Spreading Out the Misery

September 18, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

During my junior year of high school, I found myself in an unexpected situation where I had the highest grade point average in several of my classes. It wasn’t thanks to any sudden stroke of genius (my prefrontal cortex still had a way to go), but an accidental shift in my approach to studying.

You see, junior year was when I began studying for the ACT and when I got my first job. My parents insisted on the latter once I was able to drive so I could supplement the gas money they were giving me (some of which was being siphoned off for before-school Starbucks, unbeknownst to them).

The additional responsibilities pushed my school anxiety into hyperdrive—I was afraid I wouldn’t have time anymore for my former caffeine-fueled, cram-style method wherein I’d camp out in my friend Nina’s room for the days leading up to a big test and frantically try to commit everything to memory.

>

“I just had to spread out the misery such that each day featured a little bit of work (no ‘off’ weekdays), but no one day featured a lot of work.”

My new part-time job was at a gym’s daycare center, so I’d typically head there after school, do my four-hour shift until about 7pm, then venture upstairs (free gym membership, baby!) and walk on the treadmill for about 45 minutes. While I exercised, I’d review my notes for that day. I’d read through them as many times as I could over the course of the walk, and then head home and finish the rest of my homework.

In retrospect, this sounds like a pretty exhausting existence (or a testament to a 17-year-old’s boundless energy reserves). But this approach—spreading out the misery of my test prep with an hour of leisurely, low-pressure note review each day vs. panic-cramming for the 48 hours before each test—enabled me to start acing tests with very little “official” studying. My weekends before tests were (regrettably) spent running from the cops or (not-regrettably) hanging out with my parents instead of being holed up in Nina’s room practicing geometry.

The repetition of this daily routine paid dividends, literally and figuratively—while I did relatively well in school my freshman and sophomore year, my grades junior and senior year scored me an out-of-state college tuition scholarship that was worth, at the time, about $25,000 per year (and based on how the cost of college has risen since, I’ll assume it’s now worth $250,000 per year—#SadJokes).

I didn’t have to sacrifice sleep, be a genius, or do anything exceptionally difficult: I just had to spread out the misery such that each day featured a little bit of work (no “off” weekdays), but no one day featured a lot of work.

Doing a little bit every day was more manageable than the alternative, and it generated better results—it didn’t require exceptional performance during high-pressure periods (i.e., in the days leading up to an exam), but instead took advantage of my regular ebbs and flows. I’m sure there were some afternoons when I retained more, and others when less material made it through my thick-ass teenage girl cranium, but I dollar-cost averaged my effort.

So often, I talk to young professionals earning above-median (in some cases, well above-median) incomes who feel as though there’s no point in investing in the stock market until they earn $X more (“X” is irrelevant for the sake of this example, but anecdotally, it’s usually about 20% more than whatever they’re currently earning). They’re delaying their misery until an unspecific point in the future that they assume will be less miserable, thanks to having more money on hand. But what does this often mean in practice? Forcing yourself to go above and beyond once you reach your forties and fifties.

>

“The thing is, spreading it out over time requires prioritizing it now—even if it’s just ‘a little every day.’”

Part of the reason we have a tendency to do this, I think, is because we overestimate the struggle awaiting us—we assume we’ll need to turn the dial way up in order to make progress at all, and the idea of doing so seems unbearable (or flat out impossible) in our current state.

But you don’t need to cram the misery into a single decade or two. You can spread it out. The thing is, spreading it out over time requires prioritizing it now—even if it’s just “a little every day.”

Comparing these two strategies

Retirement is life’s ultimate financial pass/fail exam.

Some people start paying more attention as they see retirement looming on the horizon—the metaphoric Tuesday before the Friday test—and spend the intermittent days (years) sick with an undercurrent of anxiety, aggressively cutting back on their spending at the exact moment when they’re probably most interested in letting loose, and realizing they may need to work for a lot longer than they realized.

>

“Diverting 10% earlier in life (a much smaller sacrifice!) means you’ll likely never need to save more than 10% at a time.”

They’re forced to cram a lifetime of financial pain into a few short years.

Compare this with the “spread it out” approach. Rather than struggling to dump 50% of your income into your 401(k) and IRA at the last minute and giving it very little time to compound before you’ll need it, diverting 10% earlier in life (a much smaller sacrifice!) means you’ll likely never need to save more than 10% at a time. This is true even in the years leading up to the big day, when you pull the ripcord and float away from Zoom calls and work alarms forever.

