My Experience Rolling Over a 401(k) – Here’s How I Did It Easily

October 18, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

File this type of task with going to the DMV and renewing my car registration – except with much higher financial consequences.

Trust me, if I could pay someone to wait in line for me for a new driver’s license or handle the paperwork for registration renewals, I would – and this task was no exception.

The issue with delaying (or foregoing) this task? According to Marketwatch, forgetting about an old 401(k) plan costs individuals an average of $700,000 in retirement savings over their lifetimes (here’s the original whitepaper).

So you can imagine my surprise when I found out about a service that does it for you for free.

Wait, what’s the catch? I immediately wrote it off as a scam. They’re either going to sell my data to QANON on the dark web or make a break for it with my hard-earned employer contributions. No way, José.

Is Capitalize legit?

But upon doing some further digging, I found out a few things:

-

They may get paid a commission by the brokerage firm you transfer to if they have a partnership with them, but there’s no direct cost to you – and there’s no illicit dark web data sales going on, either, so rest assured your #data should be A-OK.

-

It was featured in Tech Crunch, Yahoo! Finance, and Bloomberg, which means it’s good enough for me.

One thing I want to call out from the jump is that the primary reason I was hesitant to roll over a 401(k) to self-management in an IRA is because of the fear of losing the coveted Backdoor Roth IRA loophole. After a certain income ($140,000), you can’t contribute through the “front door” of a Roth IRA. You have to use the backdoor, as I wrote about here.

If you have any other Traditional IRAs hanging around (whether they’re regular, rollover, SEP, etc.), it fouls up the taxes and you end up with a big bill. I wasn’t keen on taking that risk, until…

Recently I decided that the backdoor Roth IRA may be more trouble than it’s worth. After all, since I still have access to an employer-sponsored 401(k) with Roth availability, I decided I’d just get the appropriate amount of Roth exposure through my 401(k) and move on with my life.

You can also consider rolling an old 401(k) into your new 401(k), but I like the control and options that comes with an IRA that’s self-managed instead of managed by my company (just a personal preference; you may feel differently!).

Now that that preamble is out of the way…

What’s the best way to roll over a 401(k)?

Ideally, a way in which you’re paying (a) no taxes on the amount and (b) someone else is doing it for you. Hard to beat, right?

Fortunately, a rollover IRA doesn’t impact your annual contribution limit to your other IRAs (i.e., you could roll over $50,000 to a Traditional IRA from your Traditional 401(k), then turn around and contribute $6,000 to a Roth IRA without issue).

I liked this process because it spelled out – at each step – what I needed to do to make things go seamlessly.

Using Capitalize, step-by-step

Step 1: Visit Capitalize’s site and click Get Started.

