March 2020 Lessons for 2022 and Beyond

May 2, 2022

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Let’s all transport ourselves back in time for a moment to March 2020.

In retrospect, you may not feel that much of an emotional reaction thinking back because of what we now know happened afterward: The stock market, housing market, and job market recovered relatively quickly and surpassed their former highs.

But join me for a journey down masked memory lane for a moment, before we knew that everything was going to turn out all right…

I remember anxiously pacing around my two-bedroom apartment, running through potential outcomes with nothing but time to ruminate on what was happening. I worked for an airline full-time and as a fitness instructor part-time back then, which meant my two main sources of income suddenly went from steady to threatened overnight.

Unless you worked in healthcare (or for Netflix) in 2020, you can probably relate.

It was the type of unrelenting, world-altering reality that I was having a hard time wrapping my mind around, and the first real twinge of panic set in when I was looking over my budget for April planning.

(I was already obsessively on my financial independence quest by this point, so regular budgeting and investing check-ins were part of my routine.)

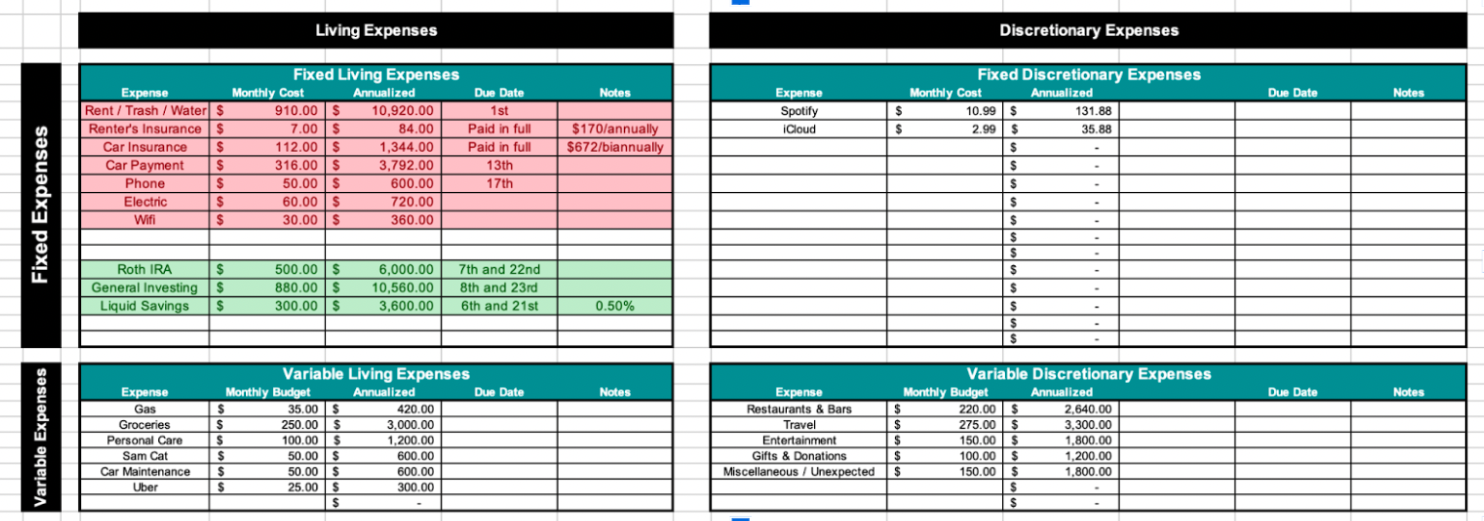

At the time, I earned about $3,200 per month after taxes and 401(k) contributions from my full-time job on semi-monthly paychecks, and another $500 or so from my biweekly instructor paychecks—taken together, I expected about $3,700 in take-home pay each month.

About $1,000 went toward my rent and utilities.

Another $450 went toward my car payment, car insurance, maintenance, and gas.

I knew I wanted to stick $500 in my Roth IRA each month, and another $880 or so in my taxable brokerage account. I had been working my way up to that number for months, and I was banking on it continuing to rise, not lower.