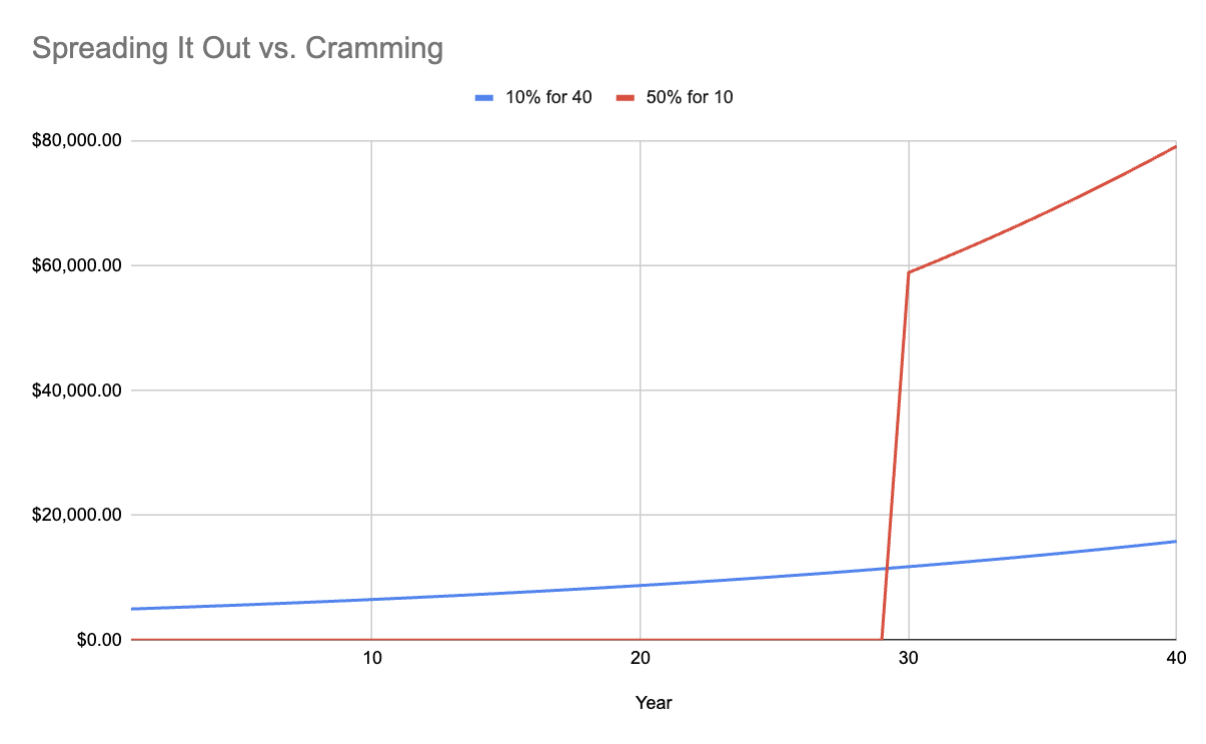

The chart below illustrates the contribution patterns of the two “paths,” one wherein someone saves 10% for all 40 years of their working life, and the other where someone realizes in year 30 (about 10 years before retirement) that they need to kick it into gear. (This assumes two earners who both take home $50,000 per year after taxes in year 1, rising by 3% per year.)

The person making consistent 10% investment contributions never invests more than $15,800 per year over the 40 years. The “cramming” investor must start investing in year 30 with a $58,000 contribution.