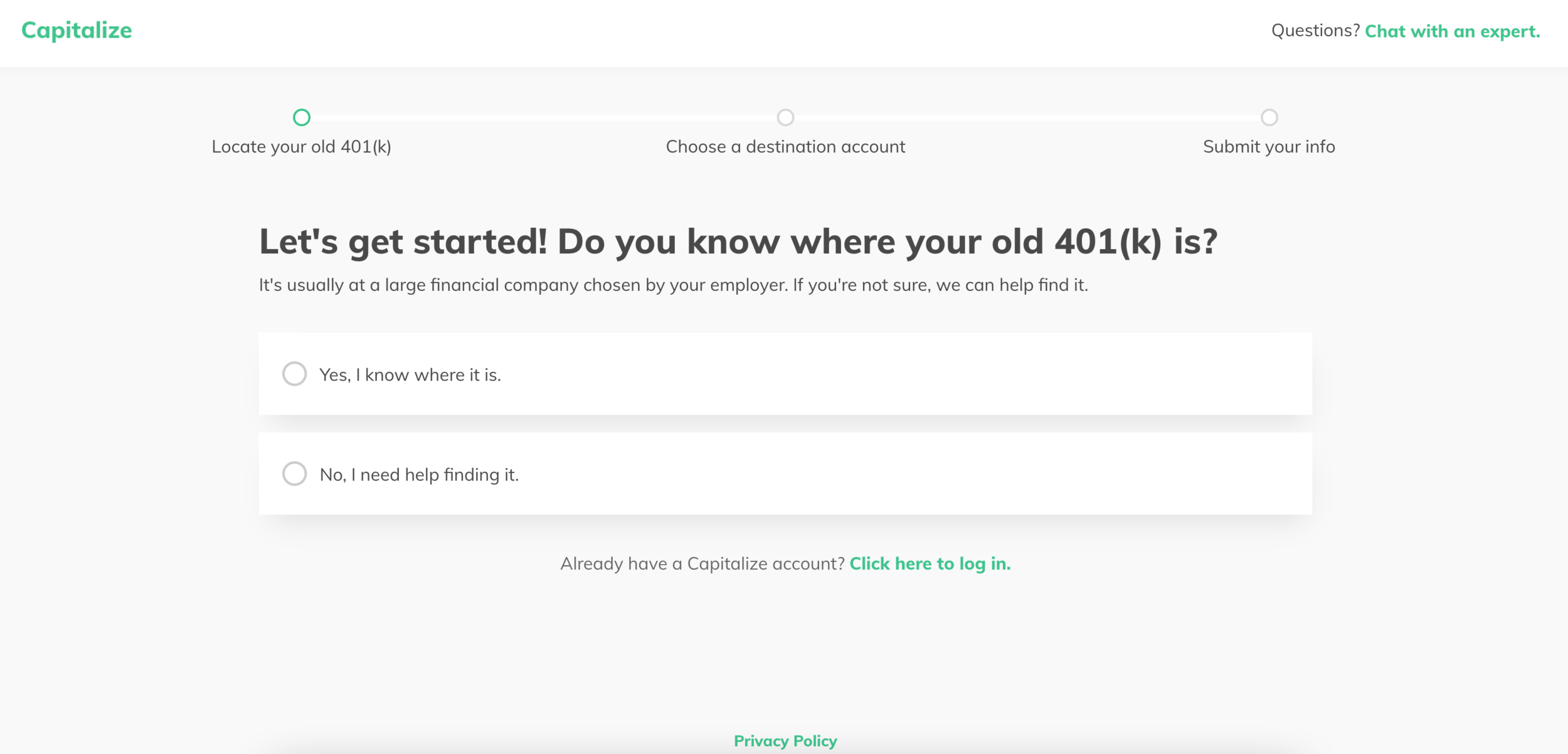

Step 2: Answer honestly! If you don’t know where your 401(k) is (i.e., the provider), they’ll help you find it.

I knew which brokerage firm housed my 401(k) through my employer, so I selected, “Yes, I know where it is.” Can we just take a moment to appreciate some good UI? I love the bite-sized questions.

