How I Organize My Life for #TaxSZN

Let me preface this post by saying that if you have access to a CPA and you’re feeling a little unsure about doing your taxes yourself (or, more realistically, you just don’t want to), it’s probably wise to pony up a few hundred bucks and pay your CPA to do them for you.

That said: Regardless of whether you file your own taxes or hire a CPA to do them for you, you need to be organized. CPAs aren’t mind readers and the return they file for you will only be as accurate as the information you provide them, so I think this “organizational framework” is useful for anyone who feels like they’re in over their heads.

(And to be clear, I often feel like I’m in over my head when it comes to taxes—I just filed for 2021 and our final tax bill was $36,640. Woof. I’m almost certain I’ll end up being audited because we had so many forms this year, but having a system in place to organize them ahead of time helped tremendously. In retrospect, I should’ve probably just hired someone.)

So your 2021 return is (likely) water under the bridge and you’re trying to get your shit together ahead of time for 2022 so you don’t have to undergo the same #pain as you did this year: Cheers to that! No time like the present. Let’s dive in.

This post may feel like it was sponsored by TaxAct, but it wasn’t (despite me sliding in their DMs plenty of times)—I’m just including them where it’s relevant since that’s who I used to file this year. Ironically, I signed up for the “Self-Employed Package” that costs $129, but since my bill was so large, I’m pretty sure they’re getting a kickback of some percentage because they ended up not charging me for it. Go figure.

Primary Tools: the Wealth Planner, Lots of Digital Folders, and Caffeine

I promise I’m not about to put the hard sell on you; you can create your own version of this Planner if you don’t use mine. I just like to keep everything in one spot, particularly:

My business revenue (income that comes in the form of 1099-NECs and 1099-Ks from sponsors, affiliates, and payment processors)—tracking my revenue myself throughout the year per client allows me to verify the 1099s they send me to make sure they’re reporting accurately and I’m actually receiving the amount they’re telling the IRS they’re paying.

My business expenses (expenses that you have to track on your own; nobody ‘reports’ these back to you)—whether it’s my podcast provider, Squarespace fees, cell phone bills, or something else entirely, I track my business expenses throughout the year so I can look back at the end and easily tally up what I spent and where.

Note: If you’re self-employed, you can also deduct part of the cost of your home & utilities (assuming you work from home on your business) using the ‘regular method’ calculation in the TaxAct software.

The TaxAct software will likely also calculate the QBI (Qualified Business Income) deduction for you, which can wipe off another substantial portion of your taxable income.

This is an area where I probably could’ve milked it more (travel expenses, food expenses, etc.) but I played it safe.

My retirement account deferrals tied to my business (SEP IRA or Solo 401(k) contributions, in most cases)—you don’t really receive any forms that tell you how much you’ve contributed, so I like to track it every month in my Planner so I know what number to report to the IRS as my contribution (this is huge, since these contributions are typically large tax deductions). If you’re contributing to an employer 401(k) or other retirement account, you’re covered here—they’ll report your contributions on your W2 and you don’t have to do anything else.

Our taxable brokerage accounts (wherever we invest money that’s taxable, outside of a qualified account like a 401(k) or IRA)—good news! You don’t need to file forms for your tax-advantaged accounts since they’re tax-sheltered, but you do need to file your 1099-DIVs from your brokerage accounts (keeping track of these in the Net Worth tab reminds me where we have money so I don’t miss any forms that are typically housed in the Tax Documents section of our accounts). If you have high-yield savings accounts with substantial amounts of money inside them, you’ll also likely need to file your 1099-INT to report your interest income. Interest is taxed like ordinary income (while qualified dividends are taxed like capital gains).

I basically duplicated our personal Wealth Planner and revamped it for business, changing the “Spending” tab to “Expenses” and “Saving” tab to “Revenue,” that way I could track revenue by source more easily from 10-12 different clients.

Having all of this information mapped out in one place will make it easier to both (a) double-check the forms you do receive and (b) have an easy bird’s eye view of where you may be missing forms. This year, I had to reach out to several different sponsors who hadn’t sent me my 1099-NEC (stands for “Non-Employee Compensation”) yet so I could file on time. Had I not been tracking revenue per client, I would’ve had a much harder time tracking down who hadn’t sent me the proper forms yet.

