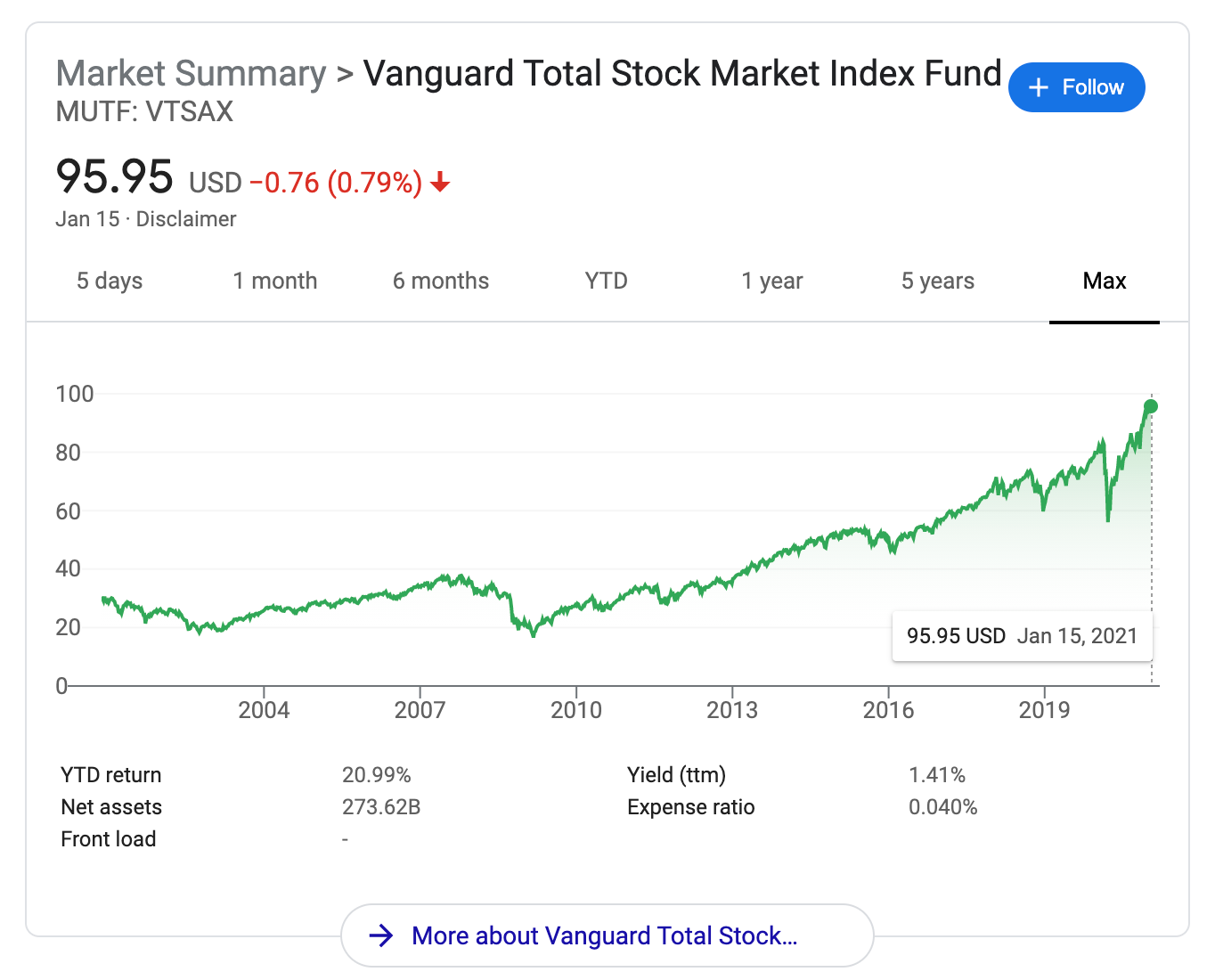

Of course, because the media loves to sensationalize big highs and low lows, it might feel like the stock market is an unpredictable rollercoaster. But what happens when you look at this same index fund over, say, 20 years?

Let’s look at VTSAX since 2000.

See that big dip toward the end? That was March of 2020. Look at where the market is now, less than a year later: Above where it was before the dip.

When you zoom out a little, it looks less like a wild ride and more like a (more or less) steadily climbing line, with little peaks and valleys.