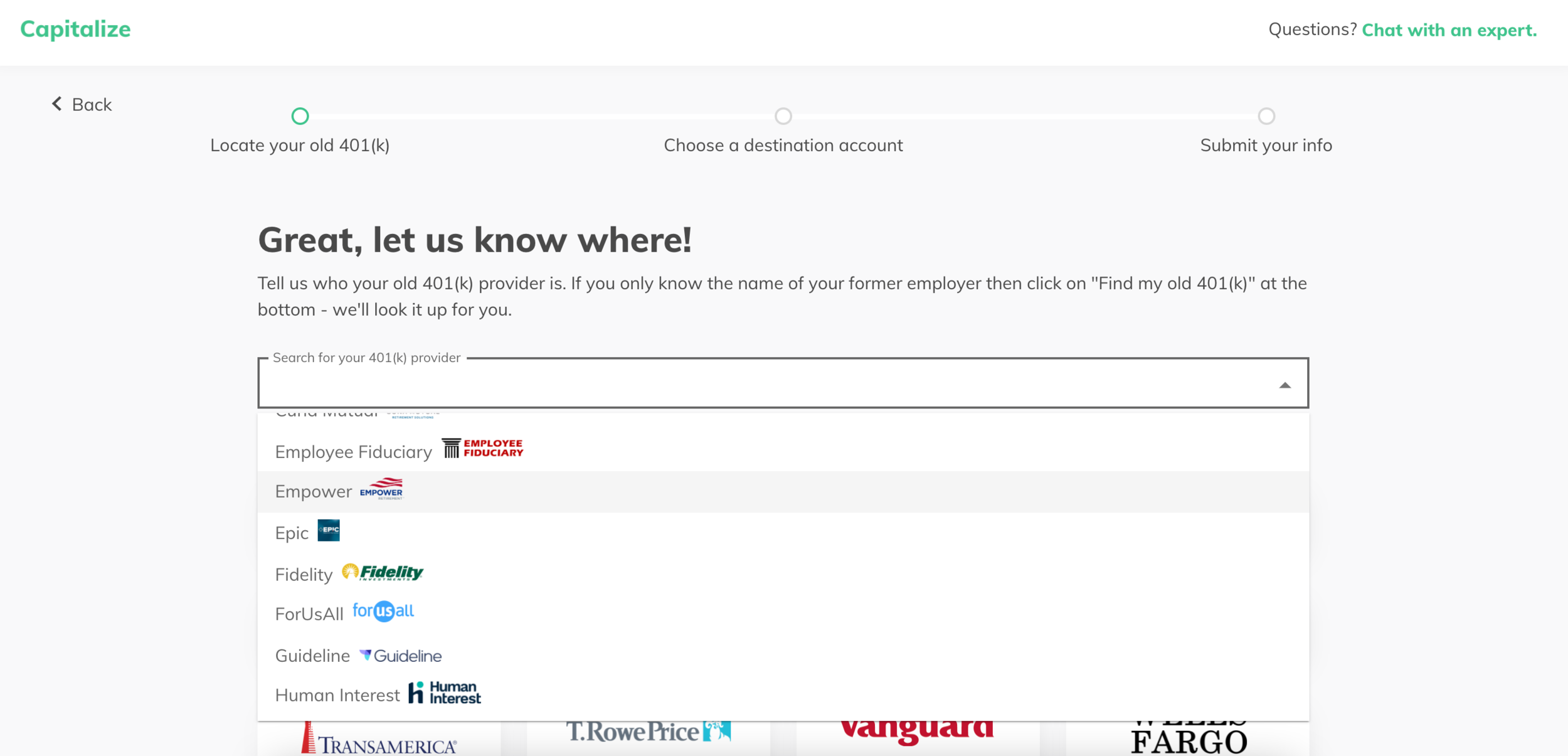

Step 3: Select your provider from the dropdown list.

I was able to find mine easily; there were so many obscure ones that I’d be surprised if yours wasn’t listed.