Basically, tracking allows me to be the adult version of Grade Grubber Summer from School of Rock.

Quick Review of Common Forms Mentioned

W2 from your employer if you receive wages from which taxes are already withheld

1099-K if you’re using an online payment processor

1099-NEC if you’re receiving payment as a contractor

1099-DIV if you’re using taxable brokerage accounts

1099-INT if you’ve got a savings account (or any other type of account) that pays interest

1099-MISC for just about everything else; this year, I received a 1099-MISC form from Chase for the points I received as referral bonuses (roughly $4,000 worth, according to them)

If you’re paranoid about missing stuff, go into your various email accounts and search your inbox for “W2” and “1099.” The vast majority of the time, these forms get emailed to you directly or mailed to your house, but knowing where you have money will make it easier to go to the source (e.g., a taxable brokerage account) if you notice you haven’t received anything yet.

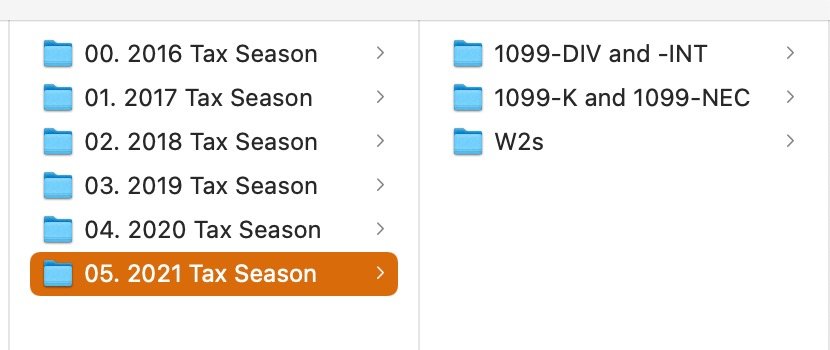

It can be a lot to keep track of, so I have a pretty robust file system on my computer for the ones that are received electronically and a physical folder for the ones that come in the mail.

Here’s what it looks like:

It’s giving “obsessive compulsive.”

Once you file your return, you’ll probably receive something called Form 1040 that outlines everything you reported (with other forms attached, depending on your situation). I like to save that as well, as sometimes they’ll ask you to report your “2020 AGI from line 11 on Form 1040” (as a wildly specific example) when filing in the future.