Taken together, that was around $2,830 of my monthly income that was spoken for, leaving around $870 for groceries, living expenses, and having fun. Not too shabby, right? I was definitely living below my means and making some sacrifices, but nearly $900 for discretionary expenses and groceries for an unmarried, childless woman was by no means austere.

Here’s what it looked like. Please enjoy the manly colors.

The gridlines…my eyes…they burn!

Despite the fact that my total income was under $4,000 each month, I still felt really proud of my financial situation and never felt strapped.

I had just purchased an Audi and was anticipating an upcoming promotion at work that I had hustled hard for. Things felt like they were on the upswing, and I was counting on that promotion to buy back some space in my budget that had been eaten up by my car down payment.

“It’s annoying,” I remember telling my dad on the phone from the dealership, “But I’m pretty sure I’ll be getting promoted in April, so I should be able to build those savings back quickly.”

Planning for April, however, brought about an entirely different feeling. Suffice it to say I didn’t get promoted (quite the opposite; pay cuts were on the horizon).

No longer was I leafing through a budget with plenty of breathing room—instead, I was divvying up my forecasted costs and realizing that my $3,700 per month was actually going to be closer to $3,200.

My chest tightened. Okay, I thought, It’s fine—I don’t have to save or invest as much!

But that “solution” didn’t feel quite right. After all, setting aside less money every month while anxiously awaiting decisions about furloughs felt like shitty timing for trimming back savings.

As I looked at my budget, I realized that I had allowed the extra $500 per month I was earning to make me feel a little lax. Because I felt like I had more than enough, I had loosened the belt, and it was time to tighten shit up.

Austerity mode

In an effort to take control of the situation, I copy-pasted my budget onto a new sheet, and began reworking things—rather than cutting back on my savings and investing, I decided to start trimming discretionary spending instead.

The first cut was easy: Travel went from $275/mo. allotted to $0. The global panorama made that much easy.

Inspired by the ease with which I had just slashed $275 from my budget, I went hunting for my next victim. That proved harder.

Now what? I wondered, perusing the categories that were left:

Restaurants and Bars: $220

Entertainment: $150

Miscellaneous: $150

Unfortunately, I was already running a relatively lean ship, so there wasn’t that much fat available to trim—and I knew I needed to cut at least $500 to avoid taking a huge saving & investing hit.

$275 down. $225 to go.

In the end, I ended up slashing $50 off Entertainment and Miscellaneous (to recoup $100) and another $100 off Restaurants & Bars, figuring I wouldn’t be going to restaurants much during a global panini anyway.

The last $25 got shaved off my gas budget, as I realized I would only be driving my car from my apartment to Thomas’s house and the closest grocery store once a week (this was before we lived together).

TL;DR—shit got thrown into austerity mode quickly. And even before austerity mode, my spending on a monthly basis was relatively low: Around $2,900/mo.

With money, perception is reality

I hadn’t actually lost my job (save for my fitness instruction, which accounted for only 14% of my total income), but the feeling that I might—or that substantial income loss was on the horizon—was enough to make me start preparing for the worst. Things felt rocky, and I reacted based on emotion.

As a catastrophic thinker plagued by undiagnosed OCD, immediately going on the defensive is my go-to coping mechanism when I feel like shit has a relative chance of hitting the metaphoric fan. “Oh, things are about to get dicey? Let me immediately wrest back control.”

Now let’s fast-forward a little bit to a point in time when things were—for all intents and purposes—the polar opposite.

“More money than I know what to do with”

Things changed quite a bit for me after March 2020—the pandemic (and consequent work-from-home movement) provided a hidden opportunity that took me a few months to recognize:

Without getting-ready, commuting, and class time, I could now work even more. Hell, all I could do was work—there was nothing else to do.

I took on odd jobs and started Money with Katie. The studio reopened. At my peak, I had four jobs: A full-time job, an hourly contract role, fitness instruction, and growing Money with Katie (with an annual revenue of a whopping and impressive $0, at that point).

Before I knew it, 18 months had passed more or less like this. My adrenals were fried to an absolute crisp, but it had been worth it:

When I eventually left the airline to work for a tech company, my total compensation jumped from mid-$70,000 range to mid-$140,000 range, and I was ecstatic.