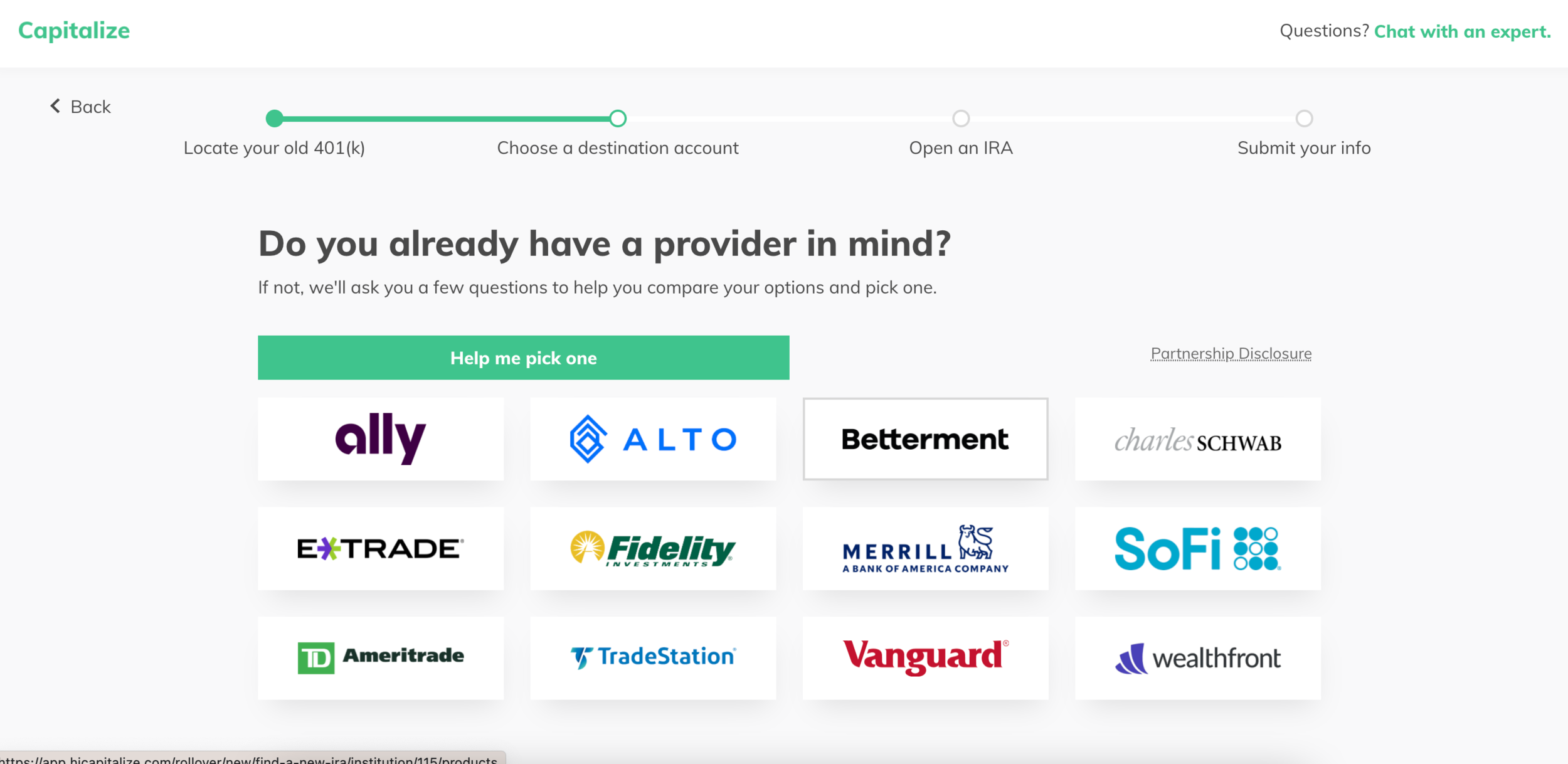

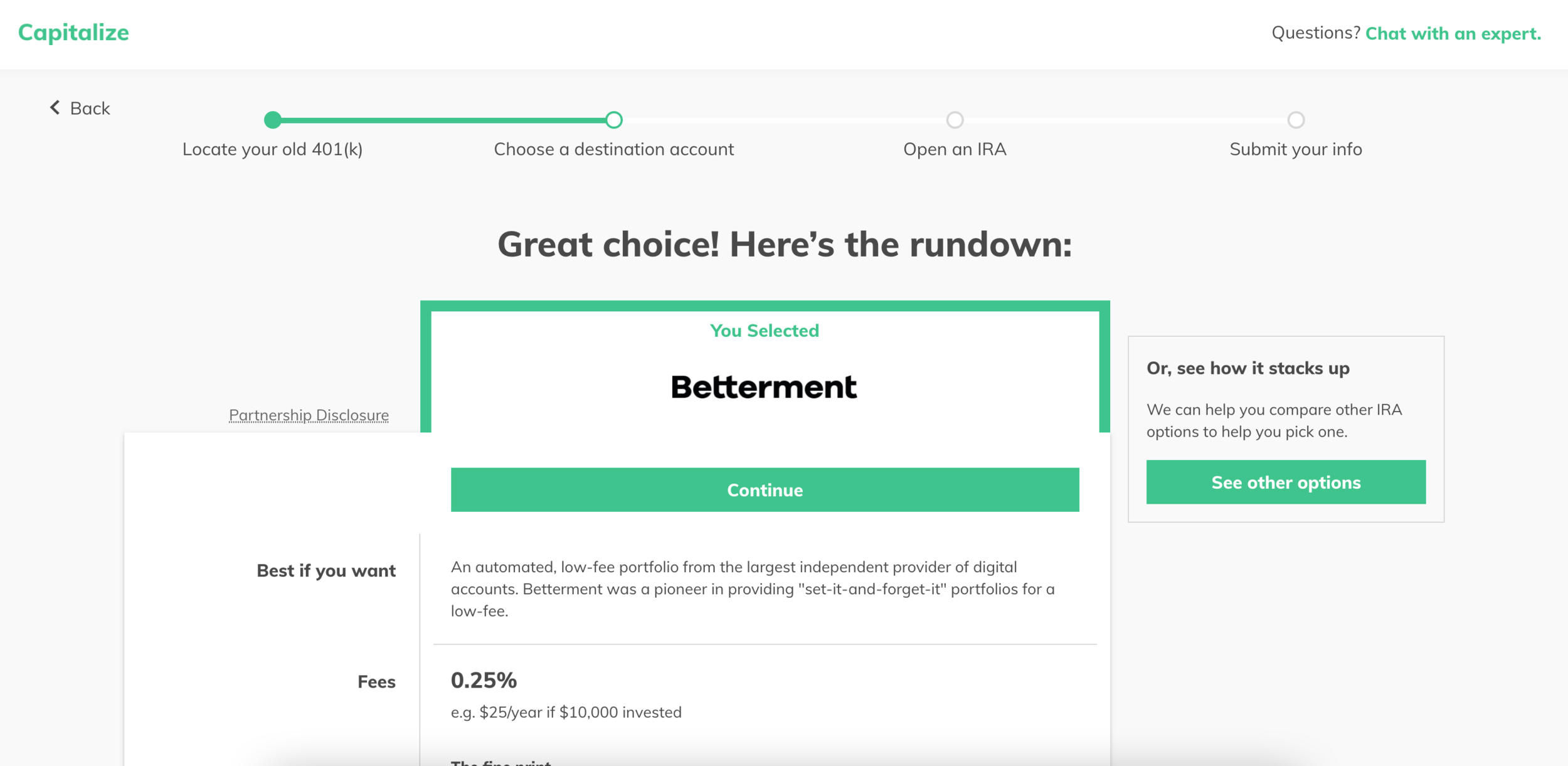

Step 4: Choose which provider you want to transfer to.

Notice how Betterment is an option! Yeehaw, boys ‘n girls. You know that’s already my top recommendation.

Step 5: Make any further necessary decisions about account type.

I clicked through a few of the options to see what happened and each brokerage firm prompts different questions; for the sake of this example, I continued to use Betterment.

It’s also around this time that you’ll need to tell them whether or not you already have an IRA open that you’d like to use. This is an interesting aspect of 401(k) rollovers – you need to have the Traditional or Roth IRA open in order to receive the funds (in other words, they need somewhere to go).

Keep in mind that you want the tax statuses to match.

For example, I already have a Roth IRA that I can roll Roth 401(k) contributions into, but I don’t have a Traditional IRA yet for my Traditional 401(k) contributions, so I’ll need one to be opened for me as part of this process.

They handle that, too, which is nice.