Examples of What My Tracking Looks Like

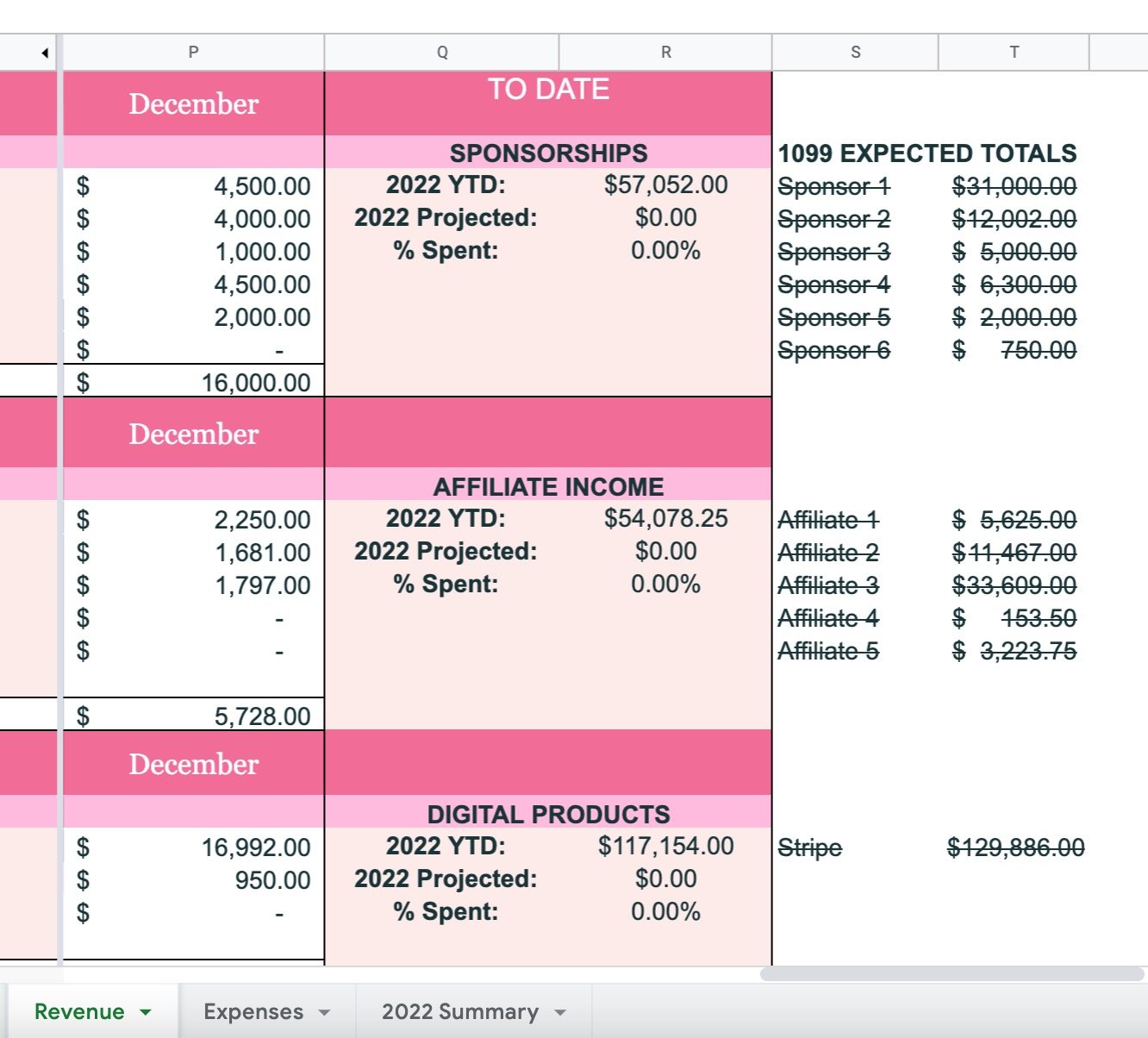

Business revenue

As you’ll see, I categorize my business income into different sections and then track how much revenue each sponsor, affiliate, or product generates (I redacted names for #confidentiality purposes in this screenshot).

I’ll usually tally up the entire year of payments from that source in the “1099 EXPECTED TOTALS” column and then cross them off as I receive the forms in the mail.

