A Visual Way to Understand Your Finances: Money Mapping [2025]

October 23, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

I love financial visualizations. I feel like my brain doesn’t intuitively make sense of numbers—but when I see everything represented visually, it resonates. (Jump cut to me sitting on a bench outside my college calculus class on the phone with my dad, in tears.)

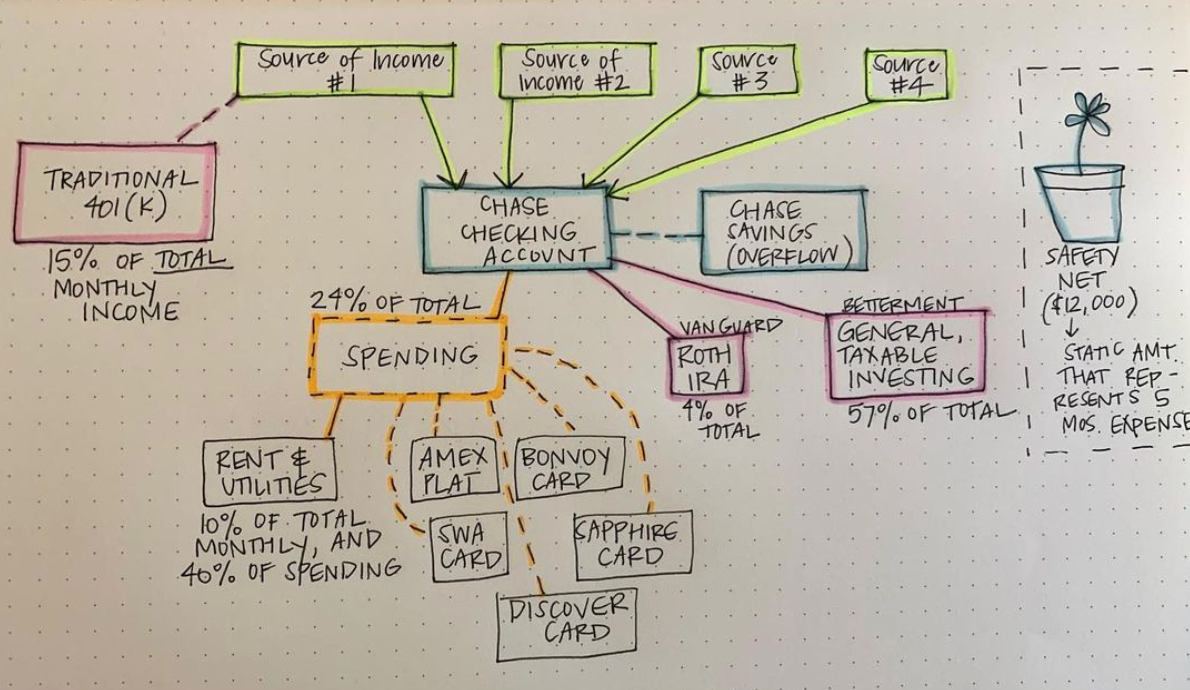

A few years ago, I did an exercise I lovingly called a “Money Map.” It looked like this:

My sincerest apologies for the inconsistent use of dashed and solid lines. I was excited.

The impetus was the realization that my financial life was becoming increasingly complex. I was having a hard time wrapping my head around the wheels that were turning in the background, and I wanted to illustrate how money was flowing through the system.

At the time, I had four (sometimes unpredictable) sources of income, a maximum 401(k) contribution, and a lack of a true “emergency fund” savings account, thanks to a taxable brokerage account product from Betterment called a “Safety Net” that I used instead.

To help make my holistic financial picture a bit clearer, I envisioned a visual exercise to put it all to paper. Out came the colored highlighters, and on came the lightbulb above my head.

I give you: The “money mapping” exercise. If your financial situation is complicated to the point that it becomes hard to keep up with (like how mine was), it’s worthwhile to take the time to streamline the way your money flows through your financial system. Here’s how to make your own, where the name of the game here is simplification.

My 2025 Update

I didn’t re-draw my old system, but things have gotten progressively simpler despite adding another whole human to the mix in 2021 (hi, Thomas). We now have:

-

Two sources of income (100%)

-

…that first pay taxes (subtracts 23%)

-

…and funds my 401(k) and HSA, and Thomas’s TSP (the 401(k)-style account that military members have) (subtracts another 10%)

-

…then the rest flows into our joint checking account (the remaining 67%)

-

…which pays our rent and our four primary credit cards each month (my business card, my AmEx Platinum, my AmEx Gold, and Thomas’s Chase Sapphire Preferred) (call it somewhere in the 22% of total ballpark)

-

…and then funds our joint taxable brokerage account with what’s left (around 45% of total ballpark)

See? It’s way more fun with highlighters.

Start with income:

Sometimes we introduce more complexity slowly over time as our financial lives morph and grow around our habits. You know how it is: You start paying rent out of one specific checking account because it just so happens to be the one set up for withdrawals. Then, you open a new checking or savings account elsewhere, but still need to funnel money back to the old one to pay the rent, and, and, AND…it slowly becomes an unwieldy mess.