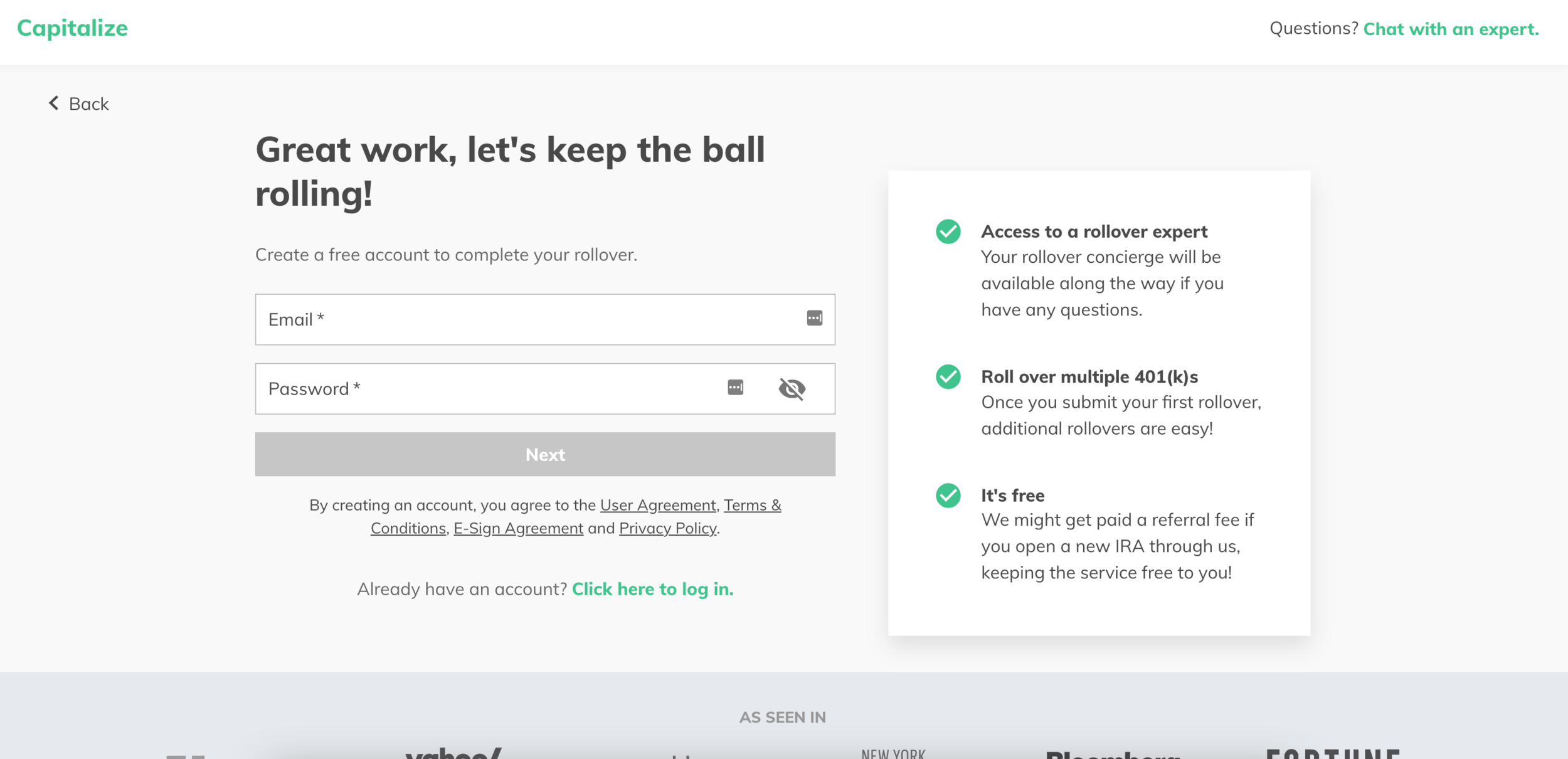

Step 6: Create an account.