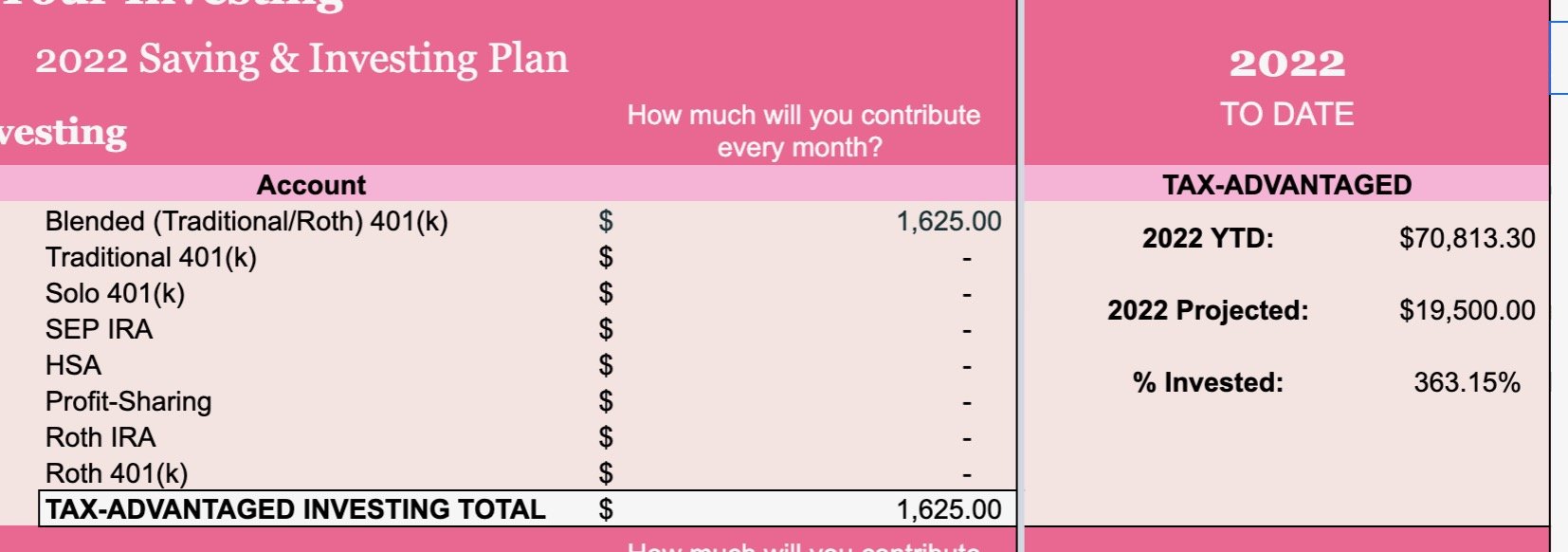

Solo 401(k), SEP IRA, or other self-managed tax-advantaged accounts

Same with my Solo 401(k), noted above—as you can see, I contributed $70,813.30 to tax-advantaged accounts in 2021, and roughly $46,000 of it came from the “Solo 401(k)” row, so I knew exactly what to claim as a contribution so it would match whatever Vanguard sends to my IRS Daddy. (I think I miscalculated my contributions because I wasn’t taking my various business deductions into account, so I may need to go back and remove some…we’ll see.)

Taxable brokerage accounts that generate 1099-DIVs

And since we’re filing jointly this year, here’s our breakdown of taxable investing accounts. I knew I needed to submit 3 1099-DIVs for me and 3 1099-DIVs for Thomas (our joint account was opened in 2022 so nothing to report, and oddly, Thomas’s cryptocurrency had $0.00s across the board for what we needed to report, so…prayers up to the audit gods that nothing is amiss there). I hid the brokerage account names for confidentiality purposes, but knowing where each account is located helps with the demented IRS scavenger hunt of finding all the correct forms.

The Wealth Planner separates “Tax-Advantaged” investing from “Taxable” investing, so you should be able to quickly see (if you fill it out) which accounts you’ll need to grab 1099-DIVs for.