Of course, some people like to maintain a bunch of accounts for different things, but I’ve found personally that that becomes an unnecessary energy drain.

So, you’ll start by drawing the cash flowing from your income stream(s) into your central checking account (or accounts, if you maintain joint finances with someone in a “yours, mine, and ours” fashion).

The 401(k) contribution (or 403(b), or HSA, or…you get the picture) has to come directly from the paycheck, too, and that’s great—so make sure you’re demonstrating that on your money map somewhere.

Illustrate your emergency fund:

If you’re still growing your emergency fund, draw a dotted line from checking to savings to represent your monthly flow of cash. If your emergency savings are already funded, set it off to the side to visualize its “reserve” status—like an account waiting in the wings.

It’s there if you need it, but you aren’t actively funneling money into it. If you have a habit of “over”-saving (and therefore “under”-investing), this mental separation can help you see where it might be more helpful to reroute extra funds to a more growth-y destination.

You may also have other savings or investing goals that you’re actively funding—like for a house down payment or future childcare—so you can draw those little metaphoric buckets as well.

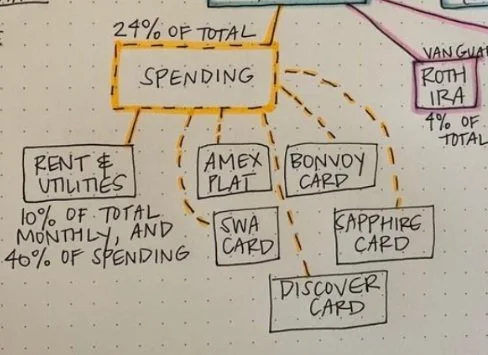

Add in spending:

Most of my spending—necessary and discretionary—happens on credit cards, which I pay for out of the checking account. There are a ton of reasons to use credit instead of debit cards: security against fraud risk, cash back, points…the list goes on.

But sometimes you have to pay something with a direct withdrawal (like my rent). I like to note that in my map where it makes sense.

You can think about the credit card as the first line of defense, or barrier, between your spending habits and your checking account. While you shouldn’t find yourself in a position where you need to be actively transferring money into checking from savings to pay your credit cards, I like to know when there’s a big-ticket item that’s going to be taken directly out of checking instead of funneled through a credit card with a “delayed” due date.

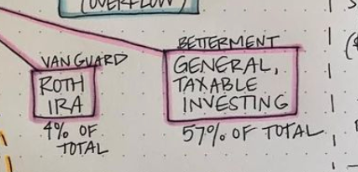

Draw post-tax investment accounts as offshoots from the checking account:

When you open a post-tax investing account like a Roth IRA or a regular taxable account, you have to deposit money directly into those accounts from checking or savings. Remembering to do this on an ongoing basis as you earn every month can be tedious, so I like to set up bimonthly auto-transfers that happen in the days following when I get paid (though in recent years as my income has become increasingly variable, I tend to manually check at the end of every month and make manual transfers, too).

What about taxes?

There’s a big missing piece of the visual puzzle above. Can you spot it? Taxes. Taxes will also be paid directly from your paychecks, so if you want to note it, you can (I did in my update above, just to twist the IRS knife). I recently sat down with a spreadsheet and listed our income, spending, and total tax burden, and was shocked at the pie chart that got spit out: We’ve paid more in taxes this year than we’ve spent on everything else combined.

That made me realize it probably makes sense to hire an accountant to double-check our tax strategy, vs. stressing about an incremental few hundred bucks spent here or there. (It also reminded me that now’s the time to invest in the business via #WRITEOFFS if anything comes to mind.)

Creating a sense of scale

You’ll also probably notice the percentages on the flow chart above. If I were really on my visual representation high horse, I would’ve drawn the boxes to scale (and actually, I low-key love that idea), but for the sake of my less-than-artistic first rendering, I just noted the percentages where applicable.

But drawing the boxes to scale can be helpful because it’ll help you see if you’re prioritizing investing (and doing so in an ideal way), or if there are a lot of leaky holes in your budget. For example, if only tiny offshoots are being sent to investment accounts or savings and the vast majority of your income is going right out the door in that spending bucket, it can help make your purchasing decisions a little more tangible.

It might also help you see where you’re prioritizing certain financial goals a lot more heavily than others—perhaps in a way you hadn’t realized.

Why money mapping is a useful exercise

Besides the fact that you can whip out the highlighters and touch real paper for the first time in months, money mapping helps you diagnose large trends in your financial life.

It can also help reveal gaps in your own understanding. If you start filling in numbers and realize that you don’t actually know where part of your income is going every month, it can help visually guide you toward possible solutions.

For example, when I saw that 57% of my investing was going into a taxable investing account, it made me wonder if there were other tax-advantaged options I could—*ahem*—take advantage of first besides my 401(k) and Roth IRA. (Spoiler alert: I ended up contributing more to my HSA and opening a Solo 401(k) for my self-employment income.)

Happy mapping, nerds!

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time