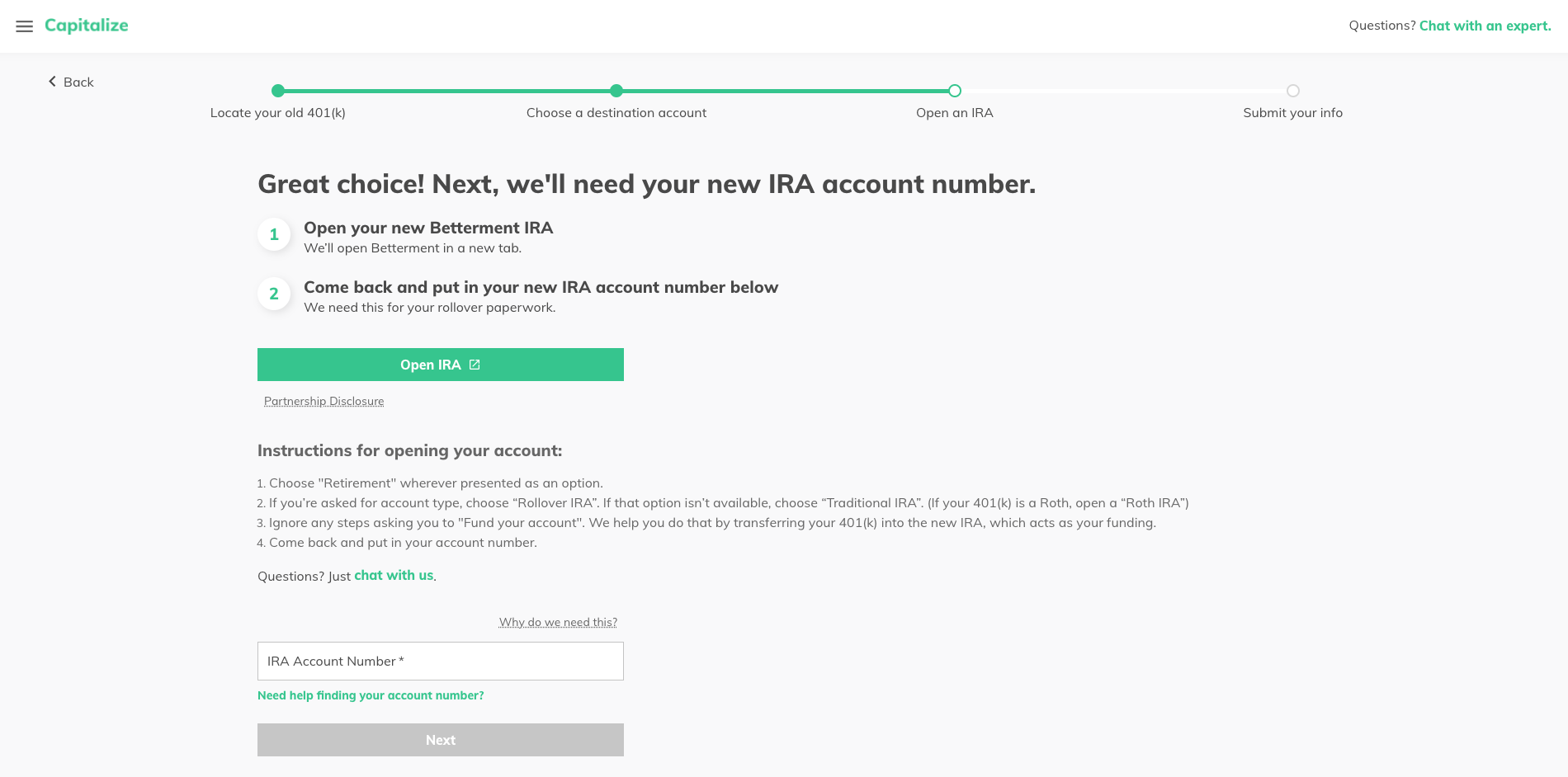

Step 7: Open an IRA for your 401(k) rollover to “land” in, if you don’t already have one.

Like I said, I didn’t yet have a Traditional IRA, so I had to follow the steps to open one. The “Instructions” piece was super helpful to know exactly which type of account to choose. After opening one, you’ll enter the IRA Account Number so Capitalize knows where to send your 401(k).

Timing

In talks with one of the experts, I learned that you (usually) have to wait about 2 weeks from when you leave a job to when you can roll over your 401(k), so keep that in mind if you’ve just submitted your notice (but hey, brownie points for enthusiasm!).

You can rollover more than one, in case you’ve been collecting them in your wake on a Boulevard of Broken Dreams-style cruise through Corporate America.

What happens after you submit your information

What happens next depends on what type of 401(k) plan you have.

If you’re required to fill out a form, Capitalize will do it for you (BLESS!) and send it to you via HelloSign to complete. In many cases, they’ll call your provider for you, and only dial you in when they need you to authorize the transfer. It’s like a virtual assistant for 401(k) rollovers. No more long wait times for you, #RichGirl.

On the call, they’ll verify whether or not you have mixed (Traditional and Roth) assets in your account, if you have company stock, and how much of your 401(k) has vested (if you had an employer match with a vesting period).

It never fails to amaze me how many people have company stock in their 401(k), and knowing how to handle that in a rollover is super valuable. (Remember: Diversification is usually always a good idea, and holding a bunch of one stock simply because you worked for the company isn’t usually a great long-term plan.)

Mailing a check vs. mobile-depositing

Then, they’ll verify where and when the money will be moved to your IRA. In many cases, the 401(k) provider will mail you a check (it will say, “For the benefit of <Your Name>,” that means it’s a direct rollover). Sometimes they’ll be able to wire the money, but a check is the most common.

If your new IRA has a mobile deposit function, you can deposit it on your phone. If you need to physically mail the check to your IRA, Capitalize will literally send you a prepaid, pre-addressed envelope with tracking. At that point, I was sure it would become wheels-off, but no – they give you the damn pre-stamped envelope.

I’m still in the middle of my process, but so far, it’s been super easy.

The fine print, because we’re talking about investing

As always, these are my opinions (not financial advice) about what’s “better” or “worse,” and I’m not a licensed financial planner or advisor. If you’re considering any Roth conversions or making any big changes, consult a CPA.

Investing involves risk of loss and performance not guaranteed. Just my opinions, not advice. I asked Capitalize if they’d be willing to sponsor this review of their product, and they obliged. I may receive a commission if you choose to work with Capitalize using the links on this blog post, and I appreciate your support if you choose to do so!

You may also like…

Featured

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time

![How to Contribute Thousands of Extra Roth Dollars Each Year: The Mega Backdoor Roth IRA [2025]](https://moneywithkatie.com/wp-content/uploads/2021/10/Frame37846-1.webp)