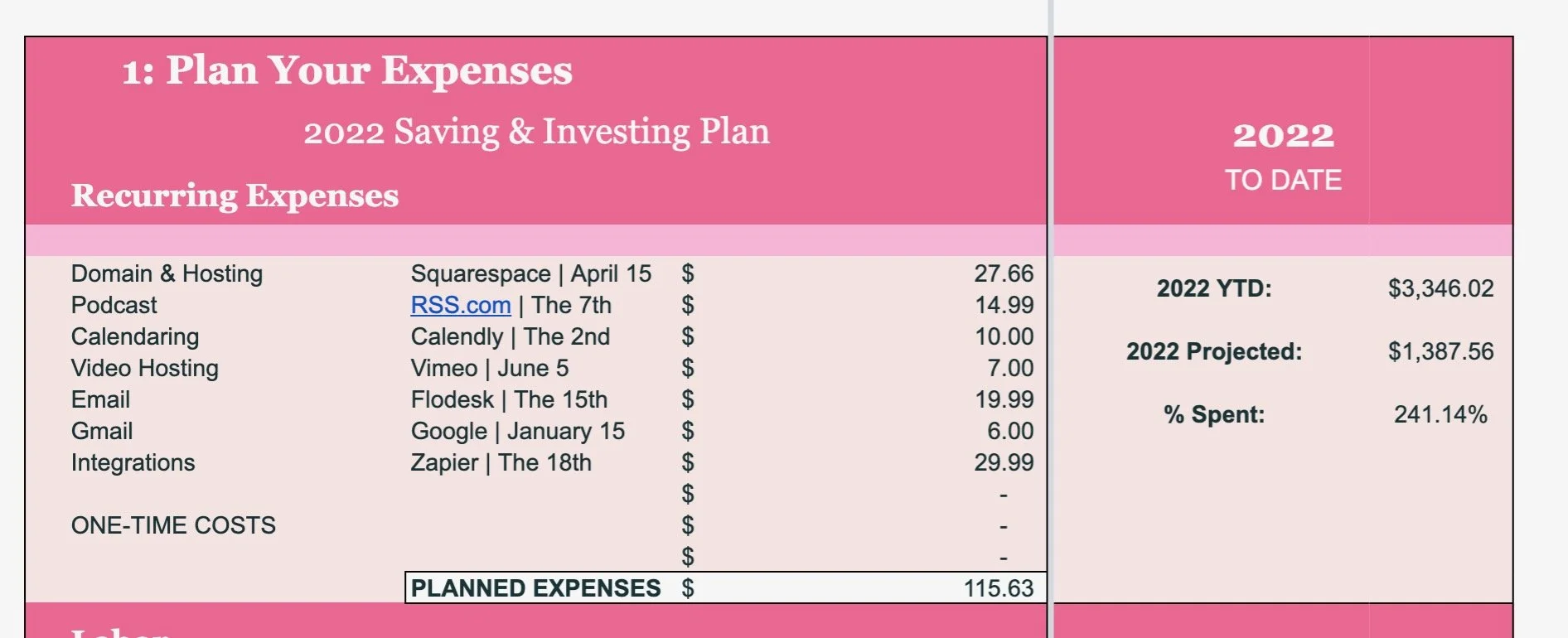

Business expenses

And finally, here’s the breakdown of my expenses. I goofed this year and failed to file 1099s for the two contractors I did work with, so…they got a tax-free gift from me, and I didn’t get to deduct the amounts I paid them. Learn from my mistakes.

The rest of this stuff has been charged throughout the year, so I have receipts to back up my expenses: $3,346.02. I ended up being able to deduct about $3,500 of our rent paid this year as well, thanks to the calculation that the TaxAct software did for me (I had to enter total rent paid and the percentage of the home that I use exclusively for business purposes; it was pretty easy).