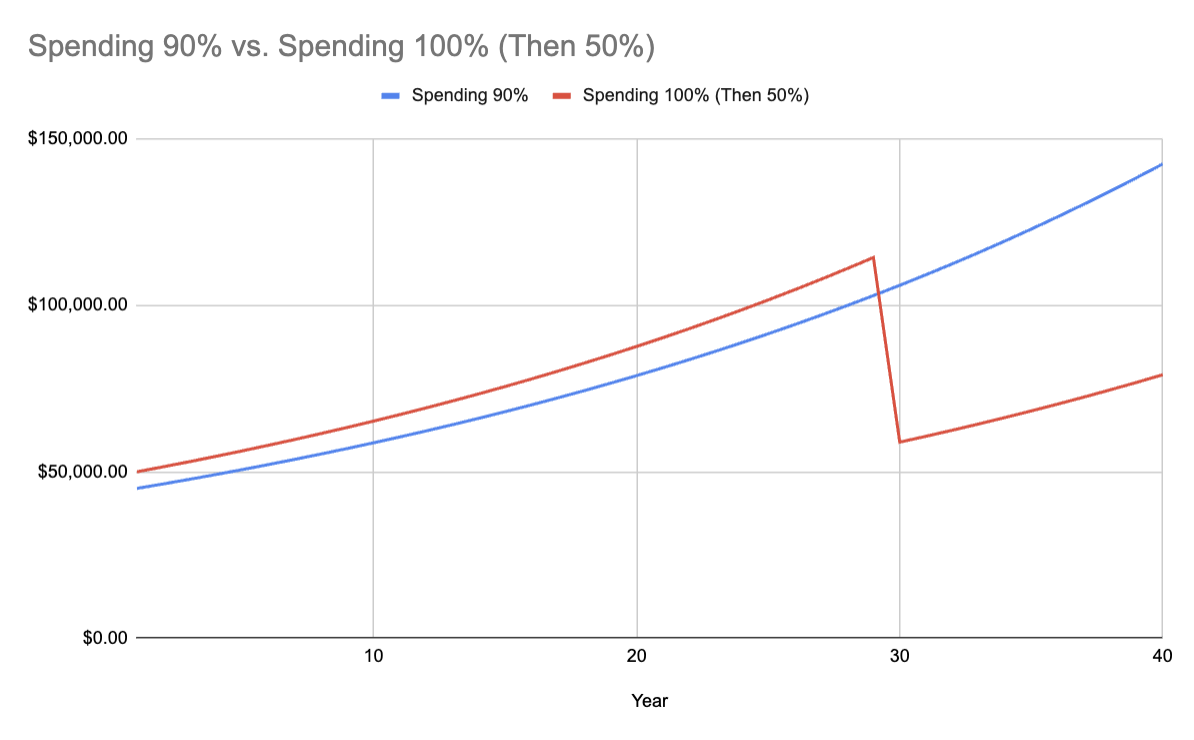

The red investor gets to go balls to the wall with the AmEx for the first 30 years, but notice how similar their spending is for the majority of their working lives, despite how different their last decade looks:

It looks like a negligible difference in spending…until it doesn’t. The blue investor got to spend 90% of their income through all 40 years—whereas the red investor got to spend slightly more until year 30, but then had to drop down to a harsh 50% for the last 10 years.

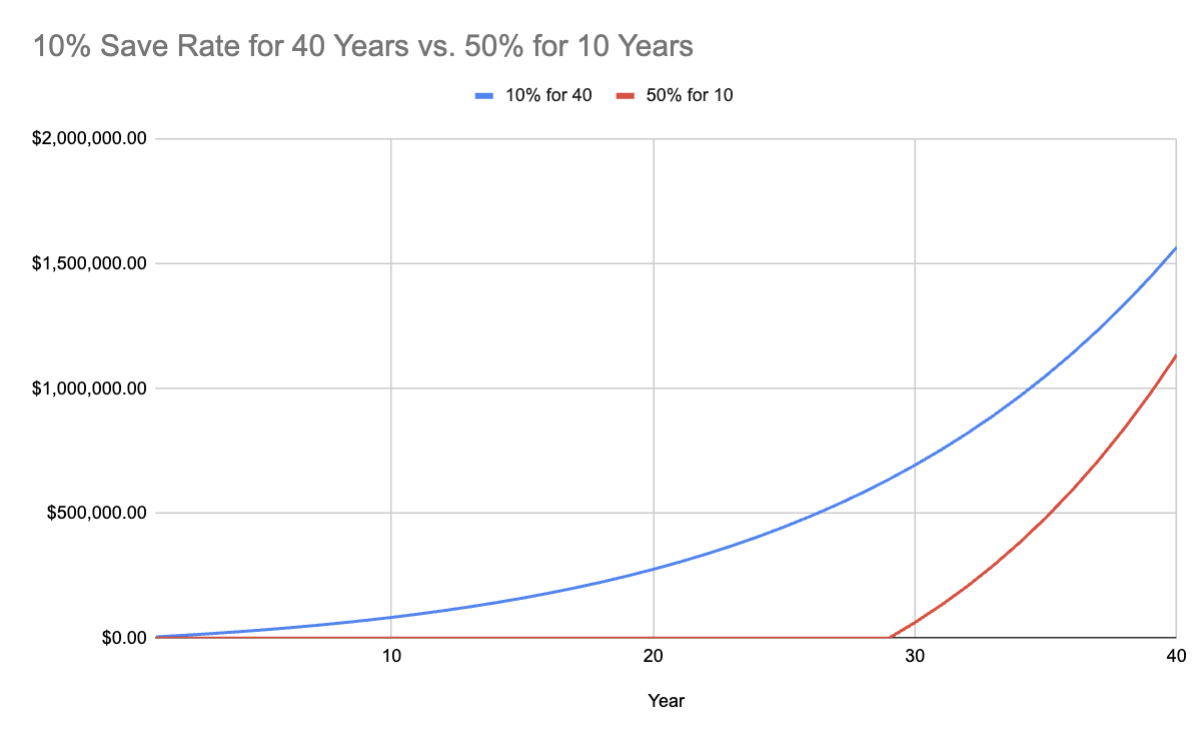

And of course, if you’re familiar with how exponential compounding works, you may already know that the 10% investor will skid into year 40 with more money. The chart below illustrates their respective account balances, using an average annualized rate of return of 7% in both cases:

The 10% investor will have almost $1.6 million in today’s purchasing power in year 40; the “cram” investor will have a little over $1.1 million. But with the red investor’s high save rate, they’d catch up to the 10% investor if they worked and saved 50% for an additional six years.

(In order for them to retire with the same amount as the 10% investor at the same time, they’d need to maintain a 70% save rate for the last decade.)

Is it easier to save 10% for 40 years or 70% for 10 years?

If you’re trying to retire early, a 10% savings rate probably won’t cut it (try 15% or 20% if that’s your goal). But if you’re happy to retire on time (which is no small feat!), a lifetime of investing $1 of every $10 you earn—spreading out your sacrifice—will do the job.

And while it depends on how your income changes (and maybe your personality, too), I’d wager that a consistent 10% savings rate is almost always going to be a walk on the treadmill compared to condensing all your sacrifice into one big sprint at the end.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time