Not only that, but Money with Katie was having a marathon revenue streak:

By the end of 2021, I was consistently earning between $30,000 and $40,000 per month (for those keeping score, that’s more than I earned in all of 2019).

“I feel like I have more money than I know what to do with,” I remember remarking to my husband, somewhat awestruck at my newfound fortune. Quite the opposite feeling from March 2020, huh?

There would be days where I’d get a paycheck from work, a $4,000 sponsor check would clear, and another $10,000 in sales would come in. I literally had dollar-signs in my eyes.

…and it didn’t take long for that to start to impact my attitude toward money.

We’d go out for dinner and—when faced with the wine-ordering decision of “two glasses or a bottle”—I’d splurge with a lot more reckless abandon than I used to. It was hard not to when it felt like the money spigot had been turned on full force in my life.

It wasn’t just the amount that was coming in, but the seemingly endless sources of revenue. I remember being on vacation in Tulum and having a particularly good sales day during the trip. On that one day (a Saturday, no less) Money with Katie earned enough money to pay for the entire vacation.

It sounds extreme, but the feeling was addictive, and it felt like it would never end.

I felt like I had a lot of money. I felt rich. (Please read that in Anna Delvey’s voice.)

But here’s the thing: Just like my perception was a little extreme in March 2020, so too was it extreme at the end of 2021.

Couple those high-earning months with a raging, unrelenting bull market, and it’s a recipe for feeling like you can’t lose.

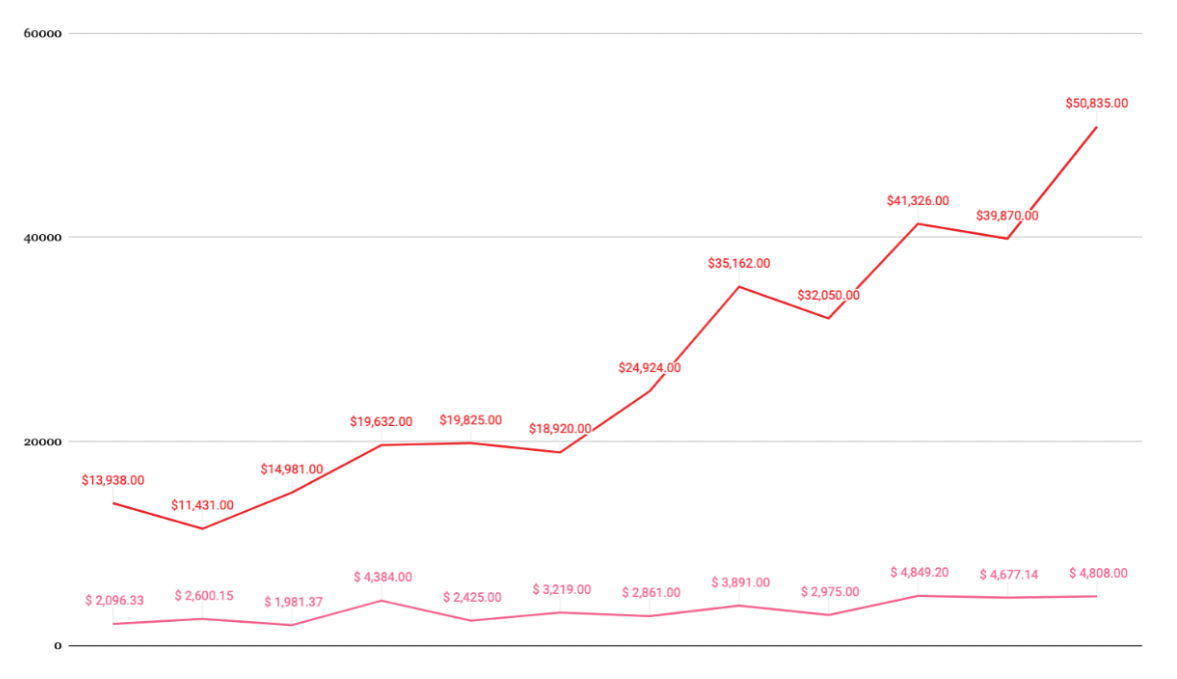

Remember how my pre-pandemic budget was around $2,900 per month? Before we combined finances in January 2022, I still tracked my own independent spending. Here’s the correlation between my monthly earning and spending in 2021 (earning is red, spending is pink):

Notice how when things start to take off in the second half of the chart, so too does the spending?