How our Return Ended Up Shaking Out

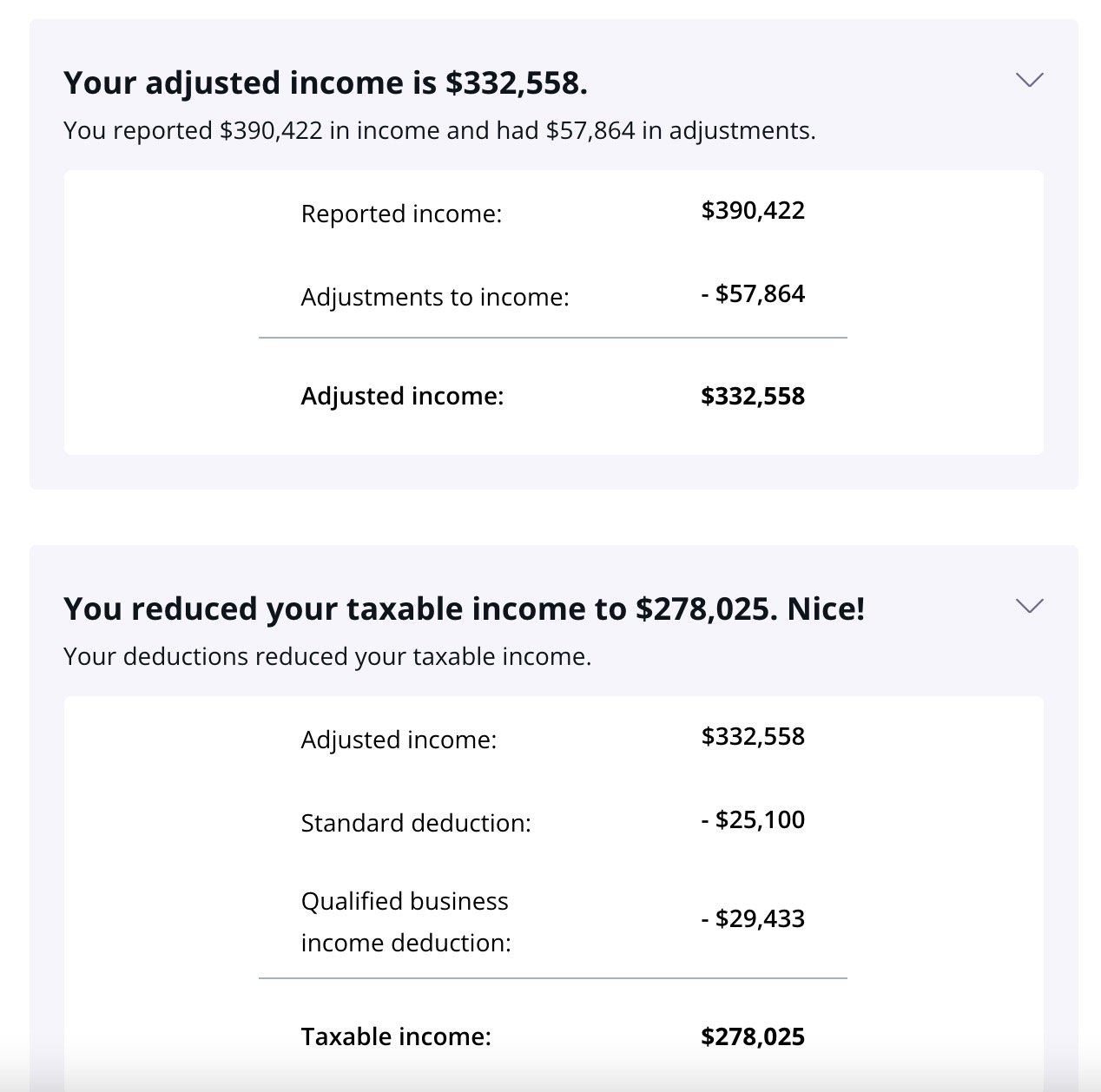

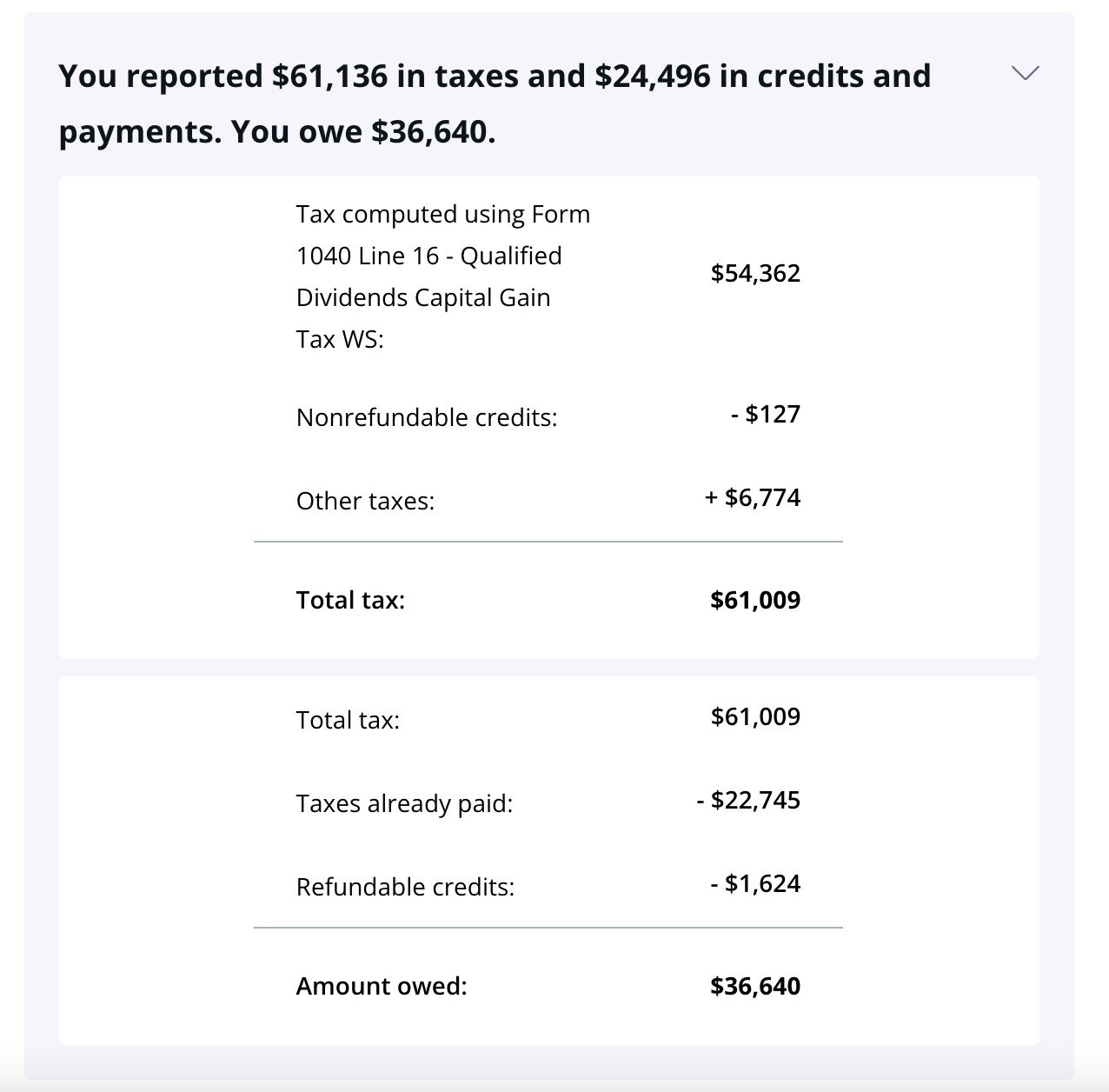

TaxAct provides this nifty little summary at the end (it took me a few months to aggregate everything and another day or two to double-check all the forms; it was certainly not an easy task this year).

We reported $390,422 in 2021 income (so close to $400,000—so close) and “adjusted” down $57,864; this was in the form of deductions like Solo 401(k) contributions and other deductions (moving expenses for an Armed Forces relocation, for example). Your contributions to your employer-sponsored retirement account(s) are already removed from that top line number, so I suppose if you factor those in (about $25,000 between us), we were over $400,000—just another feather in the cap of pre-tax investing, no?

That gets us down to $332,558, from which we were able to deduct the standard deduction ($25,100; 90% of Americans take the standard deduction, and it’s likely you do, too) and the QBI deduction for my business ($29,433) to create our taxable income of $278,025—more than $100,000 less than what we actually earned.

Again, may I shout it from the rooftops? This is almost entirely due to the power of pre-tax investing.

Now for the not-fun part:

Since we only paid $22,745 in taxes throughout the year, we owe—womp womp—$36,640 this year. Still, we’d owe a whole lot more had we not contributed to our pre-tax accounts:

$5,580 to Thomas’s military retirement TSP

$19,500 to my 401(k)

$46,000 to my Solo 401(k)

$2,700 to my HSA

…$73,780. Had we just claimed all of that as income and not contributed it to pre-tax accounts, we would’ve owed closer to $62,000 this year, not $36,000. Yikes.

Conclusions

All in all, I’m grateful that we owe money because it’s a sign of a great year. It’s a little painful to fork it all over at once, but that’s another key thing: Had I been filing quarterly taxes and setting aside 25%-30% of my business income as I went, I could’ve avoided this all-at-once tax bomb.

Like I mentioned before, I’m not entirely convinced I won’t get audited this year because there was so much going on that I’m sure something slipped through the cracks—I’m just hoping my check paid to the IRS will be large enough that they choose to ignore whatever small errors were made along the way.

And if I do get audited, well…#content.