Why trying to time the market is impossible

Nobody is able to consistently predict whether or not the market will go up or down, and that’s because the things that cause precipitous crashes are, by definition, completely unexpected.

Think back to the Coronavirus panic hitting the U.S. full-force in March. We knew about the Coronavirus in January; in February, President Trump stopped flights from China. But the crash didn’t begin until March 9, when the world (and the U.S. specifically) plunged into a panic.

Put simply, if there were sufficient information available that allowed everyone to know something outrageous and terrifying was coming, there wouldn’t be a panic that results in a massive selling of shares and subsequent crash.

Even think about the 2008 subprime mortgage crisis: All the big banks (and all the allegedly smart people within them) knew what was happening, and yet only a handful of people were able to connect the dots and realize that the entire economy was about to crash. (Wanna know more about this? Watch The Big Short.)

What you miss out on when you’re waiting around for a dip

If you try to wait until a period where you perceive the market to be down to invest your money, you’re missing out on precious time that your money could be compounding. Your perception of what’s “up” or “down” is relative to a much smaller sample size of market moves than what’s historically, statistically significant.

So what happens if you try to employ the ever-so-tempting but basically impossible “buy low and sell high” strategy?

J.P. Morgan Asset Management’s 2019 Retirement Guide showed that if you had missed just the 10 best days in the market between 1999 and 2018, your total return is cut in half.

Think about that: If you miss the 10 best days in two decades, your total return is cut in half.

That is INSANE! And the craziest thing is, we don’t know when the “best days” will be. Even after the big drop in March, the outlook was so bleak that trying to short-sell the market was very popular (“shorting” is a term that basically means you’re betting the market will continue to go down, and if you’re right, you get money – it’s like gambling, in some ways).

But it didn’t. It climbed. And climbed. And climbed some more.

Our economy was crumbling, millions were out of work, the federal government was doling out money like it came from a Monopoly box: And the market was POPPING. OFF.

All the short sellers lost money, and it didn’t really make very much sense.

What should you do instead?

One of the most strategic approaches to investing you can use is called dollar-cost averaging. It’s an attempt at minimizing the amount of volatility you experience by committing to invest the same amount of money in the same fund at a regular interval.

For example, you might decide you’re going to invest $500 per month into VTSAX. When it’s up, you invest. When it’s down, you invest. Over time, the average price that you pay for your shares starts to normalize.

If VTSAX is $100 per share one month, you’ll get 5 shares for your $500. If it drops down to $75 per share, rather than pulling your money out and panicking, you simply buy $500 more – but this time, you get 6.66 shares, because they cost less.

That’s why when the market drops, it’s always a good idea to (counterintuitively!) keep putting your money into it – this is easier said than done, as you may not feel as excited about dumping more money into a fund that’s already losing your money, but remember: It’s like the shares are on sale.

At the end of the day, time in the market beats timing the market

You should strive to get as much money into the stock market as early as possible to maximize the amount of time your money has to grow, instead of trying to time a dip for your first big investment. After all, what if you HAD invested in the stock market right before the drop in March?

You would’ve paid $83/share before the drop. After the drop, you would’ve paid $54/share at its low, and probably wanted to kick yourself.

But if you had continued to invest through the dip, you could’ve taken advantage of the “shares on sale” mentality, AND your shares today would still be worth $95 each, a 14% increase from when you got in. Not bad, huh?

Nothing is more on your side than time when it comes to investing. Whenever I come into unaccounted-for money, I invest it almost immediately. Even an extra month in the market over the long-term can matter a lot. That’s why retiring at 35 with $1M will still net you more money when you’re 65 than if you only invest a little bit each year to retire at a normal retirement age – because you had an extra 30 years for a humongous sum to compound.

Why is this good news for you?

I hope you feel encouraged by this post that you don’t have to be some market expert to get wealthy through simple index fund investing – in fact, even the market experts probably won’t do as well as you do if you commit to this simple dollar-cost averaging approach. Why? Because nobody – not even the experts – can do it consistently over time.

And we know those margins are razor thin – you miss a few days (10, to be exact) over 7,300 days, and your returns get slashed in half.

That means 50% of your returns come from .001% of the time. I don’t know about you, but I don’t want to risk it – I’d rather just go for the entire ride to make sure I catch all the good parts.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time