Even though my planned spend was only $3,470 (about $500/mo. more than in 2020, to my well-intentioned credit), the last three months of 2021 (when I earned $41,326, $39,870, and $50,835) saw me spending an average of $4,778—about 38% more each month than I had planned.

(That 38% increase each month represents my own dumb perception that I was a high roller referenced earlier.)

Now, I fully realize this income increase is ridiculous (and to be clear, it was short-lived; I’m not earning $50,000 a month anymore) and it might feel gauche to complain about my spending increases in light of the serious good fortune I was experiencing.

But it’s intended to prove a point: When I felt like my income was about to go away, I cut back a lot because I was scared. When my income started tracking upward, I got overly confident and assumed it would continue that way, which led me to being too laissez-faire with my spending—and while it didn’t become truly problematic, it easily could’ve.

If someone as dedicated to pursuing financial freedom as I am could easily slip into patterns of unchecked overspending, imagine if I wasn’t dedicated to it. Imagine if that overspending resulted in purchasing a car—or even a home—that required that type of income to sustain.

Perception is reality. Overconfidence is dangerous.

2022 and beyond

I think getting cut down to size (either through losing a source of income, a bear market, or something else) is not only humbling, but potentially an underrated lifesaver for our finances.

My net worth at the beginning of 2021 was $160,000. By the end of 2021, it was half a million.

Not only was my income on a tear, but the market was, too.

Enter January 2022: While the switch to doing Money with Katie full-time via Morning Brew acquisition has been amazing, rest assured that they’re not paying me anywhere close to $50,000/mo. on top of a lucrative tech salary. Gone are the days of owning my own business and receiving five-figure direct deposits every other day that seemingly dropped out of the sky (or, uh, Stripe).

I made the move because I knew in the long-term it’d be the best thing for Money with Katie; that there was a solid likelihood the growth and revenue we could build together would far outpace what I could do on my own in the long run.

But in the short run? I went from receiving paychecks every day from either full-time work or my many sources of revenue to two paychecks a month—back to the same feeling I had in March 2020, waiting for the 15th and 30th to receive my money.

The funny thing? It’s probably commensurate with my average after-tax income for 2021 (I have a $33,000 tax bill waiting for me this April), or thereabout—but since it’s twice a month and not every day for amounts of varying degrees, it feels like less. The slot machine of online entrepreneurship and its variable rewards got turned off.

Perception is reality.

I’ve been a lot less freewheeling with ordering bottles of wine at restaurants. The ridiculously overpriced Cartier jewelry I had been eyeing last December just looks absurd to me now.

And as the bear market feels like it eats away everything I dump into it (I think I’ve invested $110,000 so far in 2022 and my net worth went up by about $80,000), it feels like it’s a reminder that sometimes you need to let the air out of the tires a little bit to avoid getting too ahead of yourself and picking up dangerous levels of speed that are almost guaranteed to blow you up, if left unchecked.

I’d probably have a $5,000 Cartier bracelet on my wrist right now if I hadn’t been acquired during a bear market, and for that, I can only be grateful that reality stepped in.

Pessimism as a useful hedge

Even when things are going really well, maintaining an outlook of pessimism or scarcity when it comes to their likelihood to continue going well is both a hedge and an edge in the earning and investing game.

I try to keep a little bit of that same March 2020 austerity mindset in my back pocket any time I feel tempted to splurge, like when I blacked back in from an internet binge scrolling through used Porsche Macans. “Bitch,” I said aloud, “You better be joking.”

It’s the beauty, comfort, and safety of always living beneath your means.

You know that stuff would have to get REALLY bad for you to be truly in trouble, and there’s no amount of Cartier jewelry, Porsche SUVs, or overpriced bottles of wine that can replace that peace of mind.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time